June 30, 2022

End of low-interest rate era?

Here is an interesting comment made by Lagarde yesterday which should cause some concern:

“I don’t think that we’re going to go back to that environment of low inflation,” European Central Bank President Christine Lagarde said.

Followed by this comment by Fed president Powell:

“Is there a risk that we would go too far? Certainly there’s a risk,” Powell said. But, “the worst pain would be from failing to address this high inflation and allowing it to become persistent,” he said in a conclusion that was endorsed by Lagarde — “ditto,” she said — and by Bank of England Governor Andrew Bailey, who chimed in with, “absolutely.”

- Typically bullish head of US economic research at Renaissance Macro Research:

“The Fed increasingly believes a recession is necessary to address underlying inflation concerns,” Dutta concluded.

Not that we should believe their pronouncements—since they have wrong about everything up to this point. But, the fact that they are willing to drive the economy right into recession even acknowledging that they cannot do anything about persistent inflation is rather worrying.

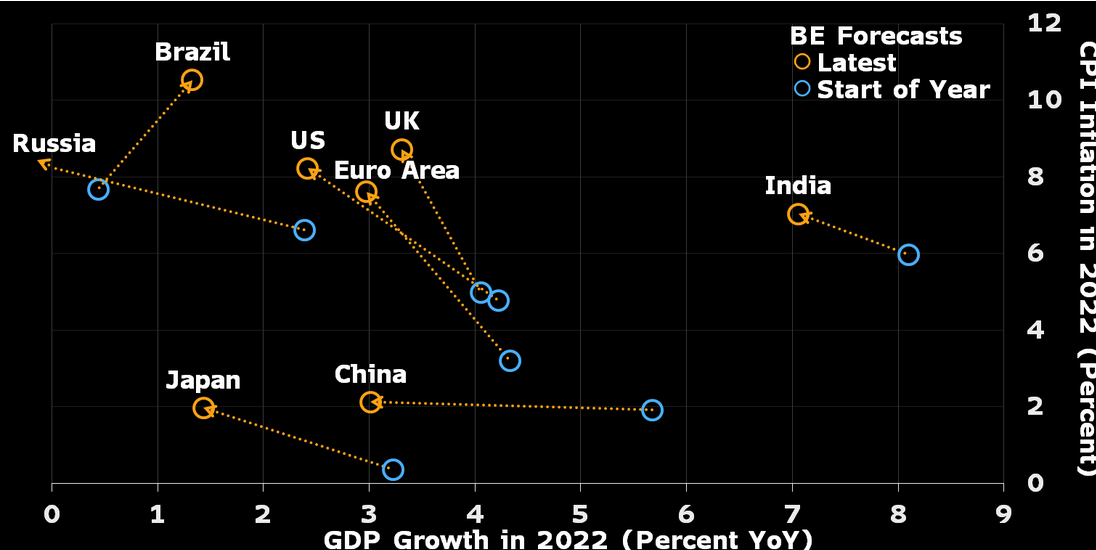

Here are where economies are heading right now.

Slower growth and higher inflation. The old "Stagflation" term is bandying about, but that should also concern everyone as the neoclassical cure is much worse than the disease.

Persistent higher levels of inflation (at what level are they talking about) will be used to extract even more from workers and sustain profits for capital.

- Unions are going to have to gear-up for real wage gain battles if workers are going to make ends meet.

- The left is going to have to double-down on public production to satisfy the needs of the population in such a scenario.

- Gone are the days where there will be (accidental) alignment of interests between central banks and workers when it comes to interest rates. Of course, I argue there never was any, but (Post-)Keynesians have often said some inflation is good.

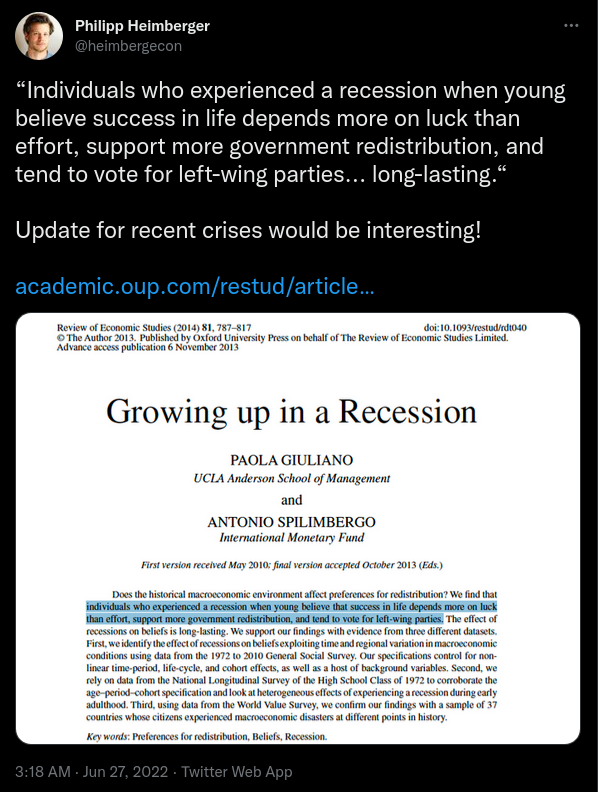

That said, there are plenty of studies that point to the effects of growing-up in a recession: mainly that workers become more left-wing. That's only if the left articulate their policy position clearly (and, of course, make sure it is left-wing).

Another interesting comment reported by Bloomberg Economics:

Prices and inflation

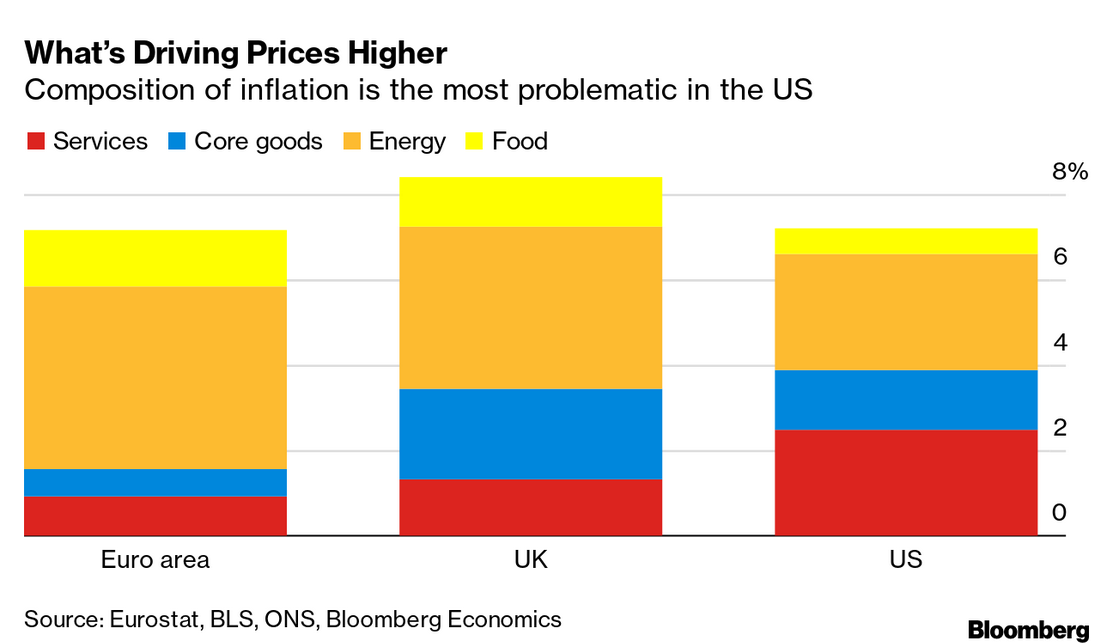

Prices are increasing in different areas in different parts of the world:

This puts-to-lie the idea that wages or unemployment are at all interesting in the current "inflationary" economy. Supply chain issues driving price increases in these areas are to blame and they align pretty well with privatized services in those regions—parts of the economy that should not be allowed to respond to these kinds of supply limitations.

Additionally, we are dealing with real inflation caused by monetary policy. And, increasingly now we are dealing with recession issues—lack of investment in new and even ongoing production.

The capacity utilization (the percentage of owned and functioning capacity) is declining, but likely not as fast as profitability is declining. If this continues (and is the case), we will continue to see inflation even as the economy slows.

It is only with the understanding that not all price increases are "inflation" can we clearly state the problem and the solution.

Many of the narratives coming out of the central bank yap fest should concern the left. With most of what people thought about central banks being exposed, the mythology of the masters of the universe managing the economy to everyone's benefit is collapsing.

The question is, what will replace it?

It is clear that private capital is not going to save the economy and governments are not geared to provide a real solution after 40 years of neoliberalism.

Workers (in labour unions?) are going to have to start by demanding public investment and jobs creating things that are in short supply.

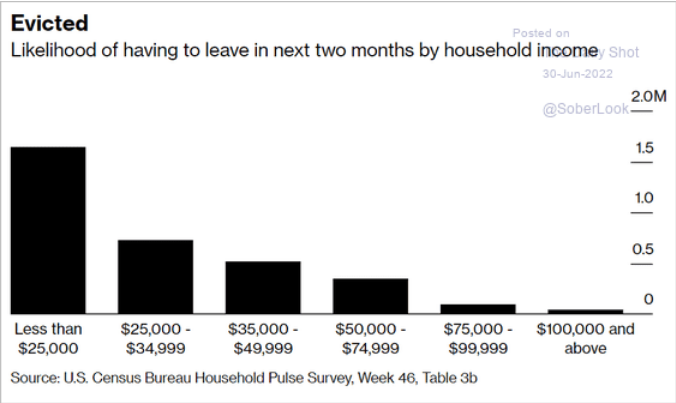

There is a role for energy transition here as people kind of get this already. But, it must expand beyond just energy. Core goods, housing, worker-provided services, logistics, and quality of life products are going to have to be part of the demands.

Here is a look at housing in the USA where there is some data on this:

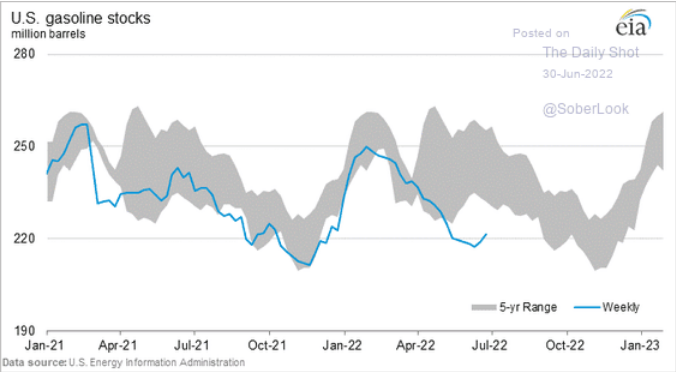

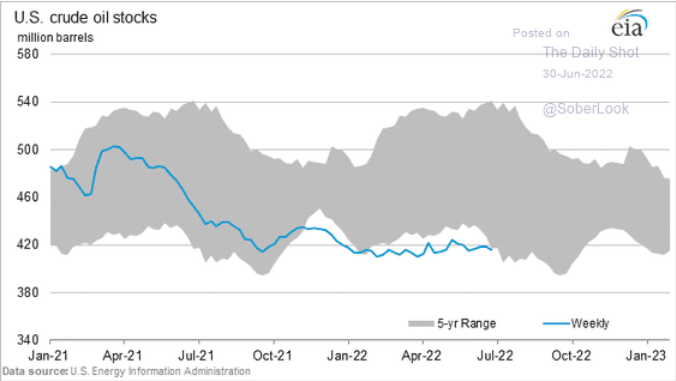

For those looking to "monopoly" and not supply for gas prices, it is mostly supply driving it:

Wealth transfer from buying the dip

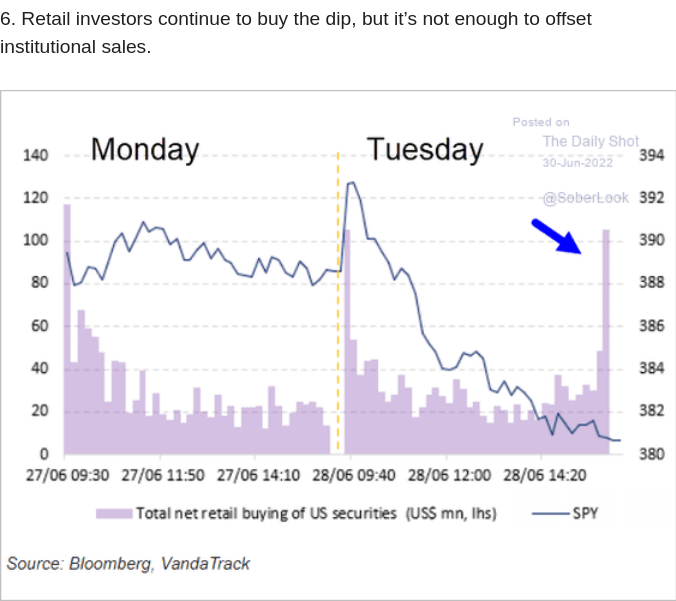

I continue to warn against "buying the dip". Here is the graph that shows how stupid it is to buy now:

This is just wealth transfer from retail to institutional investors. The entire "buy the dip" is marketing to take your money.