June 3, 2024

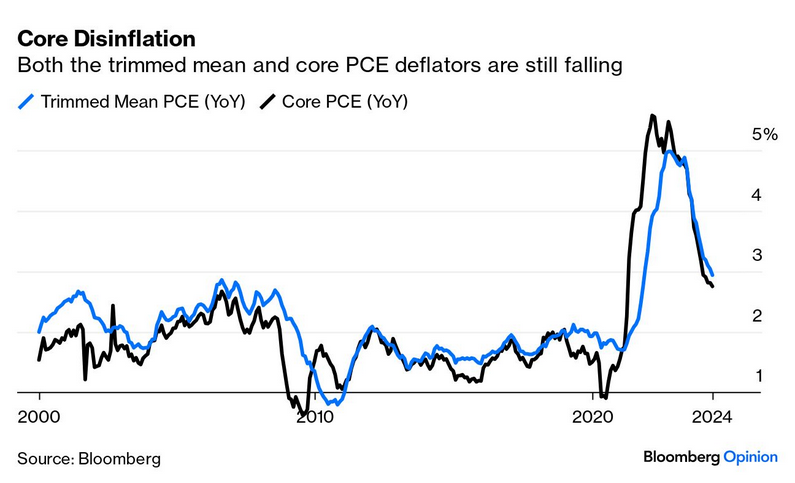

Different measures of inflation

- Central bankers make decisions based on: Core inflation and Personal Consumption Expenditures.

- Working people are more affected by energy, shelter, and food price changes.

- Price change due to inflation tendencies are best seen in CPI Trim.

- American "voters" don't look at the numbers at all and simply believe the narrative coming from their "side".

A Harris Poll survey for the Guardian last month found that 55% think the economy is shrinking, 49% think unemployment is at a 50-year high (not a low) and 49% think the benchmark S&P 500 stock index is down for the year. It’s a matter of fact that all these beliefs are wrong. The S&P was up about 12% for the year when the poll was conducted and almost 29% over the previous 12 months.

The public seem to be awash in data, but still no one really seems to have a handle on the real affect of price changes.

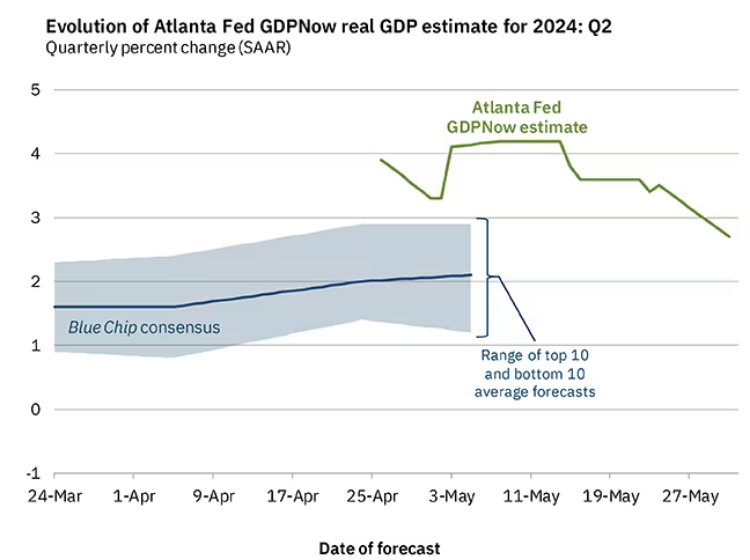

The economic model driving interest rate decisions is slippery to hold down. For interest rates to come down:

- GDP has to be falling.

- Inflation expectations cannot be falling.

- Wages cannot be growing.

- Profits must be stable

- CPI measures need to be in disinflation

Well, we are kind of there with all these little metrics.

The economy is not doing great, the expectations are muted on all fronts, average company profits are down, and spending has declined.

So, expectations for an interest rate cut is on the horizon in the USA.

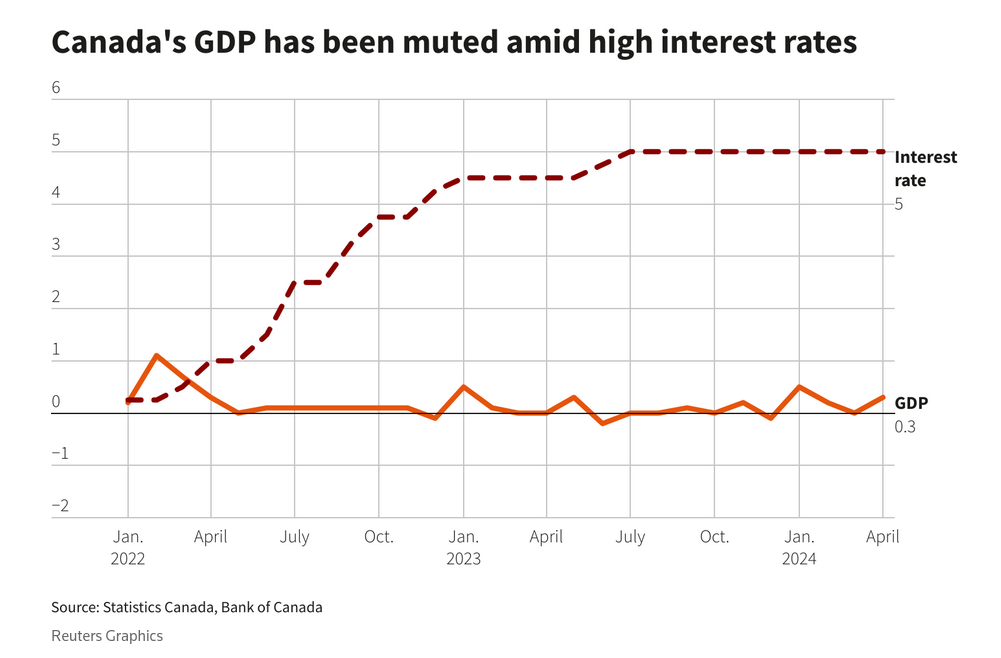

What about Canada's economic metrics?

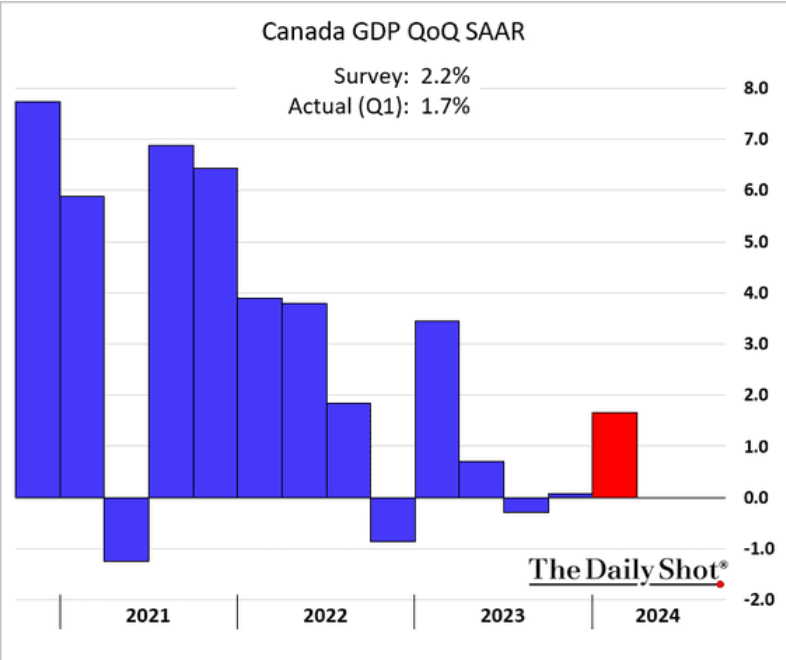

- GDP did not meet expectations and future expectations are 1.5% for the second quarter of 2024 (according to the Bank of Canada).

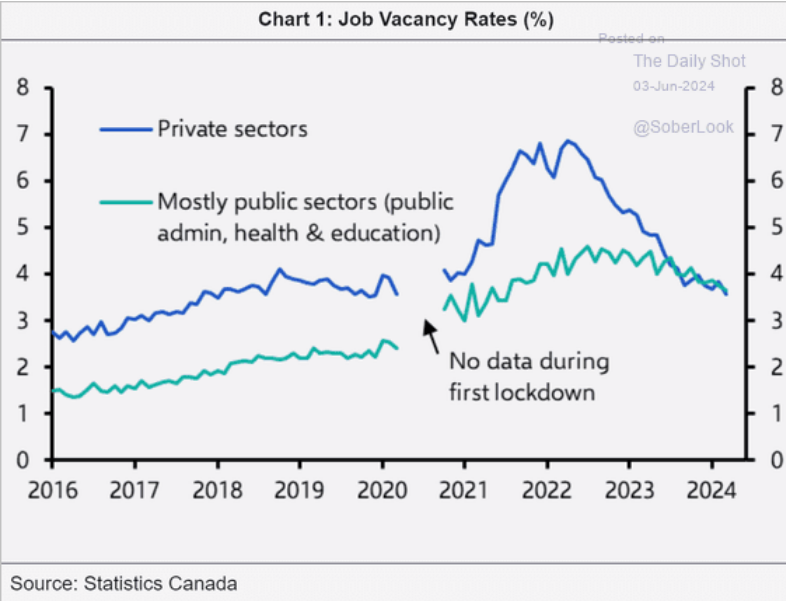

- The labour market is loosening.

So, the bets on a June rate cut have gone up. This is what mortgage payers want to hear.

The problem on the political side is that all these things sound very confusing to regular working people.

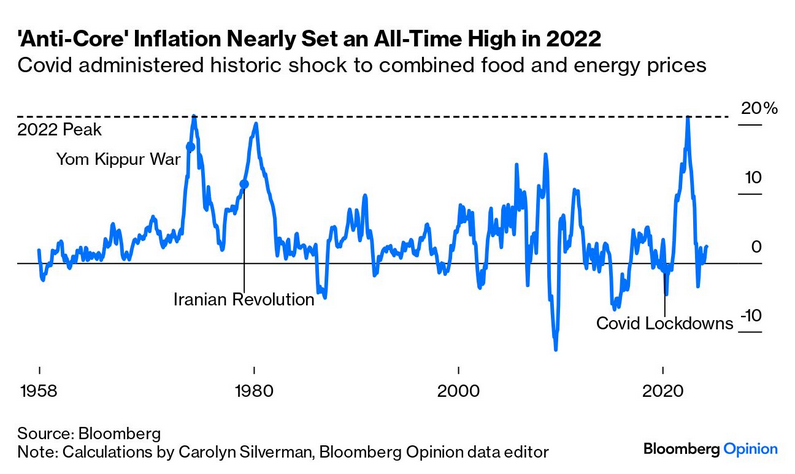

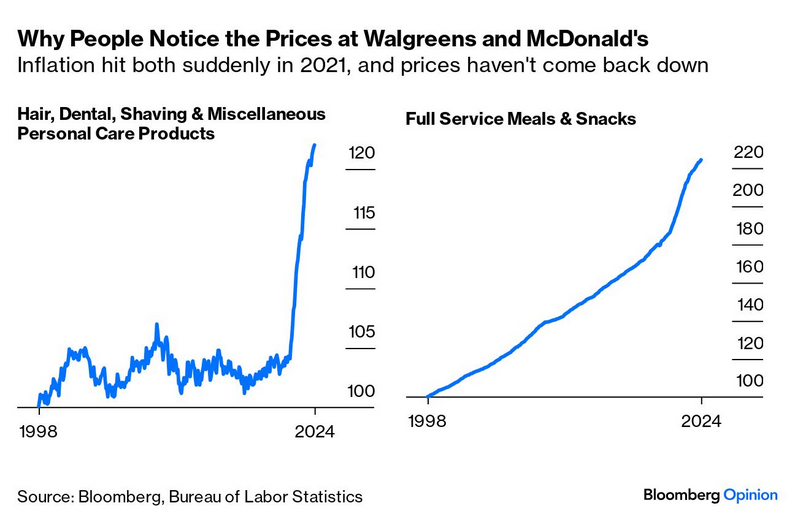

Food is still very expensive and people do not know who to blame (so they blame the person they buy groceries from and the government).

Energy is still very expensive and people blame taxes and question the analysis that cheap fuel is bad.

Shelter is still extremely expensive and interest rate declines are going to be too slow to notice the impact on those costs since rent prices have gone up it barely matters that interest rates decline slightly.

I think that the issue has to do with politicians pointing to the market doing well or not as some gauge of if politics is working or not. Those in power point to the previous quarter's growth, those who want to be in power point to prices.

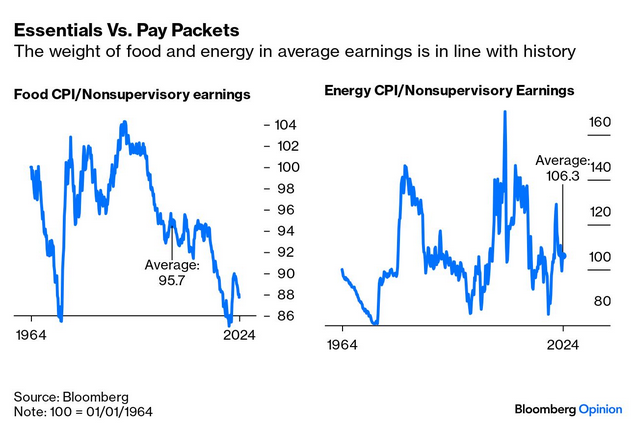

Neoclassical economists who want to explain that things are not as bad as working people think, point to historical prices.

Others wonder why prices for fast food and working class daily health products are so high:

Or, try to explain that food prices are still below the fraction of your income you would have had to pay for them before the Green Revolution. And, that energy prices fluctuate, but we are not outside any sense of normality of the fraction of your income you spend on energy.

That sounds smart, but is irrelevant. People do not have long memories and barely care what it was like last year, never mind 30 years ago. And, North Americans do not care what it was like yesterday, never mind last quarter.

The expectation that has been beaten into folks is that things get better naturally under capitalism. That is a ridiculous notion, but that is the expectation and it is driven intensely through social media outrage machine.

People blame the government when things go poorly and they congratulate capital when things go well for them. People blame individual corporations for price increases instead of systemic issues and are angry at prices on the receipt instead of the wage they get.

As we continue along this path it will be impossible to get a foothold in the discussion because the outrage that things do not seem to be getting better for people will (or has become) omnipresent. The left needs to push back against this narrative by explaining the way the economy actually works (or doesn't work) for workers.

It is not about explaining that things are better than what you feel. It is about explaining how to make things better so you can feel better.

This is not a new concept, I know. But, working class organizations must have a clear vision of what is going on and must invest in infrastructure to get the analysis out there. This means not falling for the trap of simply saying members do not "understand" what is going on. Members do know what is going on, they just need the tools to tell the difference between the narratives that are being presented to them about what to do about it.

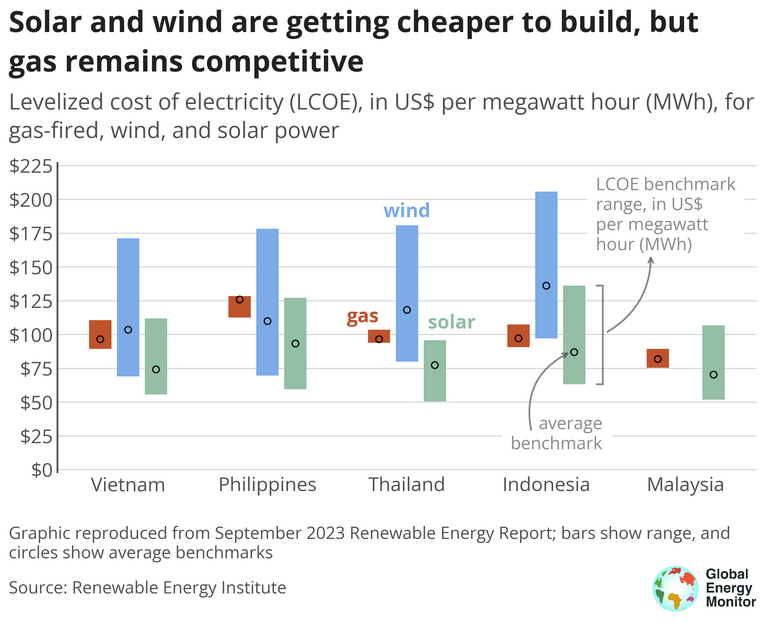

Energy and natural gas

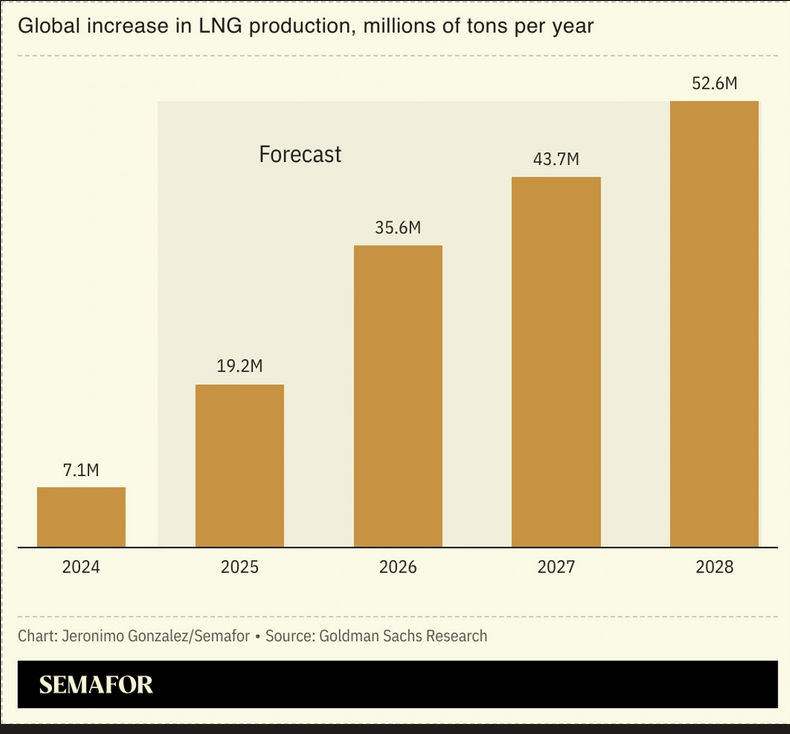

There is new analysis about gas projects and the expansion of LNG production in the USA.

This comes as a new study shows that there is no need to expand new oil and gas production to meet energy needs. Most of what is in the pipeline for new production will meet global demand.

This is in conflict with the Canadian natural gas industry’s demands to expand new fracking and export of gas to the USA. Their campaign is based on the idea that there isn’t enough supply in the USA to meet current demand. Turns out that will simply result in a lot of churn in the market resulting in stranded assets here in Canada.

We will continue to monitor the market’s expectations on this, but there is a lot of reason to think a campaign to keep it in the pipe and use what we currently have access to extract in value added ways is better for Canada. Competing with the USA on total gas production is a bit silly given they control the market. Scaling-up value added production for midstream and chemicals is a better program for us.