June 3, 2022

Progressive Conservatives win larger majority in Ontario, NDP lose seats

We now all wait to see exactly which Ford has been elected: the one who started his previous win attacking students and union members, or the one who begrudgingly recognized their incompetence during the pandemic and dialed the far-right nonesnse back? Really bad or just bad for workers?

Either way, it isn't going to be good.g

- A new leader is being sought for the Ontario NDP. Perhaps this will also lead to the removal of the people who continue to be experts at losing elections. Dare to dream, I know.

Financial markets creeping up

- General trends in market valuations have reversed to be where they were at the start of May.

- That means your money is worth significantly less than it was at the start of May, but that value was transferred to capital.

- Capital thanks you for buying the dip and ask that you to continue to fund their profits.

- The debate now is about quantitative tightening and how if it will have the impact that many think it needs to in order to save capital profits in the financial markets.

- Quantitative tightening (or, QT) is supposedly the inverse of Quantitative Easing (QE) – which is what the central banks used to make sure capitalism didn't collapse after 2009. QE also helped bring us the inflation we see now. QT is where they rush to undo this and increase central bank interest rates at the same time.

-

The problem is "increasing interest rates" and QT sound very similar when you look at how they work.

- They are both about reducing the amount of "liquid money"/liquidity in the system that can be used to do anything. This is done by subsidizing profits from owning government bonds (increased interest rates) and selling bonds to the private market instead of the central bank (QT).

- The issue is that as capital withdraws their money from the equities market (the investment in publicly traded companies) it will reduce room for profit generation on owning stocks and therefore cut growth investment.

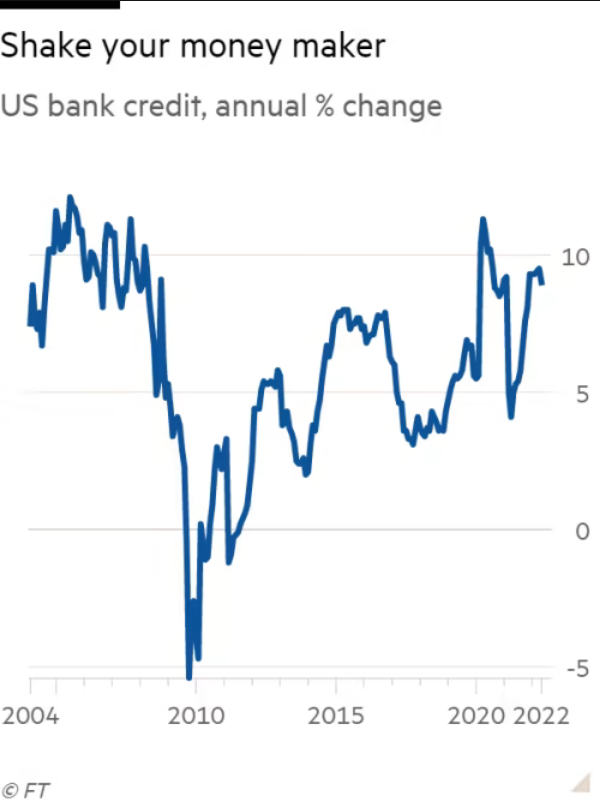

- The question is always down to will the incentive remove the correct amount of liquidity from the market that was put there in the first play by the central bank printing money? They don't know because private banking could always create as much new liquidity by lending capital money as is being "taken out" of the market by the central bank.

-

Indeed, up until today, private banks have created the exact same amount of new money through lending than has been taken out by the central banks. When does this stop being the case is when things start to get interesting.

- Warning: this is also the reason that you should not be investing as a retail investor right now, you just do not have the information.

- Add this to the dual problem in the economy: demand is being sustained at a high level and wage growth is cooling. Recession may come faster than people think—which means fewer jobs—and inflation will eat workers' lunch (money).

Lots in the news about ESG and how it is being exposed as garbage

- ESG is garbage and I have been saying this for a long time. I am not original here, but it is fun to be correct anyway.

- Starting in December things started to go poorly for ESG ratings. That poor start of the year has shifted to a full scale hate-on for the entire project.

- ESG is narrative nonsense to make people who give their money to capitalists feel not so bad about it. It is a salve for taking workers' surplus value as your own.

- Bankers and investors who are not scared of "telling it how it is" (mostly, dude bros being dude bros but also some very smart people) are becoming louder.

- The narrative is simple, there is little in the ESG that is real and the part that is real is just "being a good business" which for some companies land you in an nice ESG portfolio and some do not.

- ESG became more than that when it was part of an advertisement for selling stocks or taking on debt for their company. Some company managers saw the companies that "just happened to be green or social focused" do better, so they said "we have some of those qualities too, lets focus on those and not our bad stuff". Thus ESG was born.

- Now that fossil fuel and commodity companies are where the sustained profits are at and free debt is drying-up ESG doesn't really matter as much because higher profits are where investment flows.

- The result: None. There is no change in the way capital works and it is still killing the climate, people, and supporting oppression with bad management practices — ESG.

- OPEC (read "Saudi Arabia") has increased oil production. So, ESG.

Microsoft starts its anti-union campaign by pretending to support the choice to join a union

- Microsoft wants its workers to understand that they don't need a union, but are also not anti-union.

- Exactly what you would expect a massive profitable and historically nasty employer to say before they fire you for organizing a committee to take back some of your surplus value.

In a blog post outlining the company’s principles on engaging with employees, Microsoft President and Vice Chair Brad Smith wrote that workers “will never need to organize to have a dialogue with Microsoft’s leaders,” but that the software giant recognizes some employees in some countries may choose to join a labor organization.

“We respect this right, and do not believe that our employees or the company’s other stakeholders benefit by resisting lawful employee efforts to participate in protected activities, including forming or joining a union,” Smith wrote in the Thursday post. “We are committed to creative and collaborative approaches with unions when employees wish to exercise their rights and Microsoft is presented with a specific unionization proposal.”

- The reality is that Microsoft is concerned that investors will be uneasy about the new purchase of Activision Blizzard Inc. which is unionized.