June 29, 2022

You don't need a recession to wipe-out the working classes' wealth

But, it does help.

The US equity market capitalization contracted by more than $11 trillion from the end of last year through Monday.

Bonds have also seen major losses. The classic 60/40 portfolio — where 60% is invested in stocks and 40% in bonds — is down nearly 16% in the first six months of the year so far. That’s the steepest first-half loss since 1988, according to data compiled by Bloomberg.

Thirty-year fixed rate mortgages now average 5.81%, up about 2.7 percentage points since the end of December. That compares with the 1.5 percentage point bump in the Fed’s rate.

Prices

Average prices are still rising across the board.

However, some prices are starting to mediate their growth a little. Lumber, shipping, and trucking are all no longer growing fast, but are stable at historically high prices.

The point here is that there is a dynamic process going on. Things fluctuate a lot and that makes the current situation, with all the knock-on effects, very hard to predict.

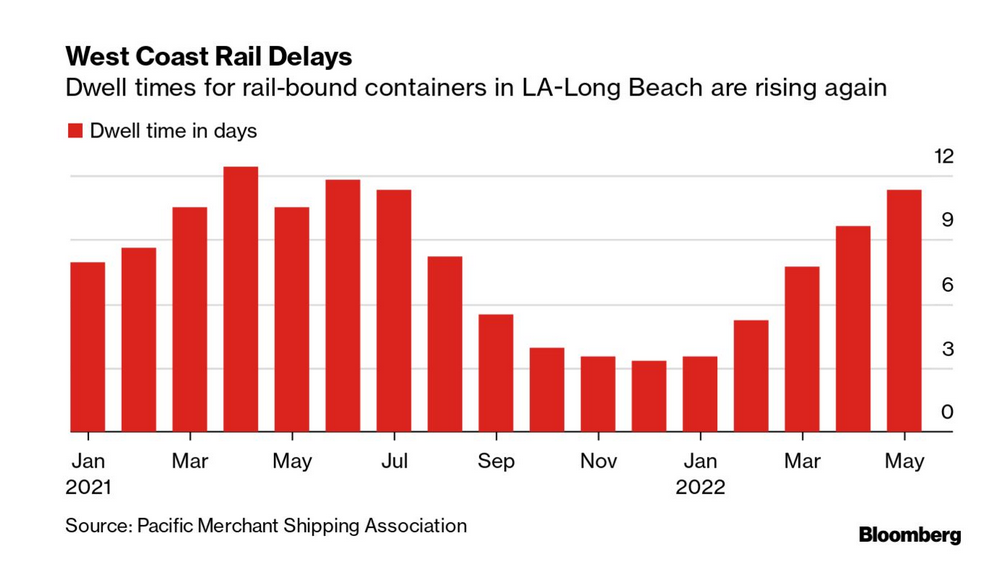

Shipping costs might not be shooting upwards, but there is new congestion at ports again.

Latin America right-wing governments on the back foot

Popular mobilizations in Ecuador and a recent (failed) impeachment process continue to undermine the power of the right wing government. Indigenous workers are demanding support for cost increases and an end to privatization of state assets.

This is the same group of workers who were galvanized against the left-wing government head, Lenin Moreno. The grievances are the same and will likely continue until some real state-lead investment shows signs of progress in the Amazon region.

Peru's Castillo is dealing with attacks from the right, but continues to hold onto government power there.

Many countries in Latin America are facing worse economic prospects as the cost of their debt continues to rise with growing strength of the USA dollar and slow growing global economy.

I feel like we have seen this movie before.

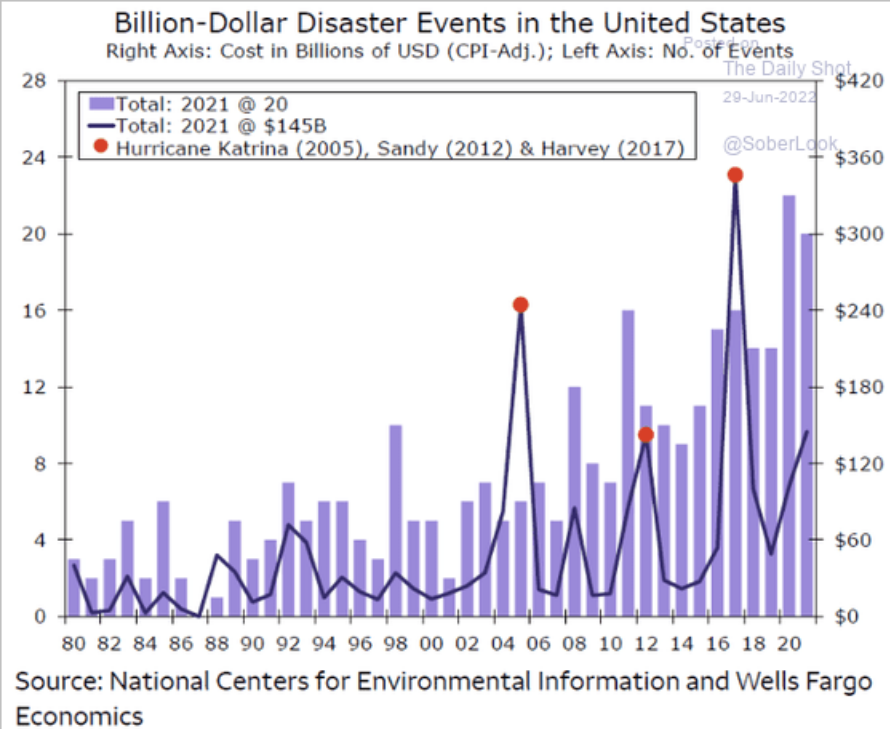

Weather (and other) related disasters

Costs are up. Way way up:

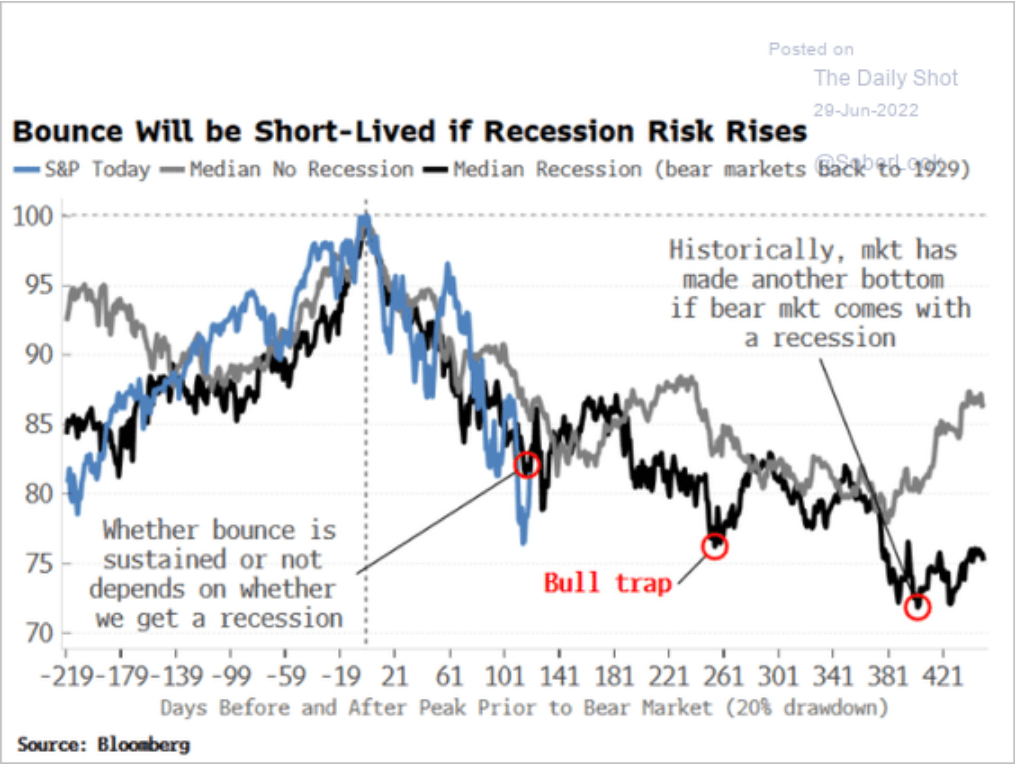

Do not invest in equities now

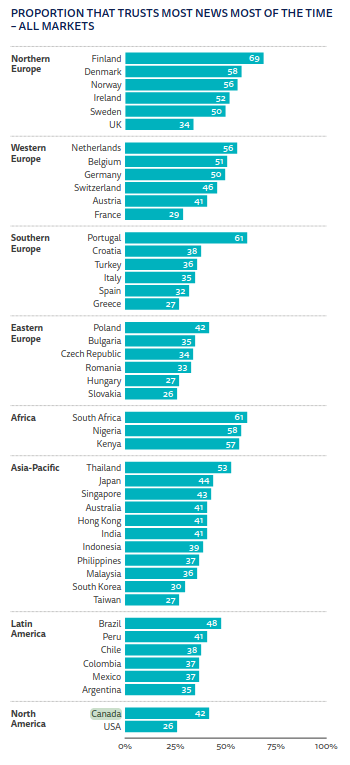

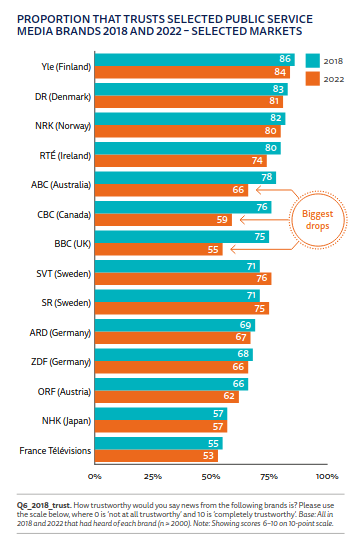

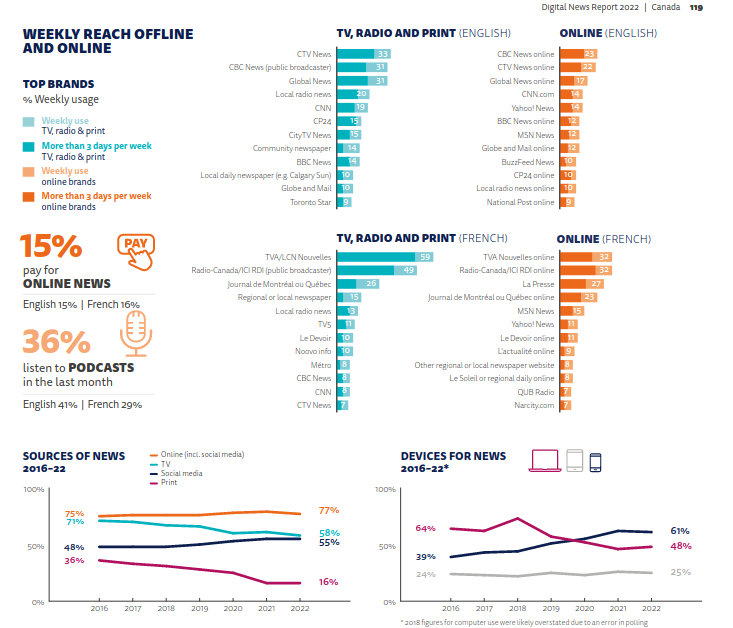

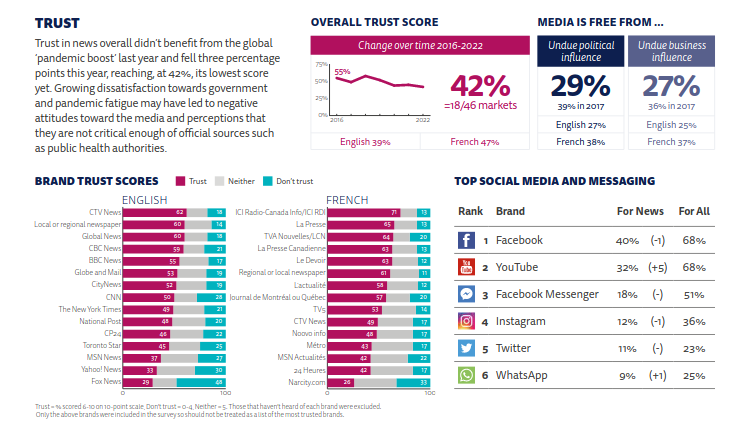

Reduced trust in public media after pandemic

There has been a loss of confidence in the state new media driven by online mobilizations of the far right