June 28, 2022

Europe

Central bankers are all meeting this week at the same time, but in a different place, as the G7 heads of government. The G7 is talking war, the central bank is talking recession.

Not exactly happy times.

European Central Bank is pushing for large increases to the interest rates and dealing with "divergence" between countries in their bond prices. Essentially, the central bank will start picking and choosing which bonds countries can sell to the bank.

Either way, it means acknowledging the Euro Zone currency is not working well and that they do not really understand what is driving inflation.

The separation of political from economic in this way makes little sense.

The left should be pointing out that the idea that the central bank can manage the global economy is and always was nonsensical. The market is failing and we have a solution to that.

Bees and food prices

In Canada’s blueberry farms, there simply aren’t enough bees. It’s a troubling sign, experts say, of what could happen elsewhere.

“We probably haven’t seen this high of losses since one of our early years in beekeeping,” said Kevin Nixon, who has been in the business for nearly three decades. He lost 40% of the 10,000 hives he manages south of Red Deer, Alberta. “I know some guys that lost 90%.”

Beekeepers worldwide have been reporting massive honeybee deaths for years, but in parts of Canada this year’s losses are catastrophic. The impact on the C$274 million ($211 million) blueberry market in Canada

Part of the problem here is that we cannot seem to articulate the issue in anything but money and profits of companies. We do not eat profits, but profits are necessary for reinvestment for us to all eat. This is not resulting in good things.

There are many things driving food prices up including costs of oil, fertilizer (oil), shipping (oil, boats, and containers), microchips, equipment, war, and drought.

The other issue is the continued presence of the bee mite that is ravaging all bee populations around the world.

Australia has implemented covid-style restrictions on bee population in an attempt to limit the spread of the parasite.

Without bees, we have no food. So, it is rather important that we both diversify our pollinator communities (more species of bees) and keep our honey bee populations healthy. However, poor regulation of the food industry's use of pesticides around the world, climate change, and lack of coordination have created problems.

As many as 400,000 colonies were lost this year and there are few options to replace the hives, according to the Canadian Honey Council. Canada imported 40,000 packages of bees—each can be used to rebuild a lost hive—but that’s barely 10% of what’s needed to stem losses. A 2 pound package holds about 8,000 bees.

The solution? There is not an easy solution, but it involves governments around the world prioritizing and coordinating on food production. Which means way more money needs to be spent on food production. Living close to the knife's edge in a time of climate change is not going to play out well.

Oil prices keep going up, no new investment in green energy

This is not a surprise to anyone who understands how investment works under capitalism, but it is a surprise to the entire green economy movement.

Price increases for oil and gas do not automatically lead to increases in alternative fuels.

In fact, high prices for oil and gas do not even necessarily drive investment in oil and gas.

So, gas taxes and carbon taxes and wishing for unsubsidized oil prices are not going to drive the energy transition either.

If we want a way forward, we have to actually push governments to invest in them. There is no alternative to this model and that should be clear by now.

The oil barons tell the truth on this because they are not concerned with this happening any time soon:

Darren Woods, the head of the biggest western oil and gas supermajor, said efforts to reduce emissions by cutting production before addressing consumption had left the world struggling to meet energy needs, pointing to an “optimistic view” about how quickly the energy transition can happen.

Governments had not only failed to deal “with the demand side of the equation” but also did not recognise “that you need a fairly robust set of alternative solutions if you’re going to reliably and affordably meet the needs of people”, Woods told the Financial Times.

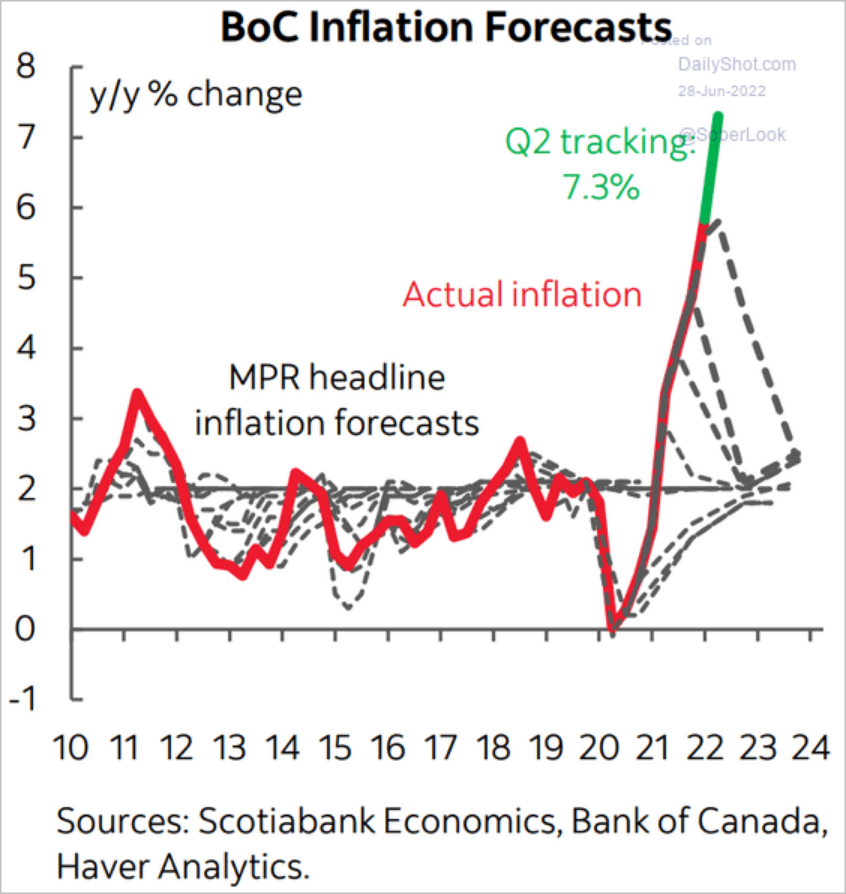

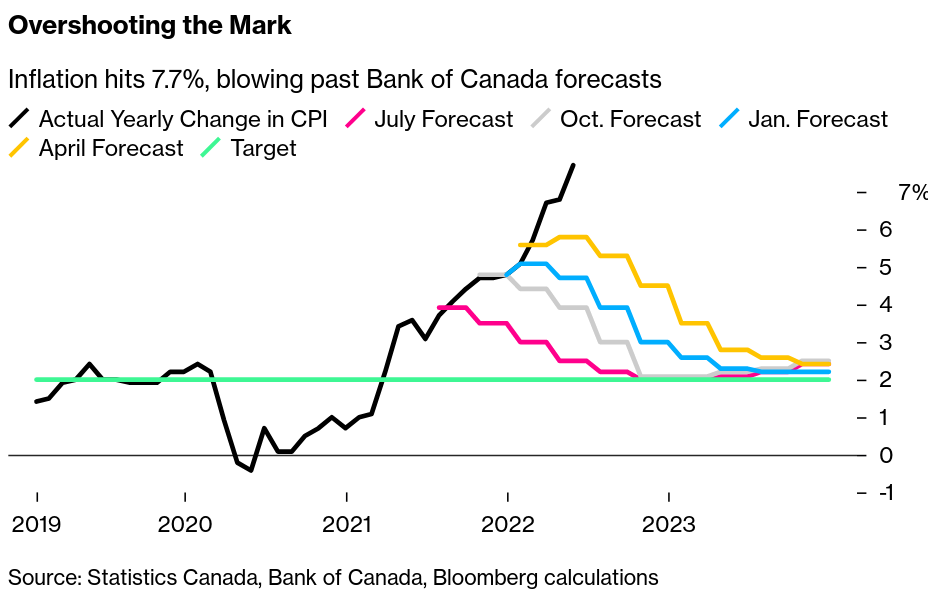

Bank of Canada: never correct on inflation

Why do we continue to believe anything these folks say?

They cannot even do their one job (manage inflation). Probably because they do not seem to understand how inflation even works well enough to predict a month ahead of time.

The central bankers think that they are doing things that drive inflation to 2% (their target rate). So, they push and pull their interest rate lever like a toddler driving the car with their plastic steering wheel—never understanding that their lever isn't really attached to anything.

The problem is that sometimes they throw a tantrum, throw the fake steering wheel, and cause the real driver of the car to stop paying attention to the road and cause an accident.

We have known for a long time that the central bank can artificially drive down interest rates and keep inflation low while profitability is subsidized (through other measures). Unfortunately, it is the only "trick" they have.

The issue is that once reality reasserts itself, there is nothing they can do other than drive a recession.

All anything anyone is talking about now is driven by the mythology of the powerful central bank "controlling" inflation. It isn't and never was true.

The lament is that the left is absent from a call that diverges from this mythology.

We need publicly owned production. It is the only thing that will solve this problem without a recession.

I get where the "labour-side" economists of the post-keynesian variety are coming from. They are engaged in a pitched battle of narratives in the popular press. Which is why they keep saying "profit-price spiral", but this isn't really helpful for creating an alternative policy frame. Or space for workers to have a conversation about alternative economies.

However, the mechanism of "reigning-in profits" isn't clear to me. There is no way to do this other than increasing public production that competes with capital.

Tax increases will increase prices. More public service wage increases do not deal with inflation and supply issues. And, pointing to profits doesn't deal with the fact that wage suppression are to blame for increased profits.

We have the bits, but there are not many interested in the story that links them into a narrative that makes sense.

I guess this is where the world is at. Facts, reality, science, history do not matter any more. But it is a little concerning from the perspective of avoiding falling off the cliff.