June 27, 2023

Keynesians demand sharp slowdown to get inflation down

The FT's Martin Wolf has demanded that the Bank of England show it's "moral fibre" and put workers out of work to bring inflation down.

Panic wrapped-up in "moral" anything is always the hallmark of bad policy. The panic is that inflation is too high and there are a bunch of "indicators" in the economy showing that people still have "too much money".

We are seeing a price-price and wage-price spiral radiating throughout the economy.

Yes, that's right. When the pressure is on, Keynesians blame workers' wages. Or, in this case, workers' spending:

The second is whether the government should cushion the blow to borrowers. The answer is: absolutely not. One reason is that people with large mortgages are relatively well off, as Torsten Bell of the Resolution Foundation points out. The right policy is rather targeted assistance for the most vulnerable.

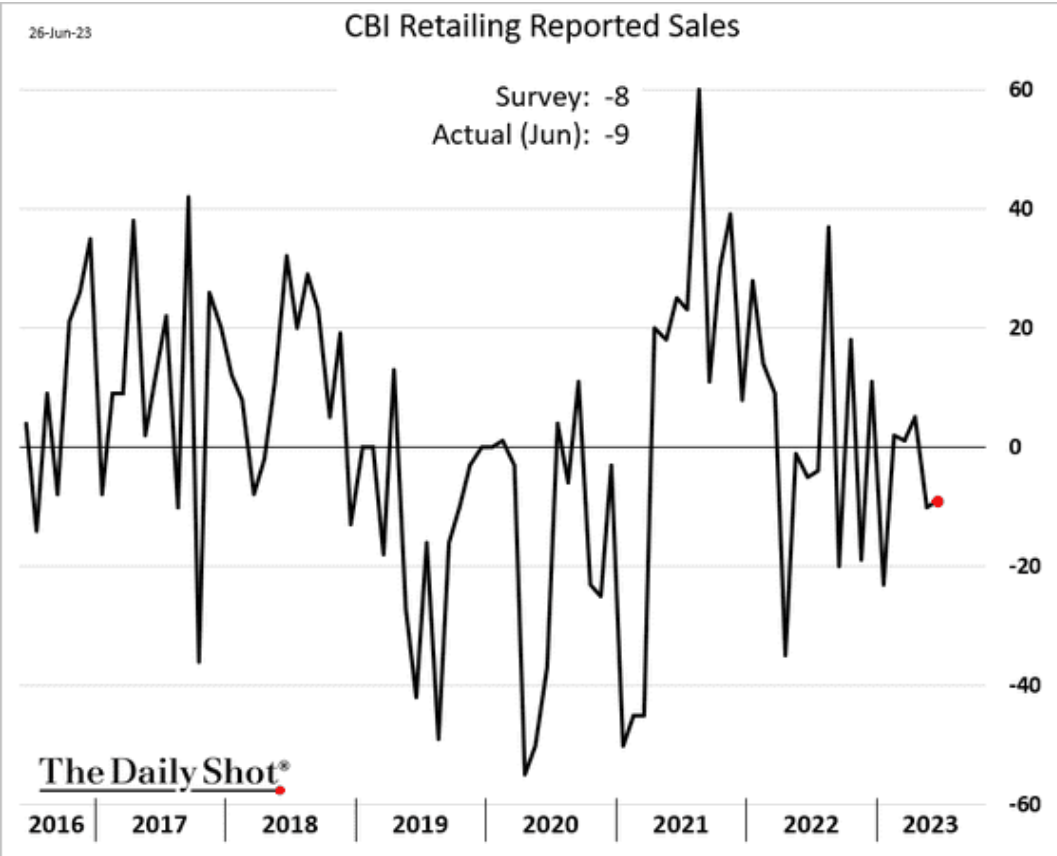

They want to put pressure on the "over consumption" even though retail sales in the UK have collapsed:

Oh, and "price-price" spirals. That's right. Prices are high because prices went up because businesses can just do that. It is genius level analysis.

The panic is that if central bankers do not enough now, inflation will be entrenched and much worse over the long term. Thus, the morality.

In other words, the ends justify the means. So, we better put on our waders and trudge through the storm, bracing against the wind, chins high, and with stiff upper lips. Just ignore all the people drowning around you.

Capitalist morality is lovely.

The "moral" crusade against inflation is getting desperate:

The prime minister insisted “there isn’t an alternative to stamping out inflation” in an interview on the BBC’s Sunday with Laura Kuenssberg programme.

While he acknowledged it was the Bank of England’s prerogative to preside over interest rates, he said it was his responsibility to “manage the government’s borrowing responsibly” in order to curb price rises.

Economists said that raising public sector pay by a large amount would add to the amount of money circulating in the economy and could intensify inflationary pressure. But they added that the government had the power to offset any of these effects with higher taxes.

We all need to pay attention because this policy of moral panic will spread here.

This recession is going to be different in narrative than the previous couple recessions, but the content is going to be very similar. Cuts to spending, increased taxes to pay capital all that money, and privatization through profit guarantees. These folks are going to try to re-live the 1990s and it is not going to work.

Andy Haldane, the former chief economist at the Bank of England, is focused on something a bit different.

A global arms race to reindustrialise is under way, reversing long-established trends in many advanced economies. The forces driving this race — decarbonisation, deglobalisation, remilitarisation — are likely to have lasting implications for the global macroeconomy and may even help it break free from secular stagnation.

I agree with the general thrust of the argument here: investment is needed to break free of "secular stagnation". It happens to be government-spending driven investment. However, the way that this happens and the reasons for the investment have to be taken into consideration.

War and responding to a species-level existential threat is not going to necessarily drive-up standards of living. We just saw a publication point to the problem with this thinking in a half-decent review of growth potentials for the economy.

The International Panel on Climate Change's socialism without socialism policy program called Sustainability Shared Socioeconomic Pathway (SSP1) has been rejected as unworkable. The only two left are called Inequality and Fossil-fuel development (aka, Fascism and Liberalism). And, having a look at the models shows that there is absolutely no way that the predictions are even as nice as these optimistic models show.

Why is this? Because the effects of not doing anything make every part of the inequality journey worse for those suffering the consequences of inequality.

There are positive take-home messages here: even capital has realized there is no way forward without heavy state involvement in the economy. The "market" is not providing enough support for profit extraction from workers and so they are demanding the state redistribute that wealth upwards.

Why is this positive? There is a very small change that is necessary to get the same outcome but without all the war and destitution. And it should be rather easy to articulate in response to the demands for inequality.

All we need to do is what capital is demanding minus the part where we give all the money to capital.

Yes, obviously this is not easy. But, every day makes it clearer that the mainstream economists—even those supposedly on the "left of centre"—are turning into rabid anti-worker sociopaths.