June 27, 2022

At the bottom of the financial market?

- Opinion is divided where we are in the markets after last weeks slight gain (still down 18% this year).

- This means we are not in a place for retail investors to invest their money. So, don't buy the dip and don't try to "join the bounce" unless you have enough money to buy whole.

- Recession, war, political turmoil, food prices, global south debt issues are all still to come.

- Hedge funds are braced for market turmoil even as some are enjoying claiming they made gains last week investing in base consumer goods.

The caution comes as a number of top managers appear to be taking bearish positions in their portfolios, even though the S&P 500 has already dropped 18 per cent this year and the Stoxx 600 has lost more than 15 per cent.

US-based Bridgewater Associates, founded by billionaire Ray Dalio, has recently taken 27 short positions above the 0.5 per cent disclosure threshold in European stocks, according to data group Breakout Point.

Among the casualties this year have been Chase Coleman’s Tiger Global, which was down 52 per cent in the first five months of the year

Nothing progressive about central banks

- Central bank heads are meeting this week in Sintra, Portugal. Expect more nonsense from them as they try to look important.

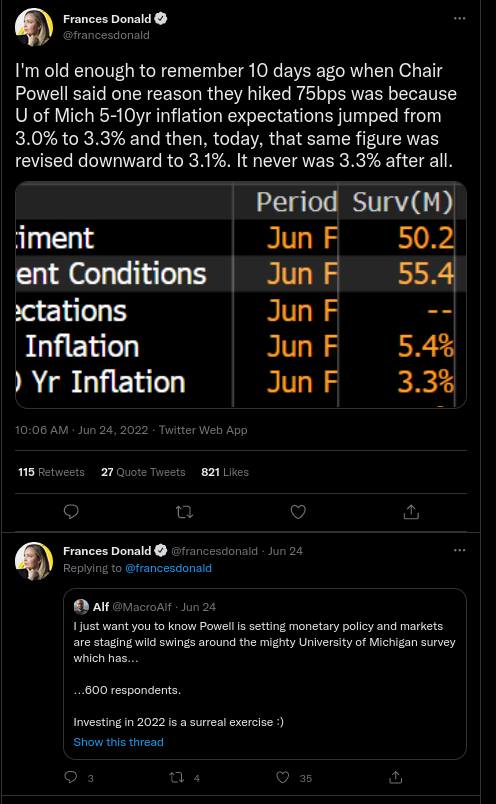

I don't post from Twitter often, but this one linked in Bloomberg was funny:

-

The central banks' bank, known as the Bank for International Settlements (BIS), is all in on wage-price spiral warnings. This is going to be a common refrain from central banks trying to prepare the world for making workers pay for any response to inflation.

- Their main point is for central banks to be very aggressive on the "cause pain" side of decisions.

Not that the BIS has ever been able to predict anything in its economic forecasting, but in its recent report it is apologizing that it doesn't know what it is going on and adamant it is wages that we must be scared of.

-

"The question for economists is not whether the labor market will slow down, but how quickly."

- The labour market in the USA is already showing signs of effect of the increased debt costs with layoffs and hiring freezes in real estate, tech, retail, and base production.

Also, talk of "high-inflation regimes" makes me want to poke my eyes out. Be prepared to hear that phrase more often now.

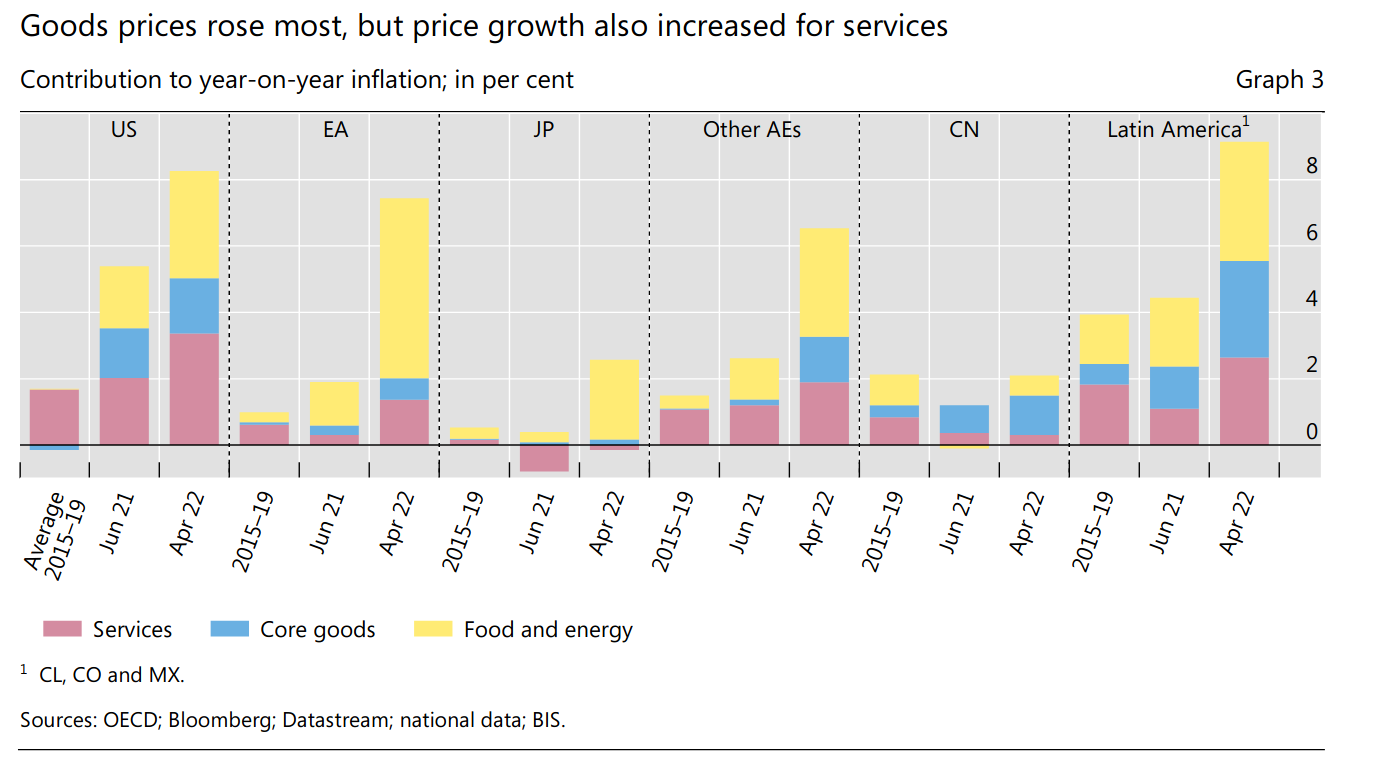

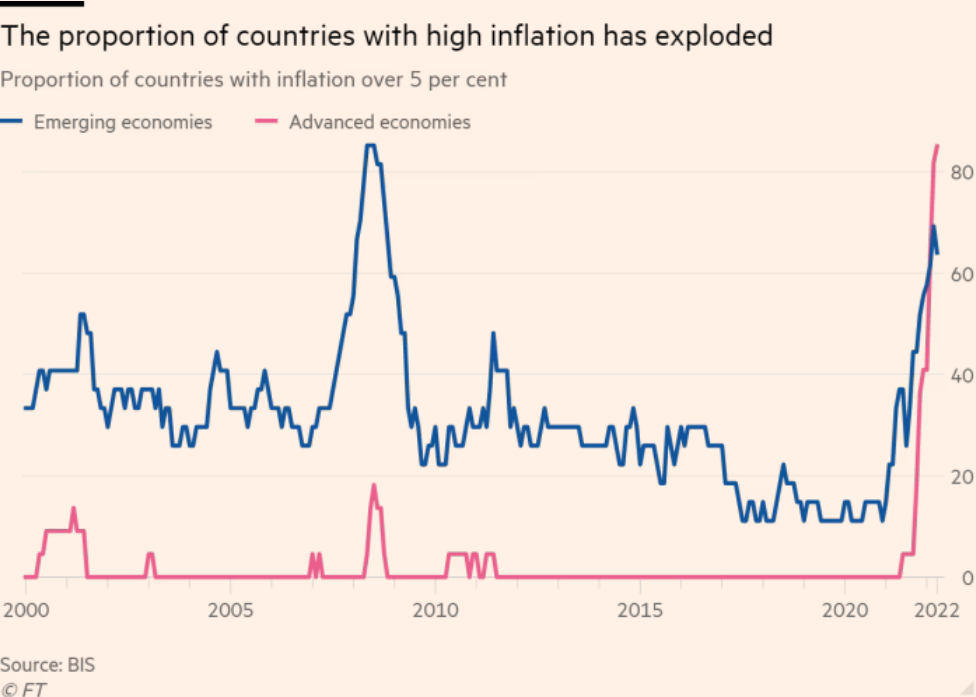

Price increase are global. Which should not surprise anyone given that money, trade, production, never mind workers/consumers are global. The BIS, however, is surprised.

Worse, however, is that inflation has yet to reach the top of the hill in Asia.

To bring down inflation, the BIS said, “some pain will be inevitable”, but it said ultimately the difficulties of entrenched inflation “far outweigh the short-term ones of bringing it under control”.

“This puts a premium on a timely and decisive response,” it told its member central banks, even if none could be certain that they had moved into a high-inflation environment.

The BIS added: “The overriding priority is to avoid falling behind the curve, which would ultimately entail a more abrupt and vigorous adjustment. This would amplify the economic and social costs of bringing inflation under control.”

This is not going to be good for people.

Narratives around profit are working

It may not increase people's understanding of inflation and prices increases, but blaming profits and "gouging" has a positive narrative effect.

Oil companies are an easy target:

- Morning Consult survey showed that more than 90% of Americans blame companies for price increases.

- 3/4 of all USA voters support some form of legislation to clamp down on "energy price gouging". Sure, it is on par with asking people if they want to pay less, but that works as a comms stat.

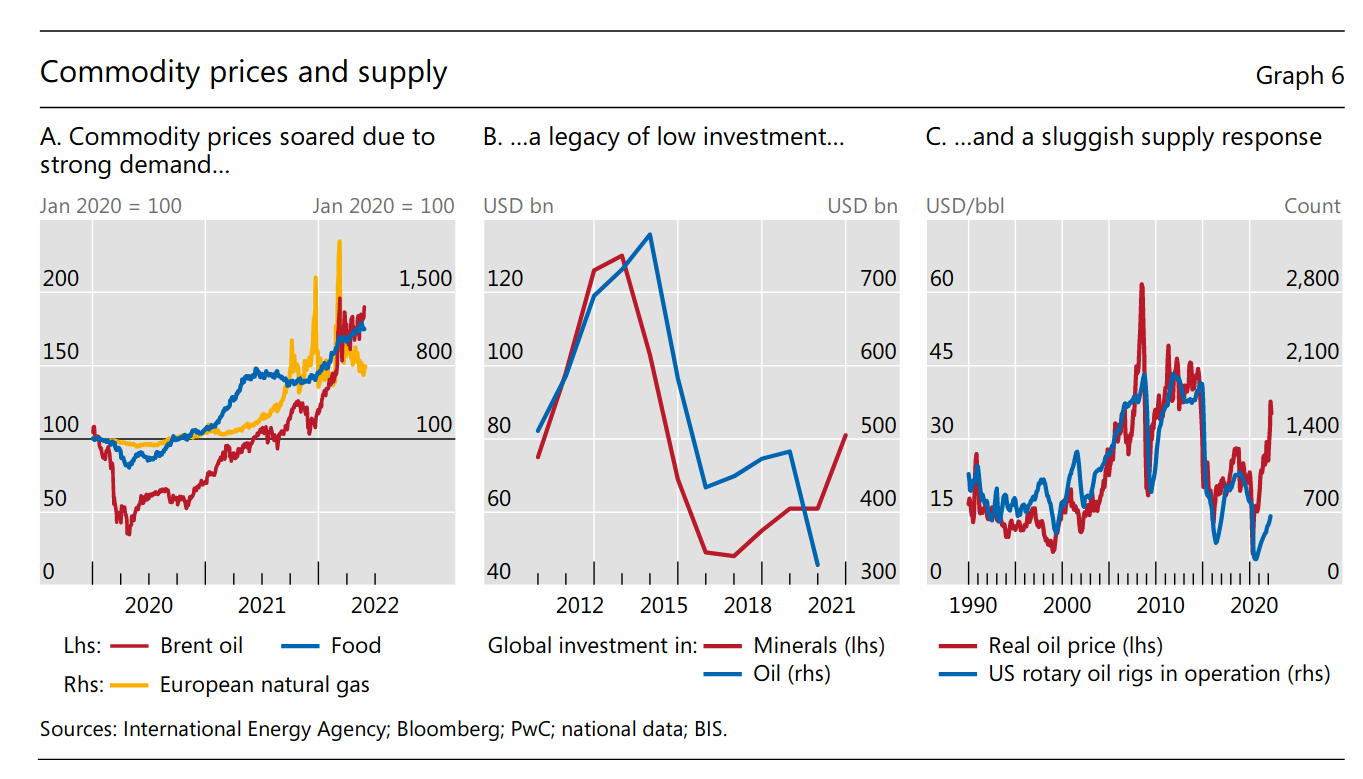

The reality is, however, that it was the demand spike and "normal" market forces that have created the cost of oil increases, impact on supply chains from war and China's covid policies, and the increase in borrowing costs (and profit expectation).

Democratic Party hacks in the USA are driving this narrative that monopoly(esque) profits are to blame in an attempt try to deflect responsibility for inflation in the USA in the run up to mid-term elections.

For the left, we have to pivot to a public investment and ownership response to this narrative. If folks want cheaper things and do not believe companies will do that, there is only one other option.

Russia in default

- Sanctions—as opposed to having the funds—are the culprit of this default.

- USA treasury department last month closed a sanctions loophole that allowed American investors to temporarily receive interest payments from Russia

- Markets, however, are unmoved as it was forecast long ago.

- At this point, it is hard to know which side is suffering more from this move.

About $100mn worth of interest on Russian government bonds came due on Sunday evening with no sign of payment, marking the end of a 30-day grace period during which the country sought to avoid a full default.