June 25, 2024

Parts shortage

There are growing fears that supply chains are again being disrupted enough to affect production. Companies are complaining that they cannot get parts and other inputs on time.

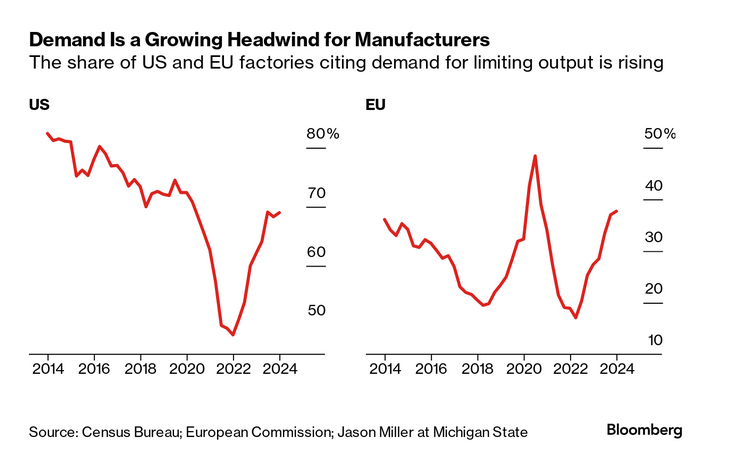

In the US and EU, demand for inputs by producers has not been stable for a long while, but recent fluctuations in the reliability of supply chains have meant that shippers are having difficulty allocating capacity correctly.

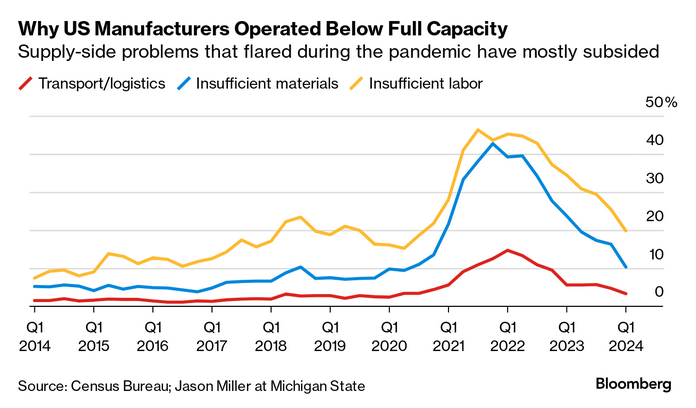

The "higher for longer" mantra for central bank interest rates has driven the economies of the world into recession in the misguided attempt to deal with inflation through suppression of economic growth. Manufacturing surveys released earlier this month show declines in demand for inputs almost across the board. At the same time, these producers are reporting that it is harder to find suppliers when they do need those inputs.

For mainstream economists that blamed the supply crunch for high inflation rates, those have declined almost back to pre-pandemic levels, which should indicate that the supply-crunch contribution to inflation is declining. However, the declining strain on supply chains is really due to a slowdown in production, not eased shipping.

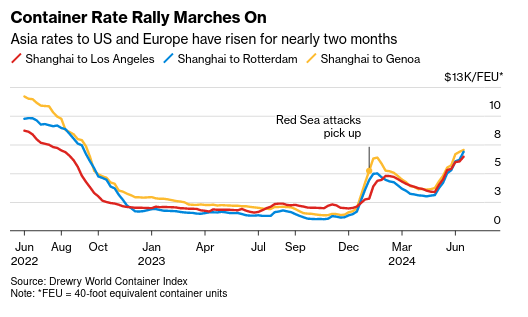

Some economists in the shipping sector are predicting that it takes about 6-9 months for prices from increased shipping costs to reach consumers, due largely to the systemic-level impact on planned inputs.

However, spot rates on shipping containers are the highest they have been since the major supply crunch in 2020. One reason is that shipping companies and container companies are in contract negotiations. The other reason is that while demand is soft, the effects of war and climate change are increasing the risk of supply chain instability.

Such instability of routes means earlier ordering and greater storage are required, which in turn means higher costs.

Airlines are still struggling with this concept as they continue to try to find savings for inputs through fraudulent means instead of shoring up production closer to their assembly plants.

The manufacturer warned late on Monday that it’s experiencing a shortage on engines, aerostructures and cabin interiors, which in turn is sabotaging the company’s delivery plans.

Faury said that cabin parts, for example, are in short supply because airlines are refurbishing older planes, meaning shipments to Airbus are constrained. Many airlines have complained that aircraft deliveries are delayed, forcing them to fly older kit for longer. (BN)

New shipping fleets are being launched next year, but the increased capacity on the seas does nothing if your boats cannot move.

Speaking of freight being unable to move, Verdi workers in Germany have been on strike at five major ports in the north of the country for over a week. The impact is being felt at the cost of $6B worth of trade being disrupted.

But any strike action pales in comparison to the impact of shipping disruption in the Red Sea. The impact of labour actions are dealt with when the disputes are over; they are known quantities when it comes to timing and effect. The Red Sea disruptions, triggered by the war in Gaza and caused by Houthi rebel attacks, are of unknown duration and effect, impossible to plan for, and not easily resolved.

Data released earlier this week for May shows that revenues of the Suez Canal dropped by 64.3%

The current issue for supply chains is that they are not resilient, and we are doing little to make them more resilient.

For example, digital traders are increasing their use of sophisticated data tools to speculate on spot prices for shipping containers. While this creates market mechanisms for the allocation of shipping capacity, in the end, it just undermines the investment in resilience across the system. These kinds of speculative markets make it seem like there is a sophisticated use of slack in the system, when in reality the entire system is more susceptible to localized disruptions because there is never enough slack to absorb them.

All this is to say that we have a problem in our supply chains created by shifts in trade routes because of geopolitics, war, re-introduced tariffs, the end of the "just-in-time" experiment, a lack of interest by companies to plan for disruptions, and a climate crisis. Add to this the significant reorganization of supply chains already because of the pandemic, and we have all the ingredients for reliving a full-blown supply-chain crisis.

A pause on this crisis is appearing right now because the economy is struggling. But the only way to make use of this pause and fix things is through investment in resilience and recognizing the negatives of neoliberal trade programs.

Unfortunately, instead of making those investments, shipping companies are pointing the finger at workers and demanding an end to labour rights and safe working conditions such as using longer trains or attempting to replace inspection with AI/automation.

Things will improve only when governments use their regulatory powers and investment capacity to build the supply chains and infrastructure we need.

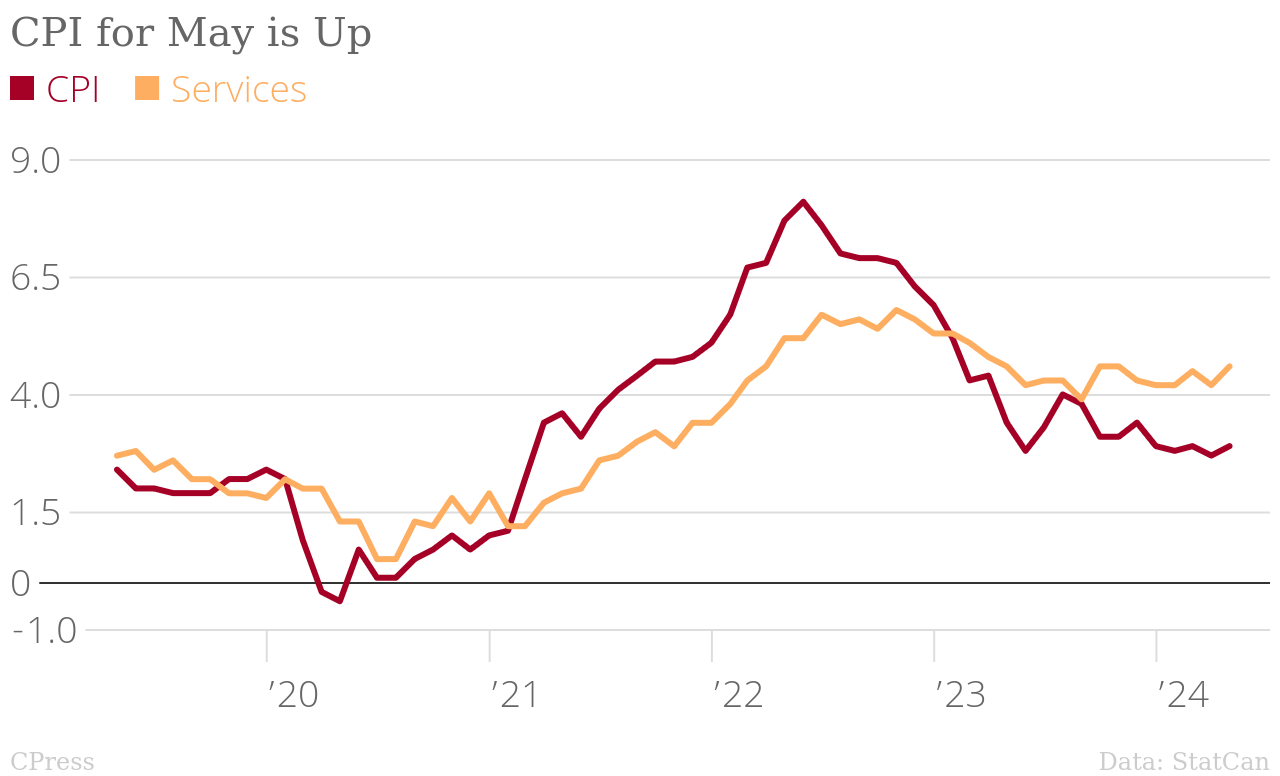

CPI for May

Get ready for the "we reduced rates too quickly" arguments.

- Consumer Price Index May 2024: 2.9% increase

Increases almost across the board, but shelter is still a key driver.

Food has wobbled back up. So much for the calls last month that we would hit deflation on food prices (a ridiculous notion).