June 22, 2022

The equity rally from yesterday has reversed

- The bounce in equity markets yesterday has come back down to earth and died. Good thing you didn't buy that dip.

- UK general prices increased 9.1% with a very large increase in bread and grains costs (6.7%).

- However, prices for raw inputs are also driving prices.

- UK price increases are going to push past 11% this fall.

USA government is going to be cutting taxes on fuel. This does little to affect costs of fuel and just subsidizes profits at the tune of $10B for oil companies and downloads costs of road maintenance to states.

The issue with the current bout of inflation and cost increases is that the solution cannot be found at the central bank or through interest rates.

Price pressures are caused by real supply issues and by simple lack of available resources to meet needs. Inflation is still here with money in the financial sector and pushed to record profits instead of to investment.

The only way out is for state intervention in production.

Climate and energy costs

Coal-fired power plants made up more than 28% of Germany’s gross electricity generated last year and has not changed this percentage for years. Renewable sources powered 41 per cent of output with natural gas and nuclear covering roughly half the balance each.

The reason? Coal costs less than a third of natural gas.

Energy investment in Europe—in response to the war in Ukraine and the threat that Russia will cut of gas and oil shipments—has grown 8%. This is still well below the investment needed to address climate change, never mind address transition from gas for heating.

Outside of China, renewable energy investment has not grown in real terms since 2015 even though this is the cheapest way to reduce the growth in use of oil and gas.

When we rely on the "market" to fix problems caused by the market, the result is exactly what you would expect: more of the same problems.

Inflation and the Phillips Curve

The Phillips curve is an old stupid idea that inflation and unemployment are related—as in if you can control one it will affect the other.

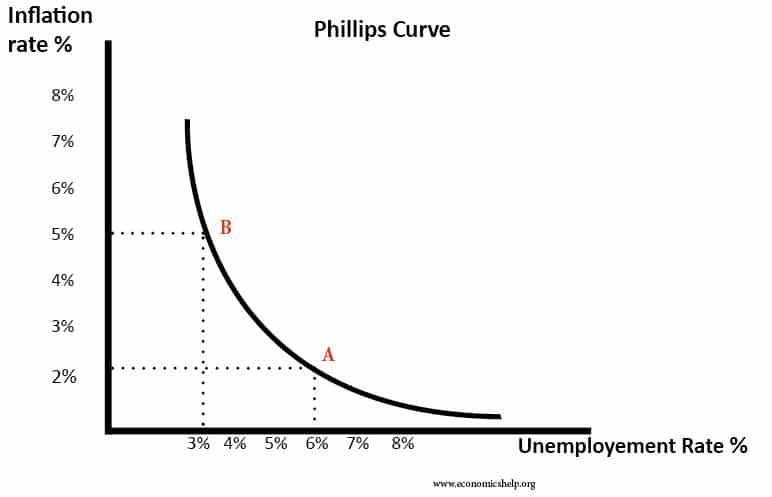

Here is what the mythical Phillips Curve looks like.

See the nice smooth relationship between unemployment and inflation? This is the world that many "economists" live in.

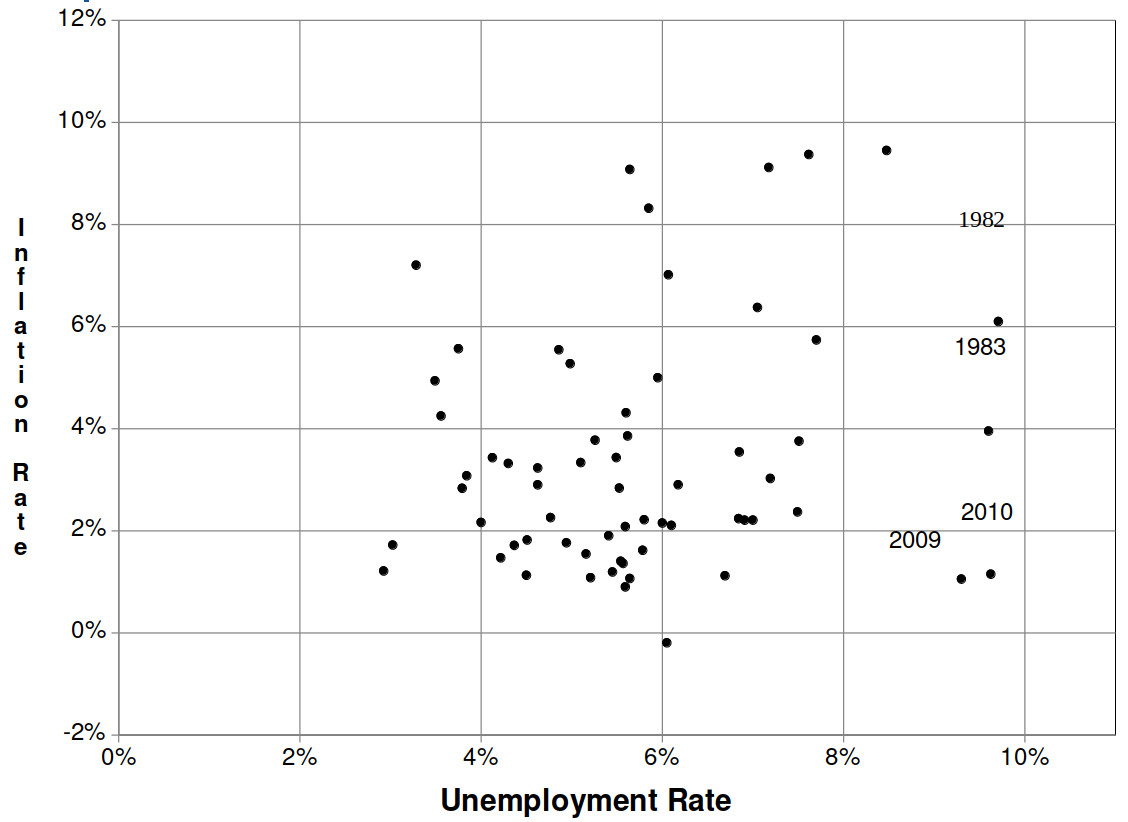

Here is a graph showing the real data.

Notice that in the real world inflation and unemployment are not even correlated. They never were. And, it is rather stupid to continue to think that they are.

Why do we care to point this out? Because the wages piece is related to this.

Neoclassical economists think that

- wages are not in competition with profits

- that prices always include some "natural" rate of profit

So, in this ridiculous economic theory, if wages go up, prices will go up to maintain the normal rate of profit. This is where the "wage-price spiral" nonsense comes from.

What does this have to do with the Phillips Curve? Under neoclassical economics wages are a direct function of labour markets and unemployment.

The natural state of neoclassical mythology is a situation where there is no involuntary unemployment in capitalism. Unemployment is just a function of government interventionist policy. That is governments intervening in labour markets. The more they intervene, the lower unemployment, the higher inflation. The more government allows workers to fight for wage increase (that is, they cannot be easily fired) the higher the artificial employment, the more wages they get, and thus the higher inflation goes.

Wages go up and down depending on supply and demand of labour and rational choices by workers to work or not work at this or that wage. Just like consumers make rational choices to buy this or that food stuff. (And, families make rational choices to live or die depending on the price of food and housing.)

It is all nonsense. No one serious actually believes any of this. But, you would never know that reading the newspapers/blogs/websites.

Larry "I can't find my glasses" Summers thinks the Phillips Curve should drive government economic policy. He wants to get back to "A" on the graph above. The problem is that the curve doesn't exist, so there is no "A" to go back to and we are not at "B" right now.

- It is hard for many people to understand that this Phillips Curve does not exist because that is all anyone is talking about right now when they talk about interest rates going up (which drive unemployment) to bring inflation down.

For those interested in what the Phillips Curve should be and why everyone is confused about it, see this paper by Shaikh.

The answer from the data is clear:

Wages and profits compete with each other. If wages go up, profits go down. There is no ability to "just increase prices" and get your profits back. Prices are regulated by competition with other firms.

So, do wages drive prices? No. Prices are driven by a bunch of things, wages not really being interesting to much of that.

So, do wages drive the costs of things? Yes. Costs are driven by the costs of inputs, which includes wages—but this does not directly drive prices and it certainly does not drive inflation.

What happens when real costs increase? Profits go down.

What if everyone's costs increase? Prices go up and profits of some producers go up but only in the short run as they can increase faster than wages. Then workers demand more wages from the increased profits. Then profits come back down—if workers win in their wage demands.

In this reality-based model, profits and wages battle for the larger mass of revenue from the prices increases, but this battle is not driving prices. Prices were driven up by the value of money (inflation) and—the current situation—the supply chain drag on supply of inputs driving the prices of inputs up.

In this reality-based story of real economics, prices are not related at all to wages.

But, you can see why capital wants you to think that wages are the problem—they want to keep the short-run profit spike going.

The problem with this reality is that the other side of the coin is that profits do not drive prices either.

Unfortunately, our side (the Left) love saying this. It is rather silly because it is not true. If it were, it would be equally true that wages drive prices.

This is the problem with (post)Keynesian analysis.

You can see why it is a mess.