June 20, 2023

Green transition good for the economy?

A green investment program is only good for the economy if done a certain way. Right now, different parts of the state are working at cross purposes: both giving money away for investment and broadly crushing capacity to invest.

We have talked before about the central banks' mad push to raise interest rates in spite of all the evidence indicating it is not directly related to inflation reduction. Neoclassical bankers want lower rates, sure. But, there is something to the notion that part of the higher nominal prices are not just because of profit subsidies.

Climate change is causing price increases with higher general food prices and increased number of crises. Added to this cost is the cost of duplicating our energy production and massive expansion of that production.

Over the short-term someone has to pay for that necessary redundant investment. That means higher prices. If interest rates go up (in our private market economy), then that investment—state-lead or not—is going to be more expensive.

Also, speed matters in the transition and the impact is in opposite directions depending on if you are a new or older energy firm. Older firms have installed production that needs to be paid for. Newer firms do not have that, but they do need to borrow money to grow.

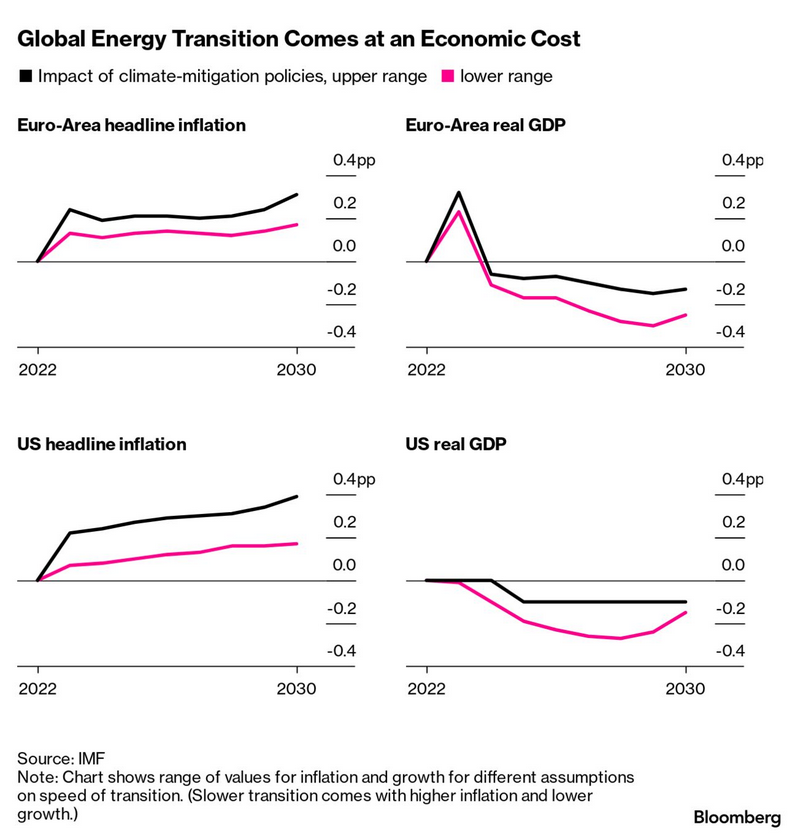

The transition might fuel consumer prices. Euro-area inflation may be as much as 0.3 percentage point higher through the end of the decade, according to the International Monetary Fund.

Similarly, Sweden’s Riksbank found that energy prices will increase during the transition as phasing out carbon-intense technologies squeezes aggregate supply, and investment in new ones bolsters demand.

Within the context of higher interest rates and massive amounts of investment support, competition is global for capital seeking out lower rates.

Nations are going to start seeing rapidly increasing competition from investors moving quickly to lower rates.

A growing chorus of investors is buying bonds from developed nations where rate cuts may arrive sooner than many economists expect.

I think that in the context of private capital investment in Canada, interest rates and quantitative tightening are undermining our competitive advantage.

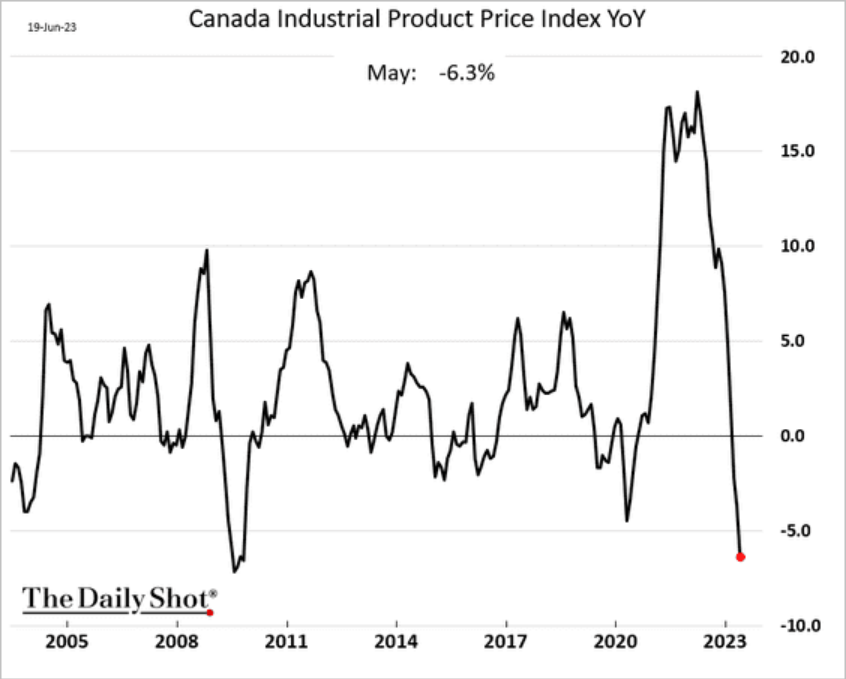

You can see that in the slowing economy, and lowering investment activity. Industrial producer prices are now falling. This is a result of over-capacity, not competitive production.

This is just for Canada. As these industrial production prices are reduced, investment here is reduced. That means a local recession-caused price reduction. Not exactly the solution everyone was looking for.

The paradigm has shifted on trade and investment. Even if there is no sophisticated awareness of the changing situation, capital will flow to where it can raise the most profits, and believing in the fairy tales of free trade and fair competition is not going to pay off.

It is not just the cost of investment, it is also the ability of those countries to pay for them. States have downloaded their and their corporations' debt burdens to the individual. This is seen in increased credit card and mortgage debt in many OECD countries.

… economies are way more exposed to higher interest rates than the US due to their more elevated household debt levels, and the full effect of their tightening cycles is yet to kick in.

Household debt accounts for about 190% of gross domestic product in Australia, Sweden and South Korea, according to the latest available OECD data referring to the end of 2021. That compares with a ratio of around 95% in the US and Germany.

The strategy of transferring debt to the worker pushed up profits for capital under neoliberal restructuring, but under the threat of climate change things are a bit different. Capital now wants direct subsidies. The money has to come from somewhere and we now know the risk of random broad-based profit subsidies is inflation. So, giving money away to everyone is not going to work.

The mechanisms show clearly that we need an industrial strategy. One that takes in all aspect of investment and impact. Since most advanced capitalist states have been running away from such a regime for 50-odd years, one can be forgive for not really being hopeful for a quick change.

One policy we need to push for is a massive build-up of state capacity to do economic planning. That means state hiring and/or bringing-together workers who have that ability and analysis. It is a simple call, but without this first step we are going to be in trouble.

It is a rather foolish bet to think that capital will finance this itself. Without direct state involvement into the economy—even under advanced capitalism—things are not going to work.

The Olympics is a show

Something needs to be done to fix this system of corruption.

French police have raided the offices of the Paris 2024 Olympics organising committee and the state-backed group responsible for building infrastructure for the games, as part of an investigation into alleged corruption in the awarding of contracts.

Venture Capital and Arms

It was only a matter of time. The companies that brought us Bitcoin, Uber, Amazon, over-production of plastic, surveillance technology, mind altering social media, and earth destroying use of energy to drive mindless entertainment are now moving into weapons.

This had been happening in the background since 2018, but now is in full swing.

What could possibly go wrong.

US venture capitalists have agreed more than 200 defence and aerospace deals in the first five months of this year worth nearly $17bn — more than the sector raised during the entire of 2019, according to data from PitchBook. US venture investment in defence start-ups surged from under $16bn in 2019 to $33bn in 2022, PitchBook data shows. Investors piled a record $14.5bn into such start-ups in the first quarter of this year. (FT)

The USA defence budget is at $886 billion for 2024.