June 2, 2022

Labour markets, wages, and inflation

- Tight labour markets are supposed to raise wages, but it doesn't always happen that way.

- The labour shortages in the airline industry, nursing, personal support work, food services, and basically all front-line are caused by pay not keeping up with inflation and decades of stagnant compensation growth.

- Even in industries with unions, it takes time to raise wages (especially when union bargaining agents are not used to asking for the kind of increases they need to keep up) and then hire trained/interested people into those jobs.

- In the UK, airlines let 45,000 trained workers go at the end of the pandemic when government profit subsidies wound down.

-

Nurses and frontline health staff who quit during the pandemic are unlikely to return unless conditions improve for them significantly.

- as 3mn more nurses could leave the profession earlier than they had otherwise planned due to the pandemic. In the USA, one in five nurses reported they might leave their roles in providing direct patient care in the next year, the survey found.

- That's not to mention the "as many as 180,000 healthcare workers died from Covid-19 between January 2020 and May 2021."

- Or, to mention the acute mental health crisis that interrupts work for many.

- PSWs – one of the fastest growing and most needed occupations everywhere – still face barely minimum wage and declining real wages.

The main problem is that the rich countries lure workers who are trained as nurses or have a targeted recruitment and training program for PSWs, etc from developing countries to maintain a steady supply and lower wages. Which is one of the reasons wages have not kept pace – along with unions not organizing PSWs outside their central agreements in institutions resulting in a temp-agency like workforce.

Nigeria and Ghana are both on that WHO red list. Yet almost 4,000 nurses from the two countries joined the UK register in the year to the end of March this year. There are also 3,655 nurses on the register from Zimbabwe, which has significant gaps in its own nursing care.

In a report to the World Health Assembly, which concluded last weekend, Tedros Adhanom Ghebreyesus, the WHO’s director-general, warned that many countries “are once again turning to international recruitment to rapidly increase domestic capacity”, a development that was “likely to accelerate global migration and mobility of health personnel”.

Oil

- Most EU countries have banned Russian oil.

- Oil prices are going up. That means fuel of all kinds becoming even more expensive.

- Brent crude, which has been on the rise for weeks, settled at $116.29 a barrel yesterday, up 69 cents. West Texas Intermediate, the US marker, was up 59 cents to settle at $115.26 a barrel.

- This has increased profits of these companies, with investment flowing in.

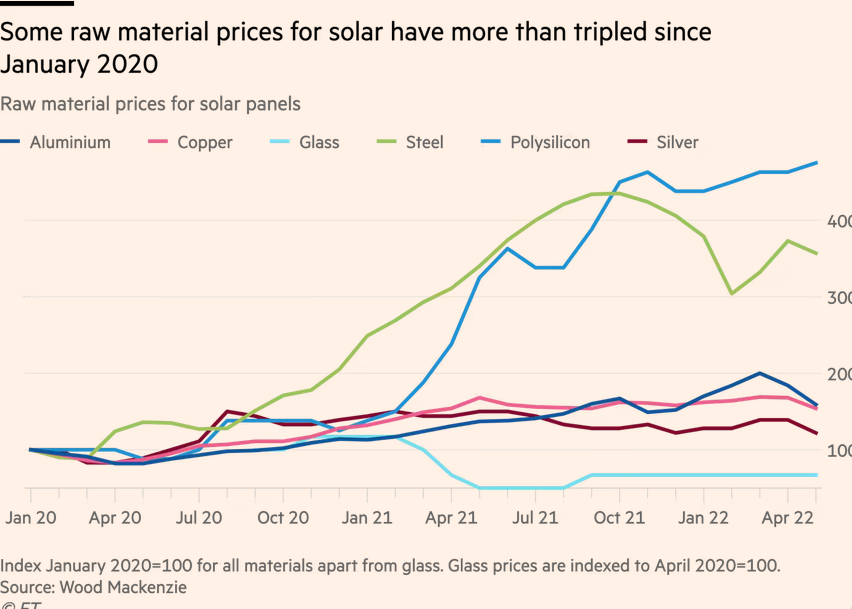

- Solar prices have already gone way up because the inputs have become very expensive. You will hear about the increased cost of polysilicon very soon.

Wood Mackenzie estimates that in order to achieve its REPowerEU goals, Brussels needs to produce three times more polysilicon, 20 times more semiconductor wafers, 42 times more cells, and six times more modules.

-

This has lead some of the world's more plain spoken investment capitalists to change their tune on "climate-orientated" investments.

- Hedge funds are moving away from stocks and into energy (and other things)

- Jamie Dimon (of JPMorgan) warns oil could reach $175 a barrel on fallout from Ukraine war and admits that capitalism isn't and cannot be "woke".

- JPMorgan being the biggest financier by far of fossil fuel companies in the six years since the Paris Agreement was signed in 2016.

- Dimon said on Wednesday the bank was “quite serious about climate” but said the US was not “getting climate right”.

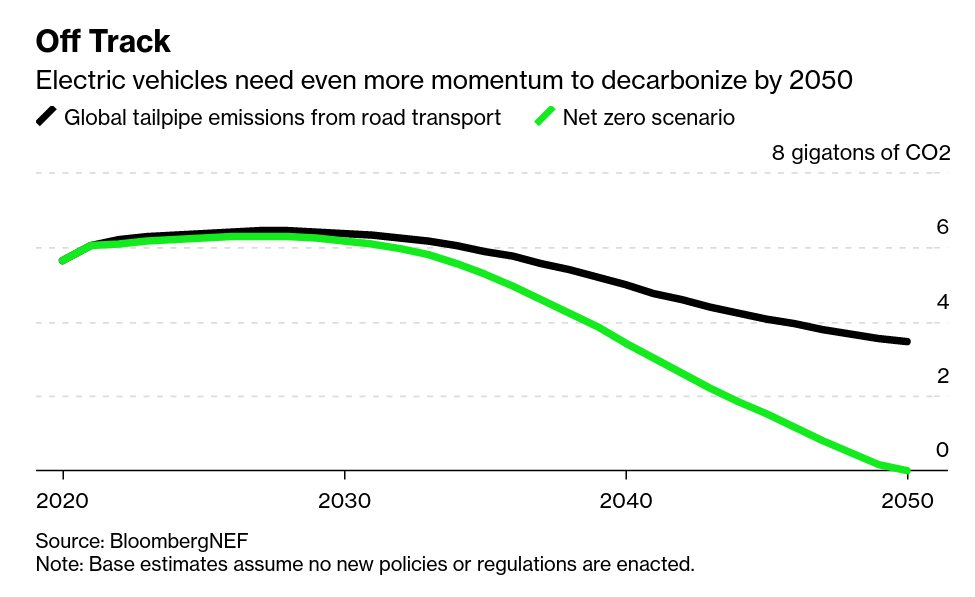

Don't think for a second that the rapid rise in EV cars is going to save us from the burn more oil that is even more expensive ridiculousness.

- The number of EVs being sold is growing at a fast pace, but not nearly fast enough to reach even Net Zero numbers:

(Finance) Capital has decided that Russia has defaulted on its debt

- "Failure to pay" bond interest has triggered internal processes.

Russia’s failure to pay a slice of interest on one of its bonds will trigger $2.5bn of insurance-like contracts used to protect against debt defaults, according to a panel of derivatives dealers and investors.

The ruling by the Credit Derivatives Determinations Committee that a “failure to pay” event has occurred pushes Moscow one step closer to a historic debt default, as western sanctions following President Vladimir Putin’s invasion of Ukraine choke off its ability to make payments to US and European investors.

The result is interesting because some very large USA investment houses were betting heavily that Russia would not default. It still has not, but that doesn't matter when the board that decides what a default is votes.

- The accrued interest is small and the principal of the bond due in April was repaid. So, the decision will not trigger a wider default on Russia’s debt.

Wednesday’s decision means holders of Russian credit default swaps will receive a payout, with the size to be determined by an auction process of Russian bonds. JPMorgan estimated last month that there were about $2.5bn of CDS to be settled, including deals tied directly to Russia and others based on a basket of issuers.

US bond-investing giant Pimco was among the investors with exposure to Russian CDS, having amassed a derivatives wager that Moscow would not default worth at least $1bn at the end of 2021, according to a Financial Times analysis of the asset manager’s holdings.

Private equity firms (hedge funds and large parts of pension funds) are being hit hard lately

- Interest rates going up directly affect profitability in the same way as artificially low interest rates were pushed down to increase profitability.

- Some players inside the industry admit it is more like a ponzi scheme than real investment.

Vincent Mortier, chief investment officer of Amundi, the largest asset manager in Europe, described parts of the industry as a “Ponzi scheme”

"You know you can sell [assets] to another private equity firm for 20 or 30 times earnings. That’s why you can talk about a Ponzi. It’s a circular thing."

- Investment in Tech is maybe 50% of this ponzi process where VC is synonymous with the industry.

- Governments have built entire policy frames around "innovation" and growth in start-up companies – because they have been lobbied heavily by the over-hyped industry.

- This means there is more than just private money tied-up in this silliness.

Pandemic job loss for women

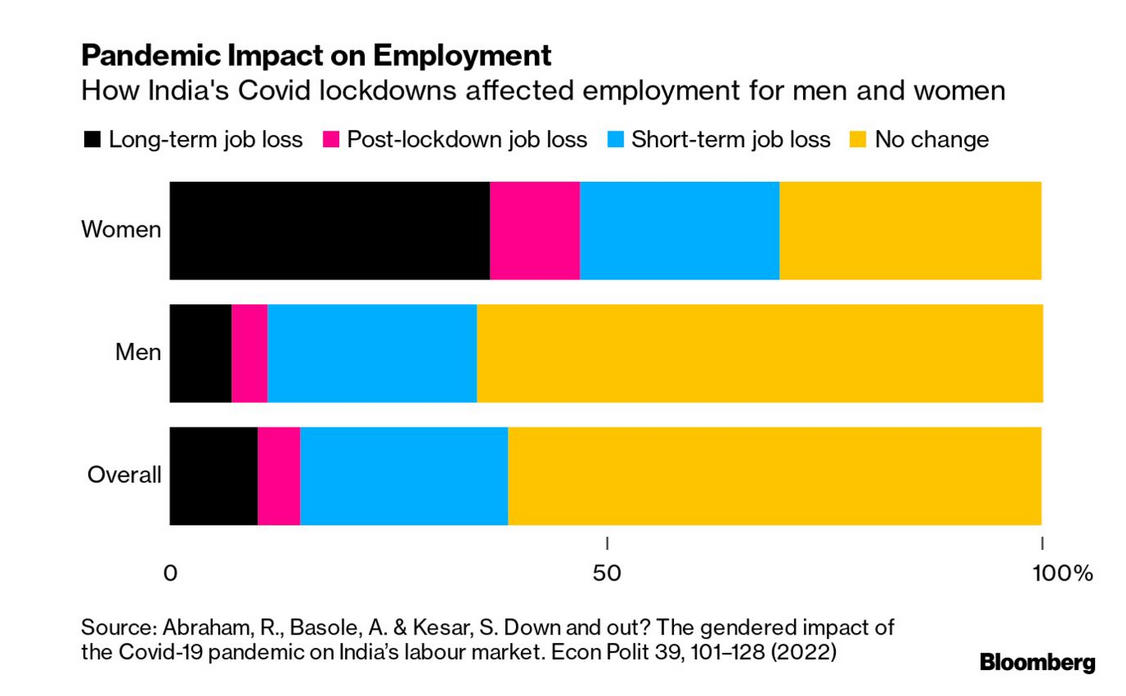

The impact of the pandemic has not hit all demographics the same.

- The world over, the policy response to the pandemic has not held women and their jobs up to standard.

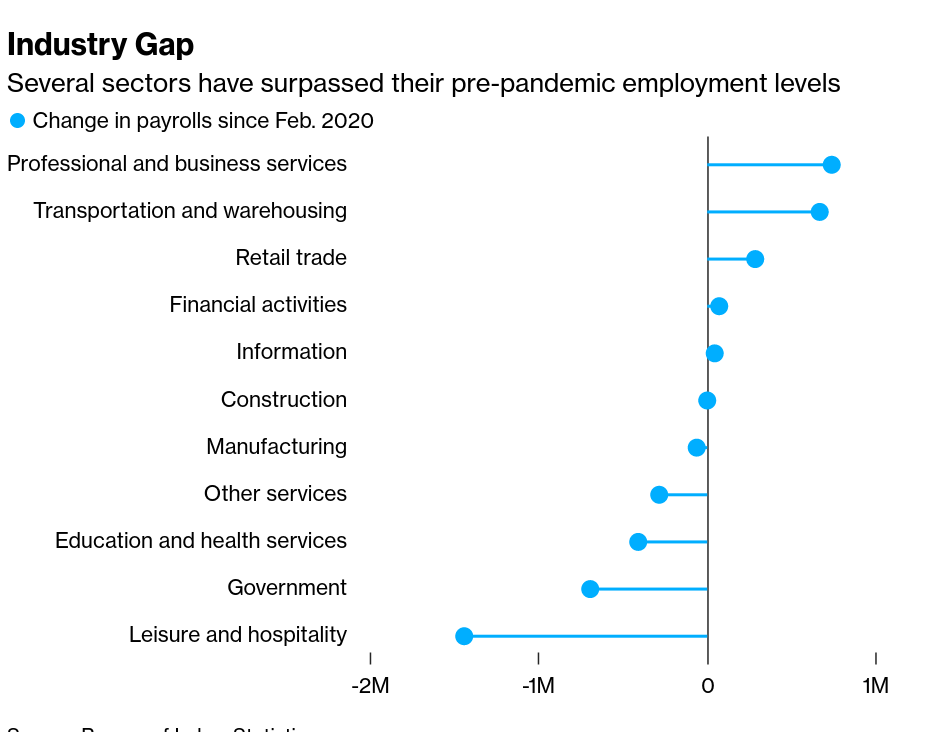

- Even the recent job growth – which is already slowing – is rather gendered (USA data):

India

Canada

The impact of Bill 124 is broadly an issue for wage suppression, but the interesting part is who has been affected by this wage suppression?

More women, black, indigenous, racialized, people of colour, and other marginalized folks who are disadvantaged by the private sector and seek employment in public sector.

Public sector blue collar jobs and front-line service jobs are sought-out for the benefits folks from disadvantaged groups need to keep themselves out of poverty. A unionized position with some benefits and maybe a pension. Front line work, but work that provides some basic support.

Then the Tories cut funding to the BPS and freeze their wages to make sure the lowest-waged workers (read racialized women) on the frontline must bear the full cost of those cuts.

While also feeling the full effects of using that savings to subsidize profits and drive inflation. Inflation that more directly impacts lower income BPS workers. And cuts to public services increase costs of these same people.

It is class warfare, but of a particular kind.

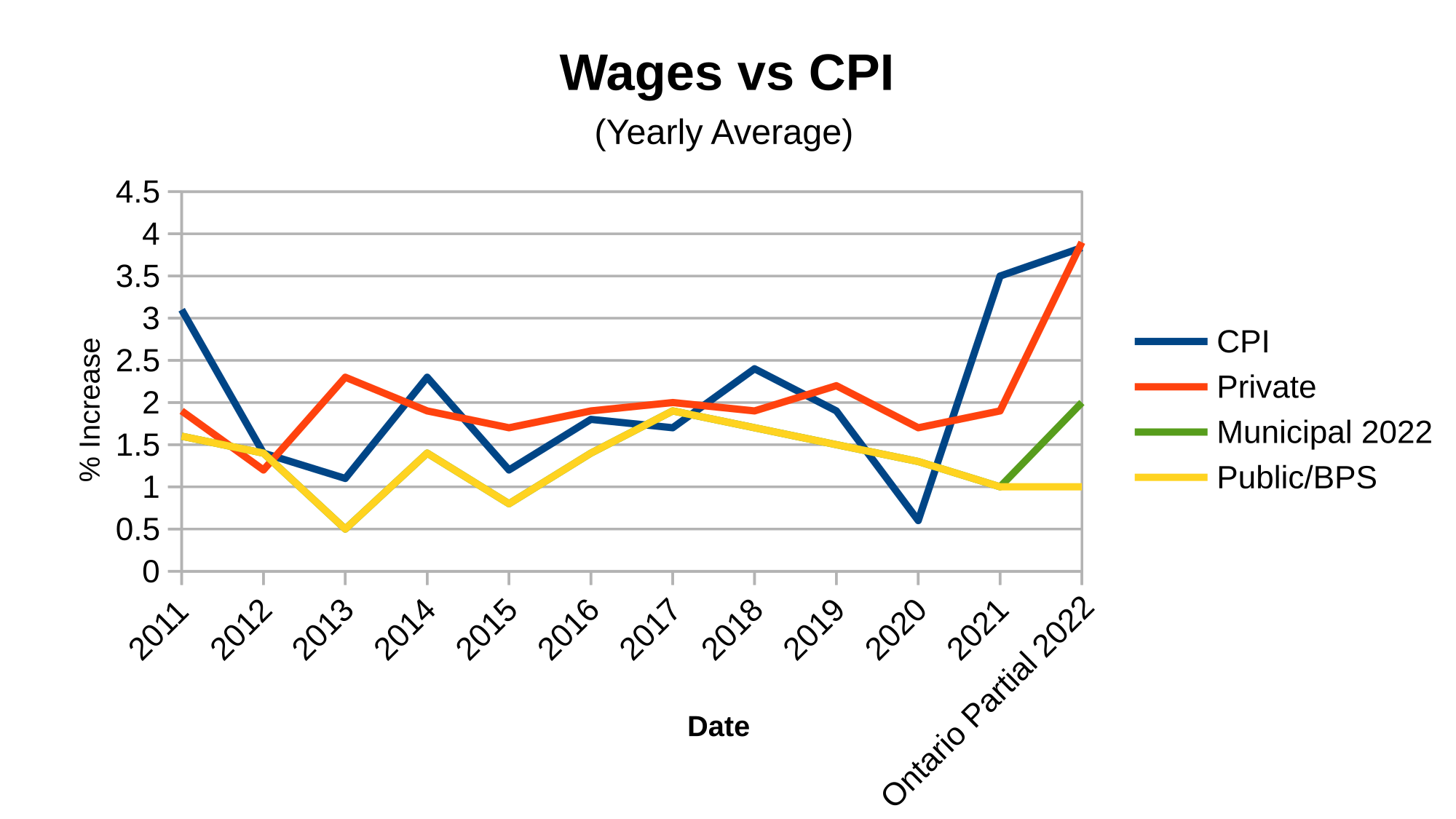

- When you see graphs like these below, just remember that the curves are made up of people and the lines near the bottom are – on average – much farther down for women than men. And even farther down for racialized workers than for others.

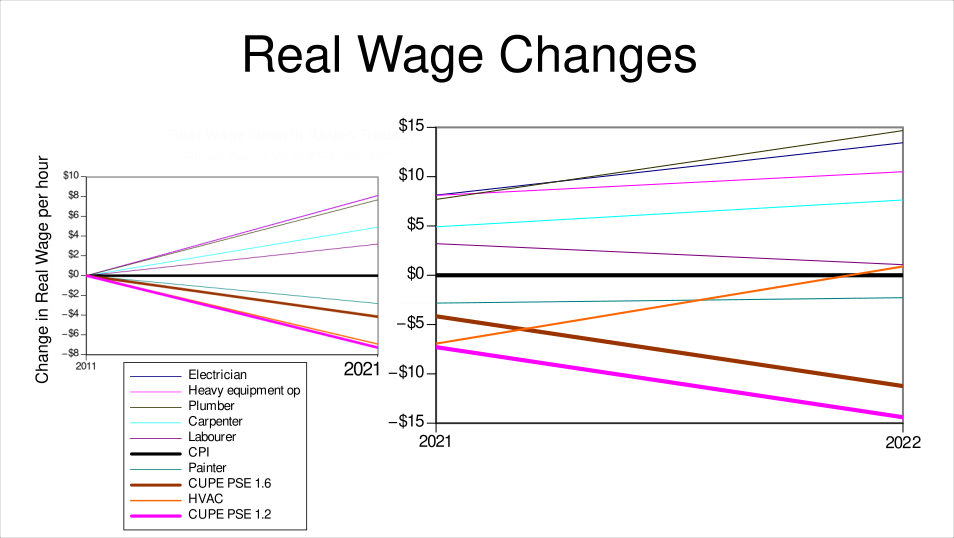

We do not have a lot of private sector comparitors for the PSE sector. Trades is one place we can see the impact of wage suppression.

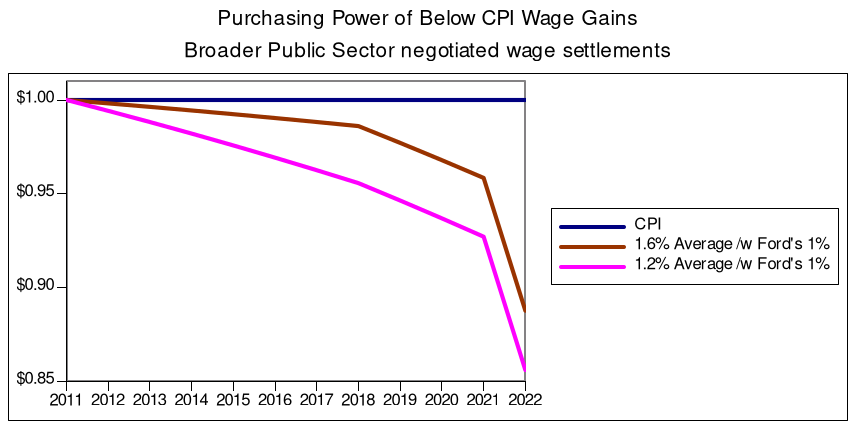

CUPE's bargaining in trades is between 1.2% and 1.6% wage growth per-year pre-Ford. Now all workers are stuck at 1% with Bill 124.

This 2021-2022 graph is what happens when higher cost of living hits, but the public sector has not been doing well anyway. Men caught in the net of policy attacks on the usually majority female broader public sector.

This is what inflation has done to real wages in the broader public sector:

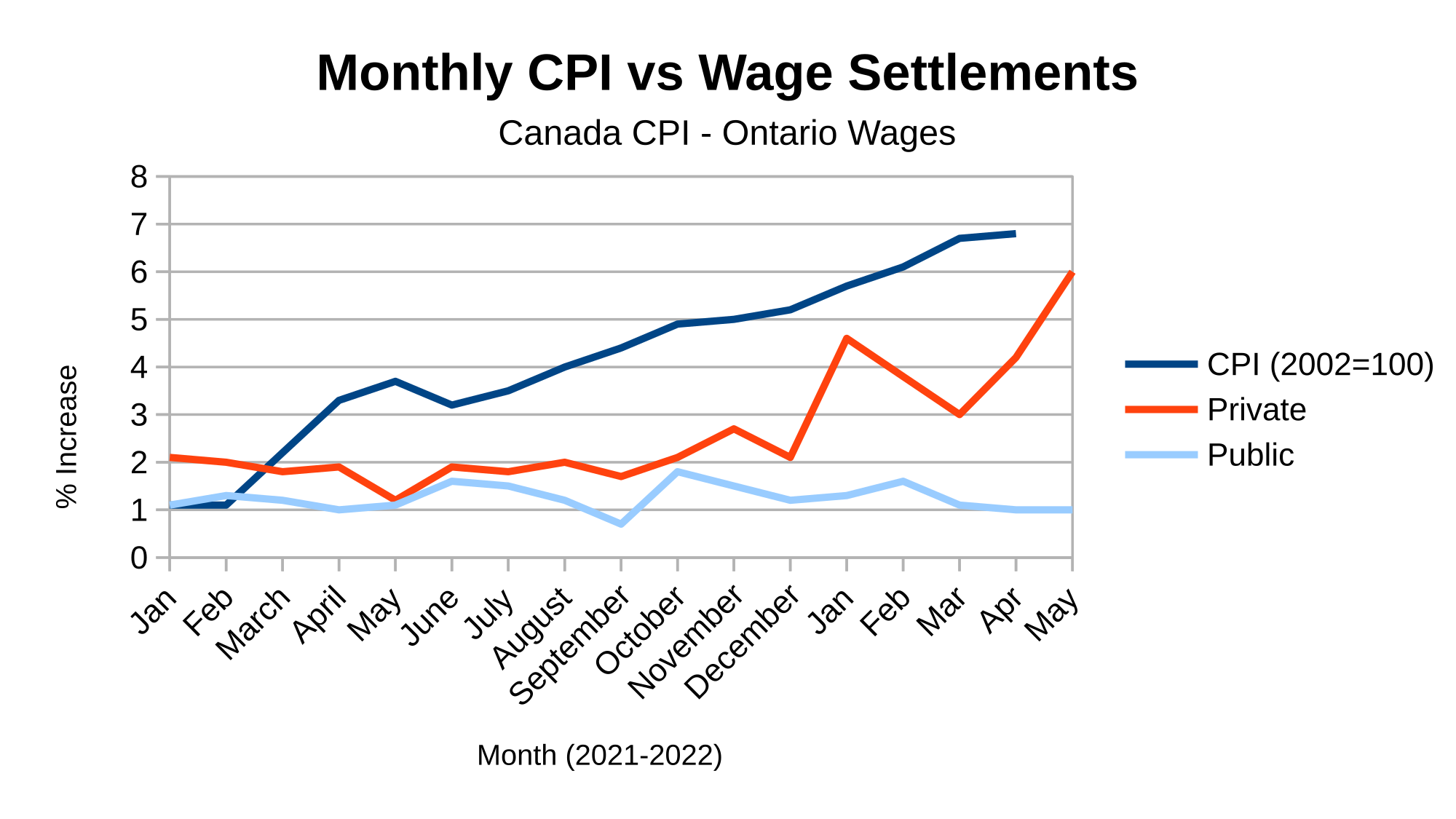

Here is general impact of cost of living has on real wages in the BPS and the broader private economy. No one is winning, but the BPS (again, read already marginalized workers) doing not so well because of policy decisions by capital and their government.

A closer look at the last year where price inflation started to take off.

The only response to this is a political one. But, the outcome of the Ontario election today is likely a non-change. So, more bad news for the working class.