June 17, 2022

Junk bond costs

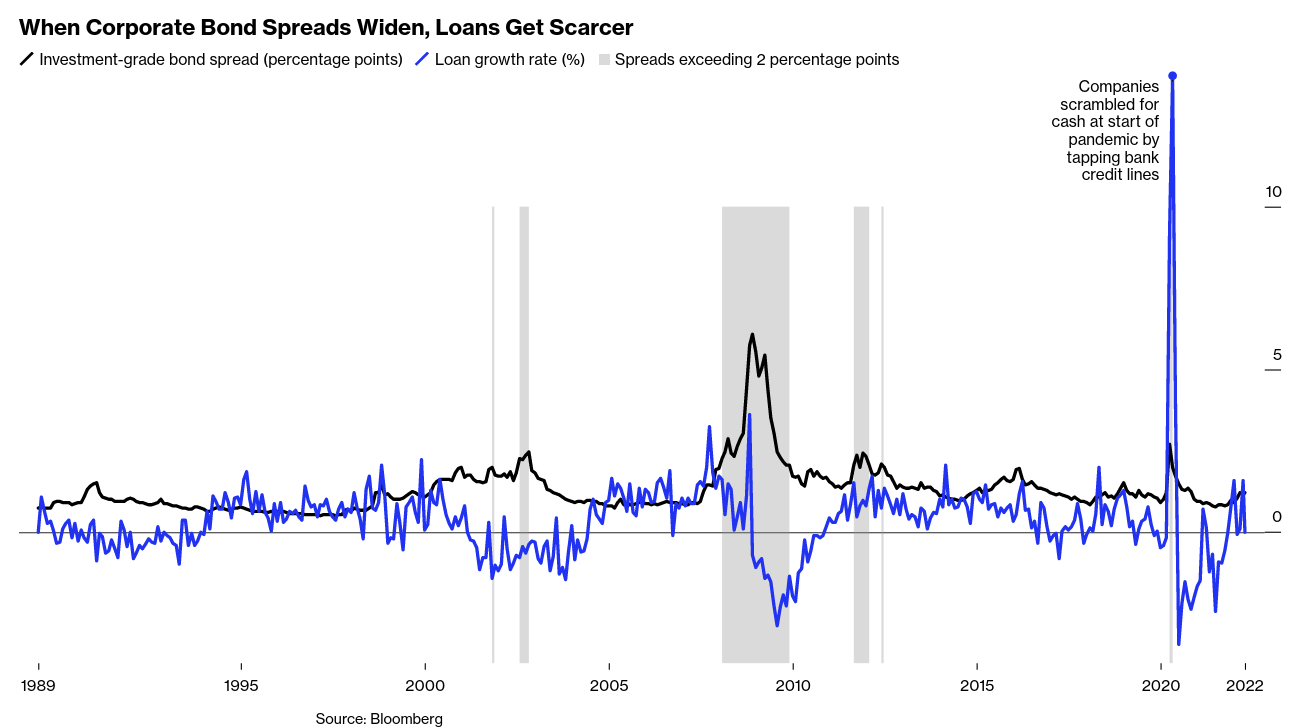

- The market in "junk" bonds (debt owned by companies at high risk of default) is pointing to a rather large collapse.

- The growth in the cost of borrowing for a company that is still profitable has been increasing with interest rates, but junk bond rates are growing much faster.

- The "spread" (the difference in borrowing costs) between USA Treasuries and these high risk companies has grown to above 5%.

- The speed of increase (an increase from 4% to 5%) in borrowing costs and the absolute amount of cost to these companies is going to put them out of business—what the central bank is hoping for—and likely drive a recession in the USA.

- There will be a lot of restructuring debt for insolvent companies, so even if the companies are zombies, the company may survive, but the workers will bear the costs.

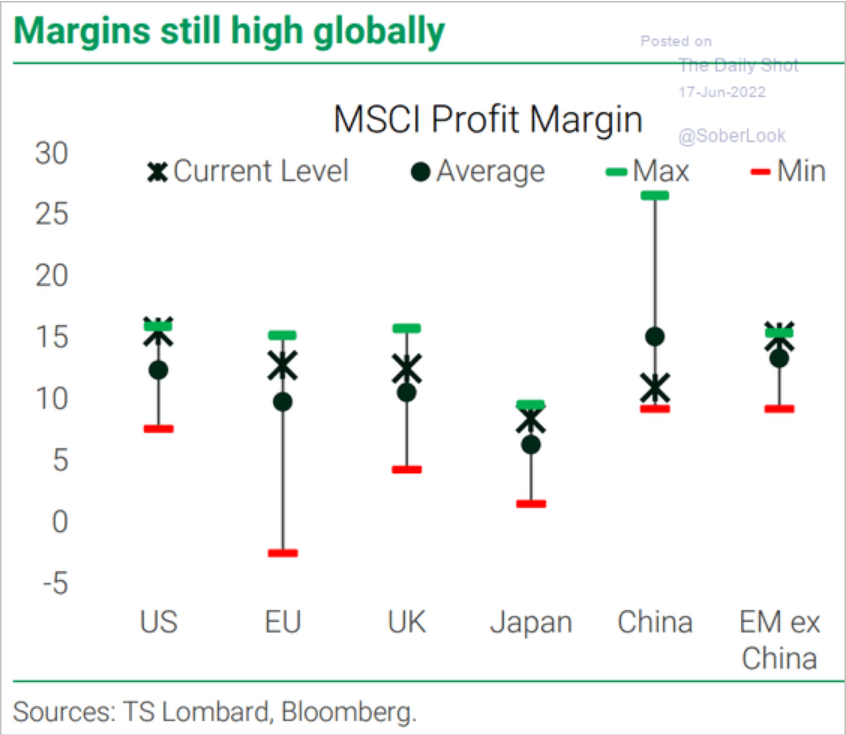

That said, there are still plenty of profit margins out there for profitable companies to keep up with increased borrowing rates. So, it will be an uneven effect.

Revlon files for bankruptcy

- You will hear that Revlon is going into bankruptcy because of inflation and pandemic-related losses.

- However, it is very clear it is because of competition and rising interest rates. The company barely avoided bankruptcy in 2021 through renegotiating its loans.

This is a good example of the situation that many established (but, zombie) companies find themselves in as they took on debt to stave off competition from brands like Fenty Beauty (50% owned by French luxury investor LVMH) with much less overhead.

Beauty companies, while not particularly interesting for many, are a good indication of the economy as they are a (half decent) proxy for many leisure activities and employment rates.

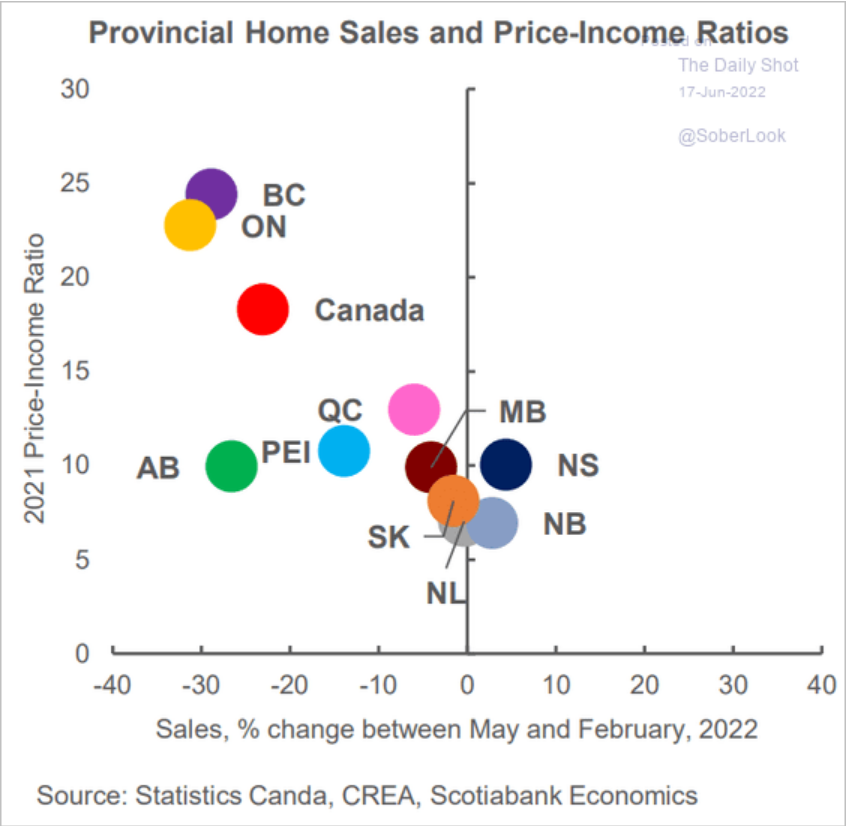

Housing and banking

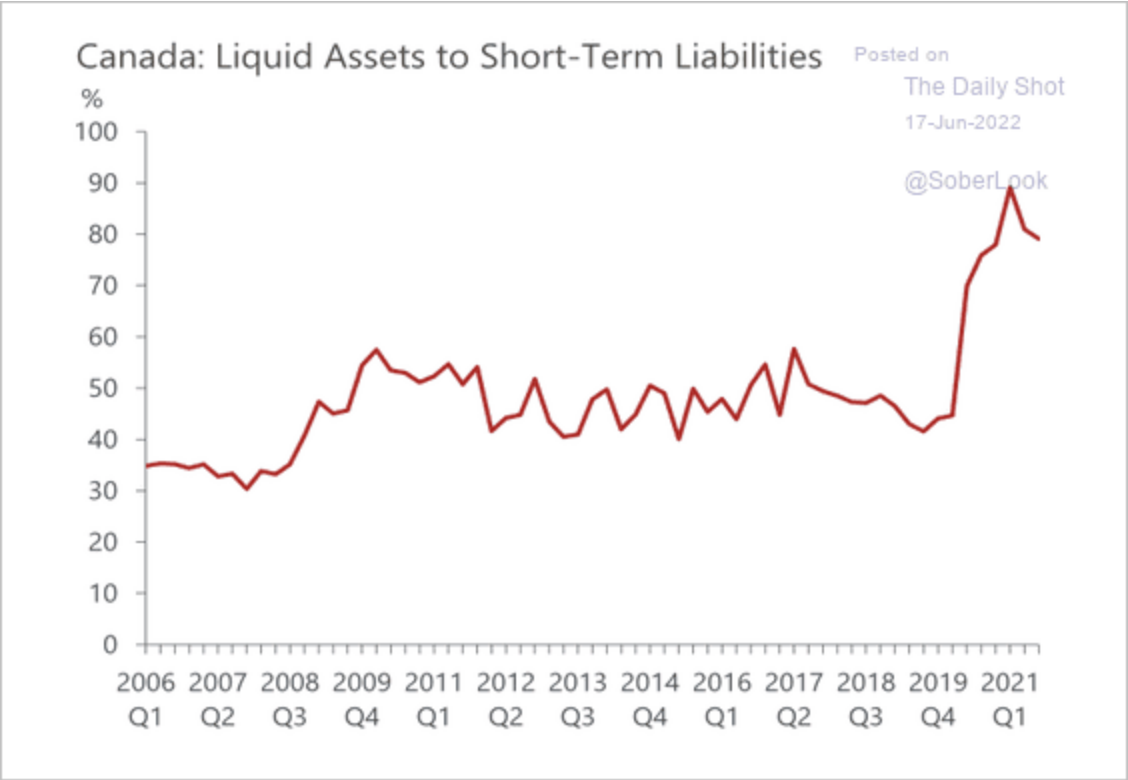

- Canadian Banks have been making a killing on home sales and debt lending since the pandemic.

- The banks have plenty of money floating around still. Expect them to go buying even more USA banks.

- However, with the increased interest rates, they may be earning more on loans rotating to higher rates, but they are gaining fewer mortgages in high-cost areas.

- In the USA, however, the housing market is slowing very fast. Especially the market of selling new homes (even to property investors).

30-year loan reaches 5.78%, reflecting tighter monetary policy and inflation expectations