June 15, 2022

Government debt is a renewed focus

- Forget the narrative that inflation is good for government revenue (it doesn't turn out that way)

- Inflation paired with higher interest rates around the world also increase the cost of government debt. This is usually fine during long wave debt and surplus cycles, but the world has just gone through a pandemic where countries borrowed and spent their way to sustaining capitalist profits (and to stop people starving).

- The policy responses that have driven inflation and wage suppression are now coming for cuts to public services because of "out of control debt costs".

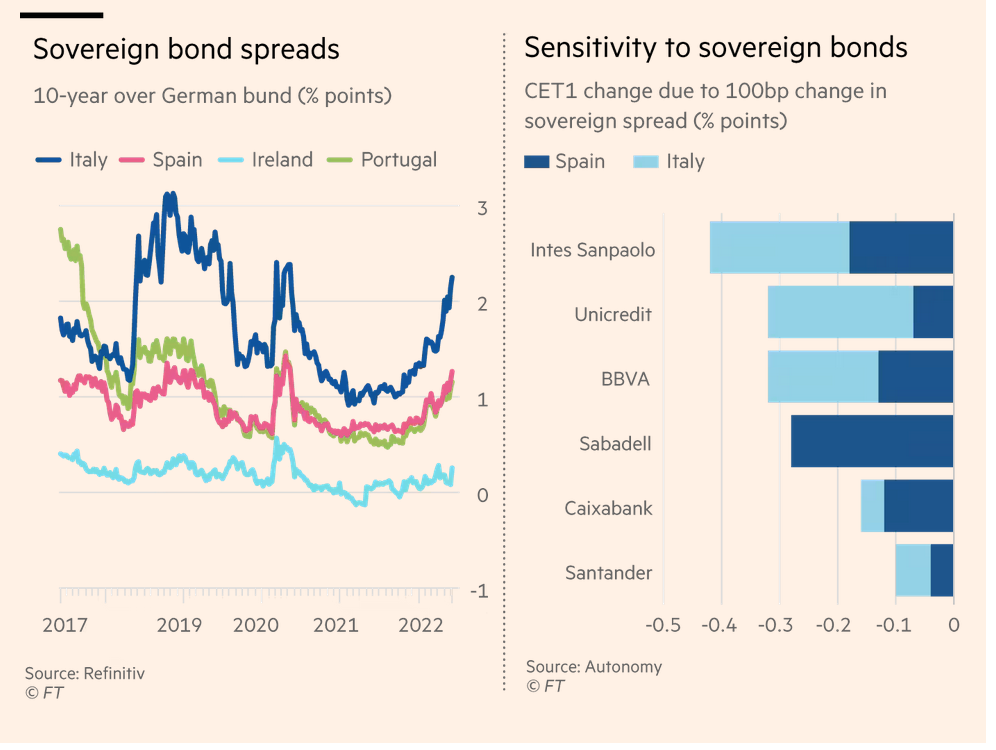

- Look no farther than the European Central Bank's emergency meeting to deal with "borrowing costs [moving] towards the “danger zone”"

- Italy's borrowing costs are pointed to as an example. It's borrowing costs have skyrocketed and are now about double Germany's borrowing costs. This is the result of the single currency and the betting against Italy versus German debt—all driven by the difference between the Euro and the Dollar.

Analysts estimated the ECB already had an additional €200bn to spend on stressed government debt from bringing forward some reinvestments of maturing sovereign assets by up to a year.

- Price increases because of the global situation of proxy war in Ukraine, cold war with China, sanctions against Russia, and general economic consequences of the pandemic are not going to make it easy for the smaller economies of the world.

- Government subsidies to banks through Quantitative Tightening (selling all that private debt they bought during the pandemic supports) is pushing private debt back into the private market.

- The question is what will the ECB do with slow growth economies like Italy and Greece where no one wants their debt. One option is for the ECB to buy just this debt to stabalize the Euro. Problem is they think that will drive inflation.

- History has the ECB not really caring if the Greeks and Italians (and others) are pushed into poverty so long as they keep control over German companies' growth and competitiveness.

- There is a real impact of this kind of thing on bank profits. It isn't as bad as it once was when just looking at government debt being held by private banks, but if you include the impact of rising rates on profitability of zombie companies it is bad. We are not seeing a replay of the Euro (government) debt crisis, but we might be seeing the start of a new Euro (and world) private debt crisis.

The story? Keep an eye on banks over-exposed to corporate debt and countries that rely on imports or export inputs as opposed to fully produced products.

Oil

- International Energy Agency says oil supply will continue to lag demand into 2023.

- This means that oil prices will continue to be a problem for prices of other goods.

It is strange to watch the response to these price increases. It is fine to blame "capital" for gouging workers on price increases, but the reality is that if the private "market" sets these prices, they are set by these forces. It isn't really gouging, it is the price.

The only solution is the same solution to all of this. The state must intervene in the markets. The left should put forward production intervention policies to do this.