June 14, 2024

Light on analysis

The financial press are focused on bonds at the end of the week as investors in French government debt flee. Investors are concerned over the potential rise of the far right, supposedly. I think that the growing alternative looks likes a broad coalition of the left also has something to do with the growing fear.

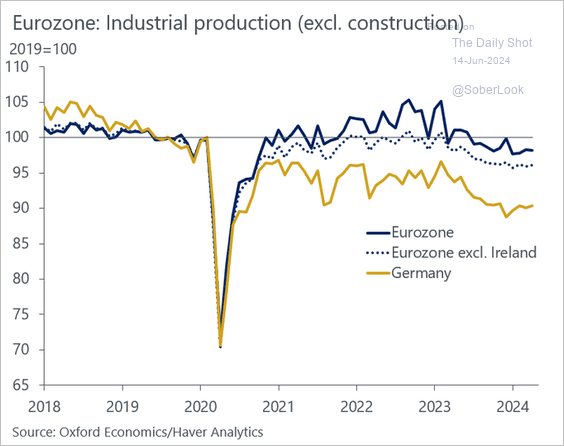

The bond investors are shifting to Germany, but that isn't helping Germany or Europe from seeing continued contraction of their industrial production.

When you look at the failure of European governments to sustain growth (in the face of all the crises they are facing in Europe), it is not a wonder the protest vote was so high.

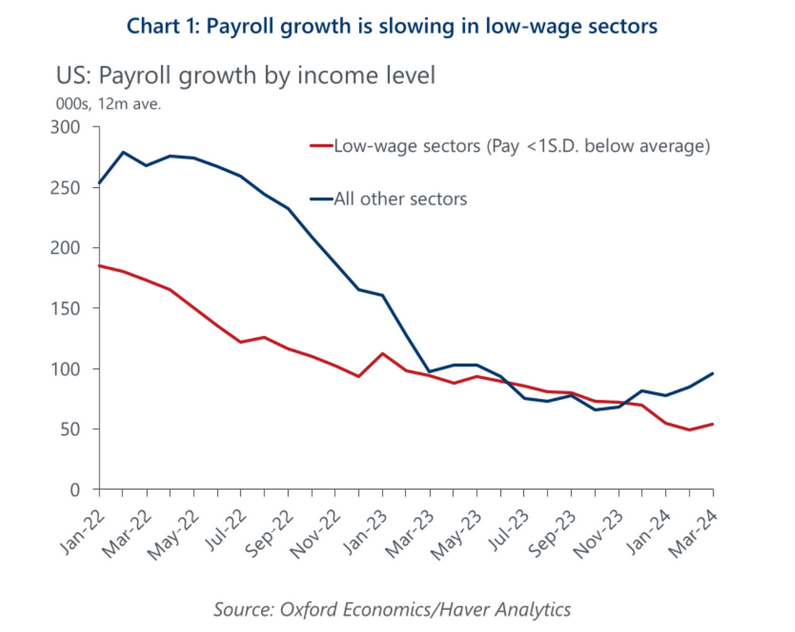

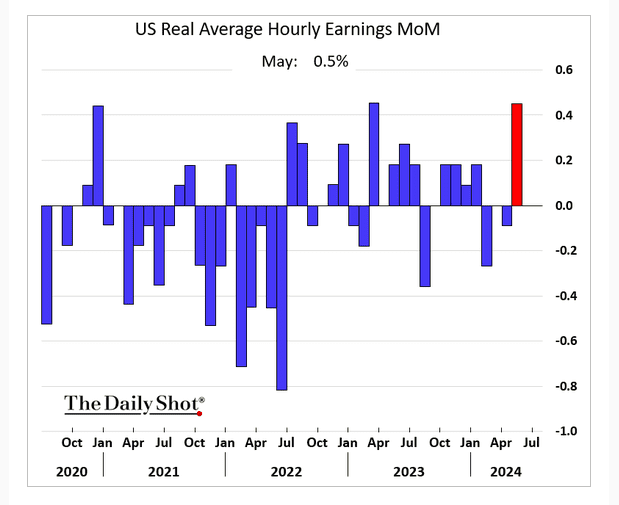

In the USA, there are signs of economic slow-down. The number of low-waged workers is declining.

This is happening while the average hourly real wage keeps apace. Are these two stats related? Probably. When you have fewer low-waged workers, you have higher average wages. However, that doesn't stop the Federal Reserve wondering if wages are growing too fast.

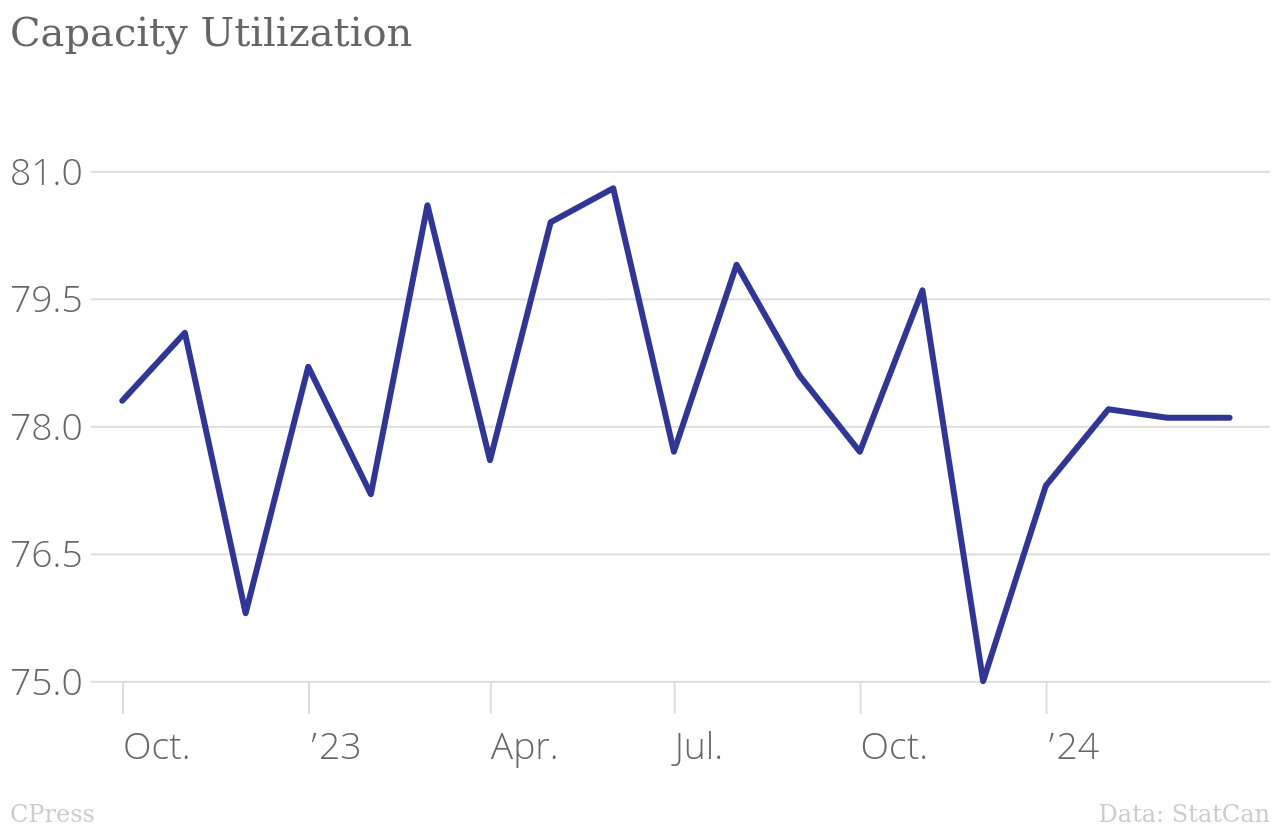

In Canada, sales from manufacturers are still in slow decline (even if they waffled up this past month) and capacity utilization has continued to follow a downward trend since 2023. Both these trends shows that the economy has not returned to even pre-pandemic growth and there is little desire to invest in new production in Canada.

__2017_constant_dollars__Trend-cycle_(2017_constant_dollars)_chartbuilder.png)