June 13, 2022

Recession worries take on inflation worries

Declining growth is on the horizon.

This is not shocking given that is what the central banks around the world have been trying to do.

- Interest rate rises are going to come faster than people wanted. Up to a 1% rise this Fall.

Money markets on Monday implied the Fed will increase its main funds rate to 3.4 per cent by December, from 0.75 per cent to 1 per cent currently.

- Nothing good about that with neoclassical bankers at the central banks demanding people lose their jobs while pretending that there is such a thing as "soft" poverty creation.

- The hope continues to be on supply-side issues and magic unprofitable production driving prices lower. Good luck given price increases for food are baked-in as fertilizer has already been paid for and oil/fuel takes time to refine and ship.

Former Fed Chair Ben Bernanke sounded more optimistic on inflation and the Fed’s prospects, giving a bit of a boost to Powell & co. in a CNN interview.

He said he sees the Fed with “a decent chance, a reasonable chance” of a soft landing in the form of a mild recession or perhaps no recession at all.

Bernanke’s assessment also hinges on prospects for supply-side issues to moderate and oil and food prices to stabilize, he said.

The US economy will tip into a recession next year, according to nearly 70 per cent of leading academic economists polled by the Financial Times.

Pound under pressure Sterling fell sharply in Europe this morning after new figures showed the UK economy shrank in April. The surprise data sent the pound down 0.7 per cent against the dollar.

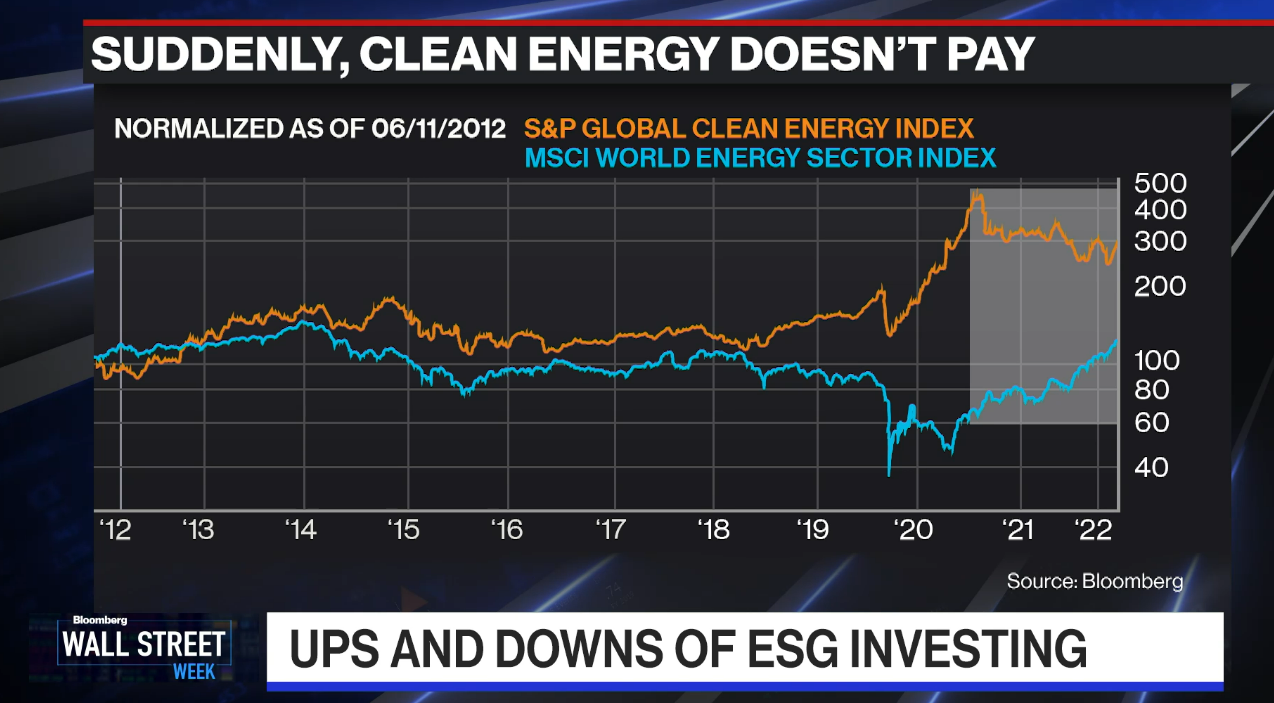

- Things are not looking good for profitability. Unless you like dirty oil. ESG just isn't there as profits from investing in oil are back and renewable energy components stop getting cheaper.

Global stocks and government debt markets sold off on Monday as investors ramped up their expectations of persistently high inflation driving aggressive interest rate rises.

Europe’s Stoxx 600 share index declined 2.2 per cent, putting it on track for its fifth straight session of falls. The regional share gauge has lost more than 9 per cent so far this quarter.

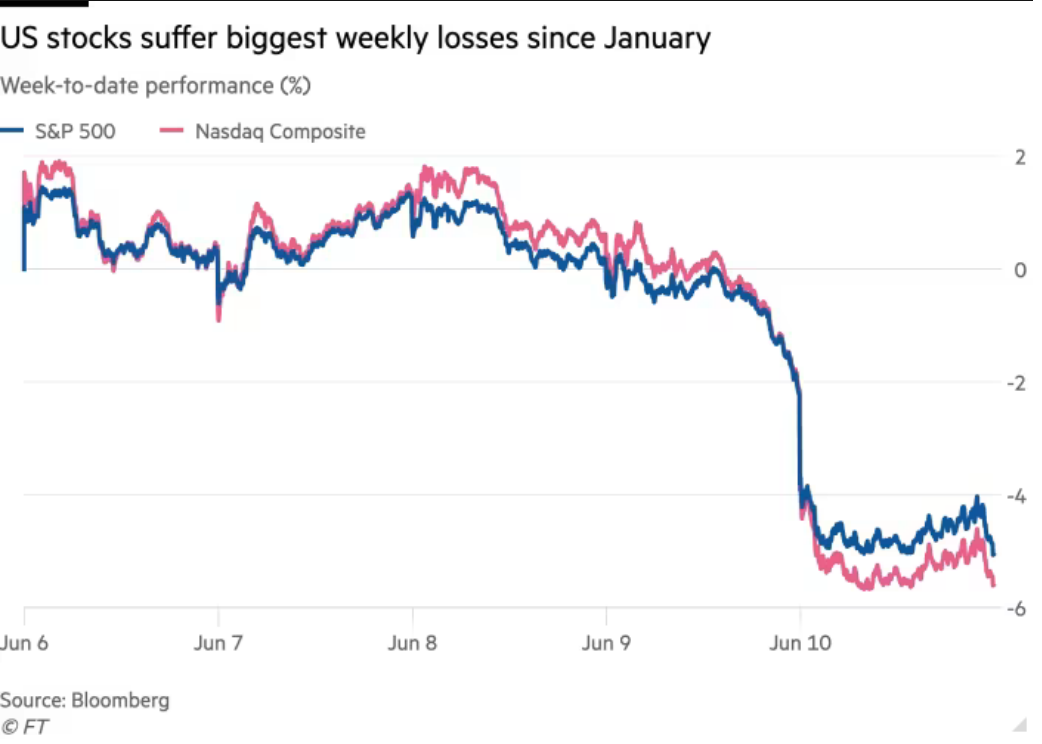

Futures trading implied the US S&P 500 index would lose 2.2 per cent in early New York dealings. The broad stock barometer also fell 2.9 per cent on Friday to close out Wall Street’s worst week since January.

Contracts tracking the tech-heavy Nasdaq 100 index fell 2.6 per cent as shares in more speculative stocks took a hit from the flight away from market risk. The cryptocurrency bitcoin has tumbled almost 20 per cent since Friday to around $24,000, almost two-thirds below its November peak.

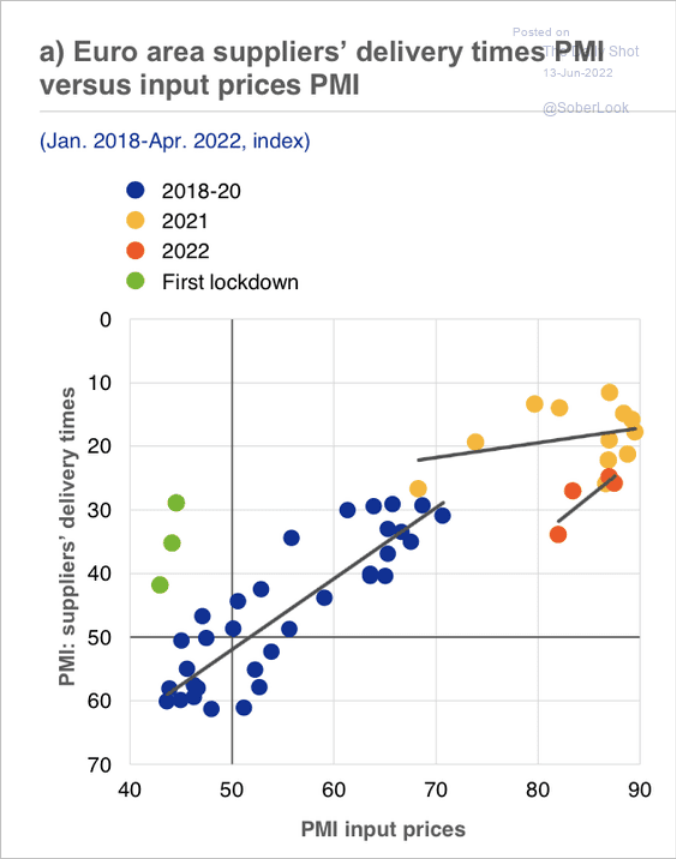

- Folks are not wrong to talk about supply chains causing price increases:

Crypto currency (read: imaginary valueless nothingness) is having a hard time

- A crypto company backed by the Caisse de dépôt et placement du Québec—Canada’s second-largest pension fund—has dragged everything down since Friday. Bitcoin is down 20%.

The value of assets deposited on Celsius’s platform shrivelled to less than $12bn as of May 17 from more than $24bn in late December.

Crypto lending platform Celsius Network halts withdrawals The $12bn digital asset lending platform said today it was “pausing all withdrawals, swap, and transfers between accounts”.

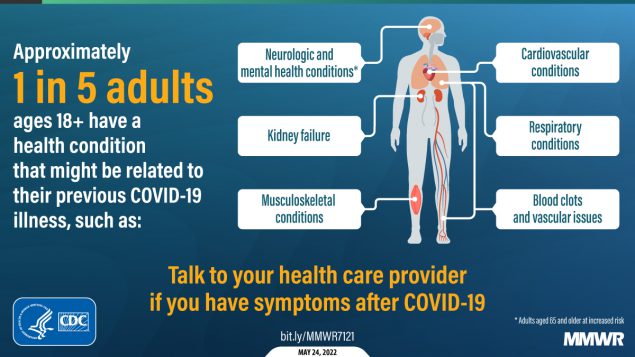

Covid continues

- China heading back into restrictions as another outbreak of Omicron sub-variant continues.

- New sub-variant in Russia raises alarm.

- Vaccine providers are releasing their target Omicron booster with GSK, Sanofi, Moderna, and Pfizer all releasing their own version of the same thing.

- This doesn't mean there are not other vaccines that are cheaper in the works, but we will not hear about those. These "new entrants" are trying displace current flu vaccines commercializing USA/Europe funded mRNA "technology" to create a jab for COVID and flu.

In the US, the FDA said Pfizer's jab is effective for kids aged 4 and under, and may formally clear it for use on Wednesday.

Some weird business stuff

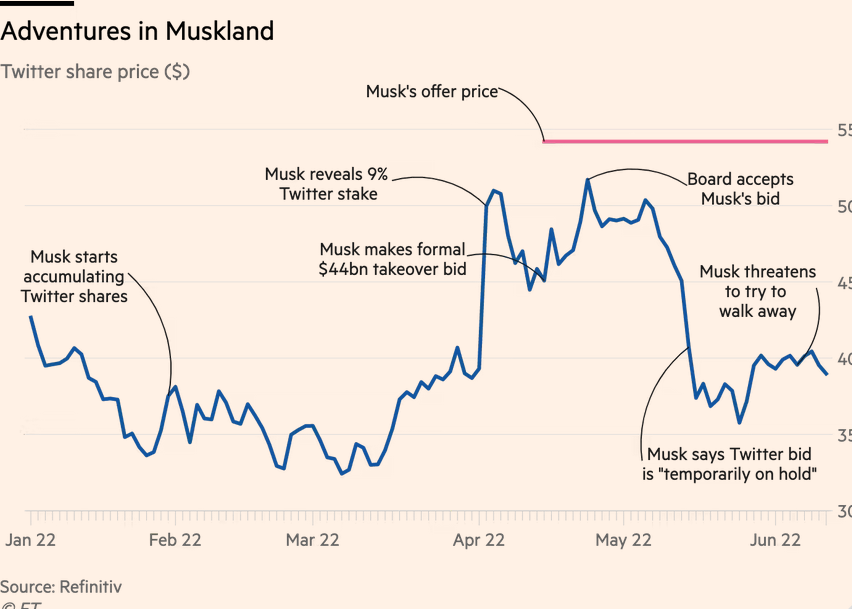

- Musk is not a business genius. He cannot even maximize the value of his own investments:

- McDonald's in Russia reopens under new ownership, renamed 'Vkusno & tochka' which translates as "Tasty and that's it". McDonald's was one of the first companies into Russia during the post-Soviet era. The question is, can anyone really tell the difference? The answer? No, they cannot and V&T is going to be opening more restaurants.

New logo:

- USA unions had to speak-up after hedge funds tried to use their silence on financial reforms as support for the hedge fund position.

The AFL-CIO and 11 unions wrote to the SEC last week — two months after the initial deadline for comments — to “clear up any misunderstandings” and express their strong support for the regulator’s plans.

The first set of proposals, put forward in December, would stop investors from using swaps — derivative products tied to the value of an underlying asset — to secretly build up holdings in public companies without disclosing their positions.