June 1, 2023

Canadian energy subsidies and bad bets

- Stellantis is extracting about $19B out of Liberal government (over a decade).

- Compares to up to $13B for Volkswagen (aka: Volts wagon).

- Equinor has delayed the $12B Bay du Nord oil field development (off NL) three years because of costs.

- Trans Mountain pipeline has been given a tonne more money. $3B this year added to the expansion of $10B last year of private debt. This is subsidized debt since the payments are guaranteed by the government. Costs increased 44% in March, 70% last year. The expansion of the pipeline is now sitting at $30B. The government paid $4B to "nationalize" the pipeline. A pipeline that has already cost $25B.

- The UPC win in Alberta means more fights over oil and energy transition. The UCP's main policy goal is to sink Alberta into the oil sands while setting it on fire. A great show if it wasn't catastrophic for the planet.

That's Canada's current (lack of an) energy policy being applied.

Poor public policy decisions and no government planning are the hallmark of the energy sector.

When you look at all the energy investments needed, it is not a lot of money to ensure we have some battery capacity and car manufacturing here in Canada.

How is $30B (over ten years) not really a lot of money? Well, have a look at some of the oil company subsidies.

And, because the amount need to be invested to charge those batteries makes that look like a rounding error. $30B is one nuclear power station's worth of investment and we will need about a dozen of those to charge the batteries coming out of one of those plants.

The Stellantis plant alone is creating 45GWh of battery storage per year. That would take over 3M solar panels to charge or 340 wind turbines.

Just to charge those batteries once.

Bruce Nuclear produces 48,000GWh in a year. Seems like enough until you realize that you loose electricity down the wire, you need to charge a car most every day, you will need to be adding 45GWh of draw every year.

Then let's talk about charging station investment which needs transmission and distribution investment.

There is a lot of investment to go. Let's not quibble over $13B, lets focus on where the true profit subsidies are going: energy companies.

We have not really even started the green energy transition.

Globally, it is kind of a hot mess. Chevron and ExxonMobil (everyone's favourite energy companies) have won out against ESG and climate resolutions. Shareholder groups have given-up trying to get these two behemoths to change investment strategies.

Total Energie has invested in a synthetic natural gas project to turn hydrogen into a methane product. The process of making it requires huge amounts of energy and makes no sense, but it is slightly better than natural gas in terms of emissions.

The USA and Canada are far behind when it comes to actual mitigation through investment and regulation.

European energy companies are being forced to invest in fossil fuel alternatives. Sure, it not enough to do anything substantial, but it is much better than nothing. BP and Shell have had mini shareholder revolts against the companies terrible plans for emissions reduction. Again, not enough to do anything about the lukewarm policies, but enough to make them have some policies.

The difference is that regulation of investment through sovereign wealth funds and competition for dollars for investment from the state.

I am not in favour of this kind of activism. Mostly because it is tempest in the tiniest teapot around. However, if you look at why there are these debates happening, it points to something positive.

Enough people in Europe want to stop climate change that it is spilling-over to investment decisions.

Why do we care about this?

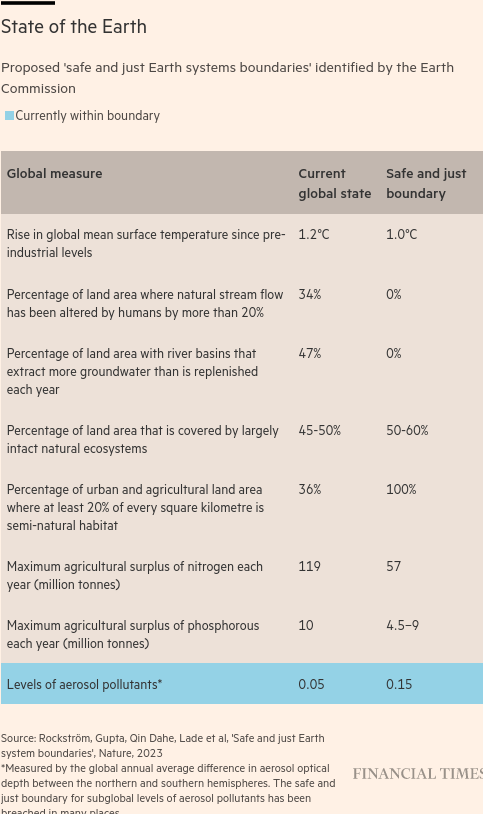

Because we are past our climate safety limits. 7 out of 8 of the boundaries that have maintained our climate have been breached, according to a new Nature article.

Canadians need to be demanding better and more. The left needs a proposal that works and isn't based on stupid politics like what were just on display in Alberta.