July 9, 2024

Global Shipping

-

Houthi's attacks on shipping continue to cause rerouting around South Africa.

- Singapore is a bottleneck for shipping in Asia as scheduling disrupts container access.

- Malaysian ports are also full.

- All unlikely to be even partially solved until August.

- South Africa's coast has a major storm system that is shutting down transit of 690 vessels where it faces 10m waves, strong winds, and heavy rain.

-

Hurricane Beryl

- Has shut down much of the Houston, Texas port and trucking supply chain system.

- 85% of city without power, and will be restored by the work of 10,000 electricity workers brought in from surrounding states.

- Rail companies have not started moving as they face weather-related constraints. BNSF (America's largest rail company) has delayed restarts of their operations in the region as power outages and flooding make track inspections and repairs impossible.

Three issues have pushed much of the global shipping system into serious delay increasing "trade inflation"

- ditcinf2024d2.pdf.png)

At the same time, the UNCTAD has released a report outlining the massive changes in the global supply chain and trade system that will occur over the next decade.

UNCTAD outlines two obvious themes resulting from rising geopolitical conflict:

- Splintering into major blocs

- Rising protectionism and costs

- ditcinf2024d2.pdf.png)

However, contrary to some reports outlining a decline in trade and a broadening of supply systems, the UN agency is predicting a reallocation of trade and an increase in the concentration of supply of goods. This is happening because of the specific demands of the USA's IRA, China's investment in production capacity, and the EU's Net Zero Industry Act are all targeted at the same inputs.

There is a massive increase in the supply of inputs to Electric Vehicles where there is limited diversity of production for those inputs, resulting in a concentration of trade to only a few major exporters.

Another example is the trade in AI and related server components.

- ditcinf2024d2.pdf.png)

Growth in global trade metrics remains negative for many sectors, except for machinery, precision instruments, pharmaceuticals, transportation equipment, and road vehicles.

Chemicals, pharmaceuticals, textiles, metals, and minerals continue to have strong growth in trade. This is mostly because of the concentration of mid-stream processing in China (and to a lesser extent, Europe) where raw inputs have to be shipped to China for processing and then back in their processed form to the EU and USA to be turned into something, then shipped somewhere else in their final or near final form.

Along with the centralization of inputs, the assembly of EVs is being distributed through the likes of BYD. The car maker that is backed by USA capital, but called a "Chinese" company is extending its introduction to "friendshore" countries. Its focus is on building production facilities in Turkey for access to European markets and Mexico for access to the North American markets.

The investment in Turkey is rated at $1B and will create 5000 jobs to build cars specifically for the European market, producing 150,000 electric and hybrid vehicles annually. A move that comes on the heels of EU tariffs on Chinese made vehicles.

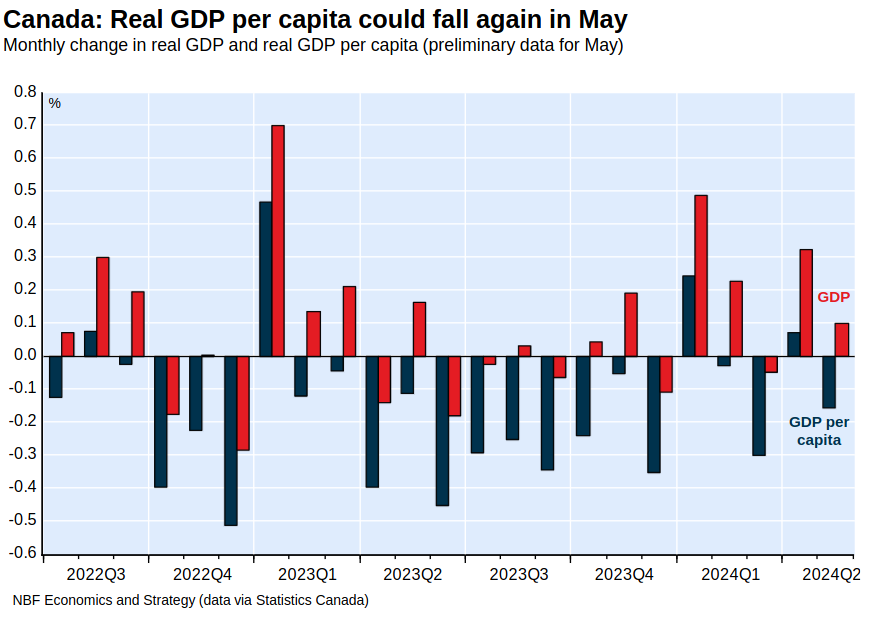

Canada GDP

Just a reminder that we are not doing super great compared to other countries on the growth measures.

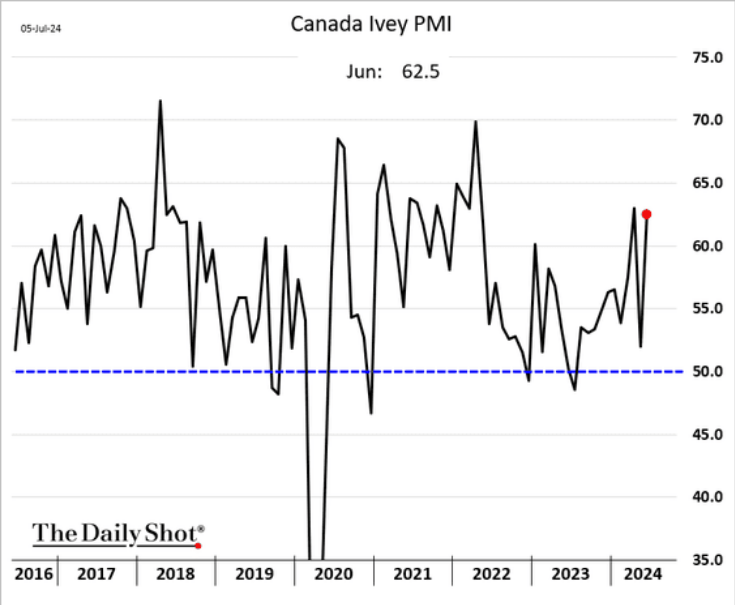

While the Ivey PMI is up again (those swings are suspect):

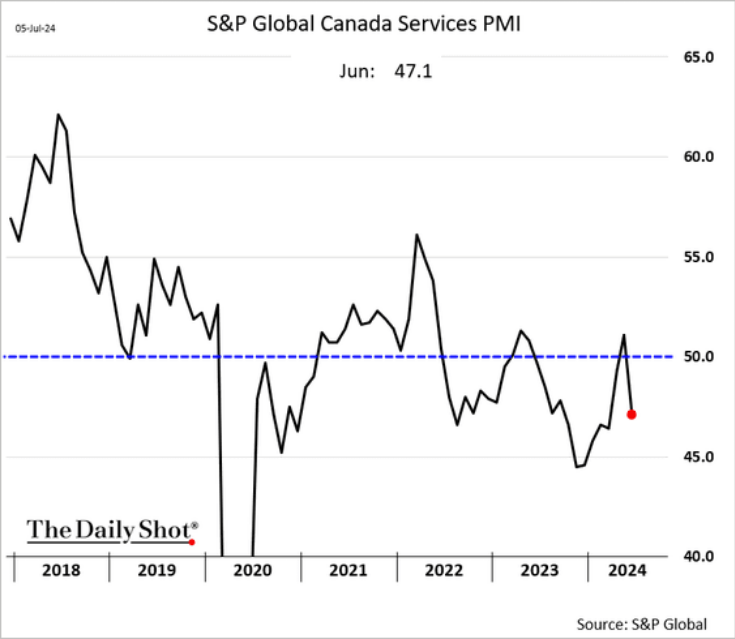

Services activity is down along with input prices for services. Slower activity is leading to a price crunch, which is not a great way to get cheaper services.