July 7, 2023

Markets are caught wrong-footed again

Today's job numbers will tell markets that the central bank will increase interest rates again. The "market" is confused and wrong-footed as this lands—even though central bankers around the world have stated clearly they are going to increase rates.

It makes for some odd reading in the financial press:

Fed Dallas President Lorie Logan said more rate increases will likely be needed. European officials are also biased toward higher rates and are emphasizing the need to keep policy restrictive for longer. Even Singapore’s central bank chief added his voice to the chorus of inflation concerns.

Third time the bond markets are wrong about rate direction in spite of being told to their face they are going up:

Of course, we are in a slow moving recession already. But, that is not what the job vacancy numbers tell everyone. Workers in the USA are not acting like they are "supposed to" and continue to quit their crappy jobs in search for higher wages.

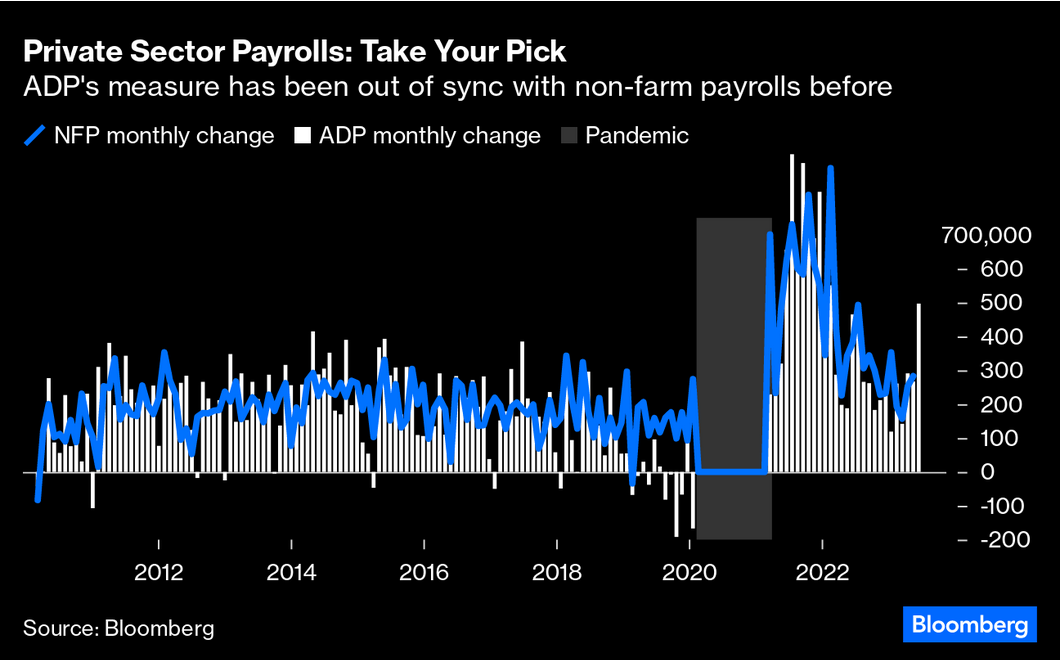

It is a short memory about jobless claims. Finance—because they have never had so much money thrown at them—think things are great. They look at this graph and claim, the previous ten years were splendid for workers:

If anything should convince people that jobless claims are not a good proxy for anything it is that graph. The previous ten years have not been all about growth.

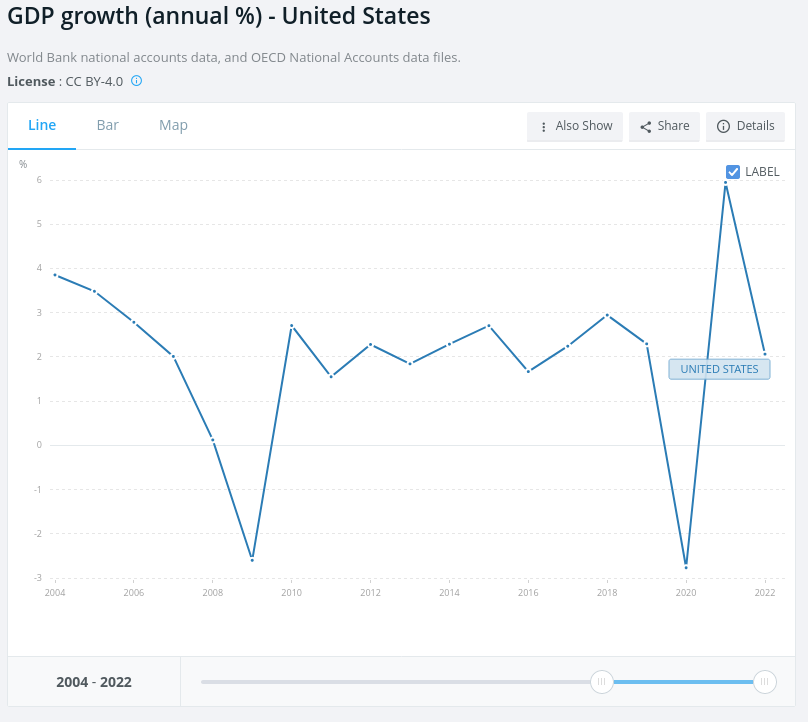

GDP sat at 2% for the previous decade and much of that is buoyed by the tech sector where free money was paying people to do not much real production.

The want of jobs and the hiring of workers at minimum wage does not a strong economy make.

Rates are going to go up because the neoclassical (and New Keynesian) economists are convinced that all this inflation has something to do with demand. But, if you look at the numbers (as we have over the previous year) everything points to costs going up and production going down.

Why do we let such confused processes run our economy?

Canadian unemployment

Canada's unemployment rate rose slightly last month to 5.4%—highest since the pandemic. Hard to make predictions about this number, but it is not great for workers. Of course, the Bank of Canada is very happy to see it going up because it means their plan of destroying lives is working, but sad it didn't go up as fast as they predicted.

On the flip-side, the number of people employed hardly changed at all.

Declines came from construction, agriculture, and educational services. Educational services are predicted, but it is strange to see construction and agriculture lead declines in the summer.

And, wages?

Average hourly wages rose 4.2% (+$1.32 to $33.12) on a year-over-year basis in June, following an increase of 5.1% in May (not seasonally adjusted).

This is slower wage growth than previous months.