July 7, 2022

Bye, Johnson. Hello, worse?

Boris is going to quit as PM today. The problem is that this does not solve the issue of which side of the Tory party will replace him. In some ways, Boris was on the side of fewer cuts to public services than the section that Sunak (the former Chancellor) is from.

This leaves the UK in a rather odd place. The spending that kept the economy from collapsing over the pandemic and the poor decisions around the Tory version of "Brexit" means that there are not many places for the hardened neoliberals of the Tory party to go.

Right-wing populism drove both the economic and social decisions by Boris. It is not what drives those closer to the political centre—but more economically dogmatic—of the Tory party. It is this more classically Tory section that is likely going to win out which means the return of what was once relegated as the "Nasty party". This was highlighted by Sunak's letter that said:

Our country is facing immense challenges. We both want a low-tax, high-growth economy, and world class public services, but this can only be responsibly delivered if we are prepared to work hard, make sacrifices and take difficult decisions.

I firmly believe the public are ready to hear that truth. Our people know that if something is too good to be true then it’s not true. They need to know that whilst there is a path to a better future, it is not an easy one.

The sacrifice is the wealth of the working class in the UK and hardship going forward.

With a Labour Party that has a leader no one wants to vote for and what will likely be a loss of support for the Conservatives, it is really rather unclear to me what is going to happen.

There is a packed contender list that usually appears when there is no clear replacement for a cult of personality leader like Boris.

From the FT:

-

Liz Truss: Dogmatic Thatcherite

- Bookmakers’ odds: 7/1

- ConservativeHome approval rankings +49.

-

Nahhim Zahawi: replaced Sunak as chancellor. A more classical Tory.

- Bookmakers’ odds: 8/1

- ConservativeHome approval rating: +56

-

Rishi Sunak: "neoclassical" does not go far enough to describe his tax-cutting and destroyer of state social supports.

- Bookmakers’ odds: 4/1

- ConservativeHome approval rating: 14.9

-

Sajid Javid: Boris backer and slimy backroom backstabber. More of a populist.

- Bookmakers’ odds: 7/1.

- ConservativeHome approval rankings +43

-

Penny Mordaunt: Trade minister. Supporter of Brexit, but also liberal Conservative caucus "One Nation" member which means she backs populist and more social liberalism of Elizabeth May's Tory tenure. Bookmakers' favourite.

- Bookmakers’ odds: 5/1

- ConservativeHome approval ratings: N/A

There are a slew of others including Wallace, Gove, Hunt, and Tugendhat who could run just to gain profile but who are currently uninteresting or just variants of the above.

Biden's Democrats push union agenda

The National Labor Relations Board's new Chair, Jennifer Abruzzo, is pushing a pro-union program of card check certification and less hostile anti-union decisions when it comes to employer interference in union votes. Long-established anti-union organizing actions such as captive audience and firing of organizers are also being successfully challenged by unions.

This is a dramatic shift from the top of the government as rights are being taken away in other forms through the USA's Supreme Court. While easier to establish new interpretations at the NLRB, it can also be taken away with a simple change in the government appointments to that board.

The current moves have helped drive small organizing campaigns of front-line service workers. Over 100 organizing campaigns at individual Starbucks.

The NLRB reported a 57 per cent spike in the number of petitions for union elections between October and March, up to 1,174 from 748 during the same period last year.

While most of these workplaces are small, there are some rather large victories including the MIT acadmeics and Amazon (and other) warehouse workers getting certifications.

First contract negotiations and striking to get those are still ahead for many of these groups. Making it easier to get a union is essential, but employers still have significant leverage in undermining the bargaining process.

Also, organizing efforts continues to be driven by unions like the United Electrical Workers (UE) and militant factions of some other unions. Unfortunately, the capacity of these groups to continue the expansion is limited as resources go from supporting years-long organizing efforts to negotiations. Larger unions are also keen on stepping-in after organizing drives have been successful.

We shall see if this process undermines the current interest in organizing and winning gains.

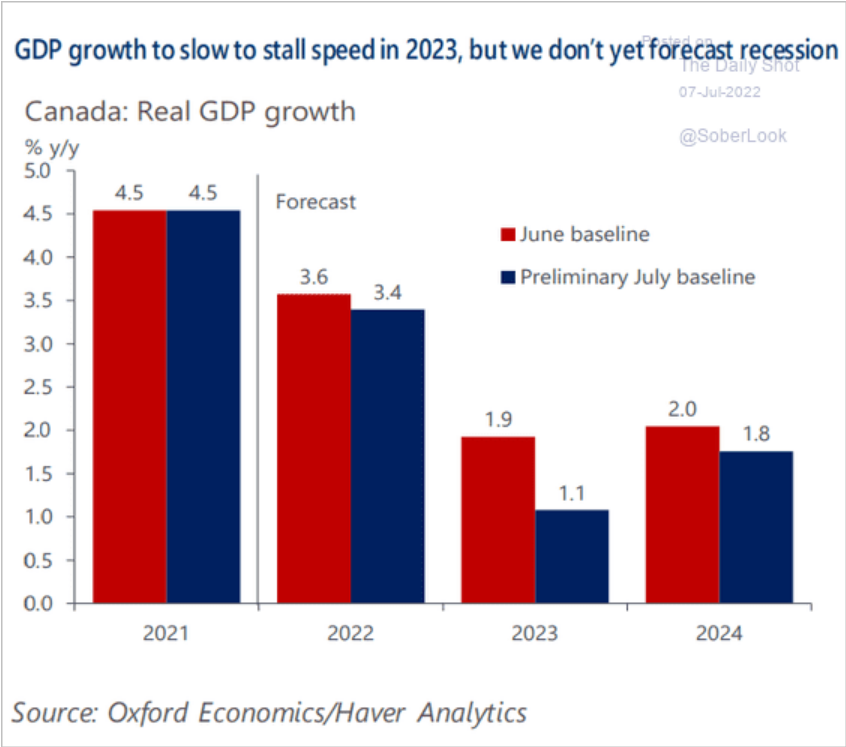

Slowing economy not good enough for central banks

- Central banks, lead by the USA Fed, are now warning that high inflation might stick around.

- The result is sustained higher interest rates and a more forceful push on the break pedal—the only one that the Fed has.

- Continued confusion about what is causing price increases along with the lack of policy tools to deal with the causes—even if they knew what they were—is going to hamper any solution.

- Increases in interest rates will likely continue until 2024.

- Slowed economic growth and higher unemployment is the policy goal.

- "The beatings will continue until morale improves." That is, they will beat down workers until capital feels better.

- Unemployment is already up in the USA.

Oil market declines, coal gains

- It all works-out for the planet destroyers.

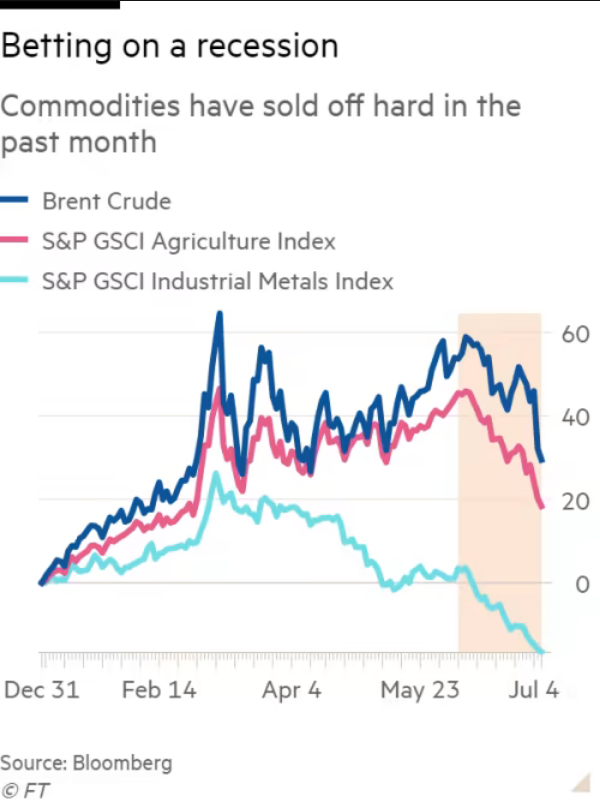

- Profits are up, but oil prices are stabilizing as production meets a slowing demand.

- Slowing expected demand is about recession, not about production of increased rate of supply.

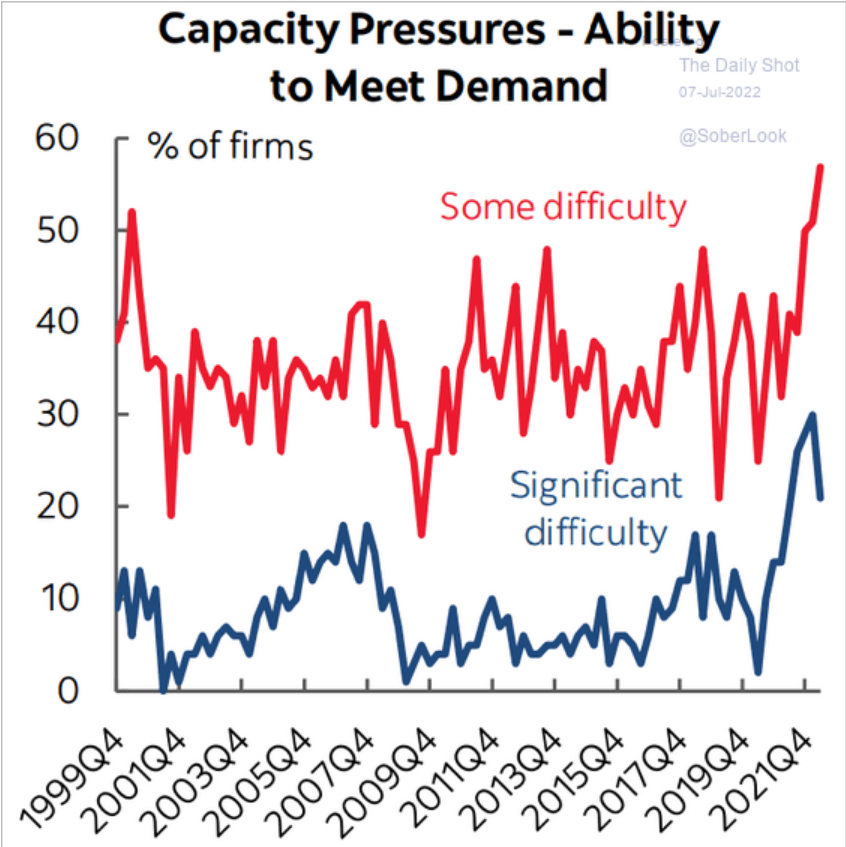

- Current refineries are running at full speed, but this causes price increases because they new production capacity is not coming online.

- So, profits will remain high and there is still a possibility that prices will go back up if recession doesn't result in actual less demand for oil—a likely outcome.

- This goes for all commodity prices.

- The coal spot price is 89% higher than January because of high electricity needs and no increased production.

- There is just no stopping the profiting from the heatwaves that they themselves cause.

There is something magical and horrifying about watching capitalism working like this.

Speaking of capacity issues, we have them in spades in Canada:

This is part of the inflation story: no new investment, full utilization of current capacity.

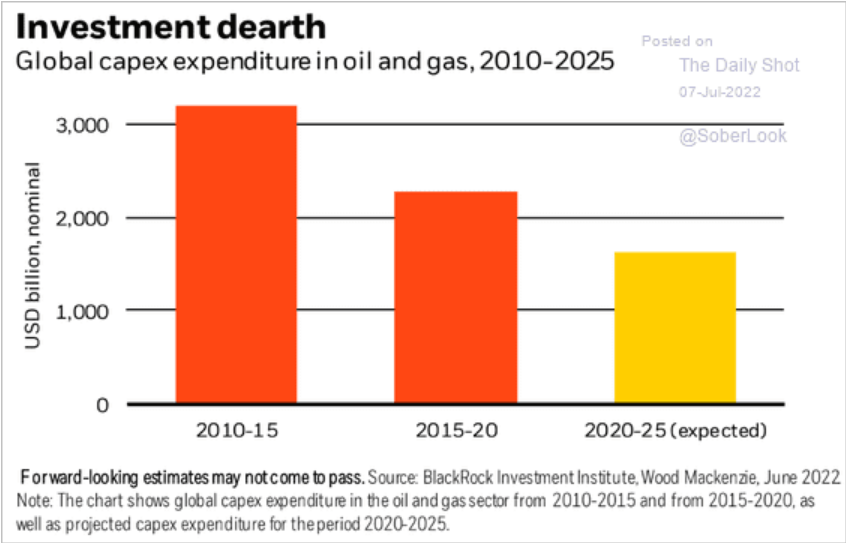

And, here is why there is no investment:

No expectation of profits.

France to nationalize EDF

- Head of EDF (appointed in 2014) has resigned

- EDF is the debt-loaded nuclear and energy company in France.

- The EDF share price is up about 15% on the announcement that the government is going to pay top dollar to capital for their shares.

The government wants to build 14 new nuclear power plants by 2050 to meet zero emission power demands. Private capital was never going to pay for this. So, nationalization is the only step.

EDF will likely become nearly 100% publicly owned and subsidized.

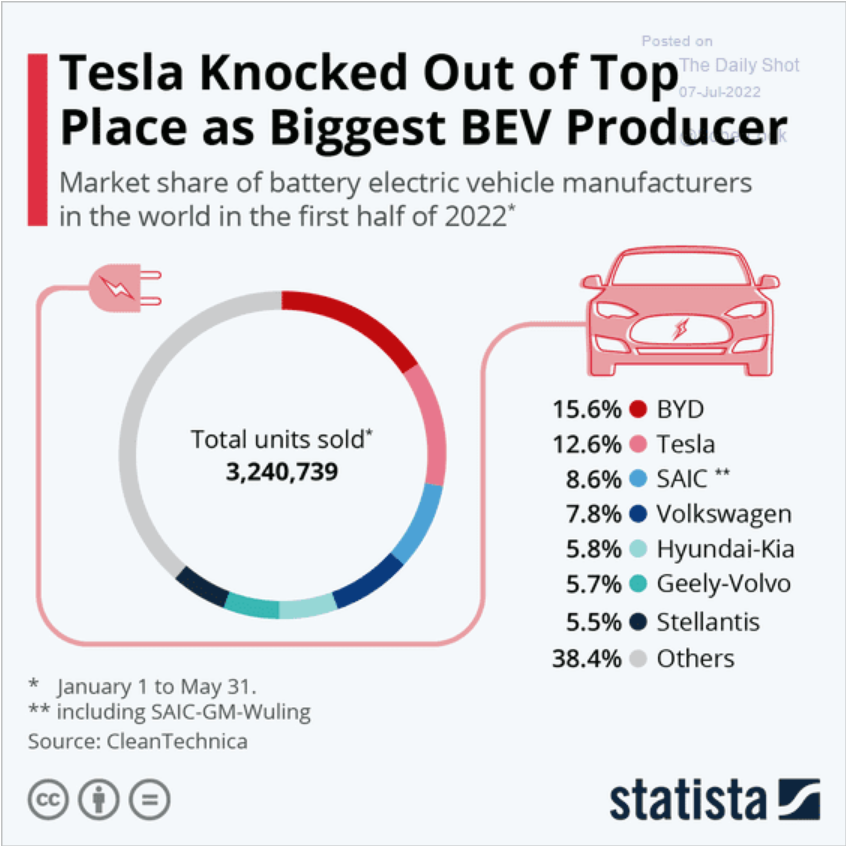

Tesla no longer biggest electric vehicle producer