July 6, 2022

Blame the workers

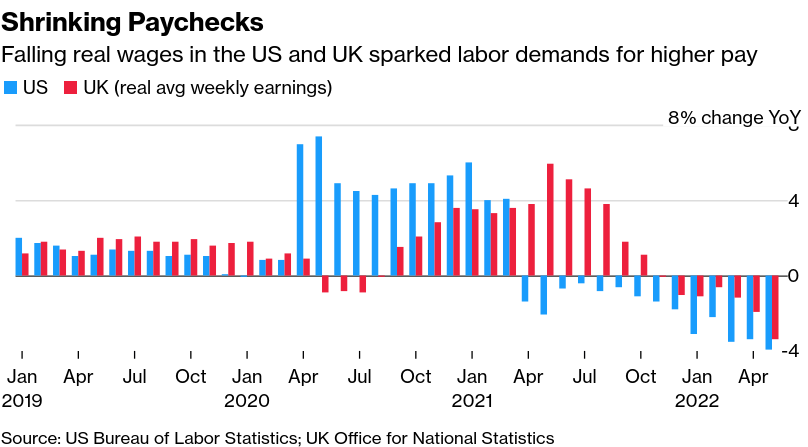

- Capital will now start blaming "labour unrest" for supply chain issues and high prices.

- The narrative that high wages are to blame for inflation is not sticking, so now capital is shifting to blaming workers in a different way: unions.

- Labour unrest is what happens when workers are not getting what they think they should be getting and have just enough power to demand it, but not enough to get it without striking.

Of course, governments will have a powerful new narrative weapon in their attack on strikers (forcing an end to strikes and denouncing unions) by blaming them on supply chain contraction and prices.

Unlike the "wage increases cause prices increase", this narrative comes with the bonus of being partly true. But, strikes are barely ever the workers' fault. It is usually that capital thinks that it can win against workers. And, capital is likely correct that if workers are pushed to strike the state will step-in and save them.

So, the blame rests with capital. The solution are stronger, bigger, and more organized unions where capital relents before they go on strike. Not an easy thing to get.

Norway forces oil/gas strikers to Compulsory Wage Board

Less than a day into the strike—that had not reached its full weight—the Labour Party miniorty government (shared with the centre party) shut down the oil and gas strike.

This is not the first time the social democrats in Norway have shutdown strikes in order to save capital profits through the Compulsory Wage Board instead of forcing the employers back to the table. Previously social care organization and aircraft manufacturing workers were sent to the board.

The Lederne is a strange "union" as it represents management, engineers, and supervisors. All other workers accepted the below inflation increase to wages in the sector.

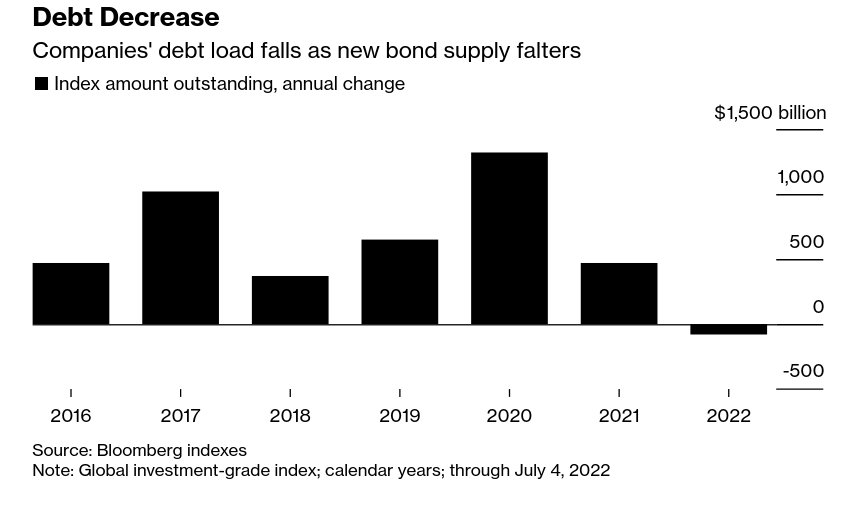

Corporate debt significantly depressed

- This can be seen in is less corporate debt taken on by companies

- Higher interest rates are part of the story here, but it is also the expectation of profits

- Recession fears have stopped investment in new production

Why does this matter? Because without investment there will be a slowdown in the economy while inflation and prices continue to rise.

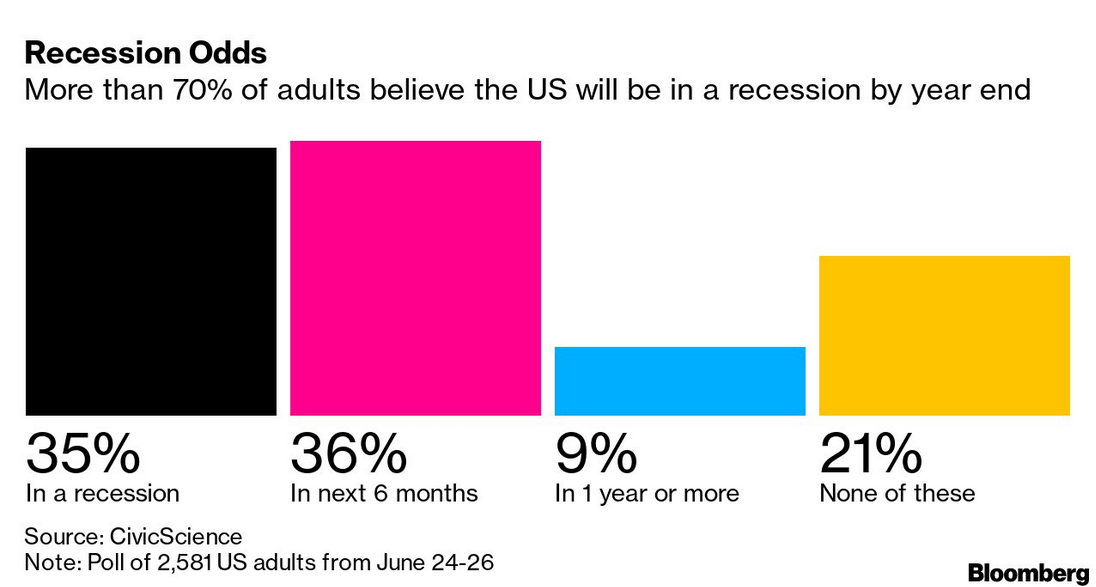

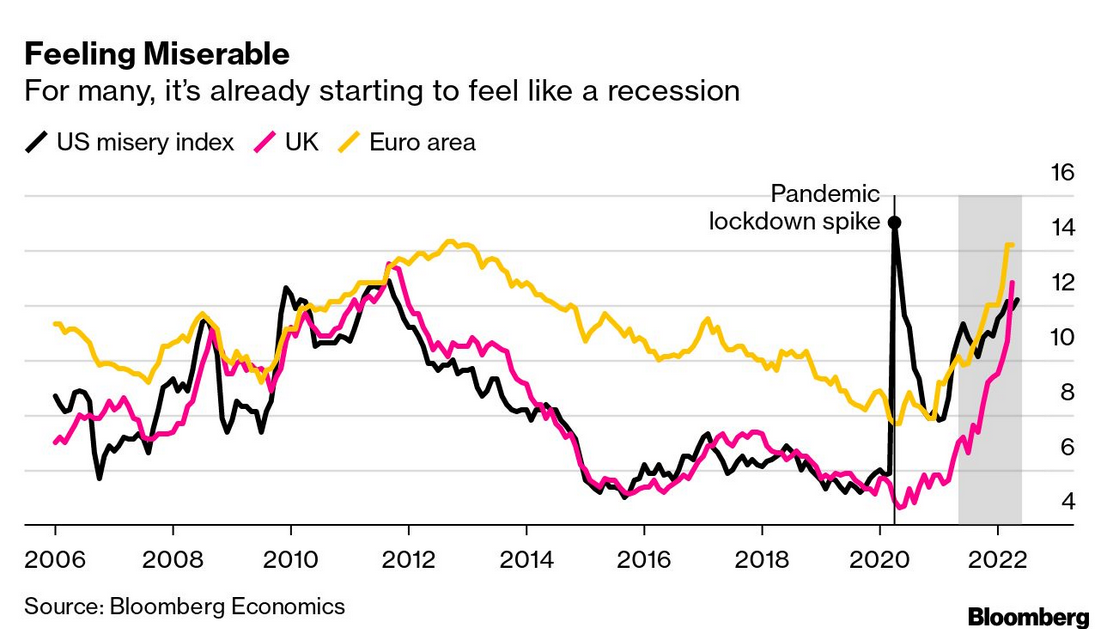

All arrows point to a recession

Many think that we are in one now and they are probably correct.

Those who own/run corporations are also not particularly happy:

Reduction in economic activity continues even as the central banks apply the breaks to the economy.

Governments around the world are moving to tax cuts but bigger reduced spending. Neoliberal dogma says that pandemic debt is becoming expensive to keep on the books as costs of issuing new debt are climbing. This is not exactly how this works, but the narrative is a strong one for governments worried about the size of their debts and the effect of taxes on inflation. Neoclassicals worry about cutting taxes driving inflation as well as increasing taxes driving inflation—must be hard to look at the economy that way.

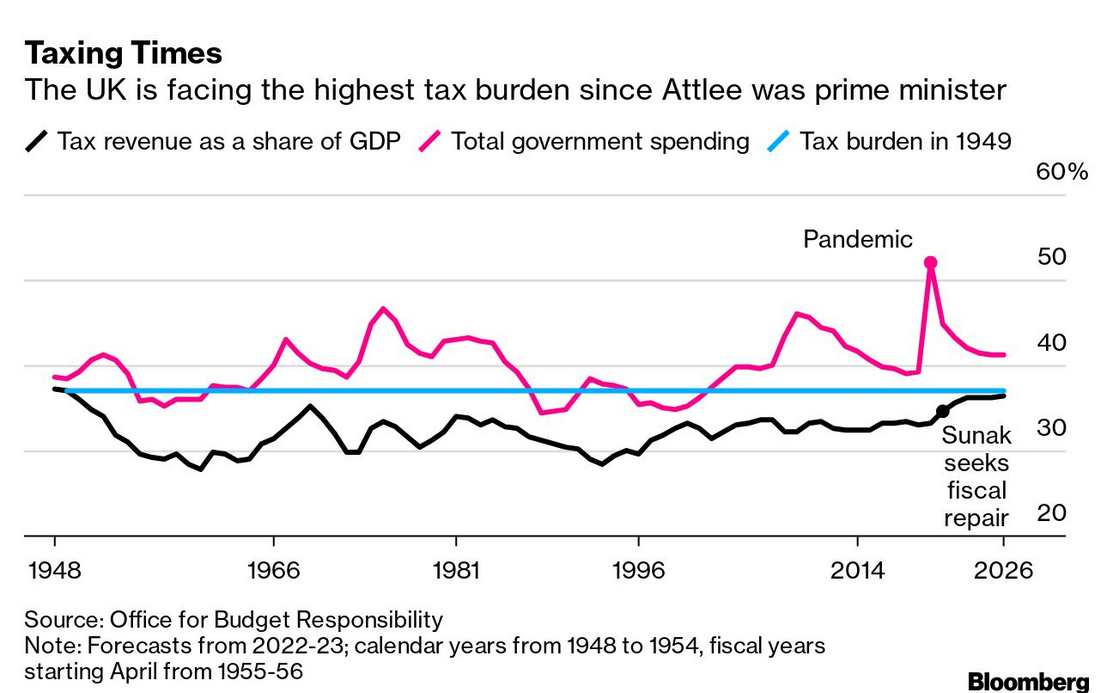

The UK is in an all out war between the two "sides" of the Tory party. One side thinks that taxes should go up and public services should be cut. The other side thinks that taxes should go down and public services should be cut.

You will notice that taxes are planned to be rather high. The pro-Boris side wants less taxation and the other side wants more. This doesn't really outline who is paying these taxes (workers) and what the government is spending on (not workers), so don't read any progressiveness into this tax fight.

You can be forgiven to think that amounts to the same thing. But, for Boris it is enough of a battle within the party that the anti-Boris forces are about to oust him. It is unclear whether that is will be a good thing for working people. I am going to vote that it is bad either way.

It can be complicated, but only if you think the economy is there only to provide profits to companies. The current cuts to spending are not being debated, but how to pay for the increased debt depends on how much you believe in the unicorn of trickle-down economics.