July 5, 2023

Residential property values fall in Europe

There is a fluctuation in Euro-zone property market caused by the slow-grinding recession and high interest rates. The first time this has happened in 10 years.

In the manufacturing hub, prices are way down.

House prices across the 20 countries sharing the euro fell 0.9 per cent, following a 1.7 per cent contraction in the previous three months.

Germany and Sweden contracted by 6.8 per cent and 6.9 per cent, respectively, on an annual basis.

(FT)

This comes as producer prices collapse from lack of demand for production inputs and much lower energy prices.

The impact will be a decline in some price indexes over the rest of the summer, but core inflation continues to be maintained. This in spite of (or, rather, because of) slowing economy.

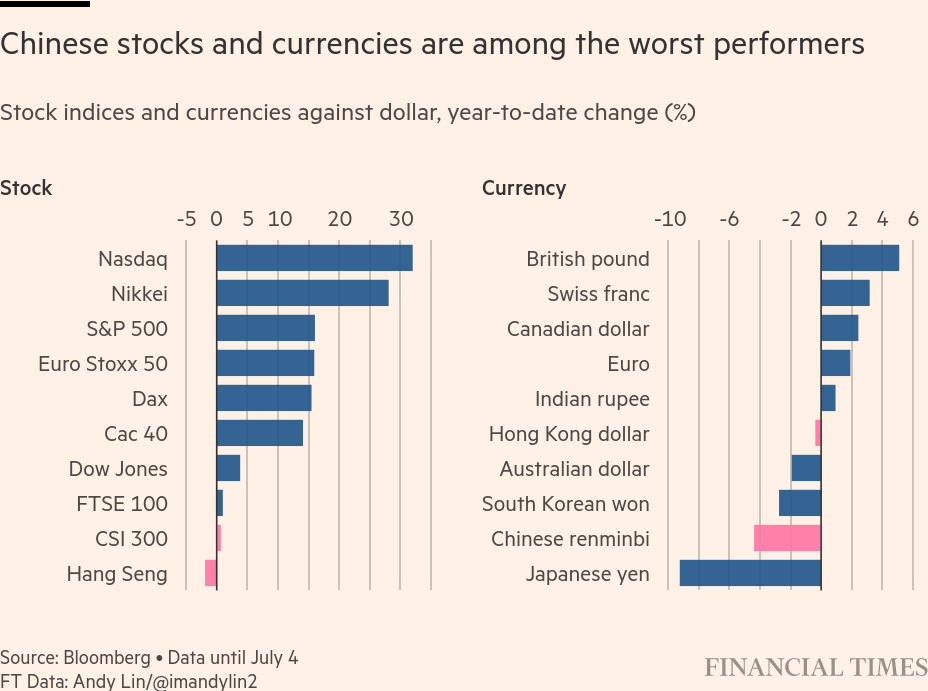

Chinese economy disappointing investors

The press is filled with narratives of disappointment at the growth rate of the Chinese economy in post-COVID-19 shutdowns.

The analysis is awkward in light of the direct attacks on the basis of growth in the Chinese economy by the USA. Why would private capital gain when the USA and allies are doing everything to undermine capital investment in China?

The reason is that the West's policy on China is to stress China's economy enough for the government to open China's capital markets. Many investors are betting on the need for China's state banking sector to "see the light" and liberalize investment regulations.

Some of this has happened with recent changes to the central banks regulations that move it more to the limited mandate end of the central bank spectrum.

There is also a new central banker in China named Pan Gongsheng who was trained in the West. Some think that this means that liberal central bank thinking is on the rise.

I think that while there has been some movement in that direction over the previous decade, it is unlikely to move where capital wants them to. China's leadership might be all about increasing wealth of the nation, but there is nothing to indicate uncontrolled liberalization.

There is enough money in China around to support domestic investment. And, in a world economy running along a slow-moving slump, China is going to be looking to broadening its own economy in lower geopolitical risk areas.

BC regulatory consultation on Medium and Heavy Duty (MHD) Vehicles

the BC government's regulation consultation period has ended for it's proposed freight transport zero emission vehicle regulations.

The proposal is essentially to align with the current California regulatory system.

There is little choice for the BC government in aligning with California's regulatory environment on trucking. There are too many trucks moving from one country to another and California sets the standard for vehicle regulations in North America. Infrastructure for California regulated trucks needs to be built in Canada and Canadian trucks need align if they want access to the USA.

Further to this—which makes the "consultation" a little moot:

- The federal government has signed a Memorandum of Cooperation with California on regulatory cooperation:

- BC signed a Statement of Cooperation with California and other states on regulatory

alignment and created the Pacific Costal Collaborative initiative.

While the review of these regulations is finished (submissions were due before July) and regulatory harmony with California is a foregone conclusion, there was plenty of opposition to the regulations from the right-wing associations of truckers.

In California, there are active legal battles against the regulation there. A motion to intervene on one of the largest legal challenges brought by the Western States Trucking Association (one of the largest employer associations) started late June. Similar lawsuits have been launched by other state-level trucking company associations.

These regulations have come in around the same time as the ports had to backtrack on their attempt to download costs of upgraded trucks to the owner-operators. The difference with this suggested legislation is that government subsidies will be providing some of the support to transition to electric vehicles.

The opposition to any change or forced upgrade to trucks will likely delay some of the implementation or soften the proposals. But, more importantly, it will be the market's response in building trucks and the infrastructure they need to recharge that will delay most of this.

It will be important to include members in this discussion to talk about the full costs and realities of implementing these transitions.

Governments are counting on the market to provide if they give them enough profit subsidies. While these subsidies might be good for investors, there is a bit of a game to be played. The longer the delay in investment, the more money there is likely to be made on subsidies. The only thing that would be counteracting this tendency is the pressure from competition for access to new procurement demands for electric vehicles.

I think that the smart money is on investing in charging stations. California has started driving an investment in this kind of infrastructure for large electric semi trucks, but Canada is far from establishing long-distance rapid charging. The likelihood is that this is where most of the "last minute" subsidy will be handed out.

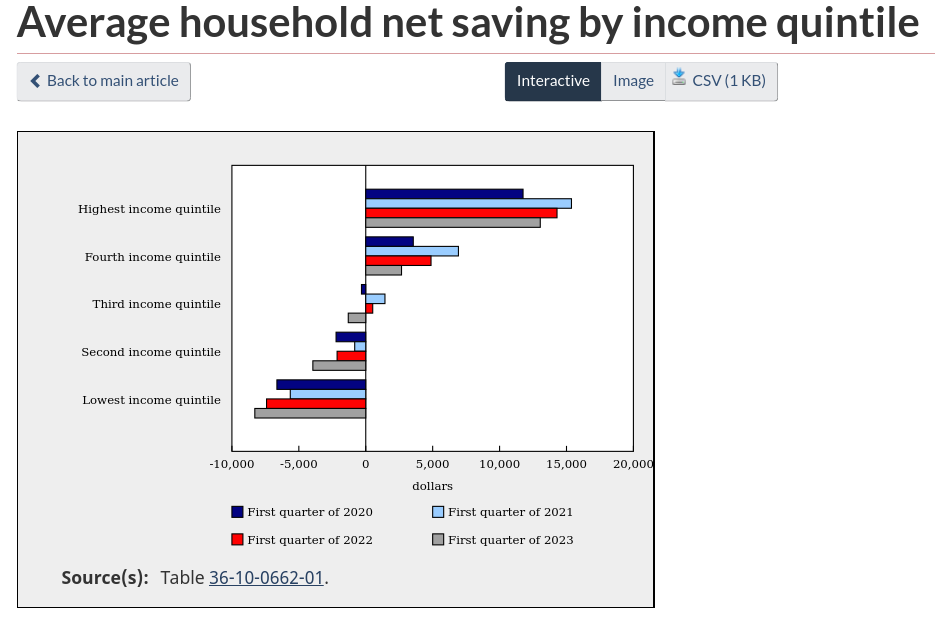

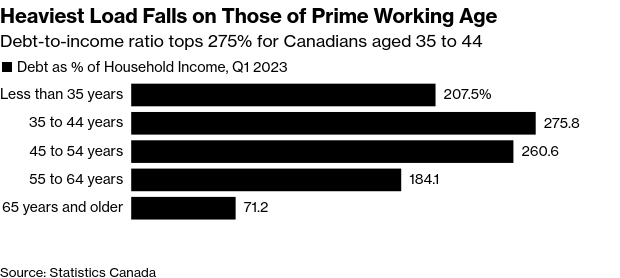

Inequality grows in Canada

The high interest rates is a clear class war when looking at savings of the majority of workers in Canada. The central bank uses "spending" as their measure of health of the consumer economy, but this shows that it is not so discretionary and driven by debt. Mortgage

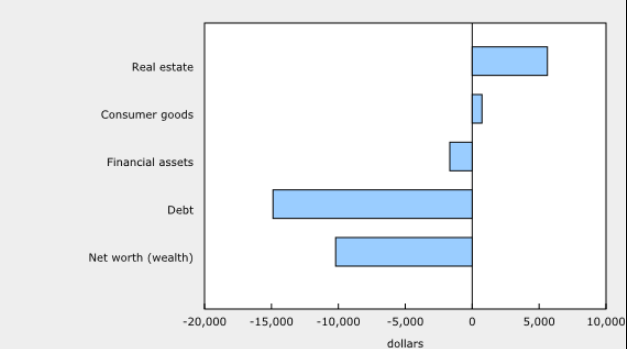

On the whole, it is mortgage debt. That is what used to drive the purchasing power of Canadians (rapid increasing property values and low interest rates) is no longer around. The impact will ripple through the economy.

The decline in net worth for all households was due almost entirely to real estate, with the average value falling by 8.6% from a year ago. The least wealthy group saw their mortgage debt rise at a much faster rate than the overall value of their property holdings.