July 28, 2023

Production

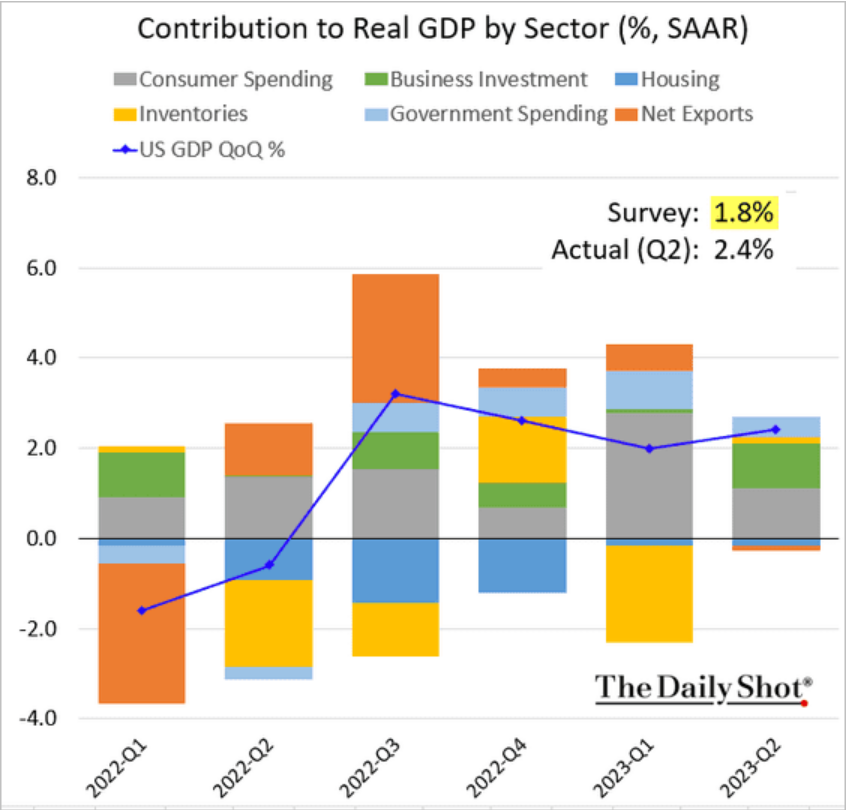

USA GDP is (almost) back to where it would have been without the pandemic hit. However, let's focus on the downside:

Look at that giant hole in production.

You can see why that giant hole exists:

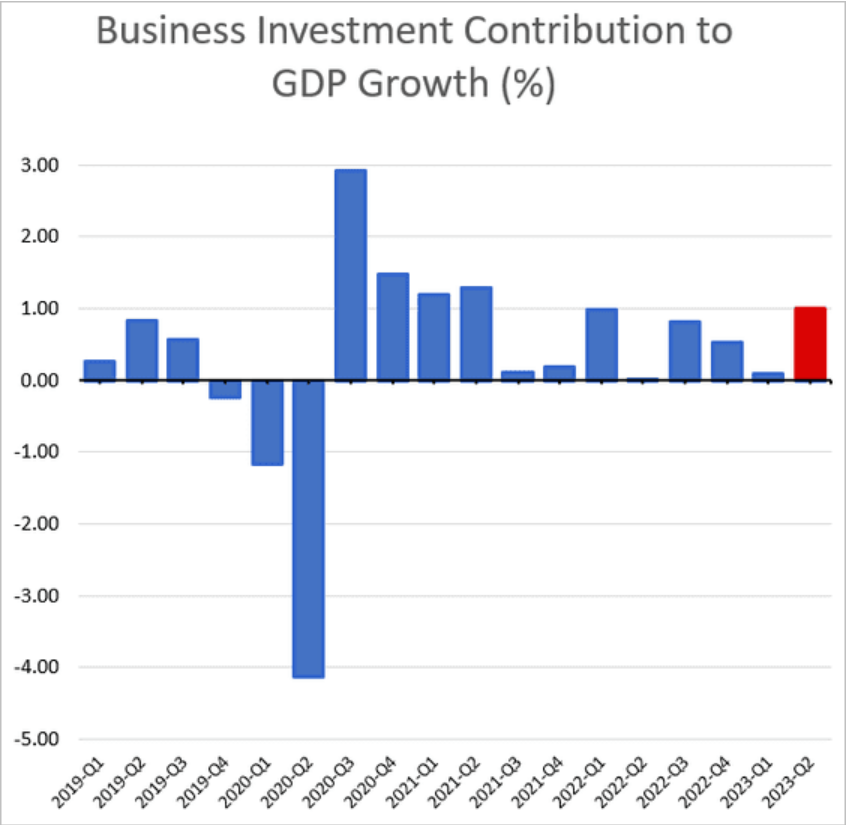

The most important part of the growth in production measures (GDP) is the business investment part. The rest of the measures sort of circle around this number:

Why is business investment so important? Because it is a measure of capitalist production and without it there isn't any capitalism.

The papers would have you believe it is consumption that is all important. They say this because if you look only at consumption things always look better. But, consumption is nothing without local production.

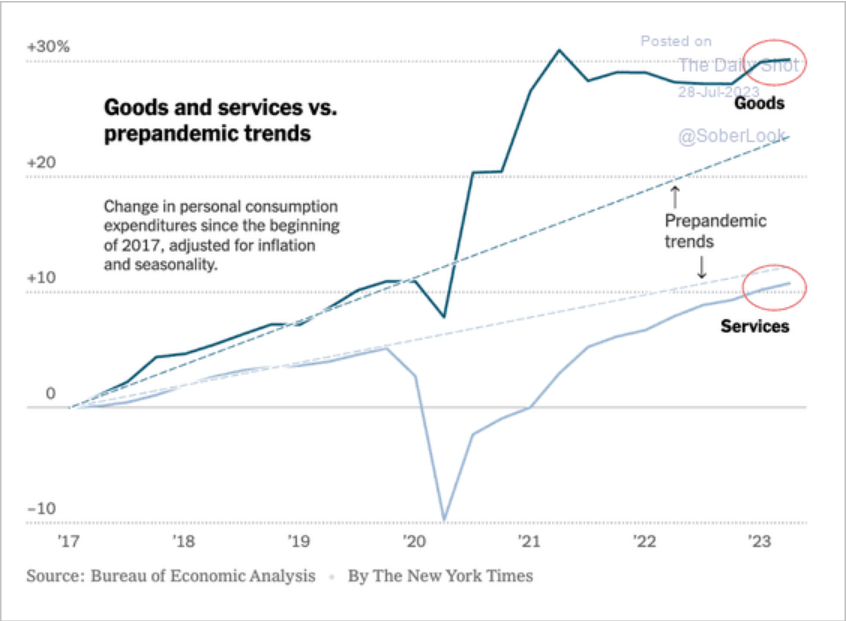

Here is a consumption graphic in the NYT.

Look at how the graph is very positive. Spending on things so great. This myth that consumption drives economic prosperity is part of the confused nature of how we talk about the economy. Consumption itself can sustain an economy for a bit, but if all you are being paid to do is sell things that are produced elsewhere you have not got a sustainable economy.

Consumption is a convenient measure of economic growth because at its core is the consumption of essential goods for living. As the economy gets weaker, those essential goods are still purchased. As those goods get more expensive, those goods are still purchased. This makes the economy look much better than it is.

In the previous 50 years the goal of the USA has been to sustain the purchasing part of the GDP numbers by driving down the price (in USA dollars) of things, pumping-up housing prices, and increasing debt loads (through reduced interest rates). Anything to keep it look like the economy was growing because the "Great American Consumer" could sustain the economy through anything.

This narrative around the consumer was so important to capital that we ignored that a massive amount of production actually happens in the USA still.

This fantasy is over. The bottom was hit during the pandemic and the lie exposed. Production is important and the CHIPS Act and the IRA in the USA is showing just how important domestic production is.

The IRA is not the "inflation reduction act" it is the "impede recession act". Massive profit subsidies to capital and geopolitical threats have been successful (in the short term) of recouping investment in production at home.

The question is, can you do avoid a recession this way? And can you have growth in the face of interest rate increases?

You can if you ignore that workers have faced a recession by focusing on consumption numbers and focus on capital's spending (by focusing on growth in investment). In the midst of the tightest labour markets in recent history where workers should have the upper hand, the "American consumer" is still struggling to make ends meet.

The USA has bet big on the investment of capital continuing. But, it is costing them:

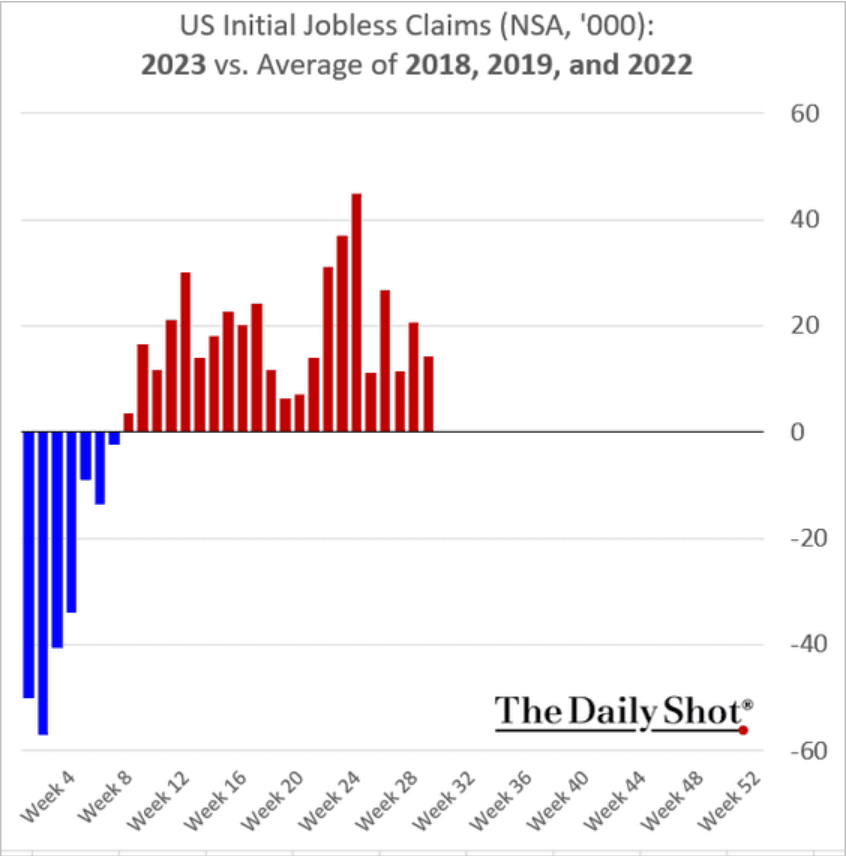

There is one thing that could get in the way of new production "returning" to the USA: workers. The new production that they are onshoring needs qualified workers to work and produce and it take a lot of time to spin up production for some of these goods.

Good thing the Federal reserve is creating unemployment:

The goal is to shift those "service" jobs to material production jobs and gain from the boost in economic activity that comes from that.

In this battle, the risks of political fall-out might land before the economic consequences of winning or losing. But, there is not enough money in the global economy to fill this gap if production is only moved and not increased. We will have to see if that is what happens.

Where is the wage-price spiral?

We do not hear a lot about wages driving prices anymore. I wonder why that is?

It is nice to be in power. You can be wrong all the time and say you have no idea what is going on and people still think the words you are using mean something.

Central bankers have made the full pivot away from blaming workers wages in the USA. This goes back to a previous post where we talked about the fact that the unions in the USA have not been able to increase wages very much because they have such low coverage. And, because there has been an attack on workers via AI.

Inflation was too high and for too short a time for workers to respond with higher wages. The result so far is capital winning this game.