July 28, 2022

USA in a recession

- GDP fell by 0.9 per cent on an annualised basis, according to official data

- This follows first-quarter GDP data showing the US economy shrank by 1.6 per cent in the first three months of 2022.

The "technicality" of this is apolitical, the declaring it an actual "Recession" is completely political. The National Bureau of Economic Research (NBER) may say that on balance the economy is not in recession because of some newly made up metric.

Profits in Oil

Analysts estimate that the supermajors — ExxonMobil, Chevron, Shell, BP and Total — will unveil a record combined $55bn in second-quarter profits over the next few days, according to S&P Capital IQ. The profits would exceed even 2008 levels, when crude prices soared to $147 a barrel. Shell kicked off earnings reporting today; Exxon and Chevron are due up tomorrow.

Exxon has signalled its refining profits will be as much as $5.5bn higher this quarter than last, largely because of the higher margins. Higher crude and natural gas prices will also boost earnings for the production part of the majors’ sprawling businesses.

However, if the economy goes into recession all that profit growth will evaporate as people slow down their driving and seek alternatives to travel.

What if we had a regulatory framework where all that profit was to be reinvested in lower carbon energy instead of being dispersed to shareholders? Well, we would not have the massive profit subsidy that Manchin is being congratulated for voting for.

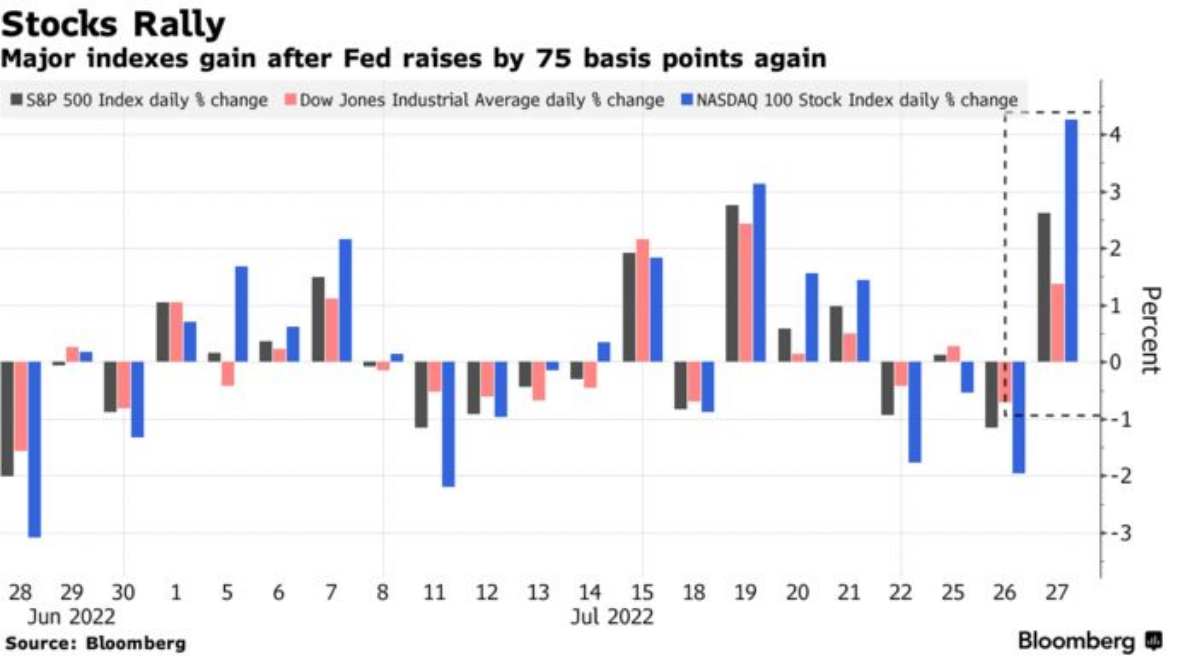

Markets are up after large 0.75% central bank target rate rise

That's right, a bigger recession kick now means markets think a smaller recession kick is coming later, which means more profits!

Basically, the market thinks it has "priced in" the interest rate rise and the resulting slow-down of the economy. And, will now start thinking that profits are again on their way up (in a year or so).

They are quite right, but also very wrong. The Fed is likely going to push hard into a real recession. Which is not good for markets.

Bill Dudley, a former central banker, says markets are underestimating just how far the Fed will go to tame inflation.

He noted Powell repeatedly pointed to the Fed’s June projections that showed officials expected to raise rates to about 3.4% this year and 3.8% in 2023.

That “suggests to me that the Fed thinks they’re going to do quite a bit more than what’s priced into the markets,” said Dudley. He now advises Bloomberg Economics, which forecasts rates to eventually reach 5%. (BN)

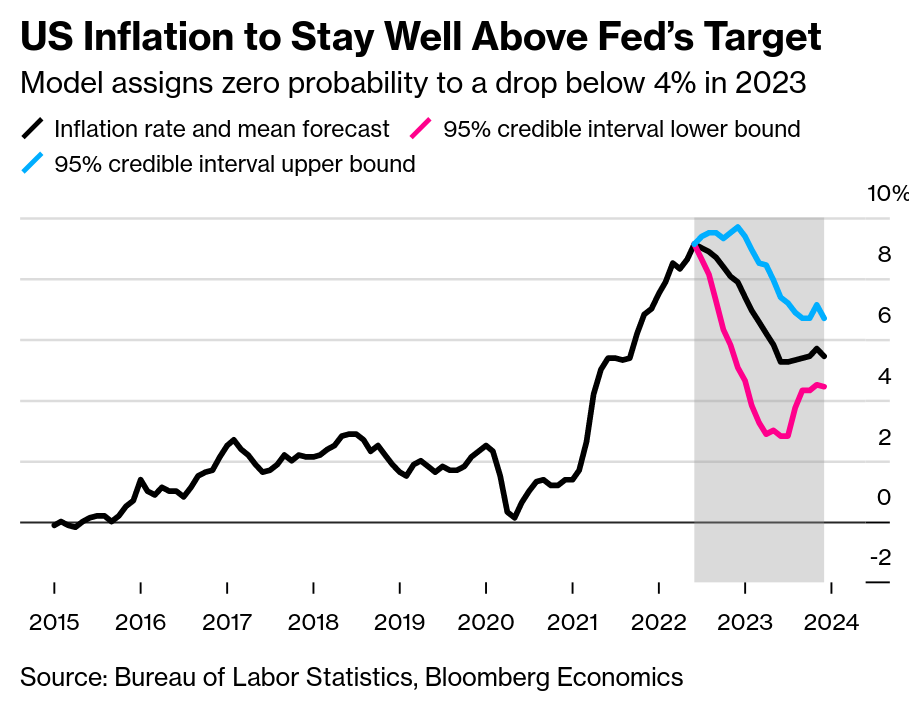

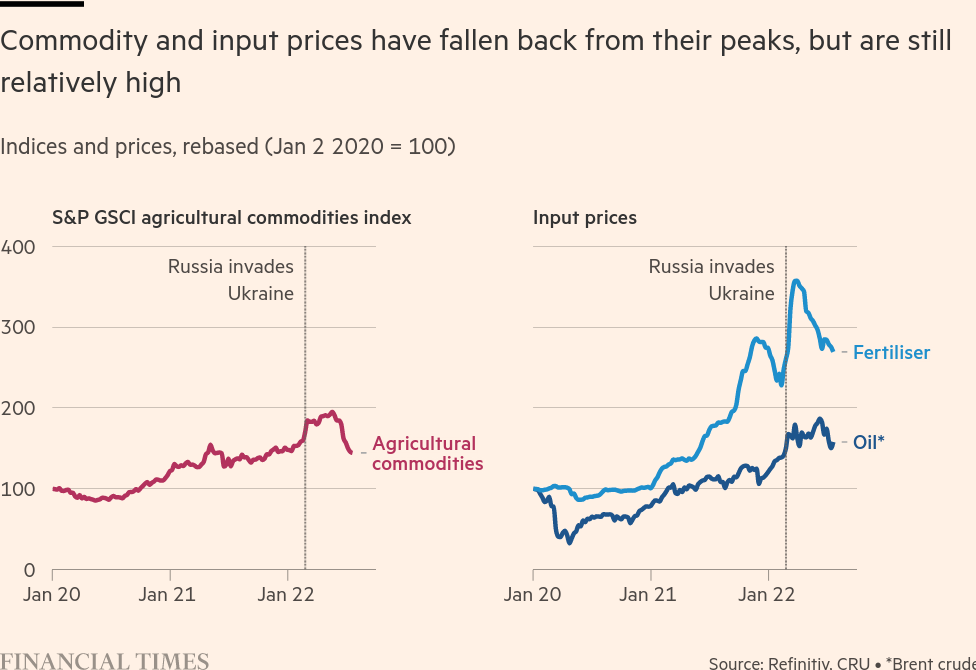

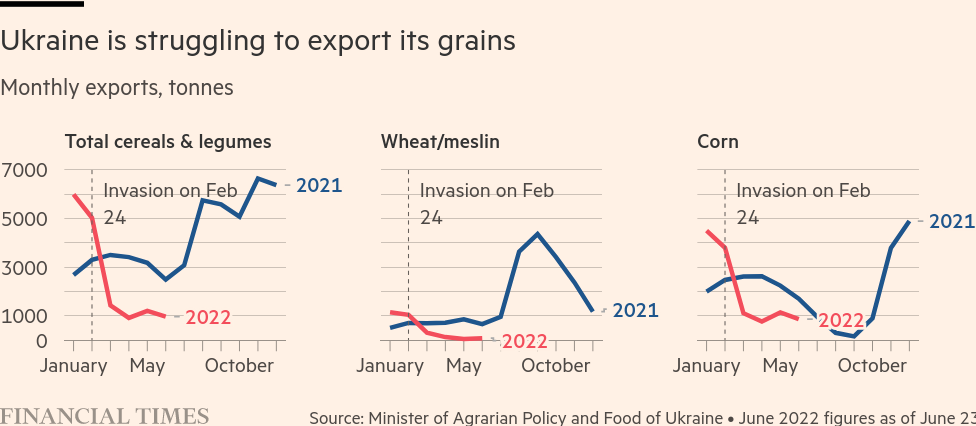

The market thinks inflation is going to be transitory still because they believe in the Fed's magical powers. This is poor analysis.

Here are two graphs showing that the cost of living will continue to be higher than people think:

Joe Manchin backs Senate deal on tax, spending and climate

Joe Manchin has reached a deal with fellow Senate Democrats on a tax, climate and social spending bill following an abrupt U-turn that paves the way for a major legislative victory for US president Joe Biden ahead of the midterm elections.

“Build Back Better is dead, and instead we have the opportunity to make our country stronger by bringing Americans together,” Manchin said in a statement.

The bill includes $300bn in deficit reduction, paid for by a new 15 per cent corporate minimum tax and closing the tax loophole on carried interest — the share of investment profits that hedge fund and private equity managers are paid as an incentive to hit higher returns.

The new tax revenue, which will be raised over a decade, will be accompanied by $369bn of spending on climate and energy reforms and $64bn to shore up the Affordable Care Act.