July 27, 2023

No (technical) recession in the USA, says Fed. Then they increase rates.

One has to marvel at the strange world of inflation politics at central banks.

When you announce that there has been "positive signs" in the data because workers are only starting to struggle and you see no robust sign of recession, it means that the data is telling you to pull the noose tighter.

The "markets" almost didn't respond to the announcement indicating that most investors knew that this increase was coming. The slight bump in values was probably due to the statement that the Federal Reserve may not be done raising rates, muted by ever positive sentiments about the future.

The muted response from the financial sector to the announcement means we need to look more broadly at the impacts of these high rates.

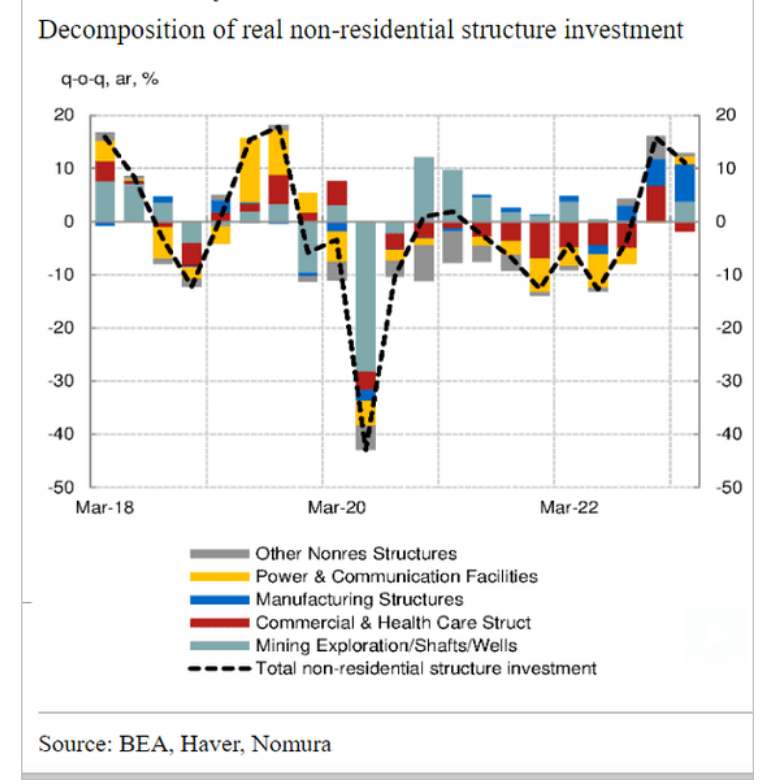

There has been a rather lot of investment in new manufacturing infrastructure in the USA. The investment is broad, indicating that companies are investing in new capacity—even though it has not shown-up yet in the capacity measures.

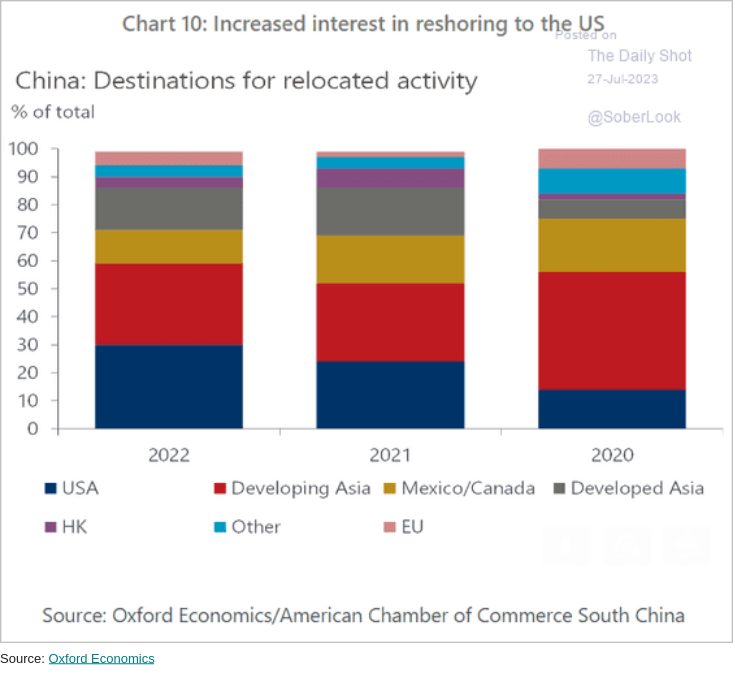

Some of this is due to the (slow) shift of manufacturing out of China and increasing amounts of it going to the USA. This chart suggests that the IRA is working in pushing some companies to "re-shore" production. But, keep an eye on that "Developed Asia" section as it is growing too—mostly displacing Canada/Mexico. "Friend shoring" doesn't mean "re-shoring".

The high interest rates do not seem to be too much of a hindrance here. Partly it is just the sheer size of the subsidy regime in the USA. The other is that the geopolitical risk for companies doing business in China has skyrocketed. Many of them look at the recent experience in Russia and do not want to be caught with assets on the other side of a sanction regime.

These are good signs for USA capital and probably (at least partially) point to why the Federal Reserve feels confident in raising rates and avoiding (technical) recession.

The issue for workers is that they have been in an all-but-named recession throughout the previous year. It is a slow moving tightening of spending capacity, increased debt, and fewer good jobs available. Workers are also facing rather huge pressures from new computing resources from AI being applied in the workplace (we will not fully see this effect for a year or more). And, there is massive change afoot. So, while there are some production jobs returning to the USA, it is likely not enough to offset the slow-moving economic crunch being experienced across the "developed" capitalist countries.

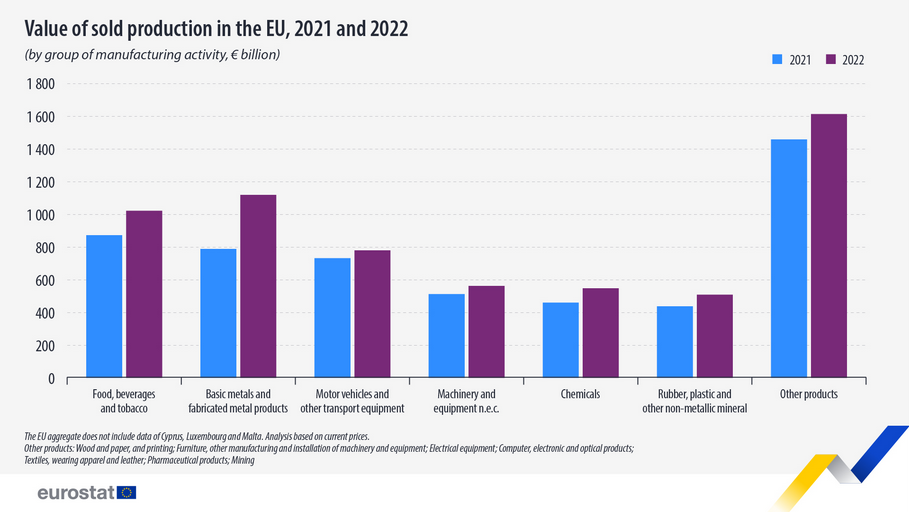

Even in the UE there are signs of actual growth in production. The take-home here is that the growth in EU manufacturing is broad and sustained since the pandemic. While Germany is not growing faster than everyone else right now, this is a broad gain for the EU.

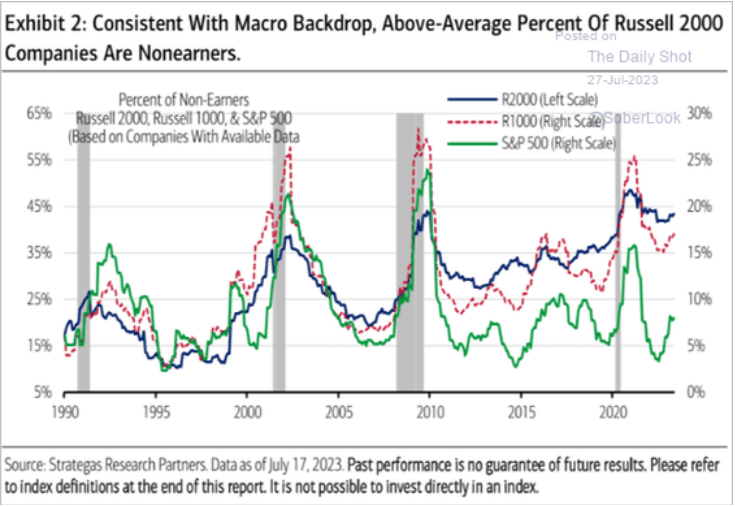

There is a flip side to all this investment and slow-downs: capital profits are way down. Profit margins are back to pre-pandemic levels and look to be collapsing farther. USA value stock prices are below their long-term average. So, we need to be careful calling out record profits everywhere because it just isn't the case.

While there are some very profitable companies around, the general situation is not spectacular:

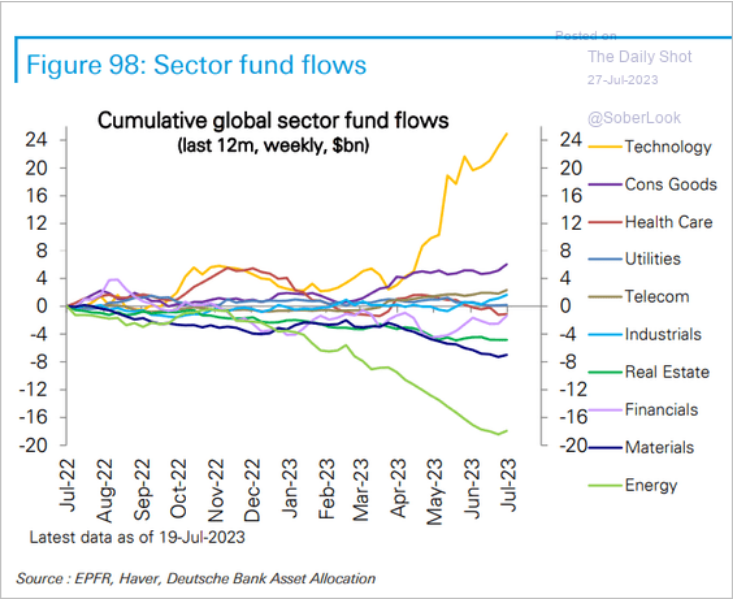

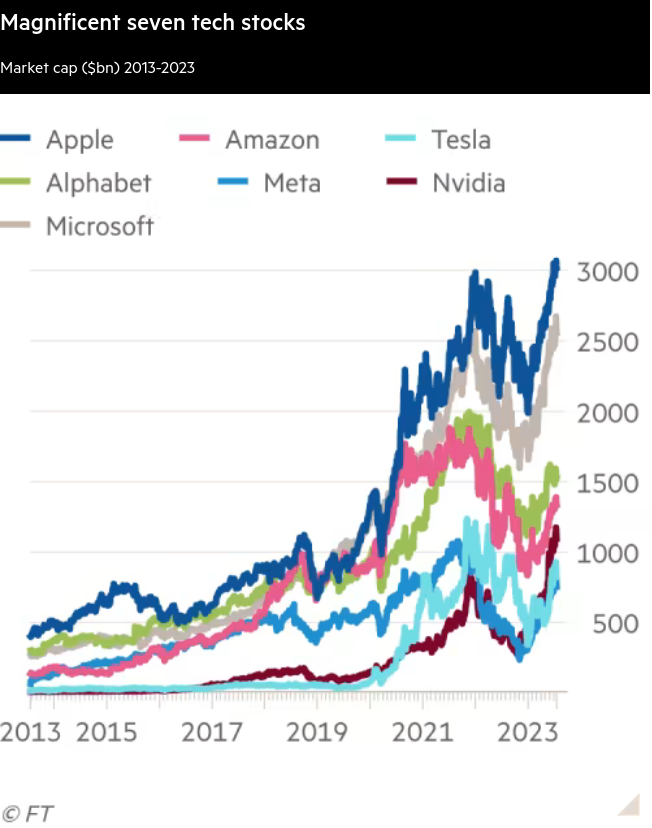

Where is the money flowing into? You can probably guess:

Is this smart money? Likely not all of it, but it does show where investors think the returns are going to be in the short term. Given the shifts necessary in the energy sector, this graph does not paint a great picture.

Productivity

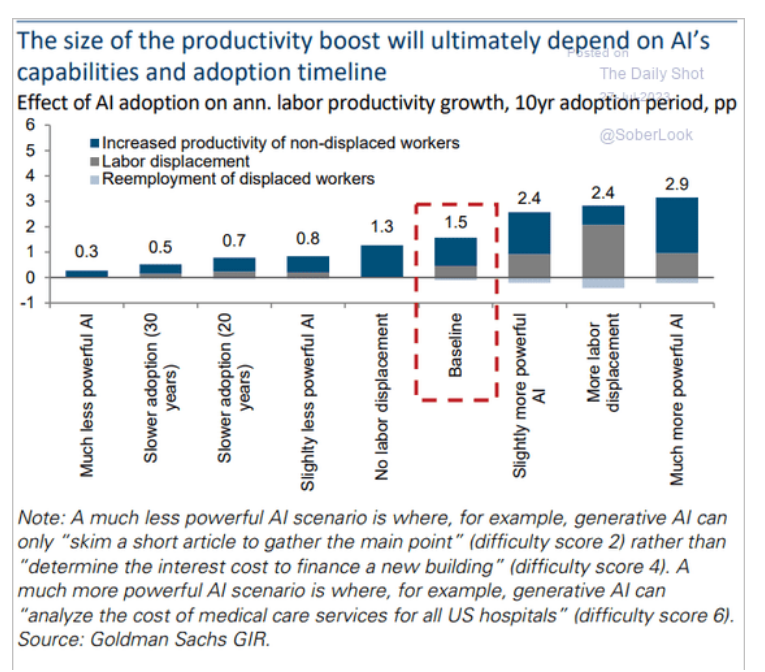

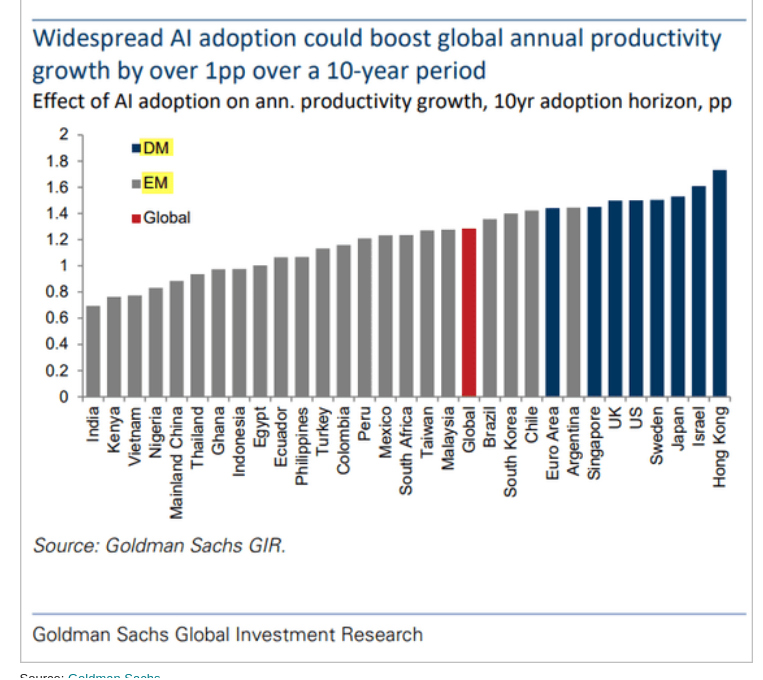

Further to yesterday, where is productivity from AI going to come from? Well, obviously from companies in sectors and in countries where companies can invest in AI and directly get some productivity.

This seems obvious, but it isn't. Not all companies will make the decision to invest (see yesterday). The more powerful AI is more expensive and it takes replacement of workers to gain the productivity boost that results in higher profits. Or, it will take a tonne of money to increase productivity in industries that will see augmentation of work instead of replacement.

But, the thing to remember is that these apply to different industries. Some industries can replace workers, others will have to augment. The role of unions is to make sure this investment—where it can be made—supports workers and we then go after the productivity gains with higher wages.

Chocolate and Oranges

Some specifics on the impact of the intense weather we have had on food?

Oranges and cocoa prices are about to skyrocket.

- citrus greening (pathogen caused)

- crop disease (bacteria caused)

Both are climate change driven and are destroying orange yields.

Cocoa is just a slow moving collapse of the ability to grow that crop.