July 22, 2022

Central bankers are risking rate-driven collapse

They used to talk about wage-price spiral, but we are on the cusp of rate-shock spiral. The central banks have all but abandoned the idea of a "soft landing" or stable control over inflation. They are determined to bring "inflation" down by driving the global economy into recession.

The term "forward guidance" is used in monetary circles to describe the forecasting and tea leaves reading that happens before the central bank actually raises or reduces its target interest rate.

The term is ridiculous and so is the concept. The idea is wrapped-up in the mythology that the central bank is all important to economic stability. The pretend ambiguous tweaking of central bank lending rate is only important for a small group of real investors, everyone else is concerned with actual investment.

The myth that the central bank has a hold over the economy is one of the most prevalent stories we have told ourselves during the neoliberal era. A story that is based on a partial truth, but also one that is tied-up in reasons for the privatization of the banking system: that it is too complex and important to be under political control.

What this means is that capital thinks that it is too important to have it be accidentally under control of a worker-orientated political party.

How has the myth been shattered recently?

The central bank has been not doing what it has been "forecasting" and it is now going to push the economy into recession even though it probably does not have to.

Basically, investors no longer believe the bank's got things in hand. Which is exactly correct.

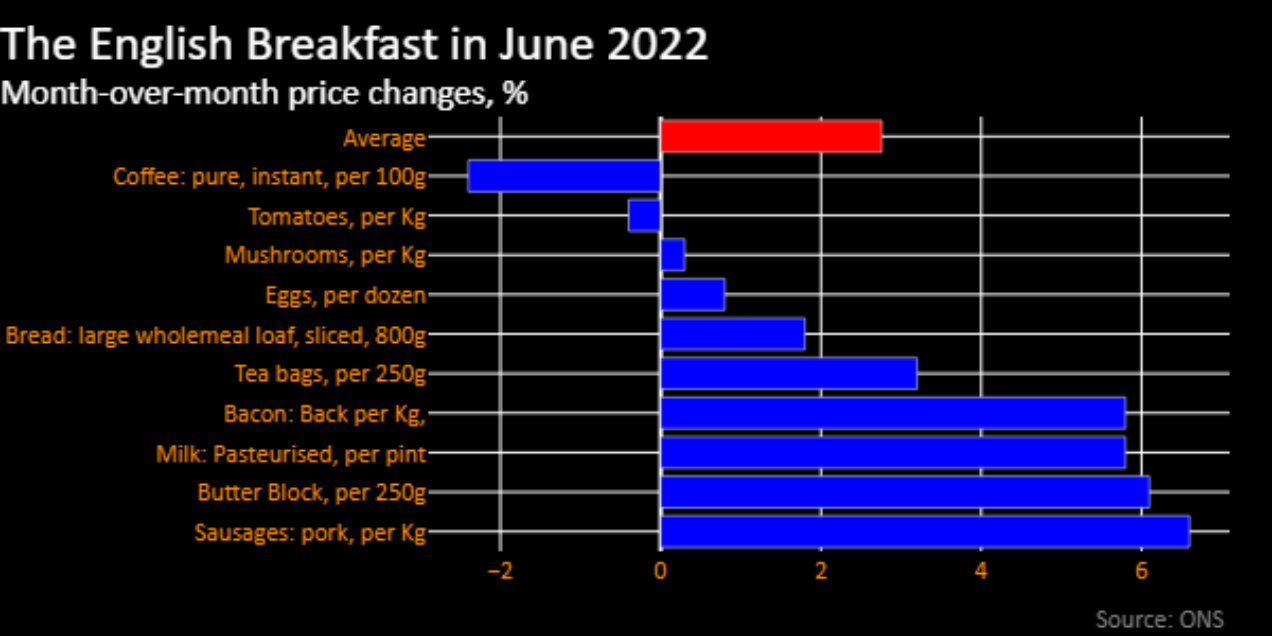

Some changes in the price of food in the UK shows the price of a full English breakfast, which is something no one should probably eat.

Home prices

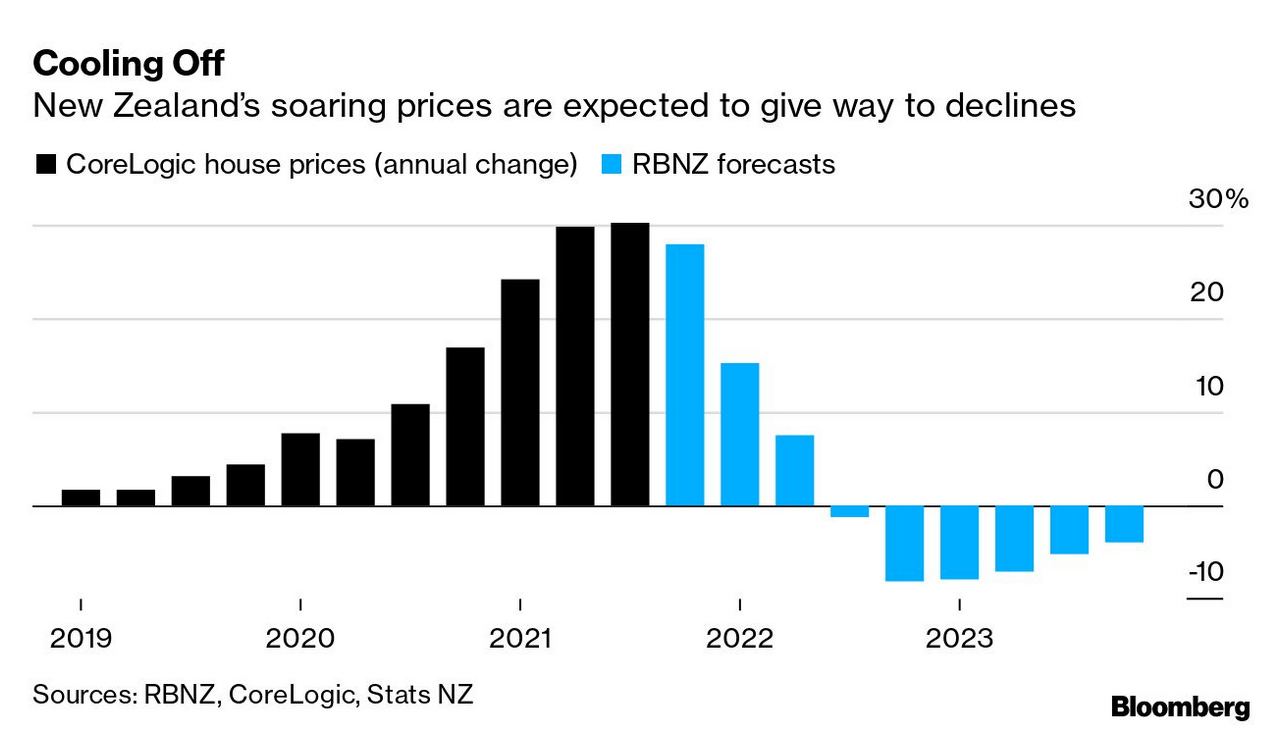

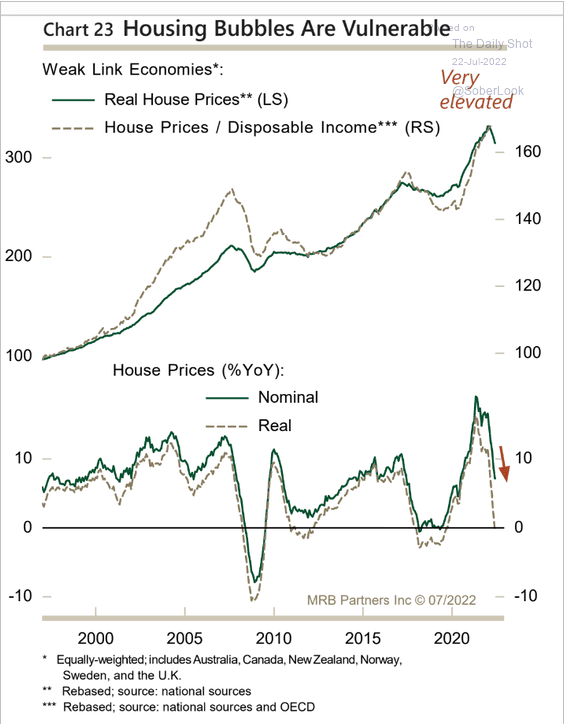

New Zealand might be predicting other housing markets as the global recession, increased interest rates, and housing market fluctuates.

median sale price down 8.1% in June from the peak in November last year to NZ$850,000 ($523,000)

It is anyone's guess how other markets will go, but this looks about right to me.

In Canada, prices just had their biggest monthly decline in at least 17 years, home values are falling in Australia’s two biggest housing markets, and there are signs of the market cooling in the US and the UK.

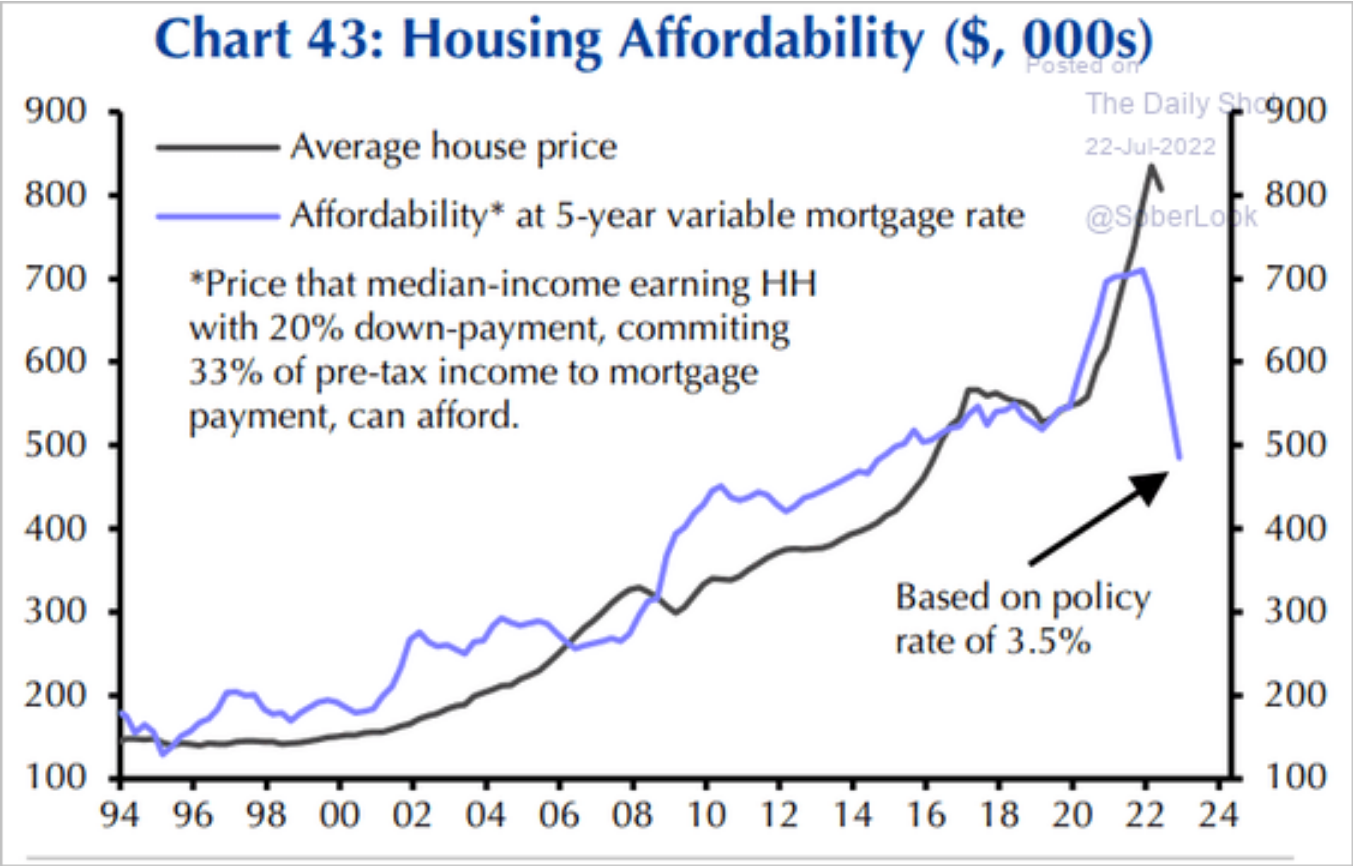

This is not necessarily a predictor of anything, but what happens when affordability collapses?

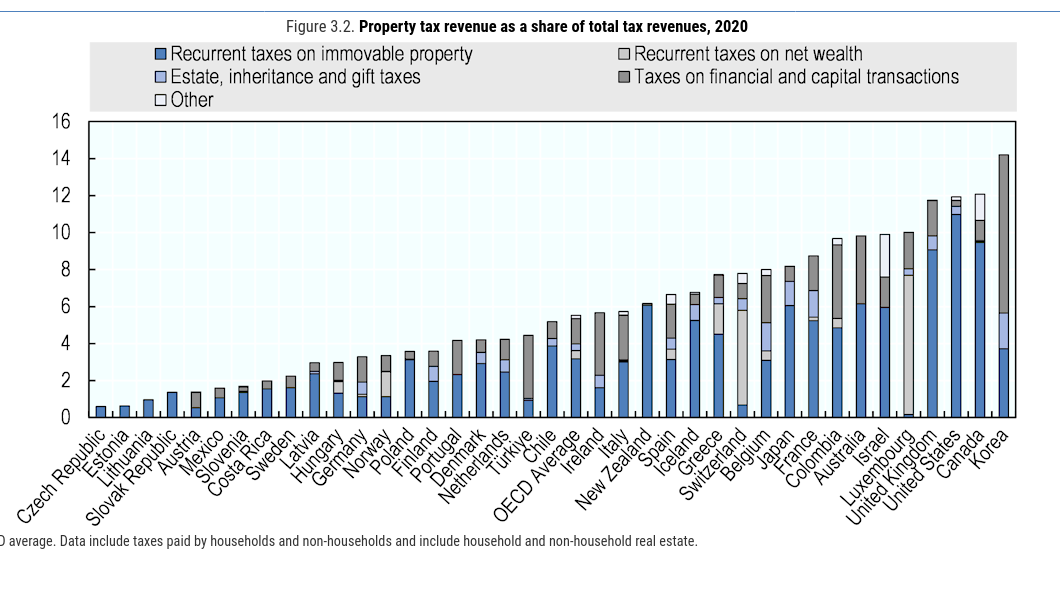

The OECD has a cure, of course for all of this:

They want more "efficient" housing taxation. The assumption is always that housing is for people who can afford it. The problem with this is it also assumes a functional housing market.

The impact of house values should concern Canadians. The government is getting a lot of tax revenue on property because prices have gone up and stock grows fast. However, that could be a risk if housing prices do not continue to grow:

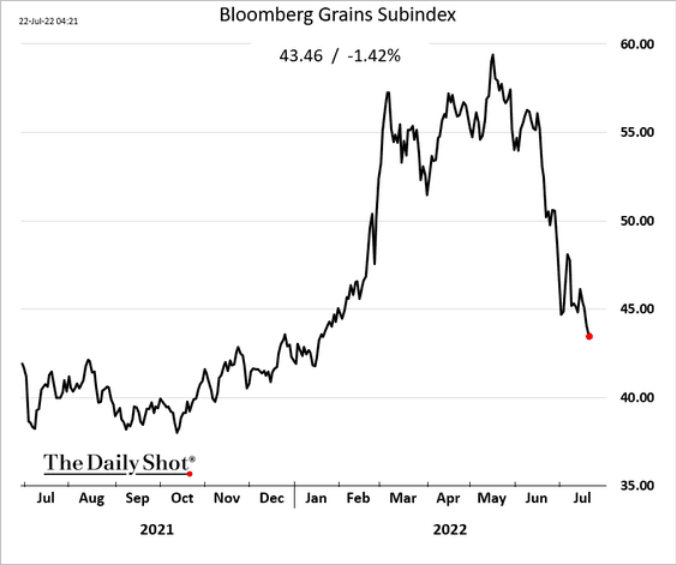

Grain prices

Grain prices are declining. Could be to do with the deal about to be announced between Russia and Ukraine, but mostly it is to do with the reduction of the backlog of in transit supply.

Also, do not expect this to impact the price you pay for food. Oil prices have stabilized for now around $100 a barrel—much higher than in previous years.