July 2, 2024

Elections

Jordan Bardella, the National Rally president, said on Monday evening that he’s doing deals of his own with some candidates of the center-right Republicans party. If there are agreements, we could see a few more National Rally candidates drop out to support those Republicans.

Macron's finance minister wrote this morning that he would only support drop-outs for Republicans and not La France Insoumise (LFI).

The Financial Times has called for centrists to vote for LFI in runoffs because the Rassemblement National (RN) is worse, but many write in its pages that the far right might not be so bad for investors.

Bloomberg News opinion pages are full of apologists for the far right, who point to Meloni as being not so bad for capital.

Reuters too is soft on the position that the far right is a threat.

In the Netherlands, the far-right coalition with the broad conservative parties is bringing all sorts of people in, with some even being denied entry into the cabinet because they failed their national security vetting. These are folks who have web pages and organizations dedicated to the "Great Replacement" conspiracy theory, plagiarism, and campaigns to push out asylum seekers. The coalition of the far right and conservatives looks like regular pro-business politics with more than a dash of sociopathic policies, which many bankers seem fine with.

The episode shows that the "centre" is not the centre at all, but the right with some confused centre-lefts hanging about, pretending they know what is going on.

Add to this that the European Central Bank continues to feed the far-right base by providing no support for investment in economic growth. Legarde has said that central bank rate tightening will continue with higher rates for much longer, as the economy is not doing poorly enough yet.

This is a warm-up for future elections, and given the way that the rest of Europe is going, it is going to be a rather messy year.

USA and Canada

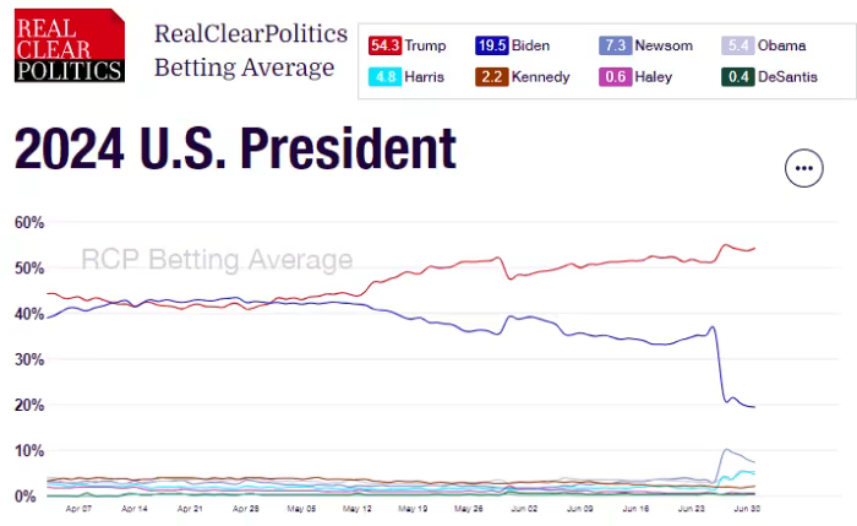

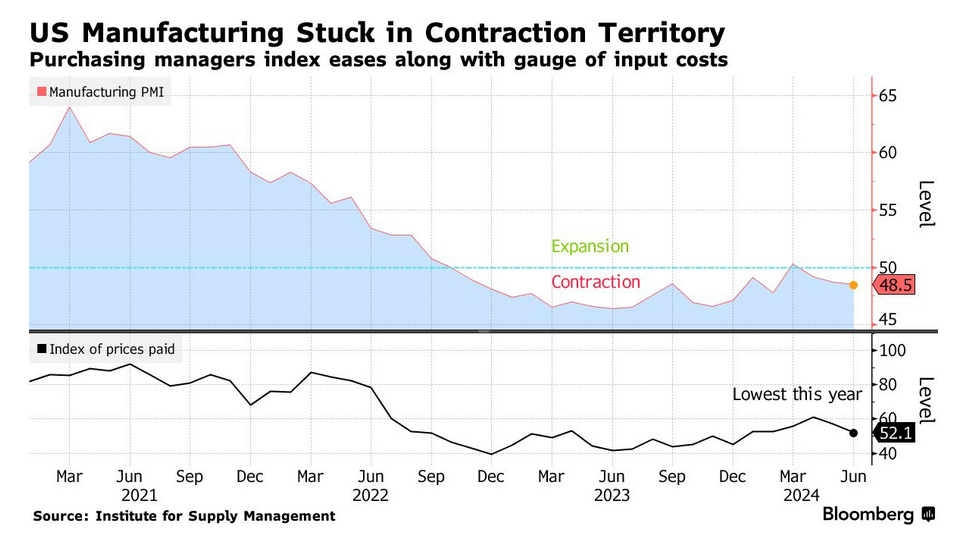

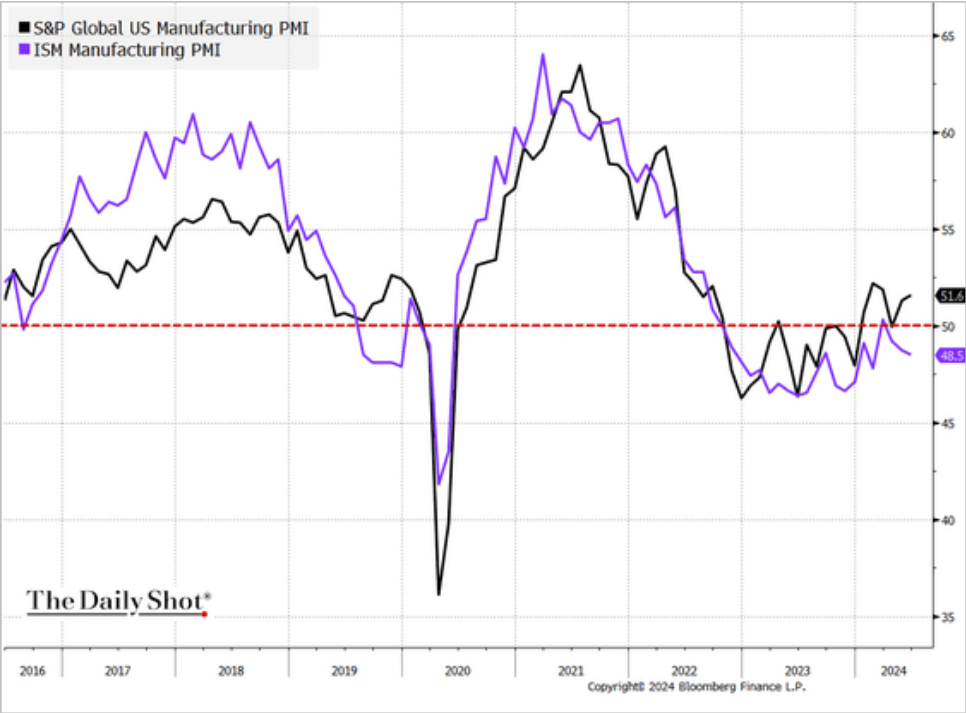

Manufacturing in the USA is not really setting up a good situation for their presidential elections.

These lines are not moving together. The ISM Manufacturing PMI and S&P's PMI (purchasing managers index) are trying to measure the same thing, but S&P does not include government spending.

The decline in ISM is likely due to the decline in inventory reductions (that is, selling what you have in stock and not replacing it).

This graph should make everyone freak out because their worst nightmares are coming true.

In Canada, the manufacturing PMI is also in the doldrums:

It was the 14th straight month the PMI was below the 50.0 no-change mark (at 48.2), the longest such stretch in data going back to October 2010. A reading below 50 marks contraction in the sector.

"The performance of the Canadian manufacturing economy remained subdued in June," Paul Smith, economics director at S&P Global Market Intelligence, said in a statement.

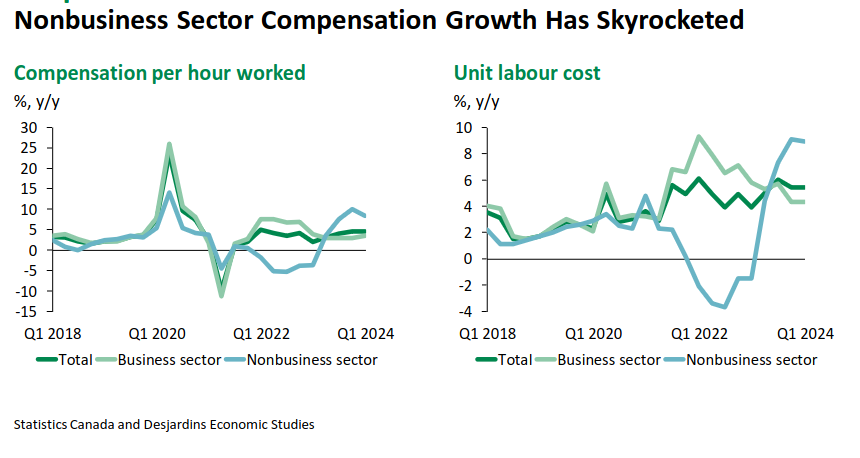

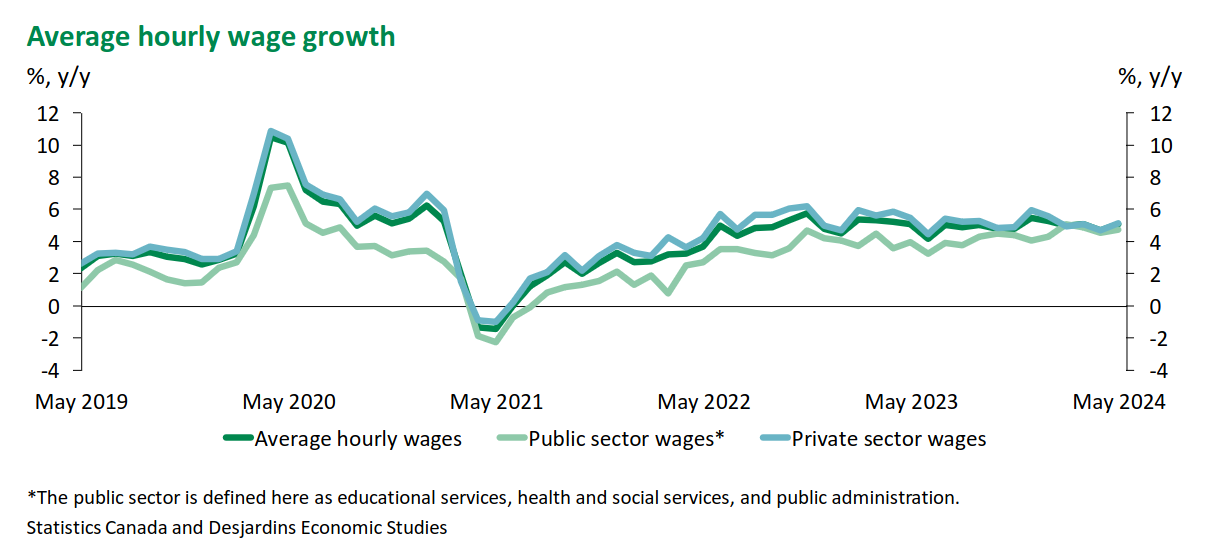

Wage growth in Canada is being sustained near 5%.

The business press is complaining that public-sector wages are too high, and hiring in the public sector has been much higher than "planned" by the federal government.

Be prepared to see the Conservatives parroting these comments. If I were a newly hired public-sector worker, I would be very concerned about a Conservative victory.