July 18, 2022

Half a trillion

Financial technology companies have lost half a trillion in "value" since the start of the year. (FT)

These include Paypal (of Musk and Thiel fame), Block (Square), Stripe, and Klarna.

On top of these losses all the financial services companies had their profits slashed near 50% (including Goldman Sachs) as shifts in Wall Street ownership slowed.

- Zombie companies (highly indebted and cannot pay their full debt installments) now account for 20% of listed companies in the USA and EU.

- These companies continued to exist because of the profit subsidies in the form of artificially low interest rates.

- Zombie companies—like most fintech and tech start-ups—were supposed to solve the productivity crisis with their innovation.

- However, they are the first to layoff people in the new "high rates" world.

The only way to deal with "productivity" in the economy is for the state to invest in real productive activities. There needs to be a pull of need to drive innovation, not a "push of ideas" from the private sector.

In the end, a fully funded academy that is independent of political and economic forces along with a strong investment program from the public sector will lead to the expansion of increased productivity.

This also happens to be the only way productivity results in more leisure time for workers instead of just profits for capital.

UK

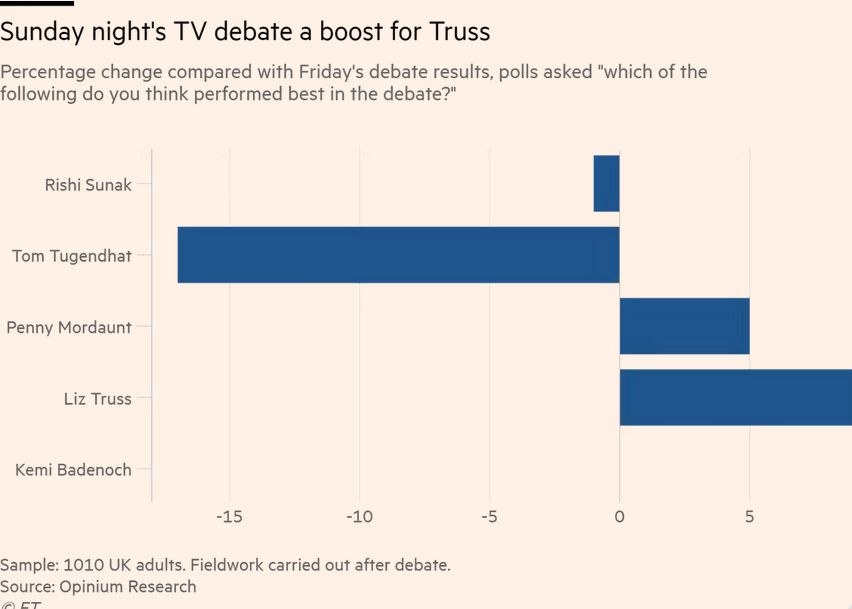

The UK Tory (and PM) leadership race is back to classic nasty Tory party:

Tories resist union demands | In last night’s televised debate, the five candidates for the Tory leadership vowed to impose real-terms pay cuts on millions of public sector workers. (FT)

- plans to deport asylum seekers to Rwanda

- focus on rhetoric of Brexit instead of dealing with it

- Ministers’ plan to deregulate the City of London

The next Tory leadership TV debate has been cancelled after Sunak and Truss pull out.

Truss and Sunak do not do well in debates when they are challenged by those who they consider have no chance in winning.

The reason given is that there were concerns that previous debates have damaged party’s standing. Because they start telling the truth about what they really believe in.

“Conservative MPs are said to be concerned about the damage the debates are doing to the image of the Conservative party, exposing disagreements and splits within the party. Both are very welcome to taking part in future Sky News televised debates.”

![]()

![]()

EU in rough shape

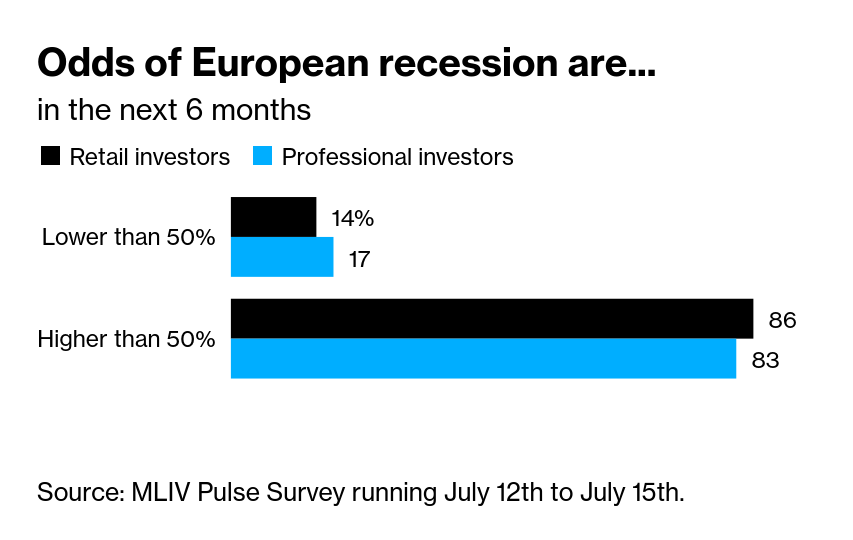

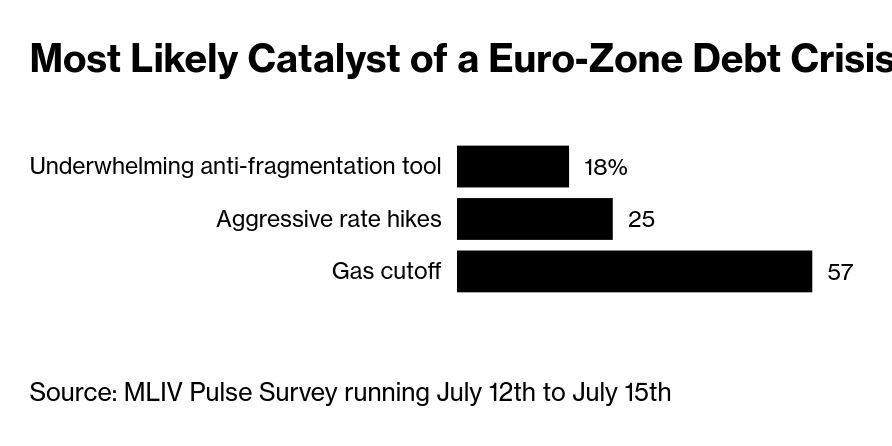

Some 41% of of MLIV readers in the latest poll of 792, who include portfolio managers and retail traders, see a euro-area debt crisis occurring within the next six months. (BN)

What is more interesting is that the European Central Bank thinks that is enough just to say they have a "crisis tool" to deal with high inflation to slow high inflation.

This is the strange world that neoclassical economists live in: pretending things are fine is 50% of their tool box.

"Trust us, we have a crisis tool that we will use if there is a crisis. So, please don't cause a crisis or we will be forced to use it!"

The threat of deploying a crisis tool is incorporated into risk models and that is supposed to somehow slow inflation by reducing the likelihood of a really bad recession.

- The "crisis tool" is the oh-so innovative program of lending different countries at different interest rates and through specific bond buying at the country level.

Sounds so innovative that it is what happened before there was a common market.

So, what are they going to do? Take the summer off after deciding to raise target interest rates between .25 and .5 of a point.

IMF is cutting it growth forecast again

Recessions are global because what is causing them is global.

- USA dollar appreciation is causing everywhere to deal with higher prices for goods and debt.

- Latin America is reliving debt cost increases.

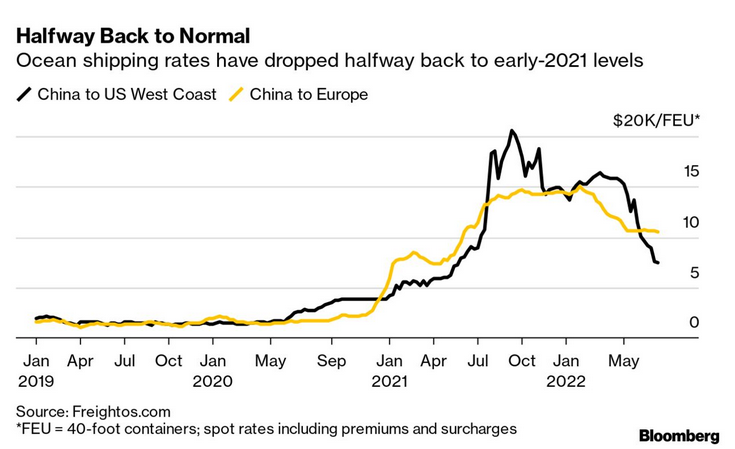

- Supply chain congestion is not growing, but it is not really getting much better either. And, there are more things that could cause supply chain snags coming.

An ever-stronger dollar imposes a whole set of problems on the global economies. For countries that import dollar-denominated energy and food, it makes those things more expensive, and is therefore inflationary. It dampens trade. It makes dollar-denominated debts harder for governments to bear. These burdens generally fall most heavily on emerging economies (FT)

The G20 finance ministers meeting in Indonesia (and other "very important people" at central banks) were meeting this weekend. They refused to release a communique to tell people how bad they thought it was going to get. Not a great sign.

IMF said it is on the verge of "substantially" reducing their estimates of global growth—down from their large cut in April (3.6%). Other international capitalist organizations already downgraded their expectations last month.

This is the way that downgrades work. One at a time in a stepwise fashion. Central bankers are always wrong—until the 1/10 move they make and accidentally are correct—because they do not really know what is going on.

Central bankers around the world are finding it tough to find the right response to price increases that are driven by supply issues. (BN)

The other things that governments around the world are pretending to coordinate on is crisis response programs for the "next" crisis. Of course, the G20 didn't agree to any language on that.

Obviously they have not agreed on language to deal with the previous or the current crises either.

All this plays into the problem of politics around inflation and the economy:

According to a Morning Consult survey, more than half of voters blame the policies of President Joe Biden, who has made tackling inflation his top economic priority.

Another Morning Consult poll shows that a larger percentage of voters think the president has a lot of control over managing inflation; more than the Federal Reserve (whose official mandate includes price stability), Congress or large companies. (FT)

The lie that the government is to blame for good times (when it is not doing anything) comes back to blame them for bad times (when the government chooses to continue to do nothing).

It is a strange situation and one the left needs to take advantage of. Intervening in the economy (in a positive way) for working people is what people expect the left to do. The policies are there, it is long beyond the time to voice them.

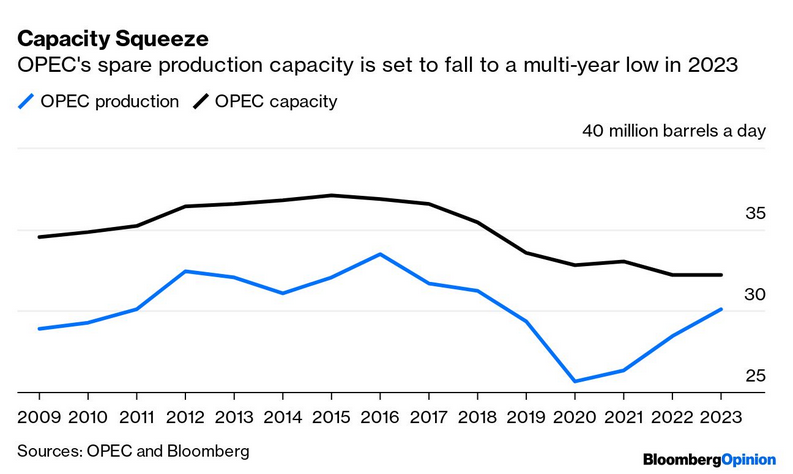

Shaikh inflation predictor

As capacity utilization rises, so does the pressure on prices.

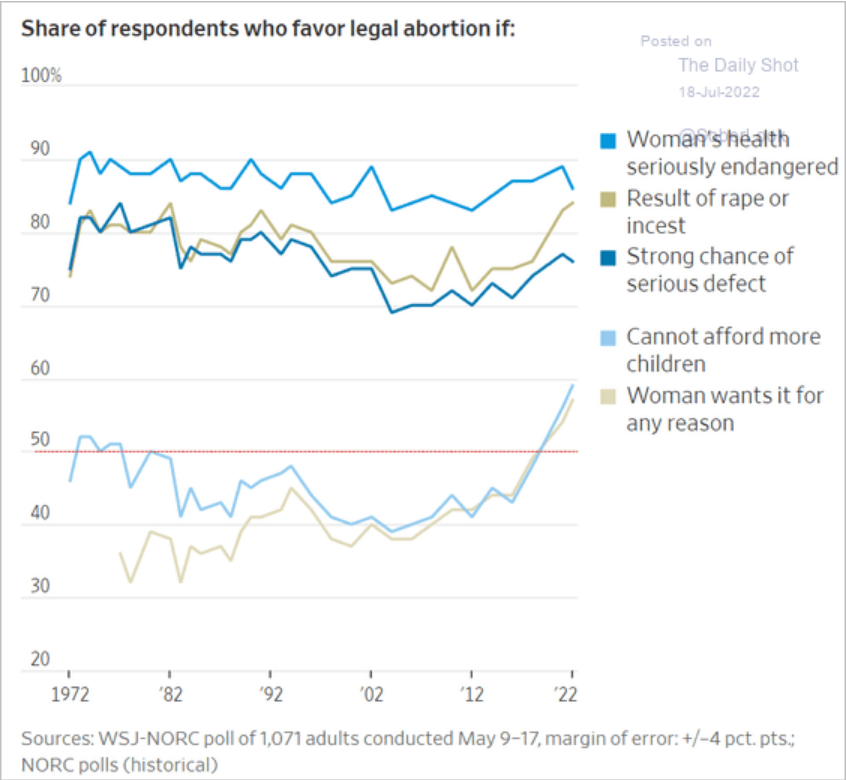

Support for legal abortion in the USA

Passwordless sign-on

Logging into your digital services like email, social media accounts, online backup services, corporate accounts, and cloud services is now possible without remembering or even using a password. This new technology is also more secure than your current password setup.

The passwordless technology uses a hardware security key. Hardware keys look like USB thumb drives. You insert them into the USB port of your computer to use.

Read more on the CPress Weekend Tech Project note:

- Passwordless logins using hardware keys (x.cpress.org)