July 17, 2023

Canadian manufacturing sales

Flat:

Rising stocks and housing prices boost consumer sentiment.png)

Mostly driven by Alberta and Ontario in chemical manufacturing.

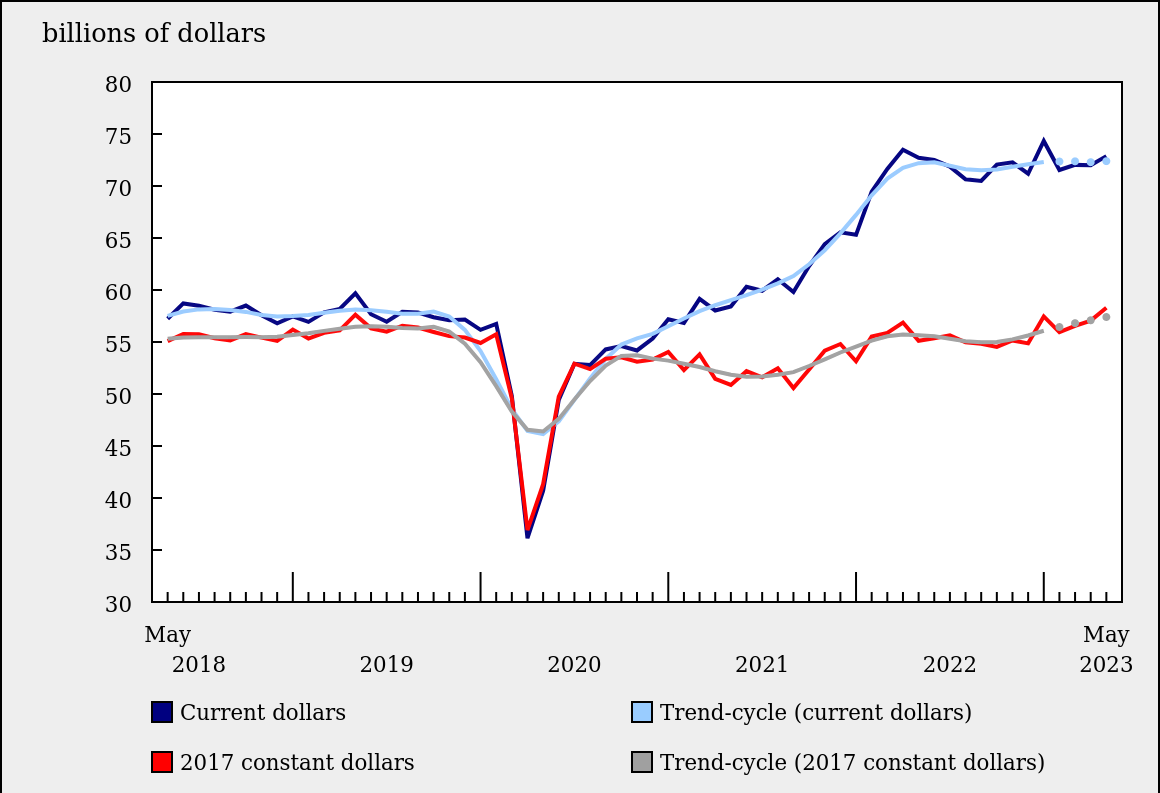

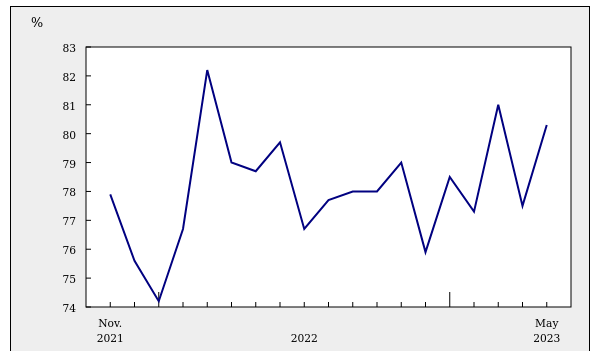

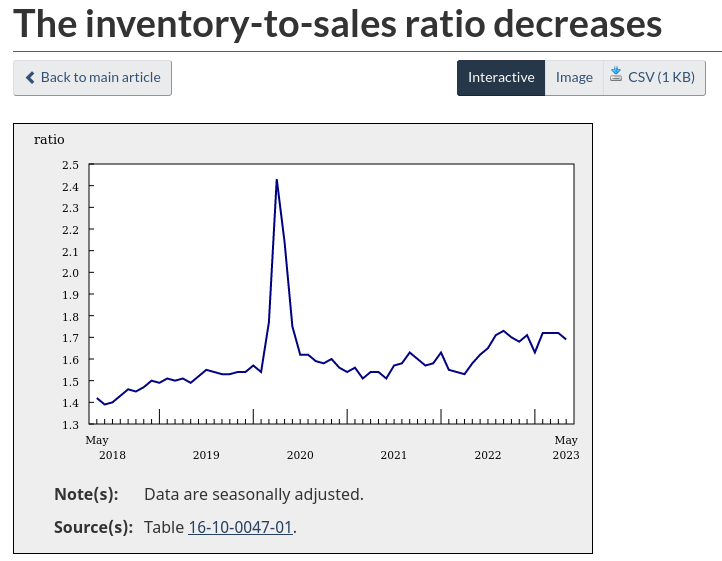

Capacity utilization rates were slightly higher in May, total inventories are down. But, because the inventory to sales ratio is still much higher than pre-inflation and unemployment continues to be tight, inflation is still likely an issue. Though, I have not done the math on it, the tension is still there for price increases to continue—according to classical theory.

This is even more the case as profits in the financial sector recover even as the central banks continue to put their thumb on the scales for everyone else.

The only thing that could moderate this is that inventory to sales ratio is still relatively high compared to pre-inflation. The type of inventory is rather important, but when you dig into the data, most new orders-related metrics are very flat. Importantly, Seasonally adjusted measures are mostly down.

The manufacturing sector is still not investing in new production and is over-extended on capacity utilization. Recession, inflation, not a super healthy economy in a normal times. But, in light of the amount of public subsidy going on, really not good at all.

Capacity Utilization.

Inventory to sales:

Canadian Mortgage rates

High.

Rising stocks and housing prices boost consumer sentiment.png)