July 16, 2024

Some economic indicators unrelated to USA politics

Canada's moving yearly Consumer Price Index edged down (0.2%) to a growth of 2.7% in June compared to May. The drag was mostly attributed to gasoline prices. Food and Services price inflation continues to be rather high and even higher than in May.

Durable goods prices are down, likely due to that softening economic output driven by Bank of Canada inflation targeting policy.

_CPI__CPI_excluding_gasoline_chartbuilder.png)

For Canada, there are two graphs that will please central bankers and should cause concern among labour leaders.

Wage growth expectations of business leaders is way down:

![]()

The Bank of Canada's Business Outlook Survey Index is sticking to the negative:

![]()

These are the economic circumstances that central banks were looking to create.

“More broadly, when you look at wage growth, I think a lot of the recent increase has come from unionized workers and from public sector workers. That could explain some of the discrepancies we’ve seen between these survey results and the actual wage statement that comes out every month.”

He noted that a significant development in data released over recent months has been the rise of the unemployment rate —David Doyle, managing director and head of economics at Macquarie Group

The reference to public sector workers is that wage growth there barely matters to the central bank; they are looking at market-mediated wages in the private sector. The rise in unemployment in the private sector shows that there is a loosening in the labour market, which will drag those private-sector wage gains back down.

In the USA, the Empire State Manufacturing Survey conducted by the Federal Reserve of New York shows that while manufacturing employers have not been cutting workers hours through the summer, they expect to start cutting back soon. This cutback in hours is usually seen as a reduction in the number of shifts at facilities.

A large gap has been forming between expected and actual conditions in these surveys recently. Broadly, the expected conditions are sustained much higher than the actual. There has always been an optimism in US business elites as they are telling the survey they plan on cutting output.

The positive expectations are driven by the belief that short recessions (like we seem to be in) end. They just do not know when.

.png)

Digital news report

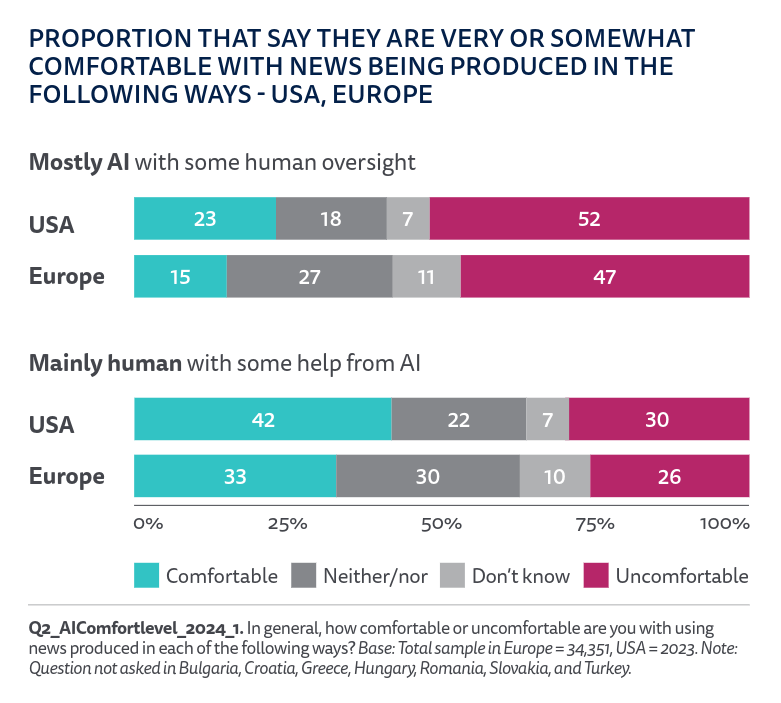

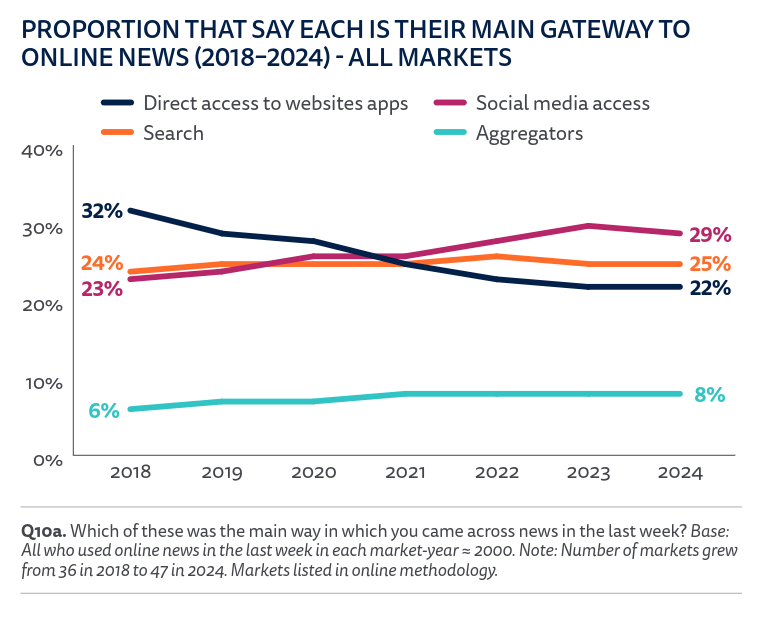

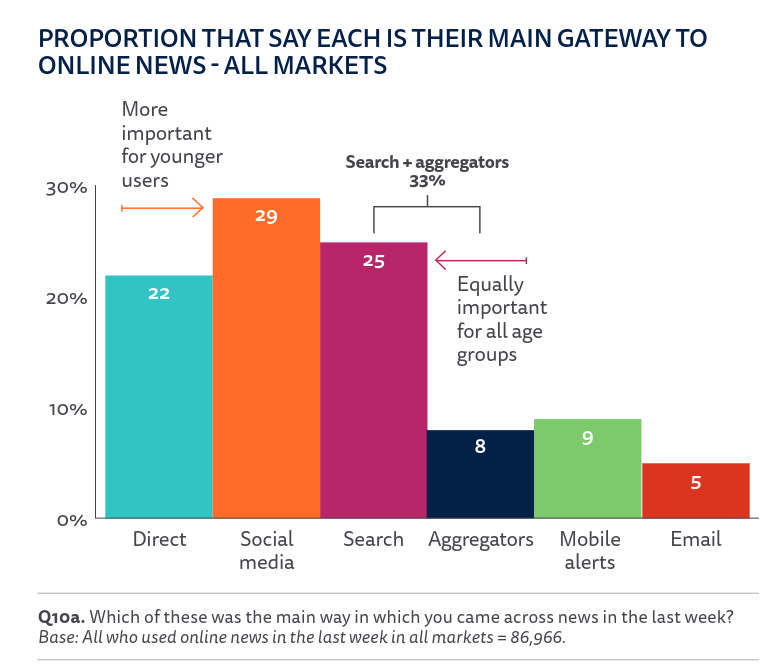

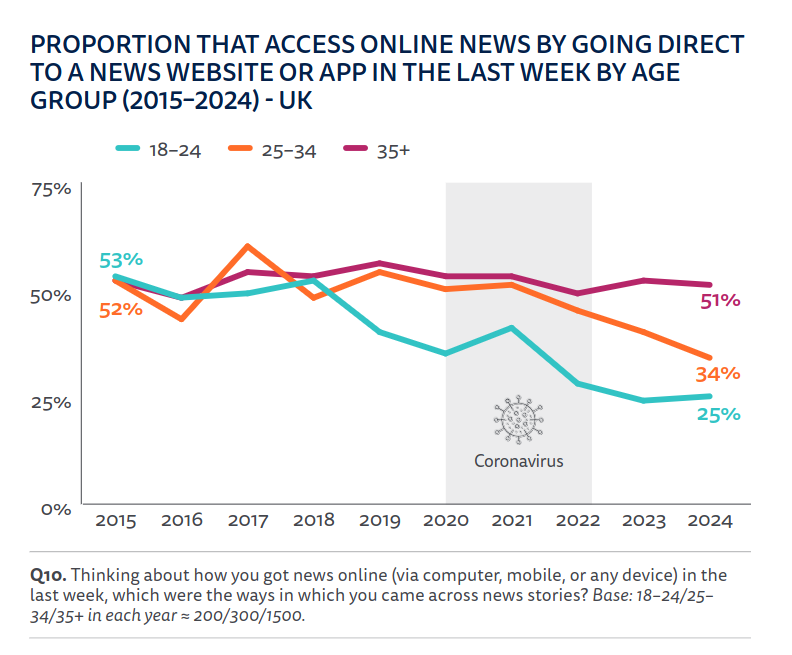

Reuters Institute at Oxford has released its digital news report outlining how people are consuming digital news.

Some shifts and some unsurprising data, but worth a look.

- Under 35s consume short video news clips more than other forms and more often than older folks. This means that if you are not producing short versions of your news and putting it out there, you are missing a large audience.

- Search and aggregators are still extremely important as a source for news across all age groups.

- Younger folks are more likely to use social media as their "news outlet", with mainstream news being replaced with "alternative" news sources for most Americans.

- There has been a consistent growth in the number of people who say they are seeing more false or misleading information on all platforms and across all issues.

- AI-generated news readers are a thing now. An AI-generated video of a news anchor reading a partially AI-generated news script on social media.

- Paid-for/subscription online news is in decline and is correlated with trust in news content. This makes me think that if paid-for news is not providing decent content, people see no value in it.

- Of those who pay for news, Canada and US subscribers tend to be paying for foreign news sources.

- Canadians continue to say that they feel worn out by the amount of news.

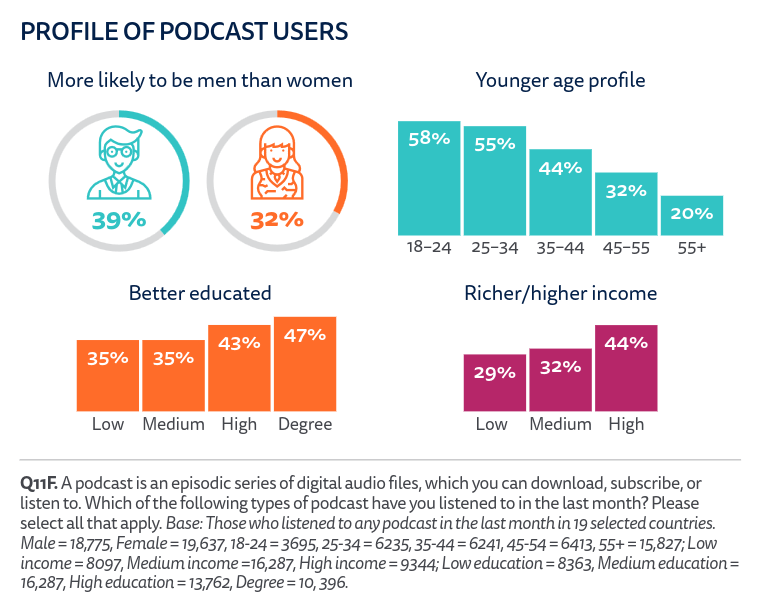

- Podcast users tend to lean towards the middle income and younger.