July 14, 2023

Investment and Industrial Strategy

Things to remember about industrial strategy:

- It doesn't work just because you think it should.

- It takes direct government investment, not fiddling with market incentives

- It is more complex than steel goes in, X finished product come out.

- Under capitalism, wages compete with profits, which means there is a dynamic to keeping production in a country.

- Automation is offshoring.

- Productivity should result in gains in the rest of the economy, which means investment in companies that produce automation products.

My point? We do not have an industrial policy just because we give money to a few companies in the same industry.

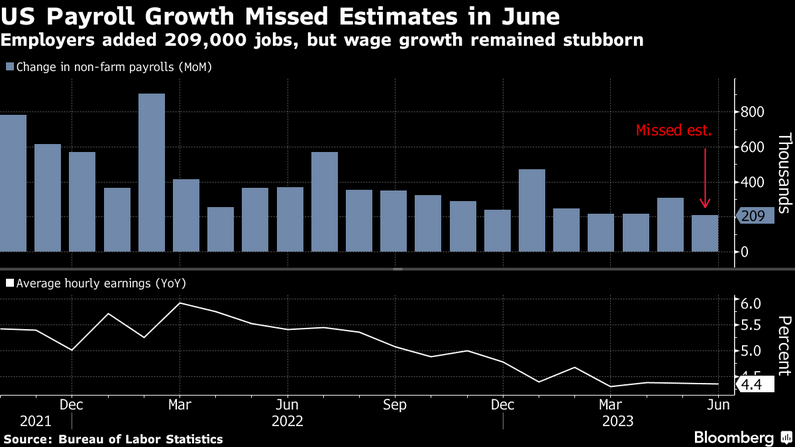

Still with the Phillips Curve?

Bets on inflation and responses to inflation still rest entirely on the unemployment numbers.

Now the big "debate" in economics is "can inflation even come down with such a tight labour market?" Millions will be spent on debating this question looking at correlations. All based on an idea that never was accepted as real.

Why this debate? Because some folks have pointed out that there is no correlation between household savings increase from pandemic relief and spending. That's right. Folks have figured out that just because you give poor people money, doesn't mean they go bananas and spend it on ridiculous trinkets.

The conclusion from this "new" analysis is that inflation was not caused directly by consumer spending and too much demand. A reasonable planet would then conclude it is probably where all this money actually landed that caused inflation (capital subsidies), but no. Neoclassical economists want to blame workers, so it must be the tight labour market and wage growth that causes inflation.

What to do when you have an entire field bending over backward to avoid the obvious?

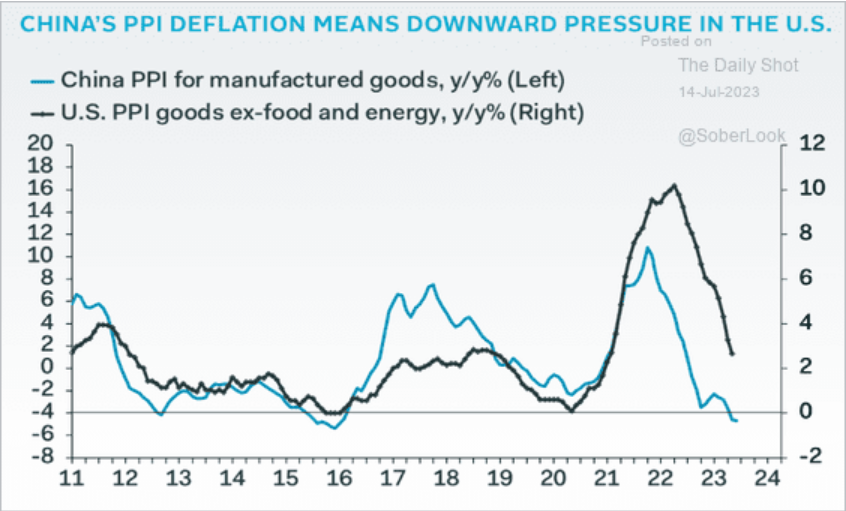

Deflation

The input prices for production are in deflation territory. Especially for some imports from China.

Bank of Canada called-out

Fiction is the word being punted about in the investment halls these days in response to the Bank of Canada's economic forecast.

Derek Holt, head of capital markets economics at Bank of Nova Scotia, described Governor Tiff Macklem’s tactics as “stealth forward guidance” after the central bank raised its benchmark rate to a 22-year high of 5% on Wednesday. To Holt, that forecast “deserves a place on the fiction shelves at your favorite bookstore or the virtual equivalent.” (BN)

The effect of this fiction is artificial support for property speculation and government bonds.

As we said a couple days ago, Oxford economics also pointed to the optimistic BoC numbers.

Some are suggesting that this is the bank's way of trying to limit the effect on the housing market of a reduction in interest rates.

They want housing mortgage rates to remain high to put a lid on future inflation.

Will it work? Unlikely since it isn't the hope that inflation is sticky that affects rates, but the actual supply and cost of houses. While banks might hedge, they still have to compete in a market where there is a tight housing supply. Banks can hardly avoid investing in mortgages.

ILWU Vancouver Port Strike over

- 13 day strike

- Strike estimated to cost about $380 million per day

- The employer says $8.6 billion total.

- 7000 workers