July 14, 2022

Energy

- Europe is now forecasting it's price index will go to 7.6% this year (up from 6.1%). Growth predictions now down to 2.6% this year and 1.4% next year. They are always optimistic.

- UK is putting odds on it going above 11%.

- USA June price index went to 9.1%.

What is to blame? Energy prices are the focus as economists blame Russia. The war is partly to blame, but there is more going on than that.

Energy prices

While some energy prices like oil (Brent is at $99.6 a barrel) and related fuels continue to be high, some other commodity prices have declined. The price decline is related to suspected demand for these inputs as we head into recession.

Prices and inflation, again, are different things. So, prices might stabilize, but does that mean inflation will not continue to be high?

Then there is this:

-

Shell has warned that Europe will have to ration energy access this winter because supply is so low and directly blamed Russia. But,

- The International Energy Agency (IEA) said that "Russian oil supply had proved resilient since the invasion of Ukraine"

-

The International Energy Agency has also says demand for oil/gas/fuel is lower as people start cutting back because of the high prices and slowing economy.

IEA said oil demand fell in April by 1.6mn barrels a day in the OECD — a decline that was roughly twice as large as the typical seasonal pattern

The IEA said there remained a risk that “the world economy falls off-track for recovery” unless governments took further steps to curtail energy demand.

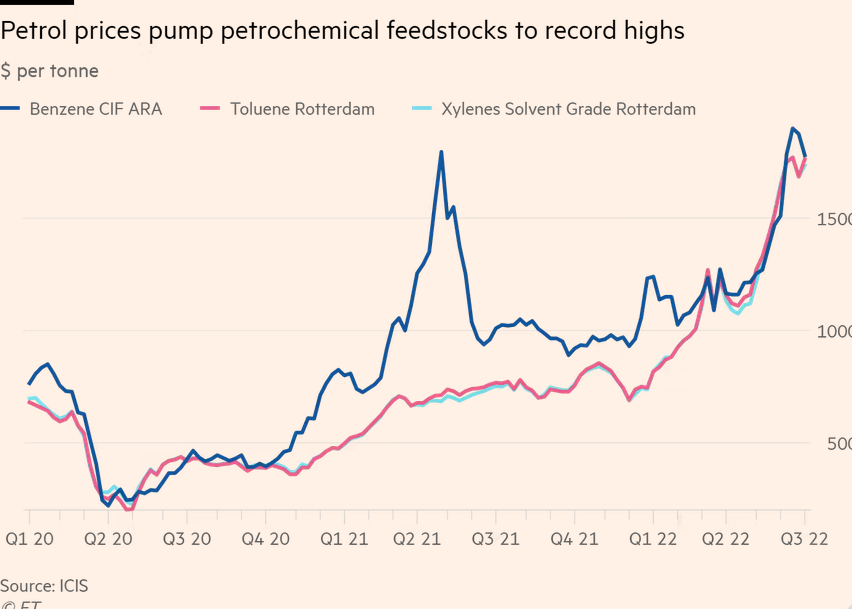

- Gasoline prices increases have caused a shortage of chemicals used to produce car parts and chemicals like Benzene used to make rubber, nylon and pharma products, placing further pressure on costs for manufacturing essential items.

-

Japan is going to restart 9 of their nuclear reactors as power shortage is predicted this winter.

Before the Fukushima Daiichi nuclear accident in 2011, Japan sourced about a third of its electricity from 54 nuclear reactors. Now, only four are operational and 10 have received restart approvals.

What's going to stop the energy price increase? Transition to electric? Nope. Copper prices will drive up battery costs along with other metals where investment in new mining and refining is not happening.

a battery-powered electric car requires at least two and a half times more copper than a conventional car; a medium-sized truck four times as much

Chile and Peru — account for 38 per cent of mined copper

Government debt costs

Driving recession is the goal, not the result, of central bank programs:

“Fighting inflation will require a decrease in vacancies and an increase in unemployment. There is no magic tool,” former IMF chief economist Olivier Blanchard, Alex Domash of the Harvard Kennedy School and ex-US Treasury Secretary Lawrence Summers wrote.

- There are increasing bets that the USA will follow Canada and build a 1% club for rising central bank interest rate targets.

- The Euro market value is on par with the USA dollar for the first time in 20 years.

- Investors move to invest in the USA dollar during crises as it is the main peg for all other currencies and backed by capitalist owned nuclear weapons.

- The global economy is teetering on the edge of recession—at least in the West.

This all has some impacts on the ability of governments to borrow and spend under neoliberalism. You can see this in the conversation in the UK's Conservative leadership race where the main focus is how big your tax cut promise is and how much they are going to cut spending.

US government debt came under renewed pressure on Thursday after inflation data for June came in higher than expected, sparking expectations of a full percentage-point rate rise by the Federal Reserve.

The yield on the two-year Treasury bond, which closely tracks interest rate expectations, rose 0.07 percentage points to 3.21 per cent. The benchmark 10-year yield also added 0.07 percentage points to 2.97 per cent. Bond yields rise when their prices fall.

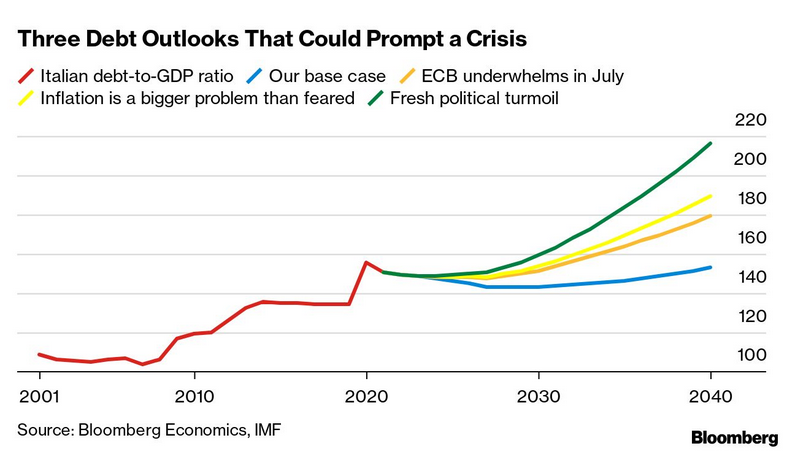

- Inflation of 90% in Argentina doesn't make it easy to borrow.

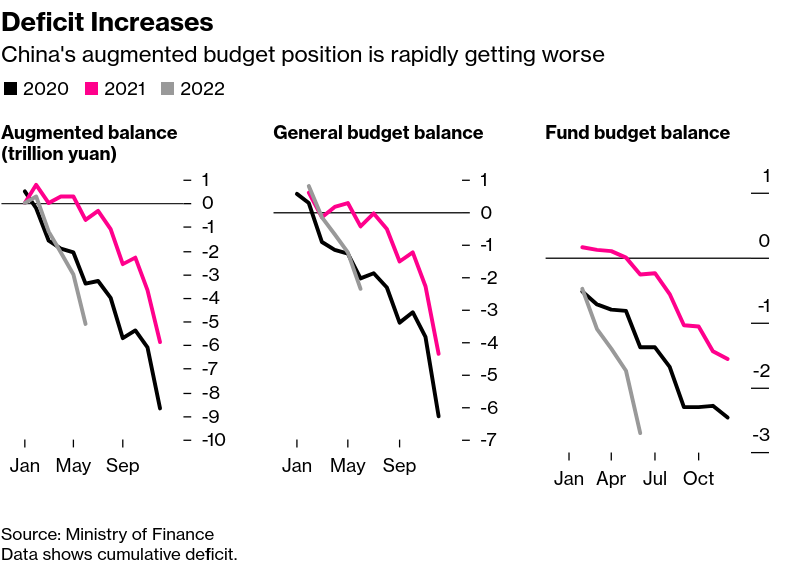

- China's deficit grew 600%

Inflation: why it matters what is causing it

https://twitter.com/shaikhecon/status/1539732115780259850?cxt=HHwWlMC-pfKMnd4qAAAA

Anwar Shaikh on Twitter “How does one distinguish between corporate profits benefitting from inflation and corporate profits contributing to inflation? This depends on your theory of inflation itself (see Shaikh, A. (2016). Capitalism: Competition, Conflict, Crises, OUP, Ch. 15)”

Why is Shaikh responding to Mazuccato this way? Because it really depends what your policy goal is around inflation. If you want to stop inflation, focusing on corporate profits will not do it. Mostly because the data clearly show that company profits do not cause inflation.

Sure, companies make money from higher prices, but doesn't mean that they are causing higher prices.

So, having Biden (and the labour movement) yell at companies for high prices is meaningless rhetoric, not sound economic policy that will actually help working families.

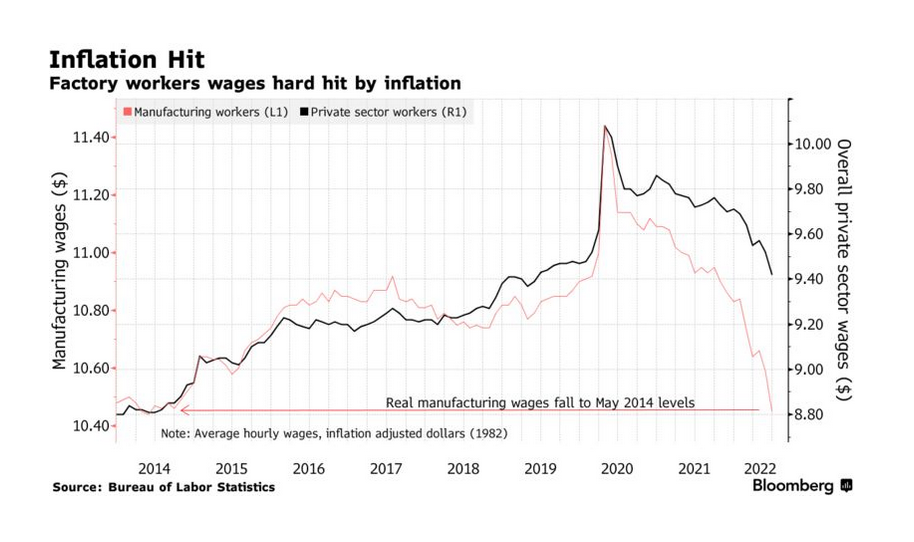

It really gets back to what we have been saying from the beginning. If you do not believe that wage gains are causing higher prices (because they are not) then you cannot turn around and say companies are causing higher prices because their profits are going up.

Why are centre-left economists going on about this then? To be honest, I do not think most centre-left economists understand what "underinvestment" really means. And, most centre-left economists think that it has something to do with wages and/or proifts. ("Centre-left" meaning "post-Keynesian" is what I am assuming here.)

For what it is worth, I think most "centre-left" economists do not actually care what is causing inflation. I think they have given up being very critical of capitalism and just want to focus on supporting wages and employment irrespective of the impact on the rest of the economy.

So, I guess what they really believe is kind of a side issue.

However, being technical about it, a post-Keynesian believes the same nonsense that a neoclassical economist believes. That prices are in some way an expression of value (or, deformed value) and that wages do not compete with profit. Post-Keynesians focus on wages in this fight for air-time and neoclassicals focus on maximizing profit.

I think that it is rather clear from the data that both of these are wrong. In fact, we have known this interpretation of the economy and prices was wrong 150 years ago. But, it persists because it is a useful fudge for people who have no interest in overthrowing capitalism.

Take, for instance, this graph:

Why do you think Bloomberg News interested in real wage growth? Because the flip side to this is profits. Bloomberg News (and those who read it) understand that profits and wages compete. They understand this implicitly.

So, why do we then have all the central bankers and post-Keynesians say that profits and wages are unrelated and that inflation is caused by one or the other growing too fast?

Because neoclassical "theory" and post-Keynesian "theory" are not about economics. They are two sides of the liberal socio-economic political divide. One that is not opposed to capitalism and just interested in the the level of income inequality.

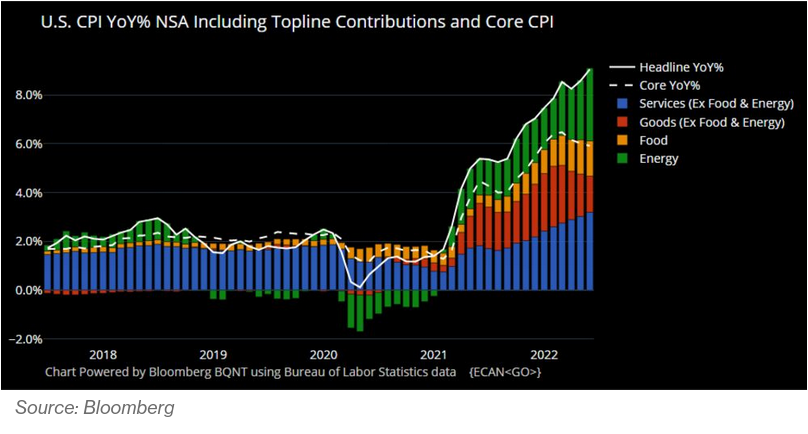

Last example. Take a look at what is driving general price growth in the US:

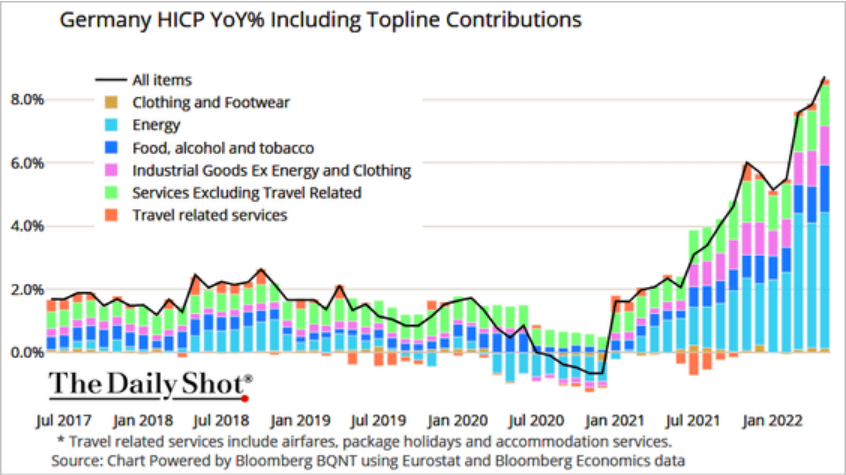

Germany's inflation pieces:

- Food price increases were known to be coming last year. They are completely in-line with what we knew they would be because of climate change and input costs like fertilizer and oil.

- Energy is a supply issue that we were all screaming about when they were taking fossil fuel production off-line without investing in alternatives.

- Goods—meaning most things coming from China—increases is also a supply issue as well as a shift in export programs in China.

None of this is particularly surprising looking at this data with the exception of covid-19 and China's production shutdown. But, even that can be explained as shipping under advanced capitalism is "Just In Time"—leaving no margin for error or adjustments like China covid shutdowns.

No one should really be surprised this is where we are and the solutions are rather clear looking at this.

So, how do we fix it? Well, focusing on profits (or wages) is obviously not going to do it. And, investment being low (investment in new production capacity takes a lot of time and is not happening) is an issue, but also doesn't explain how we fix it. Companies cannot be compelled to invest in unprofitable growth.

So, this is where we are.

Until we start articulating the solution (public investment in publicly owned productive capacity), pointing to things we do not like that are rather unrelated to the problems are facing is not helpful.