July 13, 2023

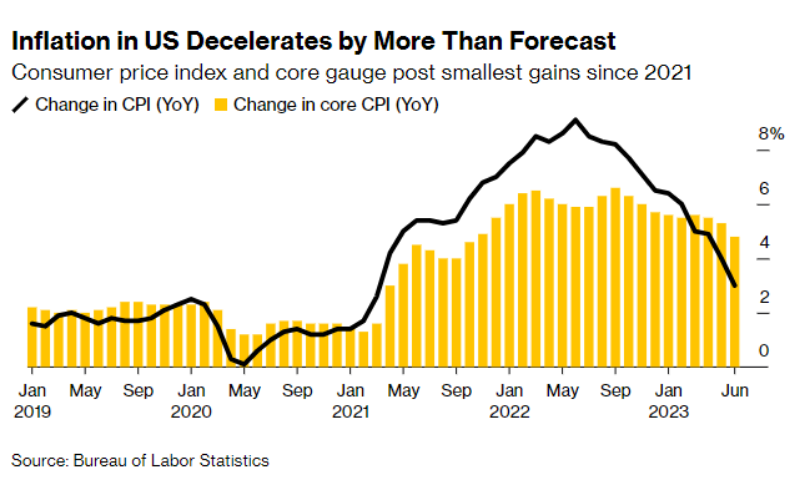

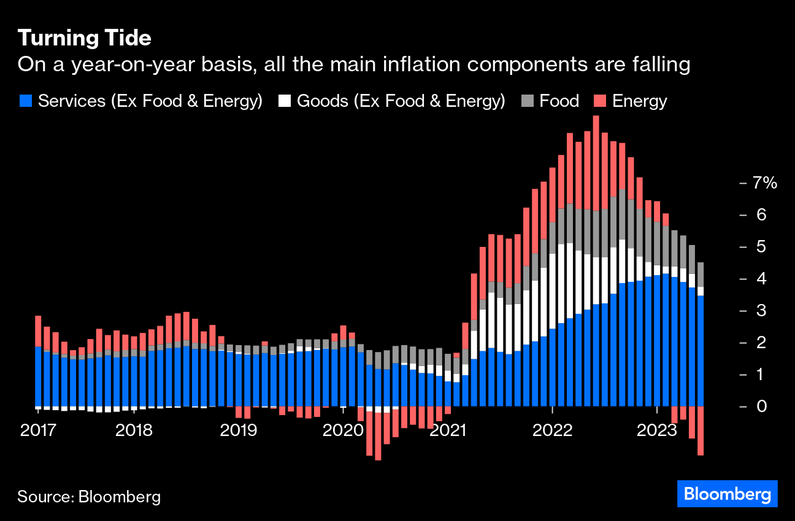

USA inflation continues to slowly fall

After the increase in interest rates this month to 5% in Canada and all but guaranteed interest rate increase later this month in the USA, the cental banks are claiming victory over inflation.

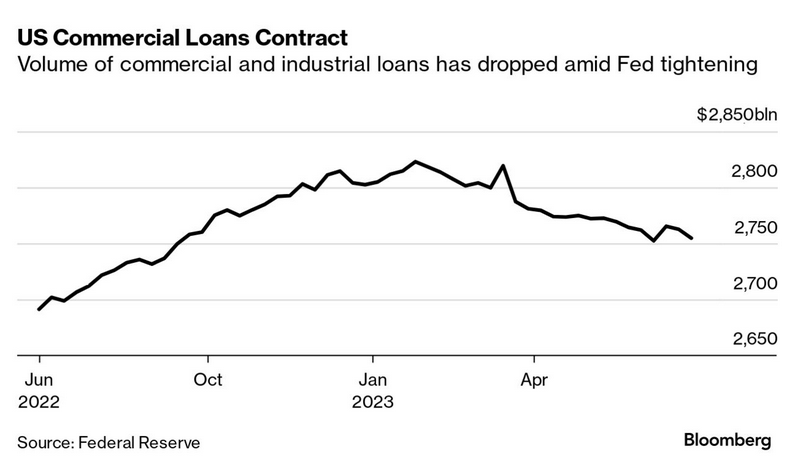

The reduction in economic growth caused by higher rates is clear:

Citigroup team, led by Nathan Sheets, wrote in a recent note that “the tightening in credit conditions recorded to date could lower real GDP by 1 to 2 percent (or even more) by the end of 2024.” (BN)

Tight credit conditions for business means less borrowing, which means less investment, which means less work. For the central bank, less work means less consumption, less price pressures, and therefore less inflation. Because prices = inflation.

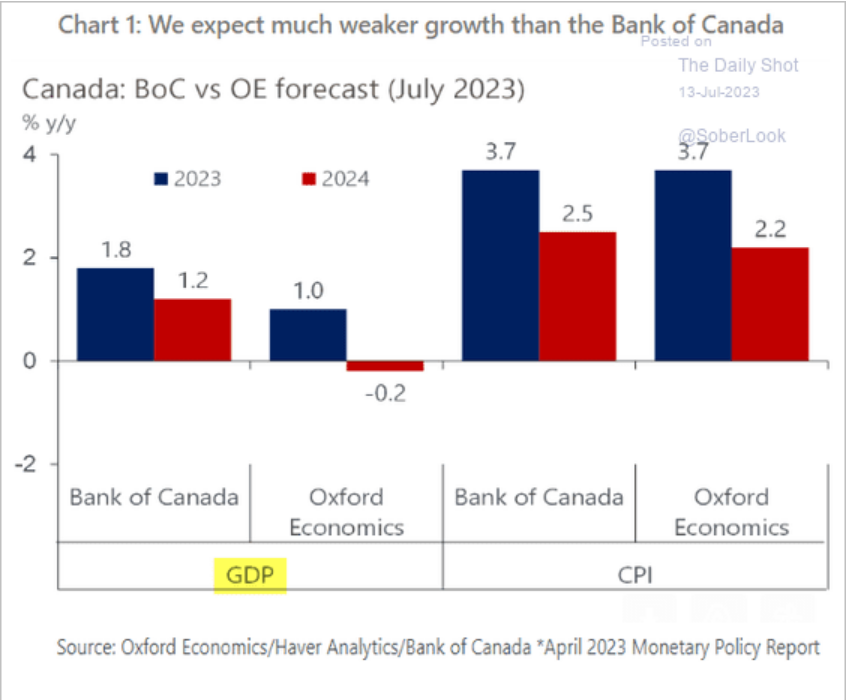

Of course, the central banks always have too rosy a picture of the economy. Even Oxford Economics is suggesting the central bank's models are optimistic:

However, I think we are getting closer to that point in time where the central bank might be correct in that inflation will slow over the summer, not because of anything they did but because inflation was going to slow one way or another by now. Prices have risen to sop up all the excess money floating around and the excess costs of doing things.

But, those prices are not going to come down.

So, have the central banks succeeded? Their current theory of inflation is that it is driven by "too much" demand linked with some parts of "not enough supply". The theoretical continuation of their theory is that prices should come down when this supply and demand disequilibrium is corrected. That is, we should have disinflation and even some reduction of prices back to a normal price level.

Most of last month's USA (dis)inflation data is driven by cost of services and rent in the USA. Service inflation was never going to be sustained long as it was just "baked-in" inflation of the products needed to provide services (i.e., the tools workers used and the prices of service inputs). Wages barely budged, so they cannot blame that. It is really that airlines and hotels did not have a massive increase in prices this month. That may reverse mid-summer as those discounts end.

Some estimates show that rent/lease price increases have stalled entirely and that their effect on the general price level is bringing those averages down fast.

So, is "inflation" actually coming down because of the central bank's rate increases? Somewhat, but their actions are not having an effect on the main price increases based on costs of production especially for food.

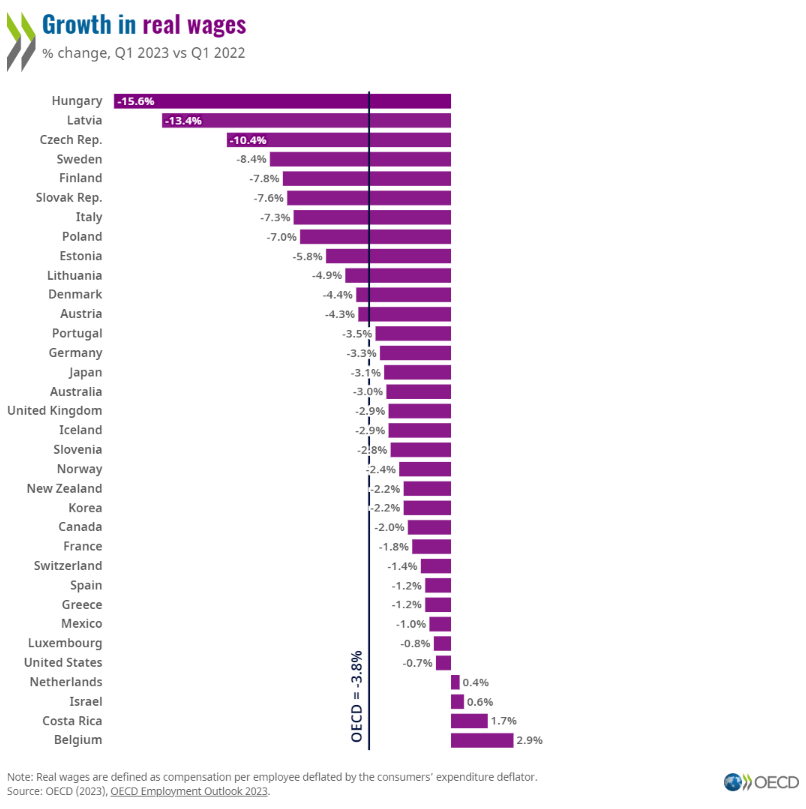

The negative impact on the working class as a whole is going to be much larger than these numbers indicate. Wages have not kept pace with the cost increases experienced by a working class family and many are about to experience even more downward pressure on wages as the economy slows even more.

Profits?

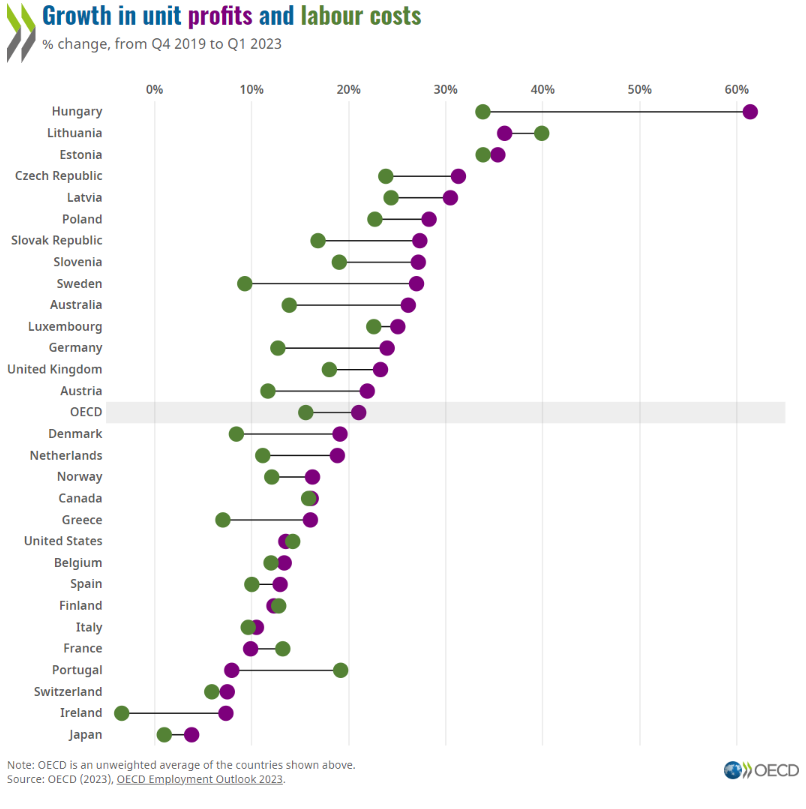

It is not clear that excess profits ("greedflation") is driving anything in Canada and the USA where most of the discussion is happening.

The OECD graph shows high profit growth in many countries compared to wage growth, but not in the USA and Canada from 2019 to 2023. This is largely because of the collapse in profits during the pandemic and the current slowdown.

France and Portugal drove the wage growth over profits index.

The profit rate being lower in Canada shows there is not much room for investment while rates go up. And, let's not forget, the entire policy program for responding to climate change is about relying on private capital investments.

It shows that there is one policy that is going to continue: direct government profit subsidies to specific capital while working people are left to deal with high prices and fewer jobs across the economy. Not really a pro-worker agenda.

Water resources

A link to the asset class creation paper:

https://www.mdpi.com/2225-1154/10/12/191

Here is an explanation of proposed aspects of the asset class they have created.

- Building capacities of project owners in structuring bankable and affordable projects to encourage investors’ economic interest in water and sanitation projects and take it to the market;

- Provision of innovative financing solutions including the use of credit enhancement and blended finance mechanisms that lowers the cost of borrowing and improve investment grade levels;

- GCF’s role in financing the transition can make it happen through supporting countries to develop and adopt policies and legislation to create an enabling investment environment; financing the transition and de-risk private investment in addressing financial market barriers and ensuring affordability and bankability and supporting new financial models accompanied by acceptable revenue in line with Paris agreement targets and SDGs.

Leveraging the Paris Agreement's targets and the UN's sustainable development goals as a way to push privatization of water and waste water resource infrastructure investment.

All nicely wrapped-up in an ESG framework.

Perfect for pension fund investments.

The facility will consist of subordinated and senior loans, grants, equity and guarantees, the GCF said. In all, $1.4 billion will be available for financing projects, $62 million will be used to support the program and $10 million will be spent on awareness and communication.

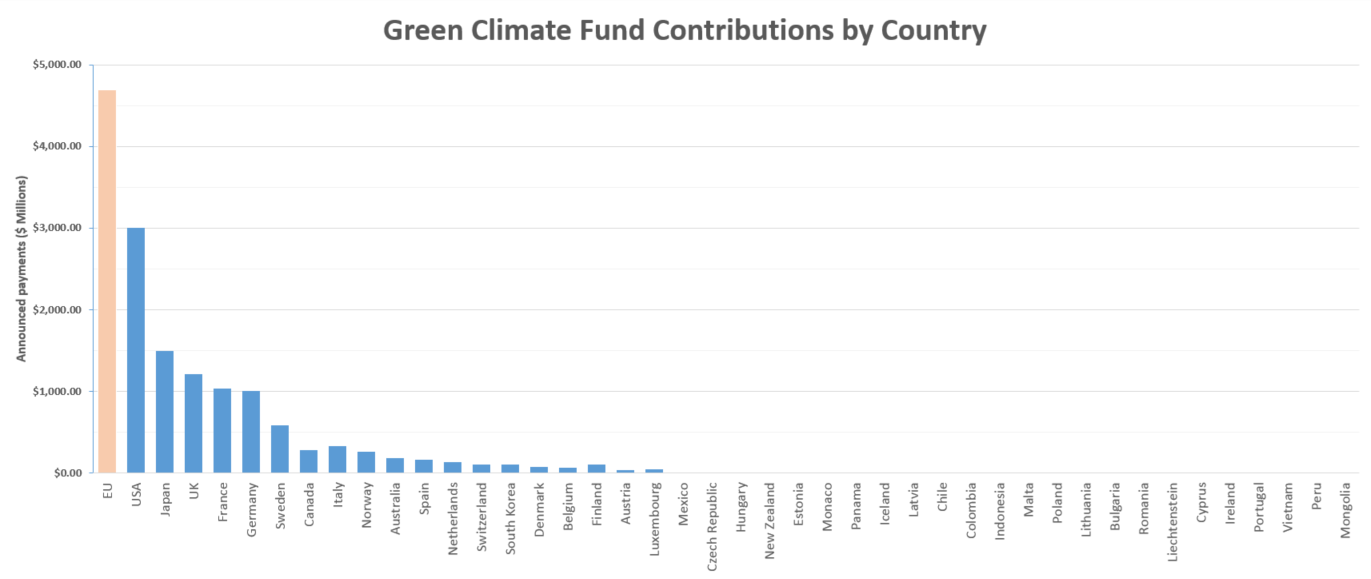

The Green Climate Fund (GCF) is a fund established within the framework of the United Nations Framework Convention on Climate Change as an operating entity of the Financial Mechanism to assist developing countries in adaptation and mitigation practices to counter climate change.

Country funders.

g

g

This is the "redistribution" of capital to poorer countries dealing with climate change. Rich countries give money to a fund, private capital from those rich countries offer up matching investments, poor country privatizes their climate-threatened infrastructure, rich country capital gets richer.

Sounds very familiar somehow to the previous model of "development".