July 12, 2022

Climate Change and profits

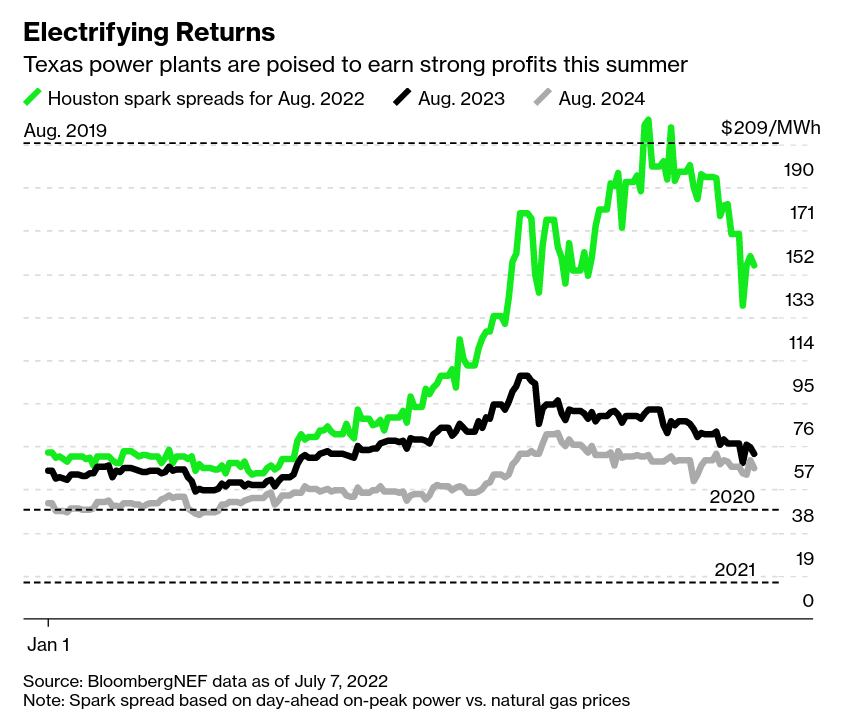

Private sector energy companies are both threatening blackouts, warning that there are massive increases in prices coming, and announcing huge profits. How is this happening?

Similar to the points made below about inflation, it is all about capacity utilization and lack of investment.

We are producing a lot of energy using most of the capacity that we have, but it isn't enough to satisfy demand.

There is also no investment in new capacity because the "market will solve everything" solution to green energy investment has failed to result in any real investment.

The only way to solve the climate crisis is to help the whole world invest in public green energy.

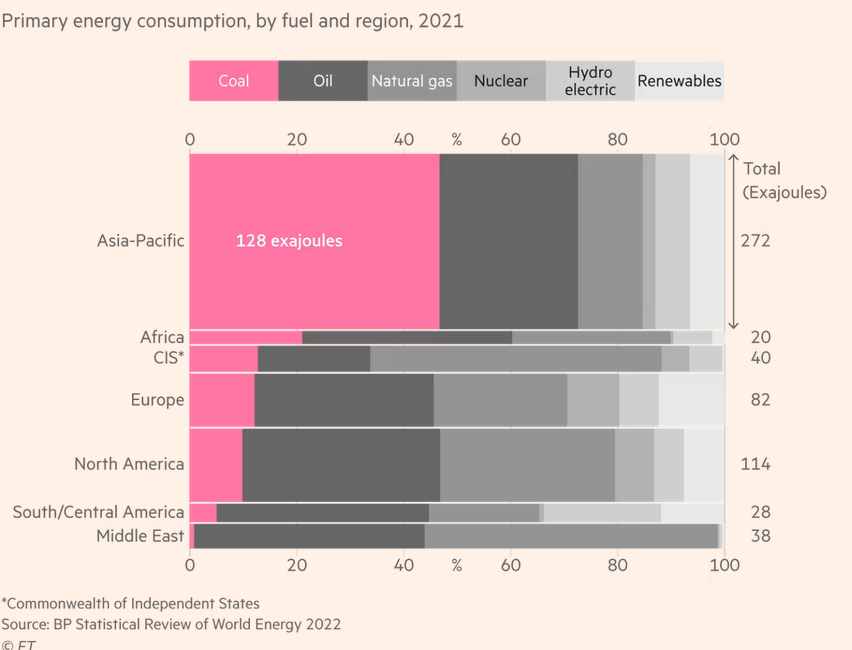

Here is the energy use by source breakdown:

You will notice that green solutions are not really making-up a significant chunk of that. The West is doing poorly, but the increase in coal and oil in Asia and Africa point to a problem: alternatives are clearly not available.

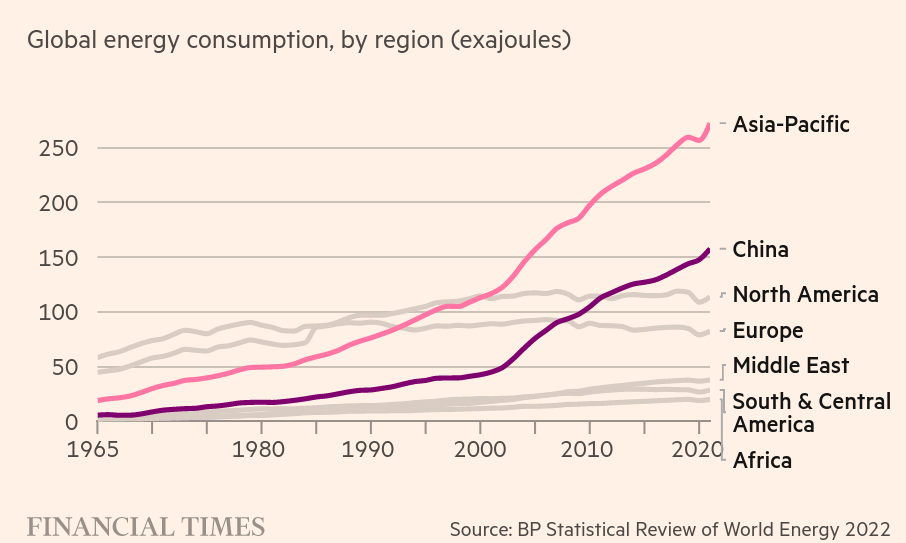

Here is the growth in energy use. The lines go up because these countries (China mostly) are bringing people out of poverty. But, they are doing it the same way that the West did: using cheap fuels.

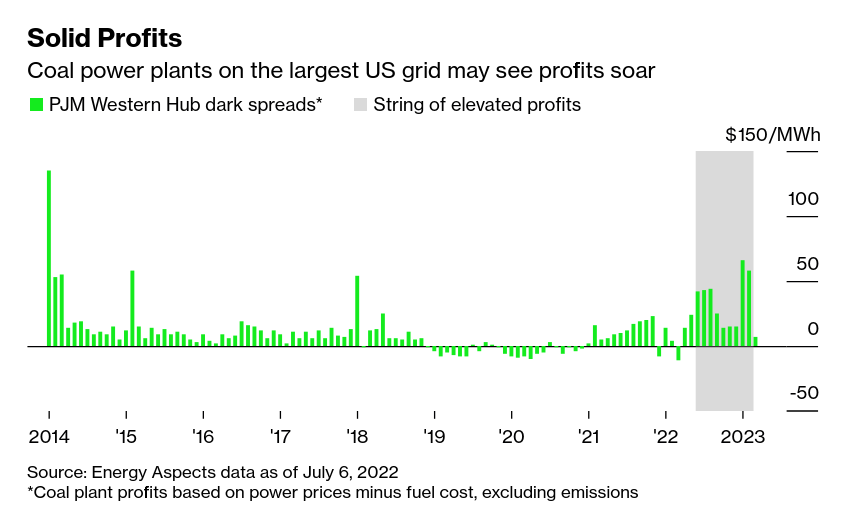

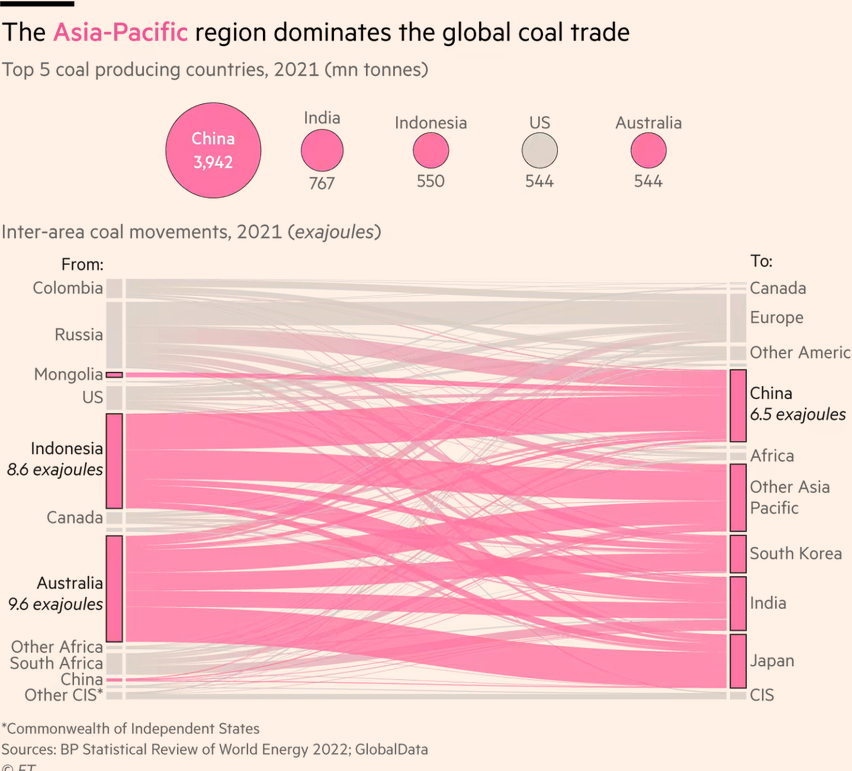

The trade in coal is still going and you can see why these (mostly private) companies are unwilling to allow their governments to shift regulation or share green energy technology.

Risk of bad things happening

The United Nations Office for Disaster Risk Reduction (UNDRR) Global Assessment Report (GAR) explores how, around the world, structures are evolving to better address systemic risk.

If you thought that it was not that bad, the hashtag for their 2022 report from an agency which is built on "don't panic" is #StopTheSpiral.

- Our World at Risk: transforming governance for a resilient future.

The report is a blueprint on how governance structure (read: "liberal capitalism") might not be able to make the transition in time.

Without increased action to build resilience to systemic risk, the SDGs cannot be achieved.

Investment in understanding risk is the foundation for sustainable development. However, this needs to link to a reworking of financial and governance systems to account for the real costs of current inaction to address risks like climate change. Without this, financial balance sheets and governance decision-making will remain fragmented and be rendered increasingly inaccurate and ineffective.

Systemic risk (the Nobel in Physics was awarded to an Italian this year on this subject) is a complex issue. The Somalian food system is shown in the report as an example of how complex risk structures are:

Governments around the world are less and less able to deal with this complexity as they have reduced employment and investment in capacity (thoughtful people with resources and ability to affect policy) in favour of giving profit subsidies to capital.

Disasters have far reaching effects in numerous areas outside of just direct disaster impact

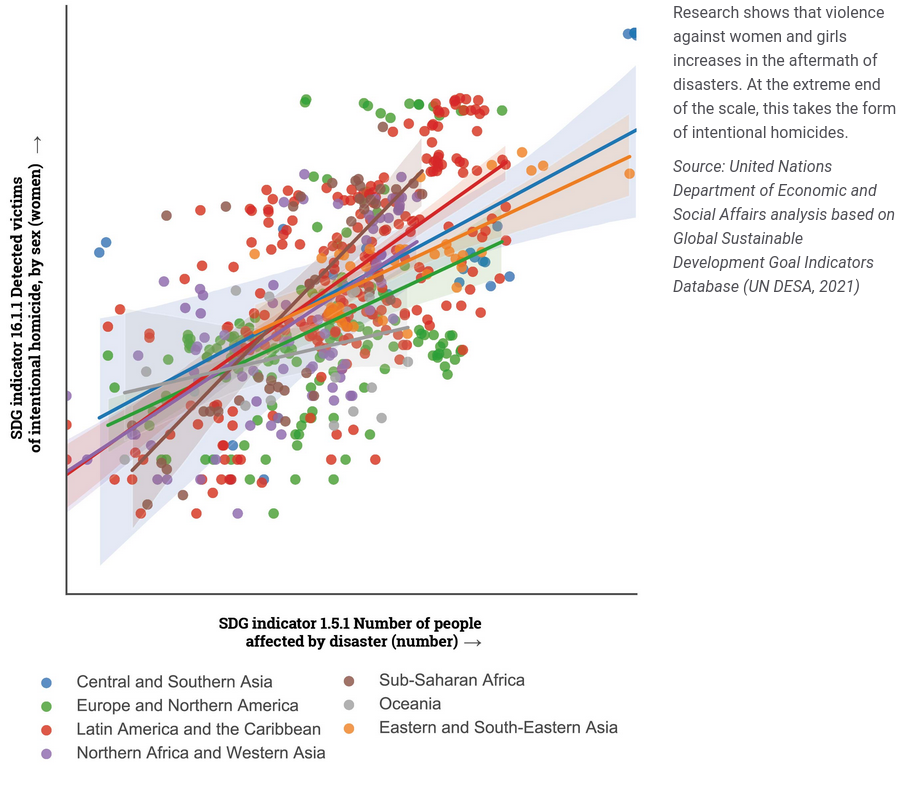

Violence against women and girls is directly related to the number of people who are affected by disasters.

This year's GAR reads like a fairy-tail list of things we need to do.

Unfortunately, the policies are still based around the "market" mentality. Things like "measuring what we value"—as if pricing the cost of bad things in a market has helped prevent anything bad happening up to this point.

They lean all in on the financial system providing indicators for investors to make the proper choices (read: Stiglitz's thesis on unequal access to information and markets). It is fine to say that we do not have the exact information that we need to invest properly to make money (and avoid loss). But, that doesn't mean that if we had the information the investments would be made either.

- Such analysis ignores the political economy of the current power and social systems.

- Such analysis ignores the reasons why the current system operates like it does.

Finally, the UNDRR's GAR outlines the one goal that is not possible without significant investment in public research capacity and the involvement of democratic frameworks. They also conveniently forget that democratic frameworks needed work against the market approach they outline is also necessary.

Reconfigure governance and financial systems to work across silos and design in consultation with affected people

- Step up participation, transparency and citizen dialogue in risk decision-making to accelerate learning and necessary adjustments

The report is important reading for socialist. We must understand the risk that the world's people face, what is causing it, and what needs to be done. However, we must also start putting forward alternatives policies to these failed free market proposals coming from the UN.

Recession, inflation, and low unemployment

Yes, you can have all three. No, it isn't "stagflation".

Under a classical view of inflation where:

- capacity utilization is maxing out (that is, every machine you currently own is producing)

- but, there is also no investment in new production capacity because capital sees no profit in doing so (even when there is currently supply shortages)

- and, workers' pay (and job creation) is not increasing fast enough to pull new participants into the labour market

You can have all three going on.

And, that's what we have now.

Neoclassical economists are very confused by this because their view of the world is too simple and rather wrong.

They think the numbers are wrong:

One ugly possibility is that the strong jobs creation data are just wrong, and will be revised down. This would be bad, because the incorrect unrevised numbers could trick the Fed into tightening policy even as the economy is cooling rapidly.

or, they think that productivity is some how involved in weird ways:

It could be that the new jobs that are being created now are low-productivity service jobs that add little to output. If this is so, the hiring should tail off soon (after all, unemployment is a lagging indicator).

We could be experiencing a productivity shock, for example because working from home turns out to mean pretending to work from home. This seems unlikely, but can’t be ruled out.

None of these are what we see happening. If anything, productivity is through the roof for some jobs. Other jobs—jobs that actually product products we need—are still producing. It is not lack of productivity growth, it is growth in production capacity that we are missing.

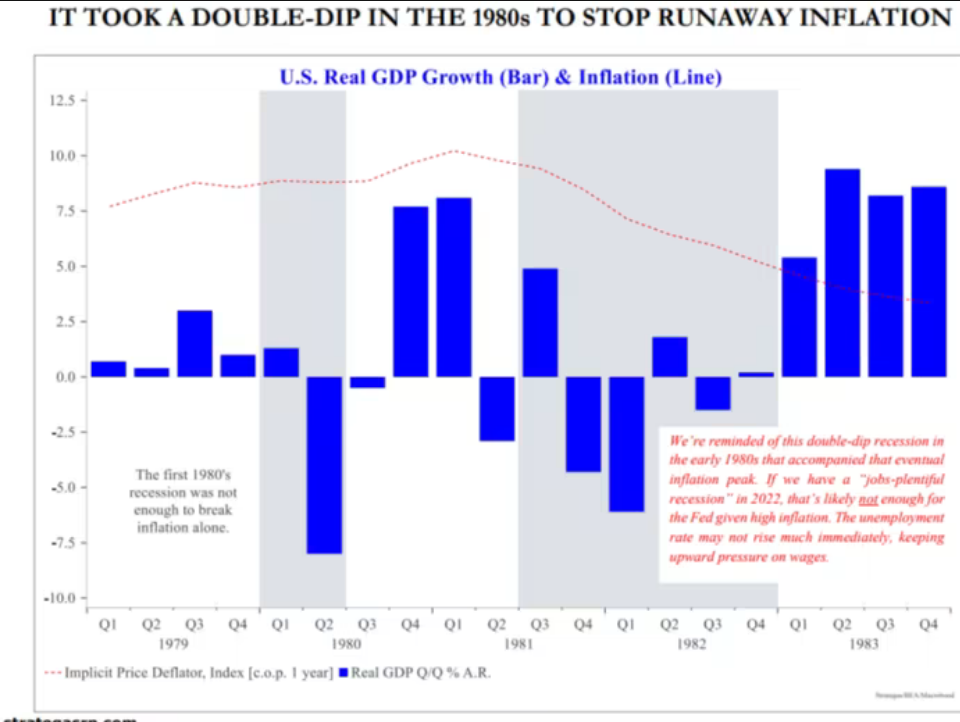

We are also being pushed into a recession by the central banks (on purpose) and we have no public production to fight against the private sector slowdown.

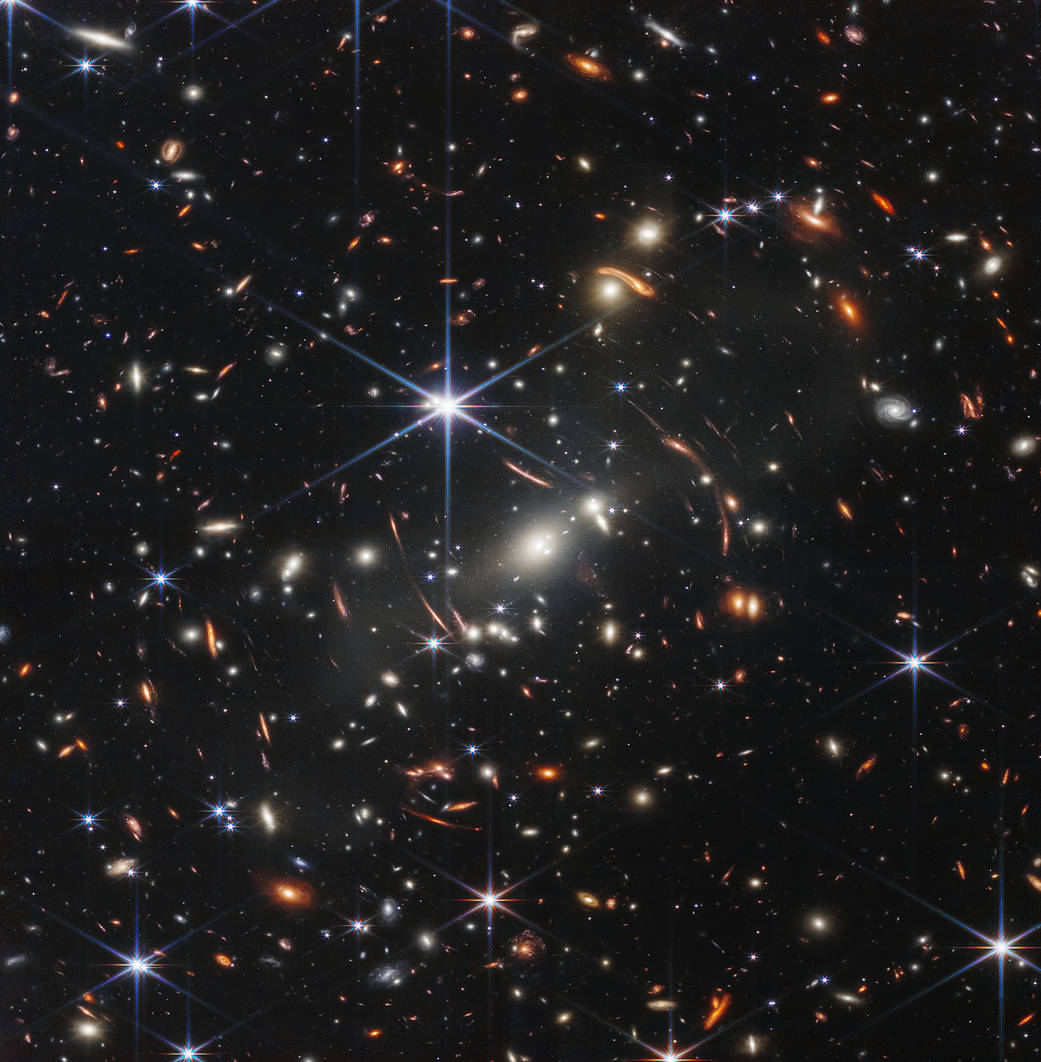

The Universe as we have never seen it

One of the first images from the new deep space telescope. Sit in awe.