July 11, 2022

Canada's economy

Some graphs outlining Canada's current labour market and economy.

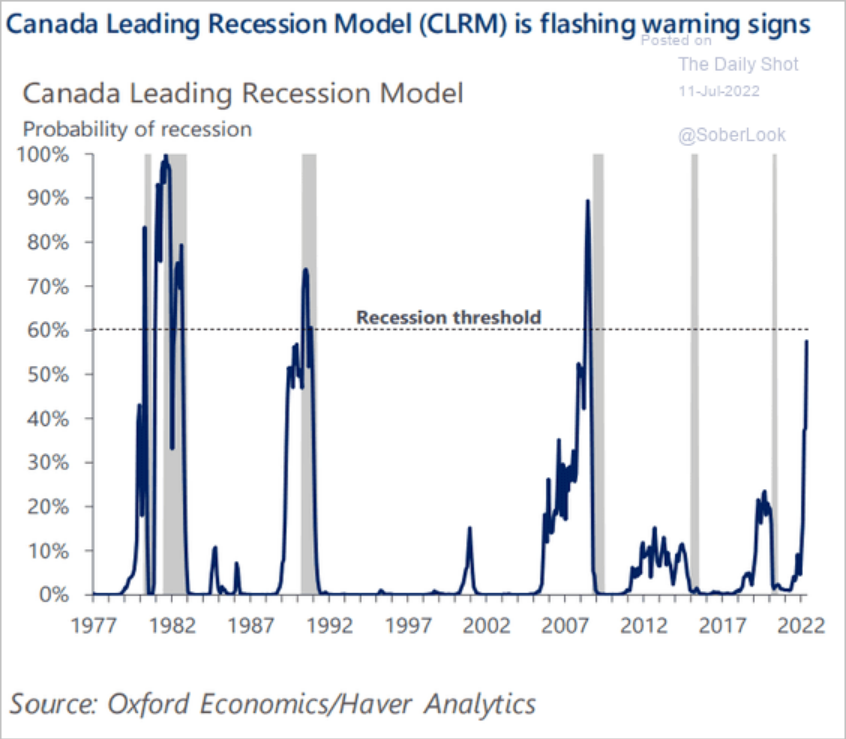

Oxford economics looks at previous recession indicators and finds one that matches:

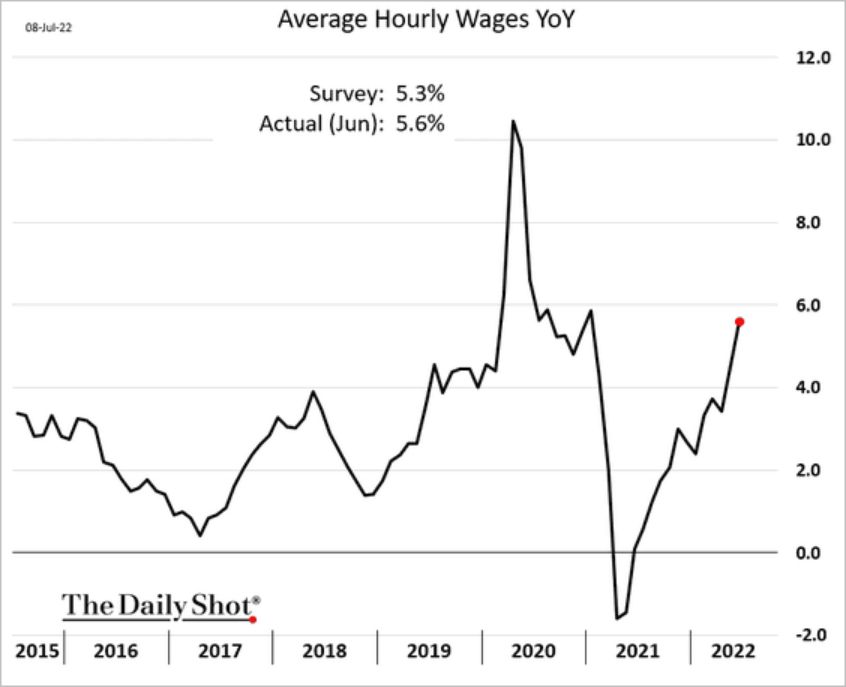

Wage gains across Canada's economy, but not as high as inflation.

Labour participation rate doesn't match neoclassical assumptions about the unemployment rate changes. The likely reason (apart from neoclassial economics having no clue) is that wages are not growing fast enough to pull people into the labour market (that's what they might would say too). The other theory is that the labour market is not functioning because there is a demand for certain (low wage) jobs but not others.

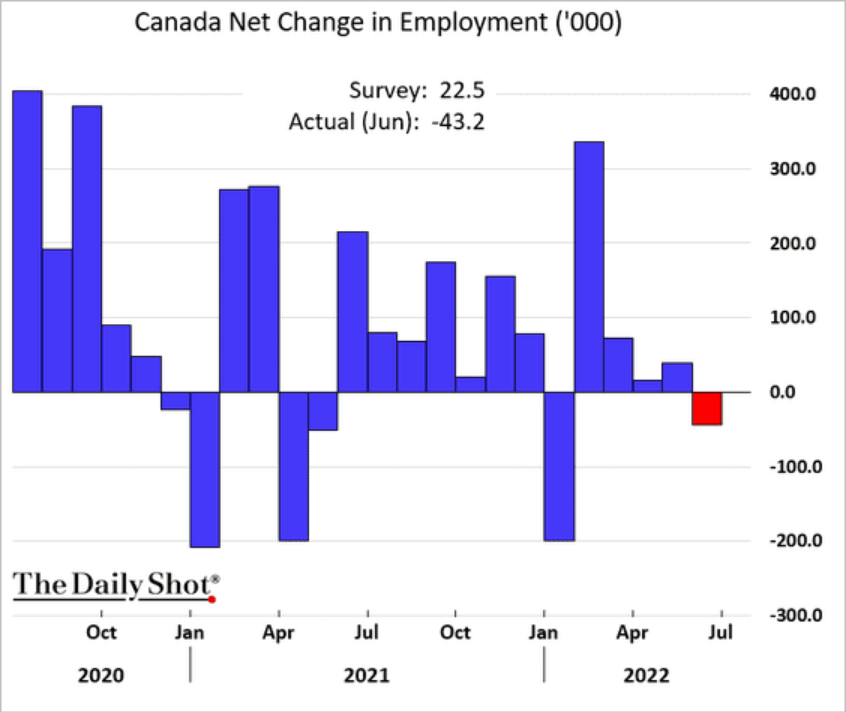

Employment is down. See above comment.

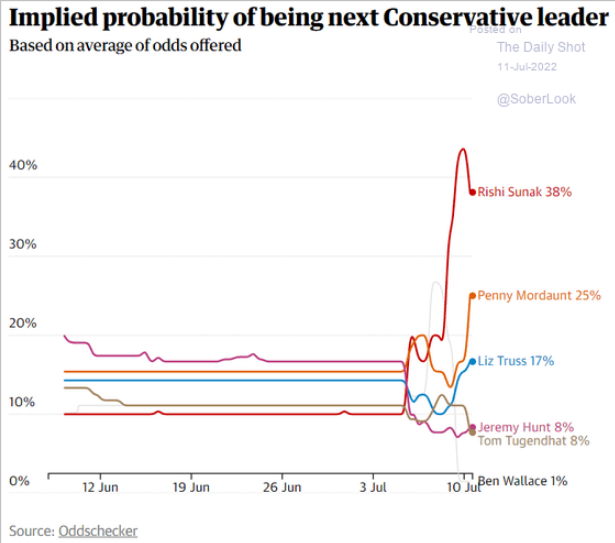

UK Conservatives and elections

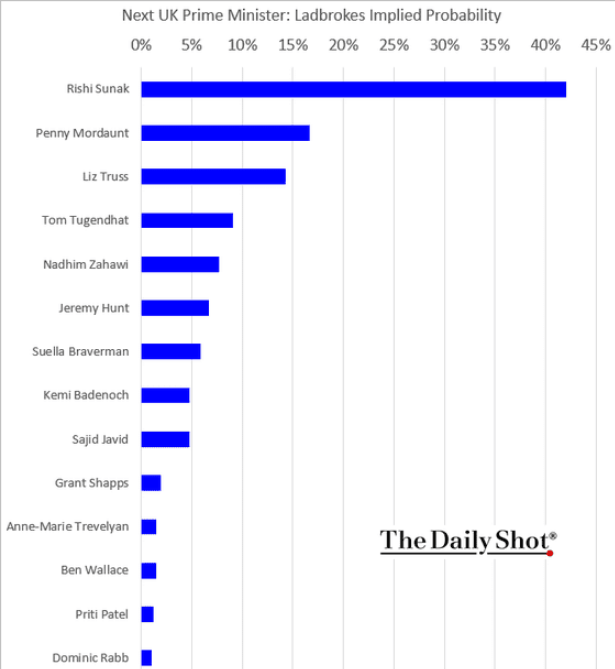

Bets on who is going to win the Tory leadership race after Sunak threw his hat in:

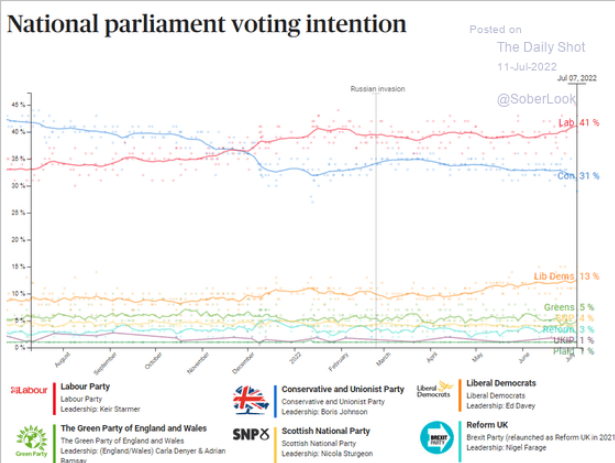

The upside is that by doing absolutely nothing, Labour is ahead. If only they had a leader who anyone wanted to be PM.

Brazil

Lula is on the path to election victory and had an interview in the FT

Lula says he will name a finance minister who is not an economist but a skilled politician advised by a group of experts, as he did in his first term. He wants to review labour reforms enacted after the PT left office and says he will overhaul the tax regime — a move the Bolsonaro government attempted but failed — to make the rich pay more.

Lula has little sympathy with business people who worry about possible extremism and criticise him for a lack of new ideas. “The Brazilian elite has a slave-owning mentality,” he says, referring to the criticism he received when his party formalised the employment of domestic workers. “You know what they said here in Brazil when the traffic was bad? That it’s a disgrace that Lula allowed poor people to buy cars.”

Despite his hostile rhetoric, Brazil’s economic elite is not panicking at the idea of Lula’s return to power. The constant political turbulence of the Bolsonaro administration has unnerved the business community despite the implementation of some economic reforms, such as limits on public sector pensions and some privatisations. And Lula is a known quantity. “Lula is not an institutional threat,” says one senior banker. “We’ll lose some quality in economic policy but it won’t be a reversal.”

His views on geopolitics will be less welcome, with the west now enmeshed in a new cold war with Russia and China. Lula has previously criticised Ukraine’s President Volodymyr Zelenskyy as partly responsible for the Russian invasion. But he insists that Brazil will not be drawn into taking sides in the Ukraine war, and that negotiations must be attempted. He criticises the US for its “lack of patience” in seeking peace and sees himself as a potential negotiator who can speak to all sides, including China, Brazil’s biggest trading partner, and the US, its ally and biggest foreign investor.

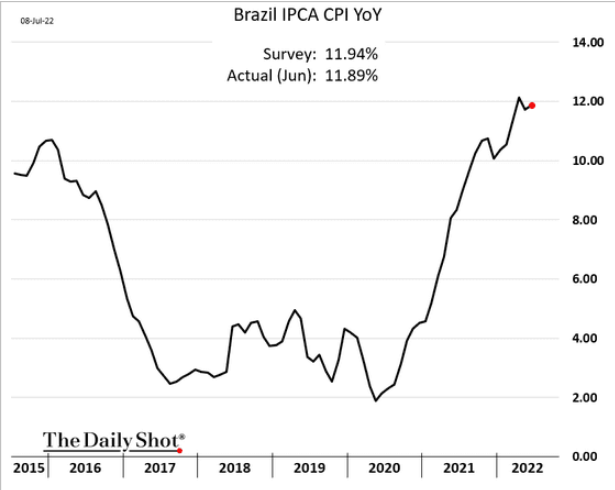

Which is all to say, nothing has changed much except Brazilians are markedly poorer today than when Lula left office:

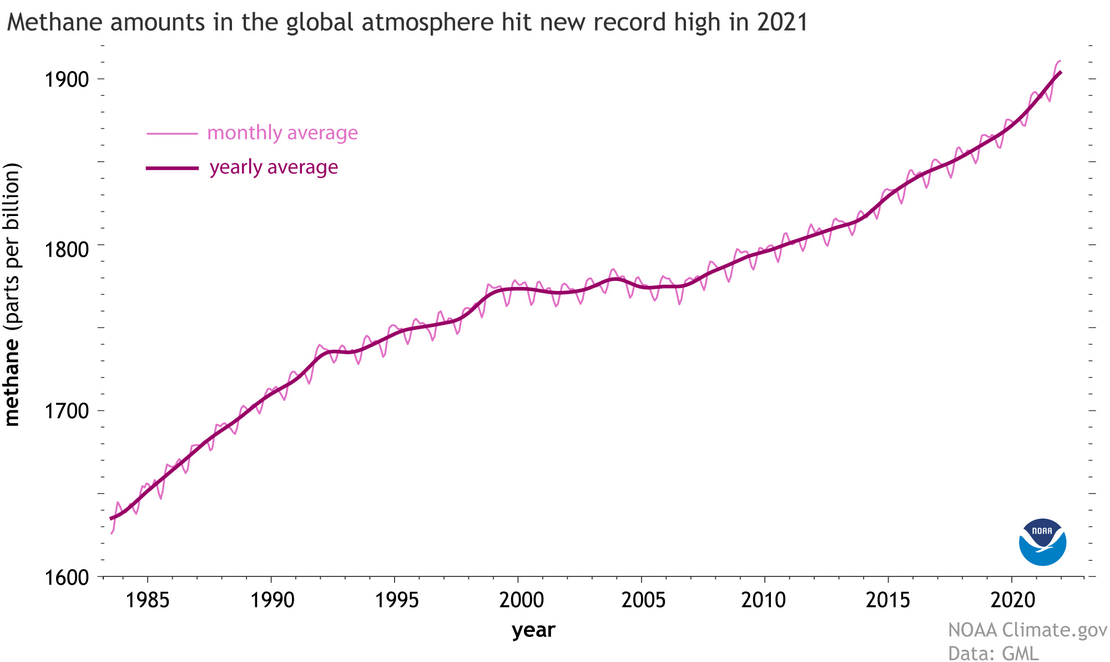

Climate

Methane is at an all time high undoing any reversal of CO2 emissions (if there were any to report, which there isn't).

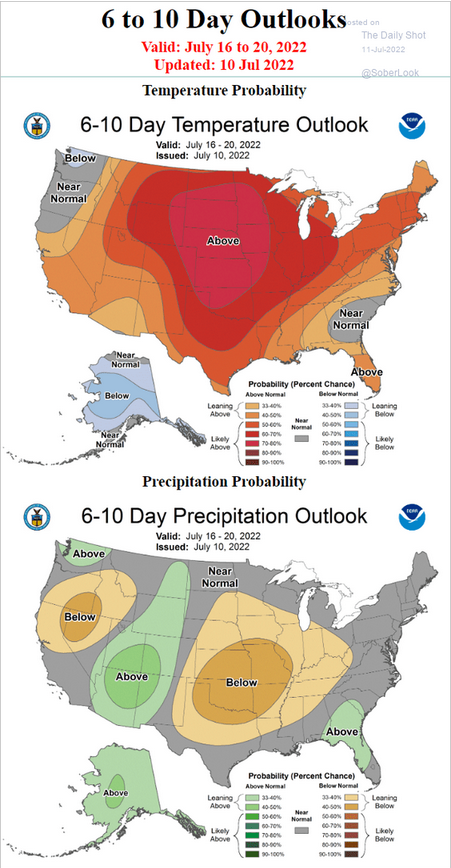

The effect of continued climate change on food prices next year are not very hard to predict:

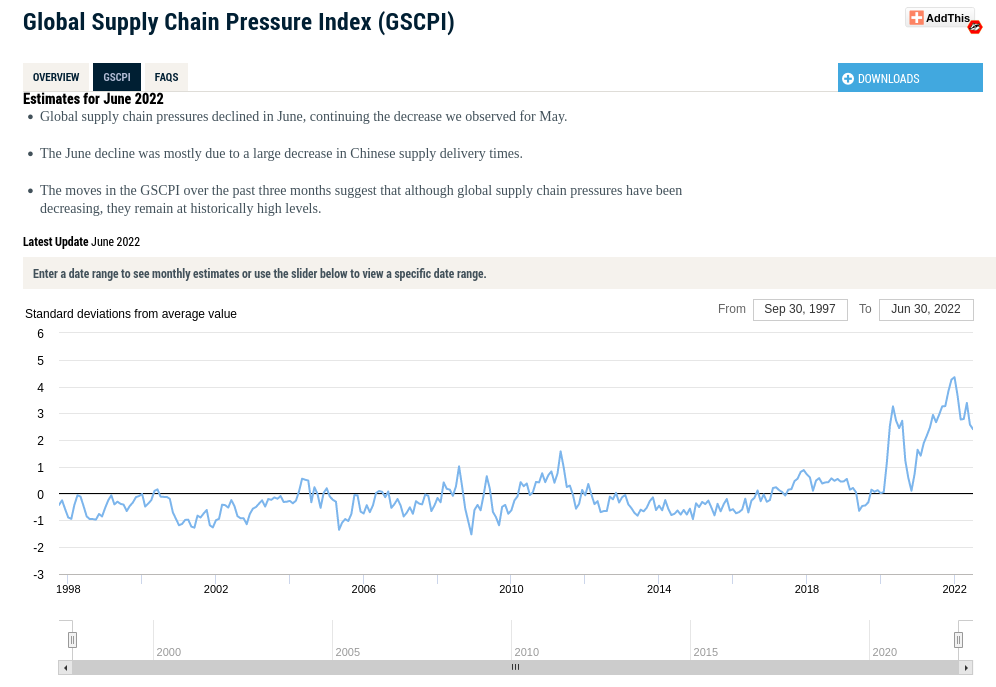

Supply Chains

Better is not good:

Universe

- Small and insignificant on a universal scale.

https://www.visualcapitalist.com/cp/map-of-the-entire-known-universe/

There are very few diagrams that can display logarithmic scales properly (because there are very few things that big). As such, we have a hard time understanding how big the universe is.

The Oort Cloud reaches 3.2 light years or about 1 parsec (give or take). 1 parsec is 3.1 x 10^16th m (give or take).

The graphic goes from the Oort Cloud to Rigel in the same distance it goes from Rigel to the Horsehead Nebula, but the Horsehead nebula is 100x farther away from the edge of the Oort belt than the Oort belt is from us.

The graph goes past 10,000,000,000 parsecs.

While we can see things that are 3-4 light years away with (youthful) eyes. The brain can only distinguish things 3-4kms away that are about our own size.

And, we generally have a problem understanding things that take longer than our lives to travel. And we generally have a problem understanding speed faster than sound.

So, forget understanding the universe's size.

This math is also why people have a hard time "understanding" pandemics, climate change, economics, and any large scale anything that we cause collectively.

The only solution to understanding this is, of course, communism.

Internet outages

There is a general misunderstanding around the Canadian telecom market.

People think it is lack of "competition" that causes high prices and outages. I will let you in on a little secret: it isn't anything to do with competition or lack there of.

With two players in a market, there is competition. Is there anti-competitive behaviour? Sure there is, but that is not the reason for "high" prices. The reason for high prices are high costs.

The costs of sustaining Canada's telecom system is extremely high. The reason we have outages and low investment is because of these high costs and significant pressure to keep prices as low as possible.

The only way to solve this is through nationalization. This will not reduce costs, but it can bring prices down.

The reason these services were privatized in the first place was because of increasing costs as technology changes in the sector very fast. It is in a constant state of investment before end-of-life. This provides a drag on expansion, which is why the government (stupidly) provides a profit subsidy for investment in rural expansion and outsources the blame for the costs.

Rogers and Bell do not have outlandish profit rates and investors are not making more money investing in these companies than other communications companies. Their costs are high, their debt is high, and their prices are market prices.

The return on investment for Rogers is 4.04%. It's net profit margin is 10%. TELUS, BCE, and Shaw are in the same range. BCE and Shaw are slightly higher, but they are a slightly different kind of company in its investments.

This is not low and it isn't a company in financial trouble. However, it is plenty that could be re-invested to make prices lower or increased investment if it was not a private company.

It is a broken system and is one of the reasons Rogers had the outage. Outages happen all the time, you just don't notice because the "internet" can re-route things quickly and there are redundancies throughout the network. However, Rogers, TELUS, Shaw, Bell/BCE cut corners to keep prices low resulting in slow investment growth and janky systems that break.

All the commissions that are being launched to investigate the "unacceptable" outage will not result in anything except more profit subsidies and empty promises and off-loaded blame.

The way to fix it is clear, but no one is calling for it because it is an expensive proposition and goes against the narrative that it is a "monopoly".