January 8, 2024

Production and Industrial Strategy

Contrary to mainstream narrative, China continues to be the worlds producer and is weathering their property investment crisis because of it.

While Germany loses some of its industrial charm and the USA trips over its own feet trying to convince capital to invest, an industrial strategy based on being the world's producer of green transport technology is panning-out for China. As industrial production is sustained through a focus on stable supply chains and production of mid-stream products for batteries and electrification, its sets a stable economy for other producers to also weather economic variations.

Without sustained investment in production, there is no basis for sustained growth in prosperity of the working class. Which is why industrial strategies are so important over the medium to long terms.

Canada might no be in direct competition with some of the major producers for volume, but there is no reason that a broader production base cannot be sustained—or at least attempted to be.

After the fact reasoning on inflation

Since neoclassical economics does not really have a "theory of inflation", in the coming months you will see many comments on "who was right" on inflation and why.

They are no more informed that the suppositions that happened while inflation was growing rapidly, but they are going to sound that way as mainstream economics seeks to write the history in favour of capital's interest.

For example:

“We had a period because of all these shocks where the Fed and the ECB kind of threw their models away and said, ‘we can’t really figure this out, we’re all wrong about this, but inflation is too high, we have to act,’” he said. “I think at the Fed now, we’re coming back to the models a bit, which is a good thing because that means it’s more forward looking.”

While we generally think that supply shocks are part of the inflation story, these kind of comments are quite telling about the basis for orthodox neoclassical analysis. They will throw away their models and then return to their models because the correctness of the model isn't their focus. Such flexibility will be touted as "scientific" and "rigorous", but in reality no one in science assigns different models to different data, they test and modify the central theory. It isn't really a scientific theory otherwise, it is just phenomenology.

Why do we care about the practice of looking back at inflation?

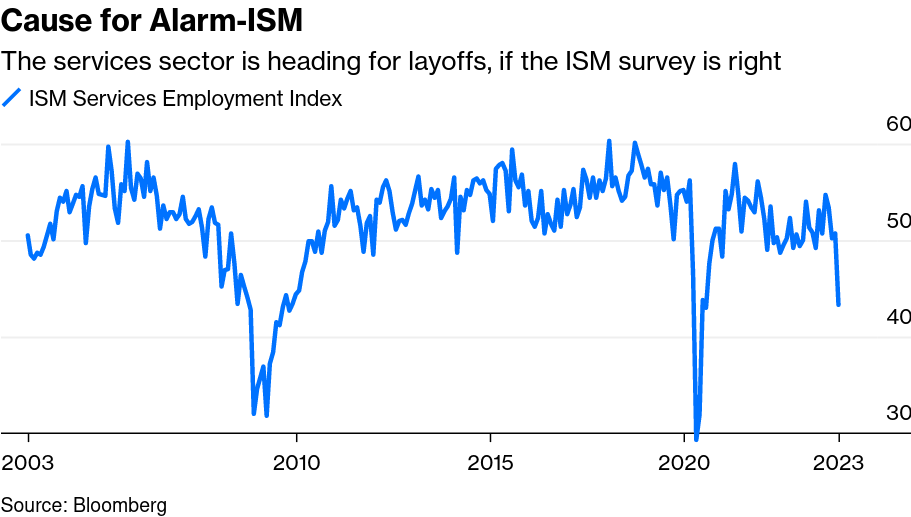

We are still in an era of high inflation and we are now looking at how "close" we can get to a recession to "deal with it" because central banks cannot get away from their notion that it is workers with too much money that is really driving inflation.

Some of the data showing where we are with inflation (and who is getting the chair kicked-out from under them) is found in the recession measures coming out of the USA.

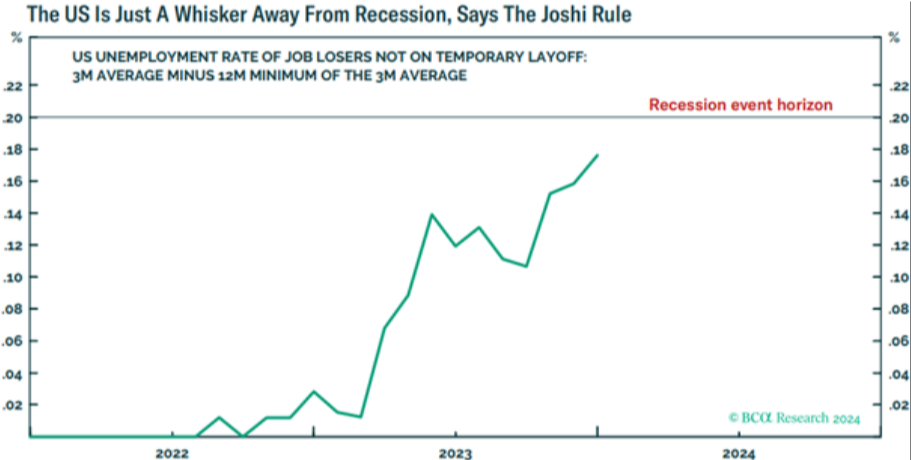

Longer term unemployment is a decent measure of how well workers are fairing. Neoclassicals look at this graph and think "great, that means that central banks are on track." We tend to take a more dim view of such graphs:

Investment in production and hiring is down, so longer term unemployment is down. This is not a good sign for pretty much anything except short-term protection of financial profits.

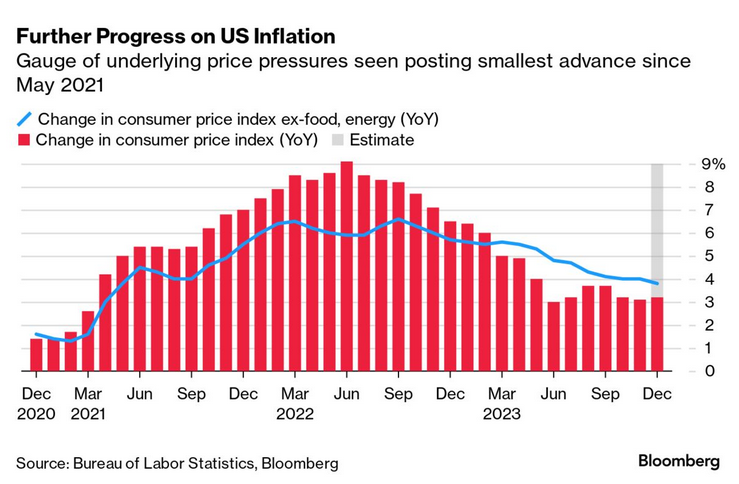

And, while inflation is on the march back to lower levels of growth, it is hardly there for core goods which Americans are (rightly?) over-estimating compared to official numbers.

Inflation has more than halved in the past year, to about 3.1 per cent in November 2023, although more than 50 per cent of survey respondents thought prices had increased by more than that rate, based on their own experience. (FT)

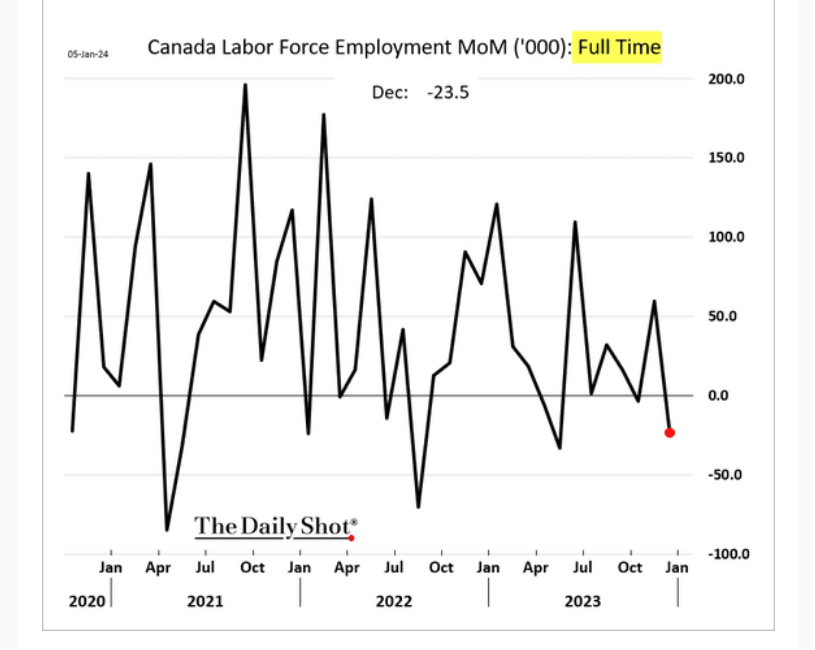

In Canada, full time employment continues to struggle.

Showing some conflicting data, the S&P Global's purchasing manager index and Ivey's PMI. Ivey has a rebound in PMI in December where S&P shows a decline. Though, this could be because of how they adjust the numbers based on seasonal variation and differences in timing of the survey.

We will have to wait and see which was correct.

AI and original thinking

Academics are funny sometimes in their statements of clear obviousness, but sometimes we need that dose of reality to be put succinctly. It is also fun with that clear obvious head-shaking statements come after much experimentation.

On AI, a research paper from the Bank of International Settlements says this:

“Our findings do suggest that caution should be exercised in deploying large language models in contexts that necessitate careful and rigorous economic reasoning. The evidence so far is that the current generation of LLMs falls short of the rigour and clarity in reasoning required for the highstakes analyses needed for central banking applications.”

The idea that a copycat cannot generate new and consistent analysis should not be surprising to anyone. Though, it is difficult to keep that notion in your mind and refer to these machines as "intelligent".

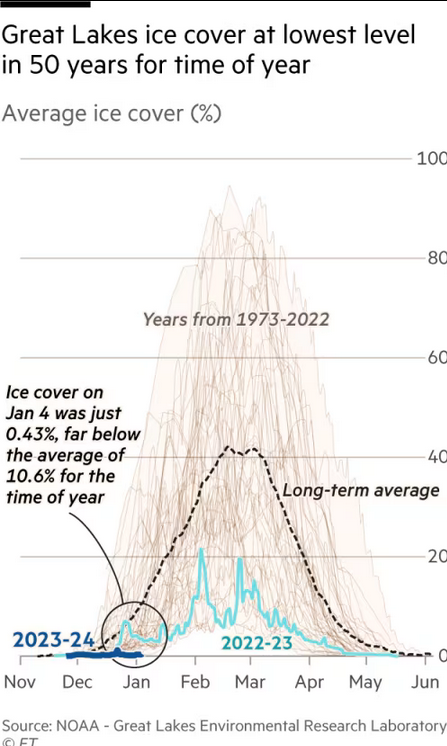

Ice coverage

Low ice coverage is not a good thing for the Great Lakes. Less ice means more evaporation which can greatly affect local weather.

Just one of the many graphs that will be produced in the next week or so on 2023 weather and climate change.