January 5, 2024

Employment, people, and jobs

USA payroll and Canadian labour force data came out today.

The USA data was stronger than predicted on the payroll side (employers reporting how many people they have employed), but households were reporting a decline in employment. These are surveys and they do not always agree (especially month to month) and they are generally criticized by statisticians for being rather garbage, but they sort of jives with the general sentiment around the economy: jobs are available, but they are not great ones.

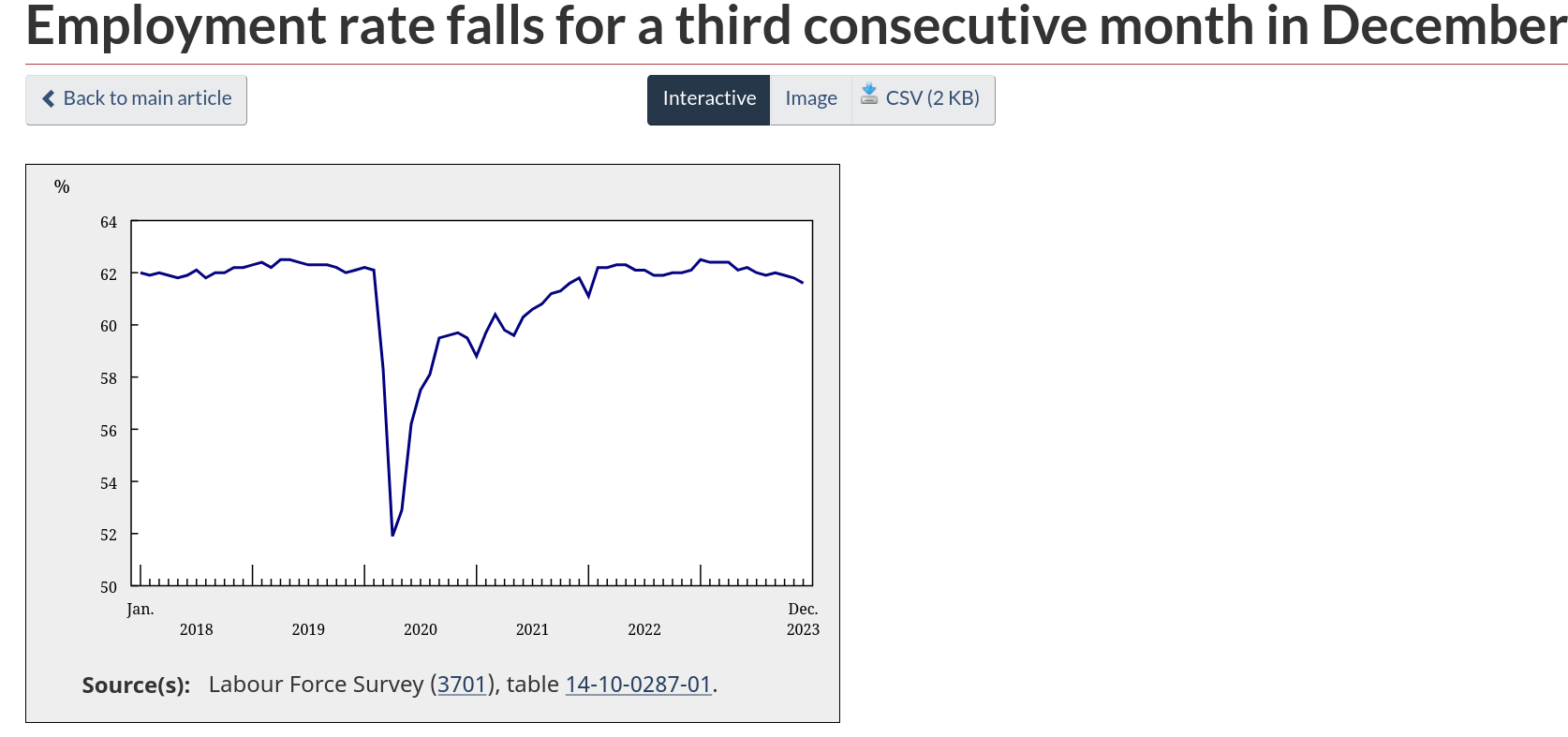

USA participation rate declined, which matches the household survey results. This is similar to the story in Canada where participation is taking the largest hit even as the number of "jobs" continue to grow slowly.

In Canada, several things are happening at the same time to make the story more important than the headline numbers.

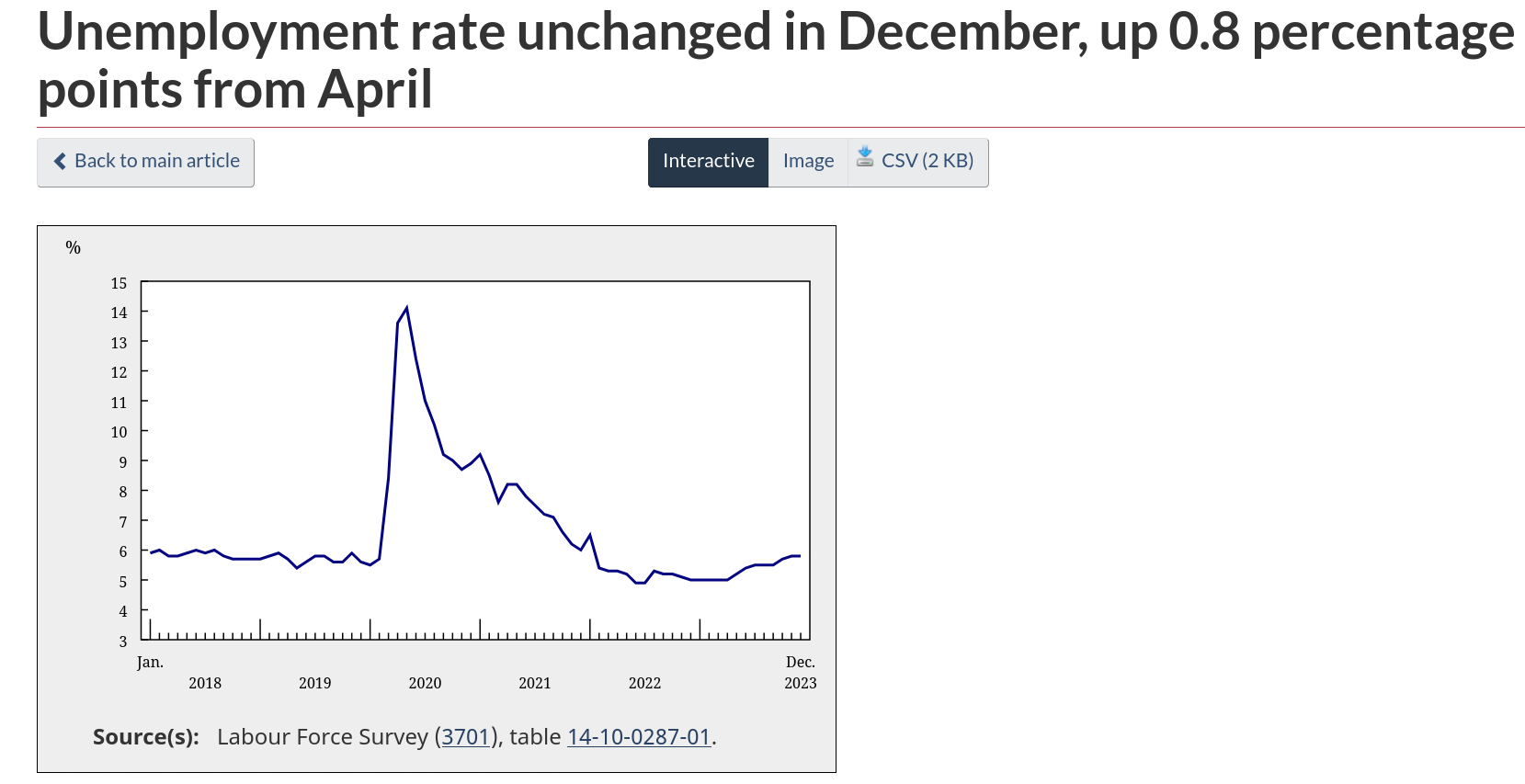

Headline numbers are that unemployment is unchanged, but labour participation rate is down.

Wage increases were up (5.7% growth) for December. While this will be something that the central bank focuses on for not reducing interest rates at the end of January, I suspect it is an anomaly created by where employment shifted.

Part of the story is that the economy is not producing as many quality jobs as it needs to in the face of employment needs, increased immigration, and job churn. More immigration than job creation, creates pressure on wages at the lower end of the wage grid, pushing youth and landed immigrants into more precarious app-based work. An example of this is an increase of 20% in app-based food delivery employment in 2023 compared to 2022. The apps are mostly racialized workers (70.5%) who are younger workers with landed immigrant status. This group also happens to be where most unemployment has occurred.

The battle for lower-quality jobs is driving unemployment, job churn, and wage suppression exactly where we need the opposite happening.

At the higher end of the wage grid, there was some employment gains in scientific and technical services. The gain in this area is probably what lead to the average wage to increase.

There was a reduction of employment in manufacturing again this month along with construction and agriculture (expected) and wholesale/trade.

What does this mean for inflation and recession?

Well, inflation is back up in Germany (3.8%) and generally across Europe prices are higher than expected at 2.9% in Dec driven by the price of food even as energy prices fall.

While the recent price growth indicators in Canada and the USA have fallen, the tension between prices and ability to pay remain.

The "market" responded to "better than expected" jobs report by declining—because a better report means higher-for-longer interest rates. It is a strange world we live in when workers doing slight better is bad.

For Canada, the orthodox economic analysis says central bank rates will likely remain high. This is obviously not what workers need and is probably the wrong call, but it will be in line with other central banks.

Western economies have got themselves into a bit of a jam here. We have loosening of the purse strings for capital. We have not sopped-up the excess money given to capital since 2020 that was supposed to be invested in production, but was not.

The only way that we can deal with inflation and get the economy working is to have a government that forces (procures) investment in productive ends. There is some move in rhetoric in this direction in the USA, but almost none here.

The impact of this "delayed" investment—since it is inevitable—is a grinding economy and an absence of solutions to the affordability crisis.