January 30, 2024

Europe

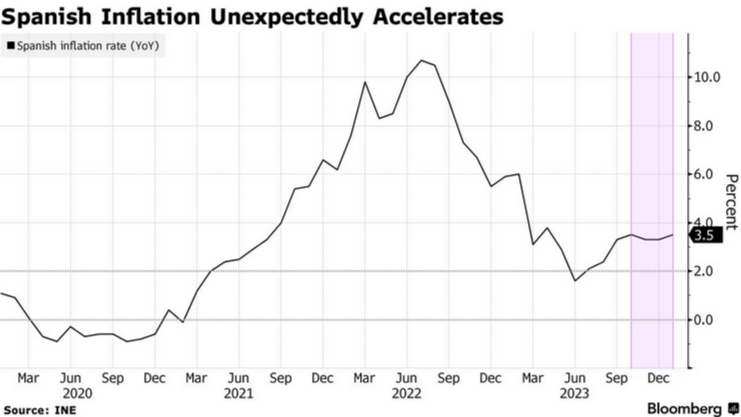

- Spain's inflation crept back up

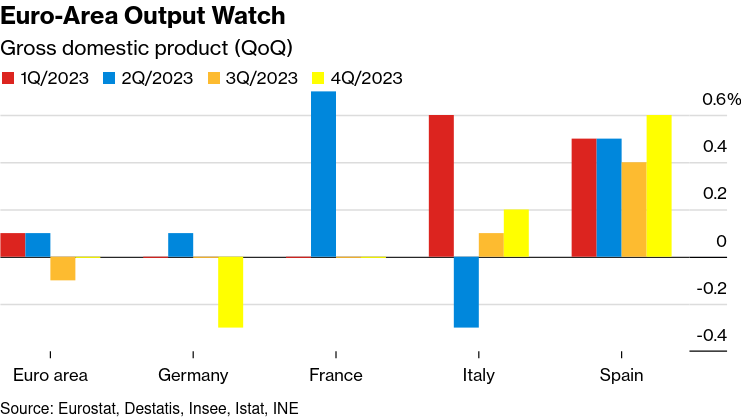

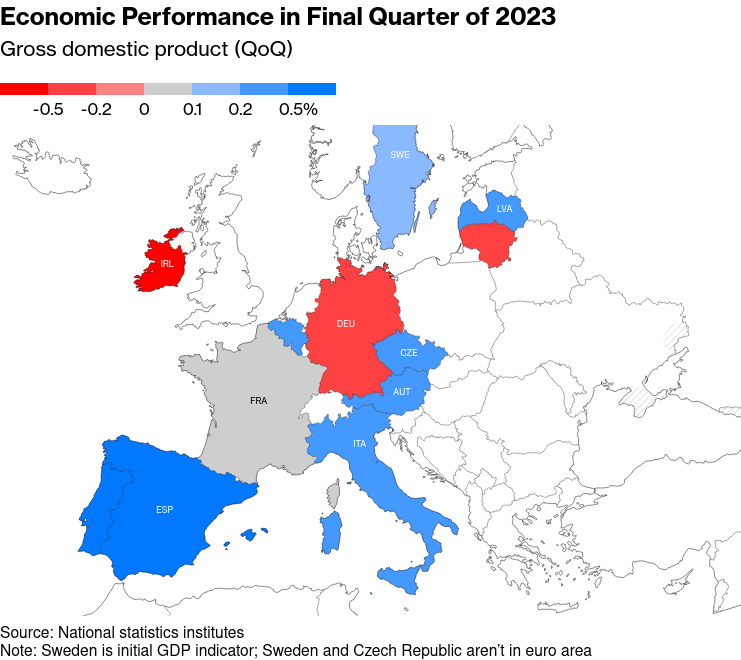

- EU data shows a slight growth in GDP.

- Still, growth is a mixed bag

The push to get inflation under control through strict neoclassical mechanisms is not working-out so well for Europe, especially when you compare it to the USA.

In addition to the slow growth, the French government is being pushed by protesting farmers to demand the EU ask for more at the free trade negotiation table between the EU and South America's Eastern country trade block of Mercorsur.

There are a few sticking points for farmers which have been significantly squeezed through declining fuel subsidies, increased input costs, climate change-related events, and strong environmental measures.

The free trade deal with Mercorsur is a focus because the EU is (as it has done with many things) trying to sneak some reduced environmental regulations through the back door. While the EU has strong environmental measures in its boarders, it tends to sign trade deals for cheap imported good from regions with no where near as strong environmental standards.

Much of the farmer's protests are being driven by the far-right opportunists. However, there are legitimate concerns with the way that the economy in Europe is set-up to support capital over endemic producers while pretending to the population they are environmentally sound.

In addition, European central banks are in lock step to make workers pay for inflation while trying to outsource their jobs.

The farmers' protests show again how important it is for the left to loudly reject neoliberal and neoclassical positions if it wants to gain support.

Broader War?

With the USA Party of End Times (AKA, Republicans) continues to call for war against Iran ("WWIII"), serious people are concerned that Biden is going to be pushed and stumble into it.

There are so many "powder kegs" in the region where concentrations of different military groups sit, it seems almost impossible for these countries to avoid blowing-up the wrong thing and not so slowly igniting the region into a broader conflict.

The recent attack on USA soldiers could not have been more centrally placed.

NATO is all but celebrating at the notion it will be called upon using its previous commanders to write articles in financial papers.

The USA has been doing assessments on it military industrial capabilities and fighting multiple related fronts at the same time. It does not have the capacity, but it is trying to build that capacity which is the reason that NATO would play a role. The 2023 assessment of industrial defence capabilities just released call for a directed industrial policy unlike the USA has seen in decades. This is also concerning.

In addition to the legitimate worry over mistakes in the region, there are too many media pundits talking about proportional response and interviewing "Iran hawks". Where is the analysis of the outcome of increased conflict with Iran and so-called "proxies" in the region?

Media calls for war always ignore the end-game. And there is no clear goal of a conflict in the region other than "putting Iran down" for its supposed engagement through proxies.

Israel has just announced that it will continue their genocidal operation through 2024 which means there is a long time yet for very bad accidents or opportunistic actions to happen—even if this one does not spark the conflict.

It should not need to be said, but more conflict in the region has no positive outcome for anyone.

The only solution is a cease fire in Gaza, an economic program for the Palestinians, and a much broader support for development of the economies of the war shattered region.

But, with all the above coalescing around conflict, it is rather concerning that the USA is sliding into another war footing.

Housing Data AMA on Reddit with StatCan?

AMA notice—Feb. 1: A discussion with StatCan housing data experts on the factors behind housing affordability in Canada

When: February 1, 2024, at 1:30 p.m. (Eastern time)

Where: r/PersonalFinanceCanada

Who: Housing data experts at Statistics Canada

Green energy spending

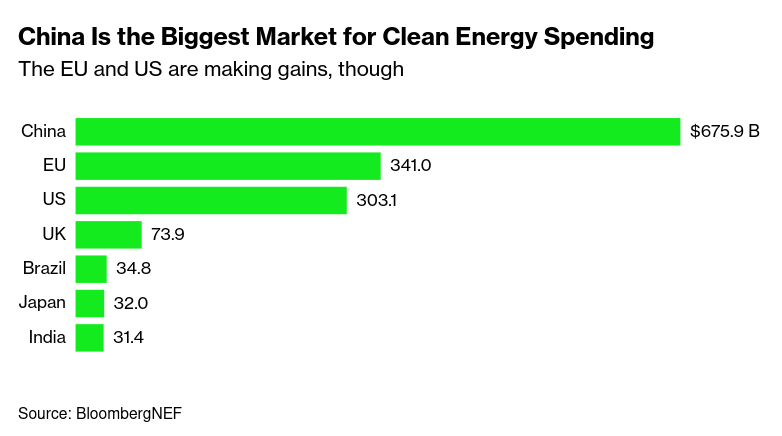

All that money. And it is not even close to the amount need to reach net zero. Mostly because the West continue to not spend money on the energy transition.

Spending on EVs globally climbed 36% to $634 billion. That made it the sector that saw the largest investments, surpassing renewable energy, which gained 8% to $623 billion. Investors poured $310 billion into power grids, which will be a critical tool to deliver clean energy that will be generated from new wind and solar farms coming online, making it the third-biggest market.

The record spending reflects the growing urgency of international efforts to combat climate change on the heels of the hottest year on record — and even more heat expected this year. However, the world needs to be investing more than twice as much in clean technology in order to reach net-zero emissions by mid-century, according to BNEF.