January 3, 2024

Happy New Year

It has been a slow start to the year for the Brief. We will return fully next week.

Canadian Economy ending 2023

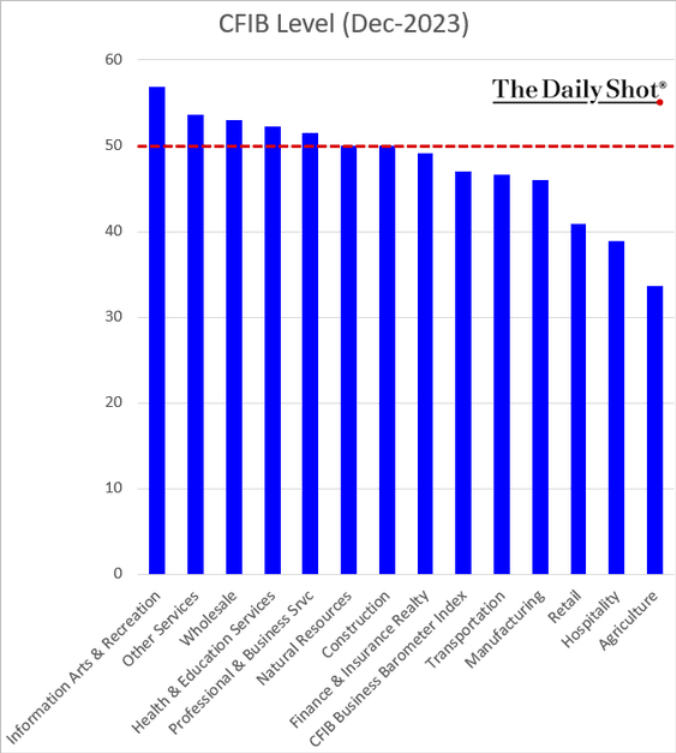

Depending on who you read, the Canadian economy is either in a "soft landing" or not doing very well at all.

I suppose that "Soft Landing" really means that the economy is not doing well, but supposedly avoiding the big "R" word. While a technical recession may be avoided, it is pretty clear to me that in every way that matters for workers, we are in a recession.

Europe looks to be in a technical recession. I do suppose we need a specific metric for if we are or are not in a recession, but there are certain things governments (and markets) can do to avoid all the lines heading in the same direction. For example, while prices of gas can drive economic "activity" metrics in Canada, the shifting of investment from month to month around the world can smooth out financial metrics while it does nothing for real world employment and production levels in one country.

So, Canada can look better than Europe, but it is only because Europe is more of a generalized indicator where Canada is just one data point in the global investment/production/output/purchasing system.

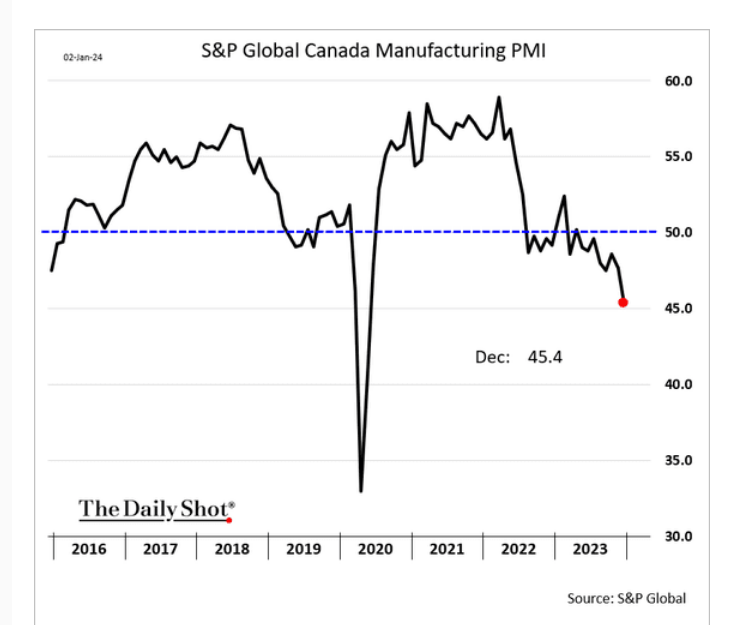

Production sectors employment, investment and new orders are all down showing a sustained reduction in activity. The only thing that is really off-setting this is some sustained activity in the services sectors and the oil/gas prices.

"Accelerated declines in both production and new orders were registered, amid reports that demand for manufactured goods remains subdued."

The output index fell to 45.4 from 46.1 in November and the new orders index was at 42.5, down from 45.4. New export orders also declined more sharply, the data showed.

"Firms noted that clients remain burdened by high prices, and these continued to rise throughout the supply chain over the month," Smith [S&P] said.

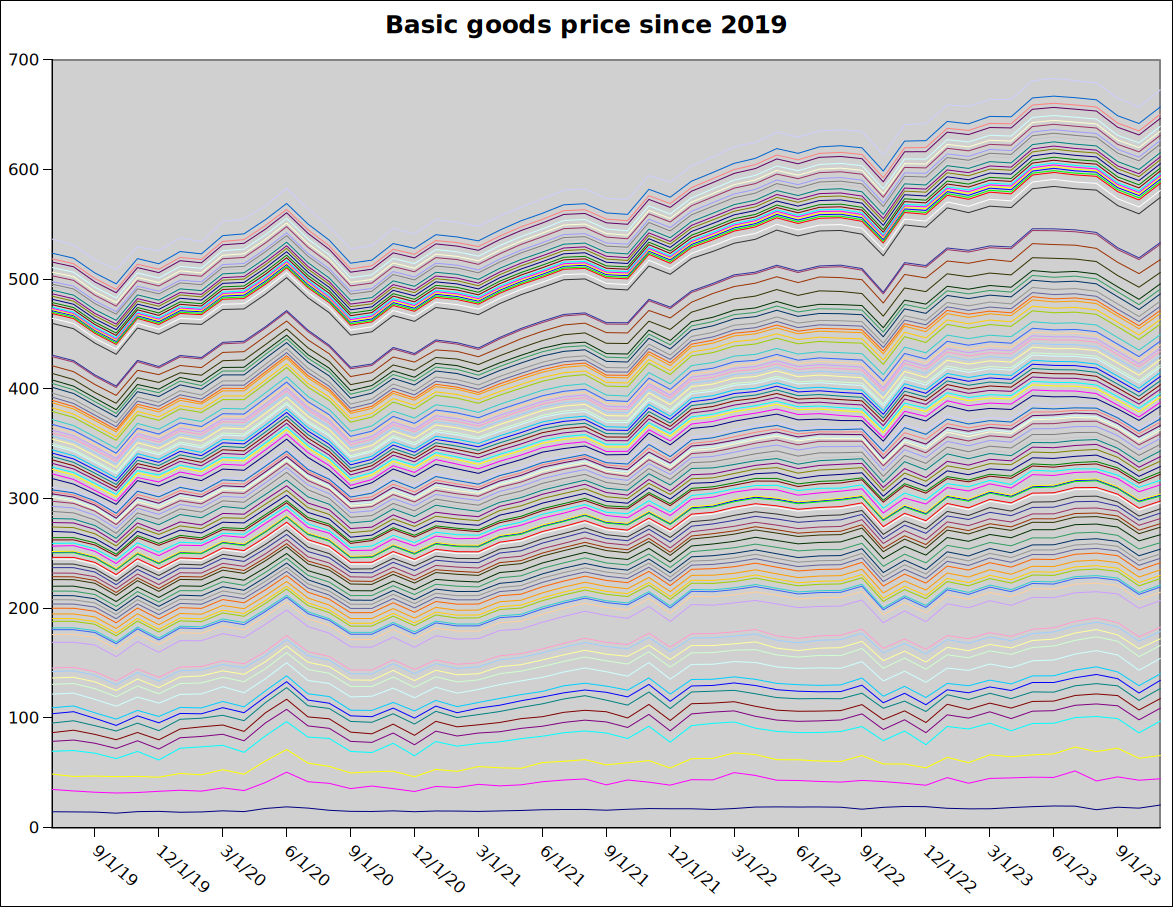

Prices for consumers are not skyrocketing across the board, but there seems to be a lot of variation in prices for basics. Infant formula, detergent, and cooking/olive oil, have continued their price increases while most lower-quality meat and basic vegetables actually declined in price in Nov. The good news for consumers is that the average for basics looks to be stabilized for the previous 4 months to November even though product price growth has shifted from month to month. (StatCan Daily: retail prices)

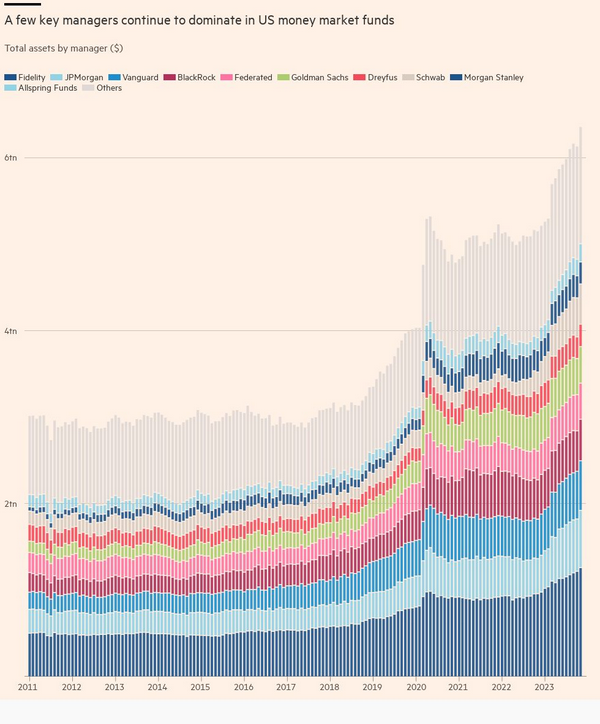

Money flows in the financial space

If you ever wondered if capital or workers benefited from Covid money injections that helped cause real inflation, look no further than the attached money managers' graph of total assets. Workers might have been given some cheques, but a certain percentage of it made its way into financial markets driving massive increases in total fictitious assets driving a weird perception of wealth increase.

And, 2023 was no different while we were supposedly fighting inflation by making "everyone" poorer, money managers index funds were being driven by the stock market gains and reinvested returns from those gains. Each dip represents a lot of money lost by retail investors, but financial capital made out pretty great.

Things are a little flat at the start of this year since much of that growth in financial flows has little to do with the reality on the ground.