January 26, 2023

European Strikes

The back pages of the business press are talking about the impact of strikes in Europe this morning.

Germany, Italy, France, and the UK are all in the midst of strike activity not seen since 2007 with airports closed in Germany, gas pumps stopping in Italy, and public sector meltdowns in the UK.

Capital is worried about the economic impact of the strikes on broader growth measures (not so much the strikes themselves, funnily enough).

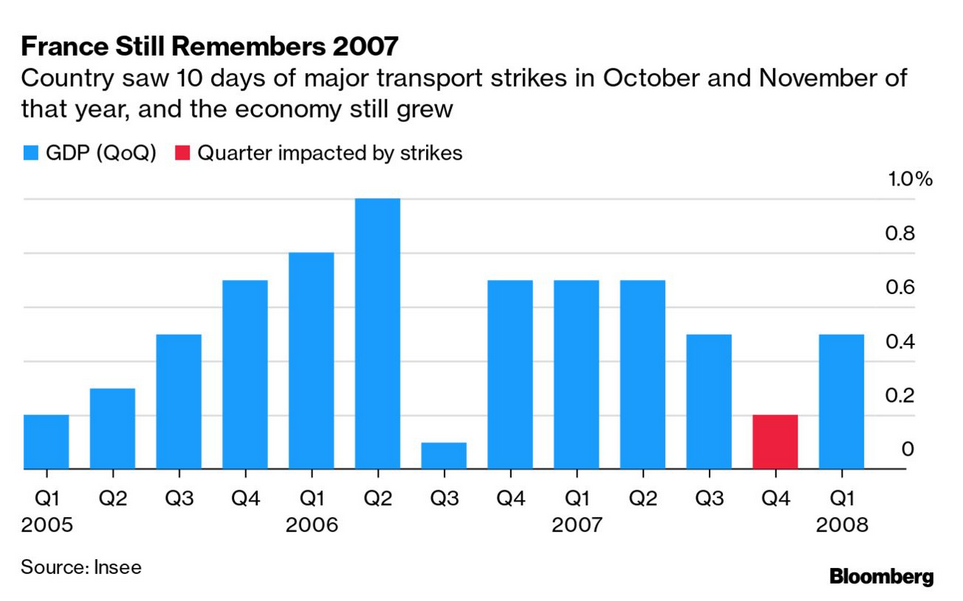

Some reports put the impact of the strikes as negligible. Some other papers point to a rebound in productivity post-strike that more than makes up for any short-term impact of the strike.

Aside from the plunge in gross domestic product during the May 1968 riots, output hasn’t been hugely affected by millions of people stopping work and taking to the streets. Even during that unrest half a century ago, the 5.3% slump in one quarter was followed by an 8% surge the next.

For the moment we will leave aside the academic blinders the economists at Insee have about the nature of strikes (hint: they are not about productivity). The reaction to strikes by capital is important for the broader political left to discuss and the focus on productivity is interesting.

The argument in France is that, because political protest against pension reform will not affect national production over the medium turn, Macron should move ahead in spite of the strikes.

France's Finance Minister Le Marie stated clearly at Davos that he does not predict a recession and so does not think the strikes are important enough to consider.

Outside of France, they are focused on the "setting a bad example" argument about not giving-in to the political mobilizations for public sector pay increases. The UK government is particularly hung-up on this as they say giving pay increase will undermine their plan to eliminate the deficit. This is because they have promised capital that they will do this without raising taxes.

The economic calculus of the government and capital to strikes—even large ones—is important to consider when developing strategies around strike and political action.

Workers generally go on strike because they are feeling concrete impacts on their standard of living. This creates a problem for apolitical unions trying to get gains at the bargaining table over a longer time-frame.

It is this nexus of economic struggle and the political aims of the working class that is being missed in the current discussion. The strike is a tactic, not an end in itself. And, the goals are not singular.

The current mobilization of workers in Europe has allowed the left to build political understanding—to raise class consciousness. In some ways, this is the true threat that more sophisticated capital sees.

Political mobilizations and strikes like we are seeing in Europe are what enable strikes to happen more often. Workers build their understanding of the unfairness of the economy through their introduction to strike action during crisis and that continues onto the next action where there is less of a crisis.

The real impact of the 1968 in France is felt today through cultural shift that happened at the time. People do not remember what was specifically won or lost, but they do remember how good it felt to fight back and build a militant working class culture.

While the talking points of the communications firms for government and capital are focused on spinning cynicism about the effectiveness of strike action, the ideologues are watching political shifts within the class carefully.

This is why it is so important for union leadership—even apolitical leadership fearful of action—to support their more politically orientated activists. The "dividends" are not measured only in short-term economic gains at the table, but building of sustained power for future struggles.

Capital is concerned about one thing over the long-term: the staying power of capitalism. Sustaining political stability of profit extraction means undermining workplace democracy. We can strike to get some short-term gains in the face of long-term loses in the share of wealth and capital is unconcerned. This is the situation we are in right now, easily seen in the previous 30 years of loss of the share of productivity growth.

If we must start demanding workplace democracy and political change during our current moment, we will start to see real gains being made. Over the short and longer term.

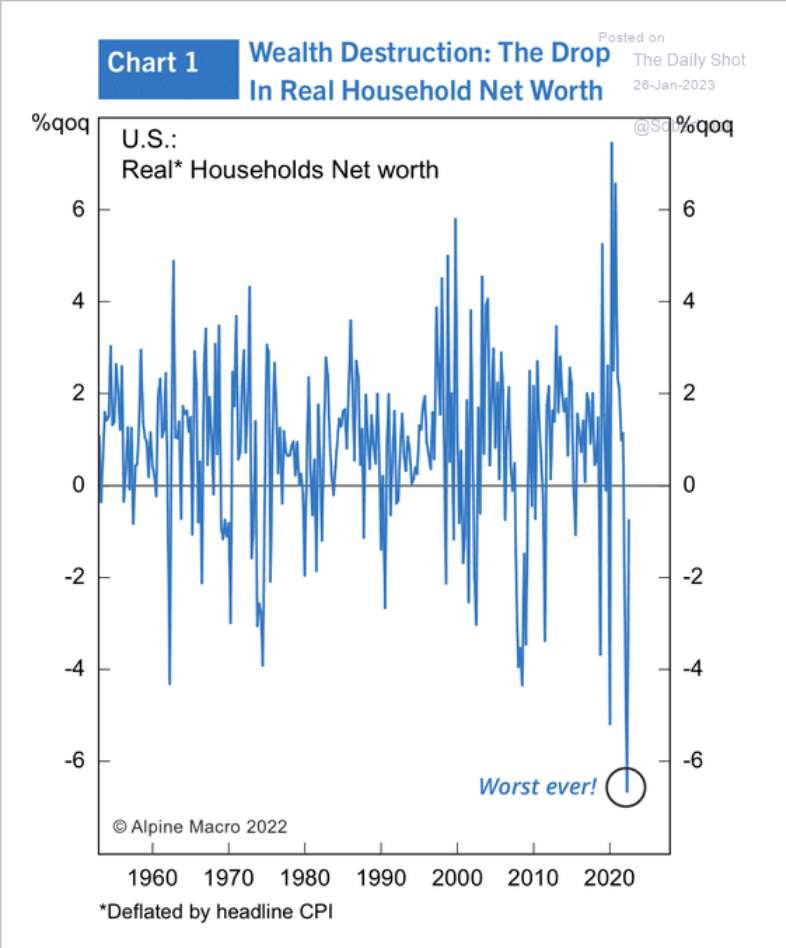

Household debt

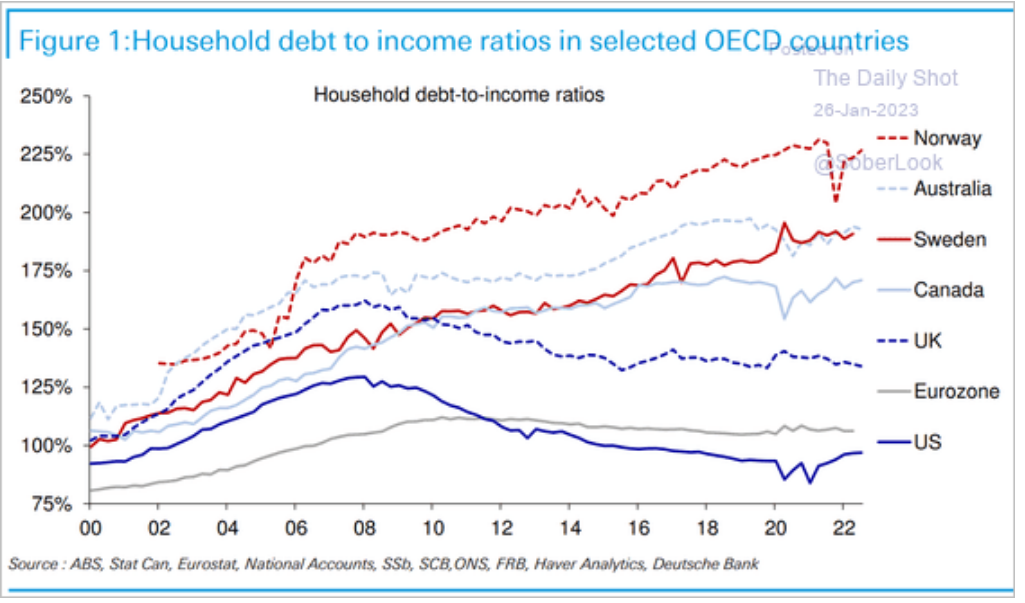

Also in the press this morning is discussion about debt. Household debt, government debt, and corporate debt.

Here is an interesting graph comparing debt:

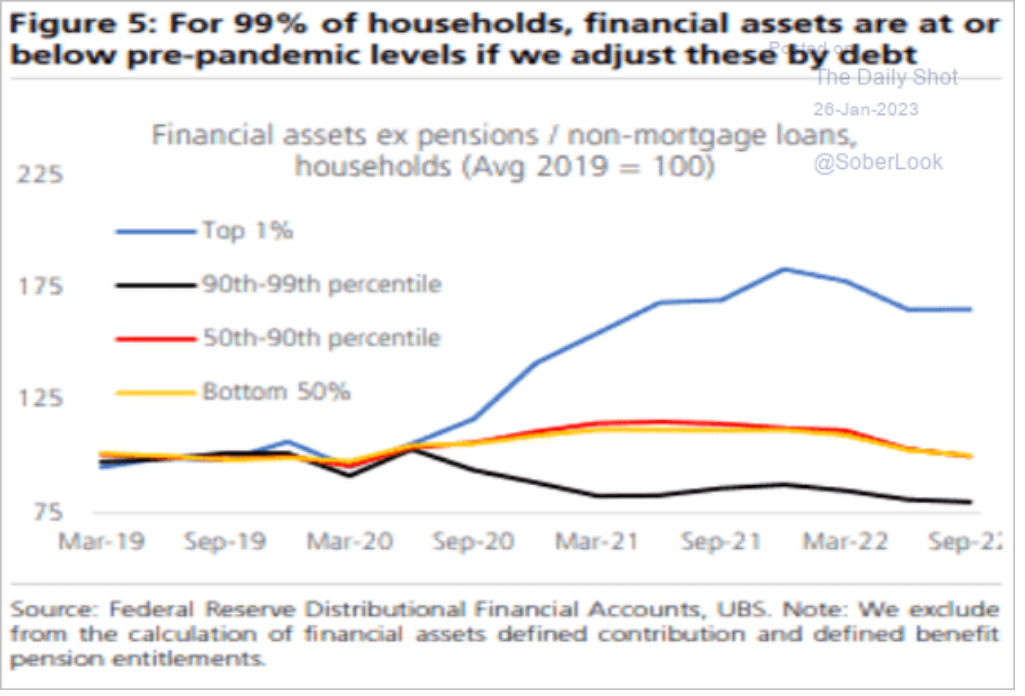

And, to see where this is breaking down by income:

So much for the pandemic economic supports for working people affecting the longer-term trajectory of wealth.

Inflation has sucked away all of the benefit from covid-shutdown supports for those in the bottom 50% of the economy. Worse, the longer-term impacts of wager restraint mean that these workers will be worse off in the coming years.

It has never been so clear that the economic system is not working for workers.

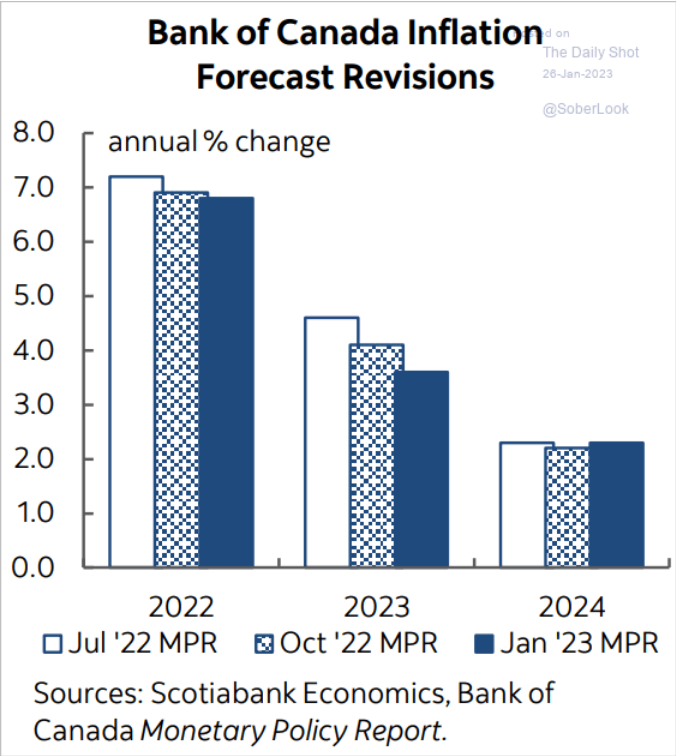

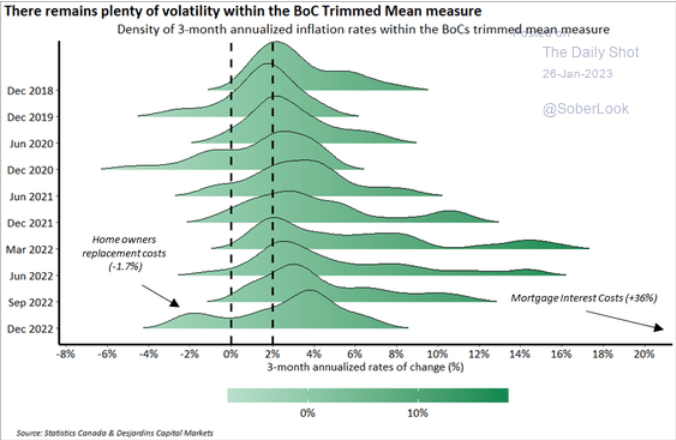

Canada inflation targets

Some predictions by the Bank of Canada on inflation

And, where things are at:

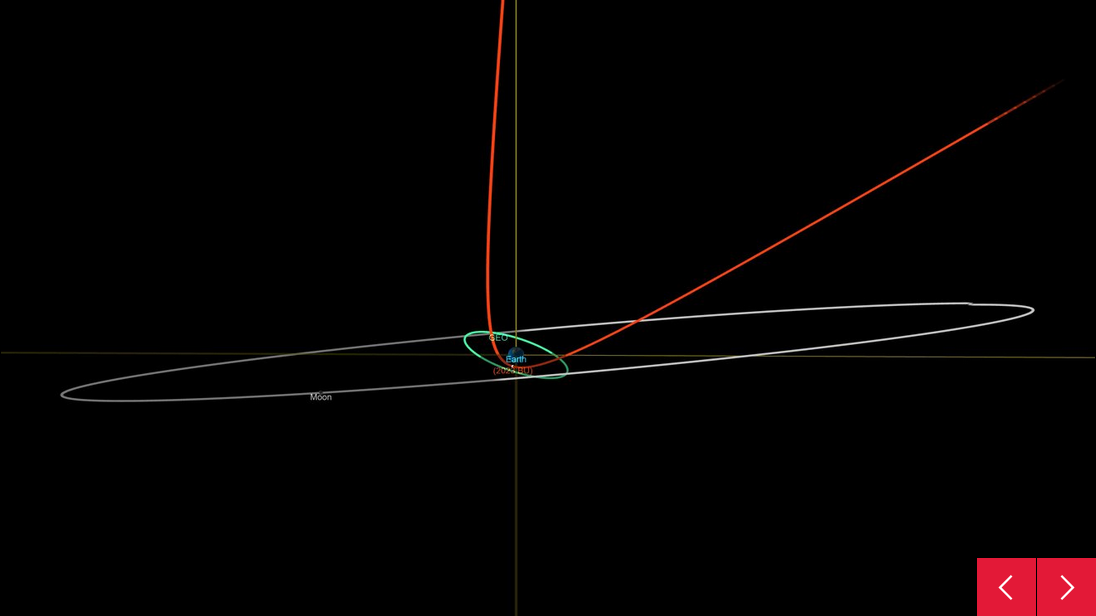

Asteroid near miss

Asteroid 2023 BU is about the size of a box truck and is predicted to make one of the closest approaches by a near-Earth object ever recorded.

There is no risk of the asteroid impacting Earth. But even if it did, this small asteroid – estimated to be 11.5 to 28 feet (3.5 to 8.5 meters) across – would turn into a fireball and largely disintegrate harmlessly in the atmosphere, with some of the bigger debris potentially falling as small meteorites.