January 24, 2024

Worker power and response

The UK government is trying to revive efforts to curb strike effectiveness after the high court struck-down its previous legislation as "unlawful" and "irrational". The law is set to allow temporary replacement workers during strikes.

This comes as Canadian workers are attempting to get "anti-scab" rules implemented at the federal level.

At the international level there is a legal process is underway to debate the right to strike at the International Labour Organization of the United Nations. It seems as though capital is uninterested in even the notion of the right to withdraw labour.

All this is happening while strike action continues to be necessary to simply gain wages in line with inflation.

- Major strikes are happening (or just finished) include in Argentina (mass strike), Germany (train drivers), UK (transit and atomic weapon workers), Finland (oil refineries), Canada (transit), US (Cal State, retail), Ireland (political), India (child care).

While workers may have had the upper hand in 2023 to push for wage gains, the results have been mixed. Many of the major strike actions have resulted in a wake-up for employer's as wage demands matched the realities of cost of living increases. However, now that inflation growth has retreated somewhat, labour markets relaxed, and profits have declined, it will be much harder to get those gains.

In addition, employers and governments seem willing to act more aggressively in response to industrial action. While large changes in the laws banning or allowing strike action are becoming less frequent, states are learning from North American lawmakers who put up enough smaller roadblocks to strike action as to make the essential tactic near useless, but also not aggressive enough to invoke a major response from leadership.

The ultimate anti-union laws and employer tactic is one that

- fragments employment so there are multiple unions into the same workplace, driving division between those who are striking and those who are not

- allows some workers to strike, but keeps enough essential workers on the job to drive division in the ranks of who gets to be on strike

- bans the solidarity strike, forcing workers to cross picket lines to get paid

- does not ban replacement workers

- shifts negotiations from sector-wide to individual units on a regular basis

- operates under broader wage growth legislation

- ending strike assigned to powerful arbitrators

You have all these things in operation and you get a situation most unions struggle to deal with. The classic example is across BC's transit services, were there have been very long strikes across smaller transit systems, under different unions, all operated under an arms-length independent government agency, fragmented and privatized services, partial essential services, disparate wages, and wage setting legislation at the provincial level.

There might be a right to strike, but the power of those strike are dented through a labour relations regime set-up to limit their impact.

Unions must develop better and faster adapting strategies to deal with different labour relation regimes as employers are using more sophisticated analysis to push back.

Climate change and the economy

With the global slowdown in the economy last year and the increase in nuclear and renewable power generation, the International Energy Agency (of the OECD) will announce that emissions did not grow. Low-emitting energy grew enough to capture the low growth in demand.

This is good news except for the fact that our global emissions cannot be so linked to economic activity if we are to reduce CO2 emissions by 2050.

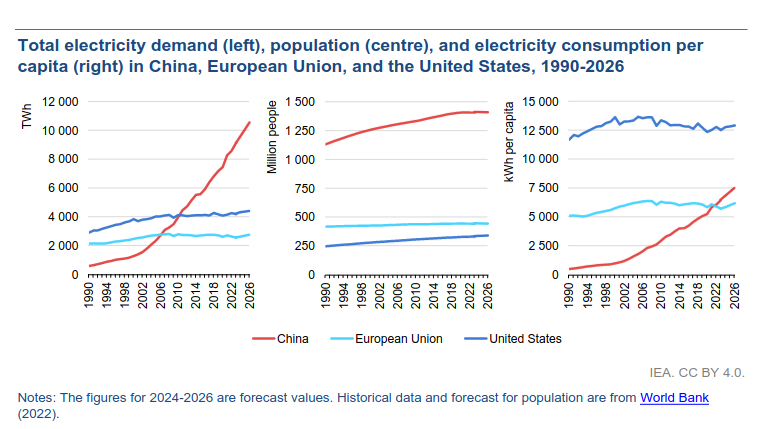

EU and Asia power demand was significantly down due to economic conditions, a warm start to winter, and a massive increase in nuclear power as a percentage of generation. Asia now accounts for 30% of nuclear power generation.

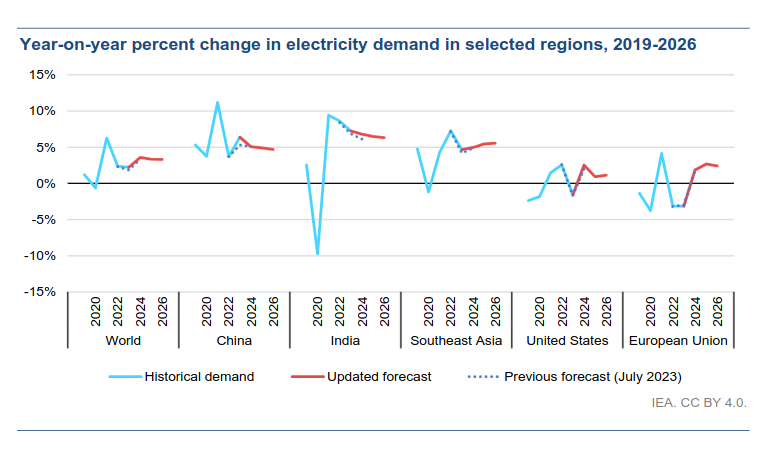

- electricity demand growth slowed to 2.2% in 2023 from 2.4% in 2022

- EU electricity consumption is not expected to return to 2021 levels until 2026 at the earliest.

- Renewables and low emitting resources are set to be 50% of generation by 2026 (again, because of the slow growth of the economy) up from 39% last year

- Nuclear power set to grow by 3% by 2025

- Electricity prices are growing faster because of economic choice of market-pricing for the consumer and the increased costs associated with renewables and transition.

- Electricity demand is expected to follow economic activity in the next couple years

China's electricity demand per person has moved passed Europe's:

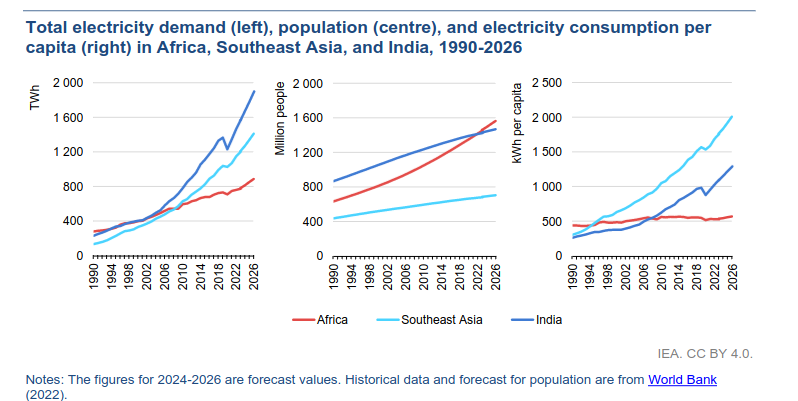

The trend in electricity demand basically excludes the right to energy for many in African countries. This very slow expansion of electricity generation in African countries is part of the reason that the world is meeting its climate goals. The climate cannot be beholden to the sustained energy impoverishment of a continent.

- 40% of the African population lacked access to electricity, mostly in sub-Saharan Africa

In order to achieve the region's energy development and climate targets, energy investments will have to more than double from today's USD 90 billion by 2030, with almost two-thirds of this spending going towards clean energy.

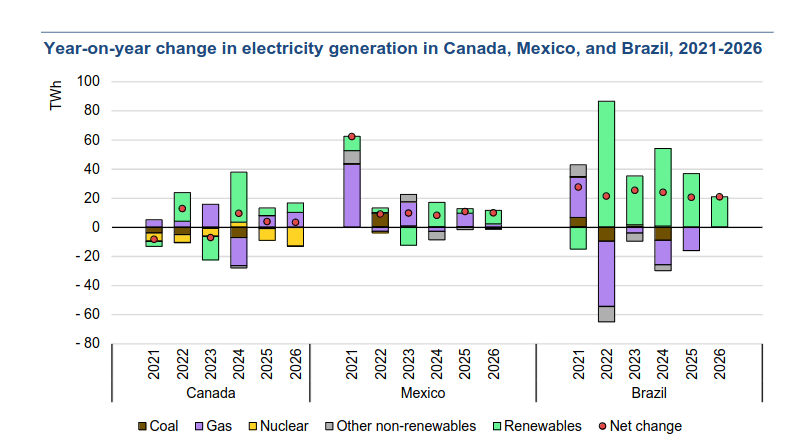

Finally, Canada's change in electricity generation compared to Mexico and Brazil:

Enbridge lawsuit

Natural Gas pipeline builder and consumer gas provider is launching a lawsuit (at the provincial appeals court) against the provinces' energy regulator (Ontario Energy Board) for rejecting its rate and investment proposals.

The OEB's decision was based on the OEB's finding that the energy transition is already in motion and that natural gas assets will likely become stranded assets in the foreseeable future:

"The energy transition poses a risk that assets used to serve existing and new Enbridge customers will become stranded because of the energy transition. Enbridge has not provided an adequate assessment of this risk to demonstrate that its capital spending plan is prudent. The stranded asset risk affects all aspects of Enbridge's system and its proposals for capital spending on system expansion and system renewal."

OEB determined that Enbridge needs to put more emphasis on monitoring, repairing and life extension of its system so that replacement projects are only implemented where absolutely necessary in order to address the stranded asset risk in that context.

The OEB is saying that the cost recovery is too optimistic because use of natural gas at the "small scale consumer" will decline, not grow, so investment should be maintenance and not expansion, which means revenue growth is less important. The analysis that natural gas demand will decline is likely based on the cap and trade estimates from the government.

From first glance, I think that the OEB is correct that Enbridge is overstating expected revenue from selling gas. Even as production of natural gas for LNG export is expected to increase over the short term, there is a drive to reduce natural gas for local domestic use.

If government policy is to move away from natural gas for heating/cooking as a primary source of energy, then shareholders might agree that major borrowing for capital projects needing to last longer than 30 years for amortization will be stranded assets.

The other question is whether this actually changes the real revenue stream or investment plans by Enbridge as a utility. My guess is not as much as they are suggesting given the policies of the federal government on the need for backup heating even if people move to electric/heat pumps.

The OEB isn't banning gas investments, they are saying the revenue calculations, timeframes, and risks are incorrect. I think anyone reading the decision and understanding that would probably agree. It cannot be that investment programs by gas utilities go unchanged in the face of climate change policies.

The Enbridge challenge to the OEB is that the OEB:

conveys a strong bias against the current and future use of natural gas.

I think that it is true that OEB (and the reality of climate change policy and needs) have a strong bias against future use of natural gas.

It will be interesting to see how the challenge unfolds.