January 24, 2023

Pharma is done being nice

The pharmaceutical industry is done playing nice. The subsidized profits from the covid pandemic are coming to an end and the industry is now back to gouging consumers. In the USA, UK, and Europe drug companies are abandoning the price negotiation systems and threatening to remove drugs from entire regions.

Eli Lilly and AbbVie have started the move by companies to pull out of the price regimes around the world and Bluebird Bio pulled Zynteglo, its gene therapy for the blood disorder beta thalassaemia, from the European market.

This is forcing a rethink of the much touted "bulk drug purchasing reduces costs" fantasy talked about before the pandemic.

The fantasy is based on the idea that a "voluntary" pricing agreement (such as between the Department of Health and Social Care (DHSC) and the Association of the British Pharmaceutical Industry (ABPI)) can reduce costs on health systems while sustaining profits for Pharma.

While the original Pharmaceutical Price Regulation Scheme (PPRS) has been around since the 1950s (near the start of the NHS), the new scheme is rather different.

The new agreements are about reducing "costs" rather than setting a particular price/profit subsidy on every pill distributed in the UK. The new system results in more profit subsidy going to more "innovative" firms. An idea that sound nice if you believe in start-ups and completely ridiculous when you realize the start-up's goal is to be purchased by the larger firms.

Gaming the system and sore losers is the result. The result is also a mess.

In reality, the scheme was really just a mechanism to increase prices of UK drugs which have been historically lower than anywhere in the world under the NHS government statutory monopoly on distribution system demanding a 15% reduction in drug list prices.

The original reduction was much higher—closer to 25%.

The scheme which was implemented in 2019 was to come to an end this year, but the drug companies are starting to pull out of the scheme early complaining about profits.

The entire industry acts as a monopoly through their trade arm which negotiates the price with the state. But, nothing is simple in price setting. The leverage the companies have in this arrangement is on capital investment in the country.

In many countries, this capital investment from Pharma means thousands of jobs.

In this whole conversation, it is important to remember that the international monopoly patent system is what gives pharma companies all this power. They own the drugs and the process to make the drugs. The self-imposed regime means we are entirely reliant on private capital for drug production.

AbbVie and Eli Lilly have withdrawn from the deal after the German conglomerate Bayer’s pharmaceutical chief executive told the Financial Times on Monday that it was reducing its UK footprint and cutting jobs as a result of the cuts to prices, coming at a time of high inflation.

Last year, US drugmaker Bristol Myers Squibb said it could divert investment away from the UK because of the increasing clawbacks. (FT)

The schemes are complex and hard for the public to understand if they are getting a good deal. For example, the UK scheme sounds good when put this way:

Under the UK’s most recent pricing deal, which was agreed in 2019 and is set to expire this year, if the NHS bill for drugs grows more than 2 per cent a year, the pharmaceutical industry pays the difference. Other countries with similar deals tend to share the extra costs.(FT)

However, the UK's NHS has allowed exemptions for new drugs such as biologics that are the real cause of increased costs to patients.

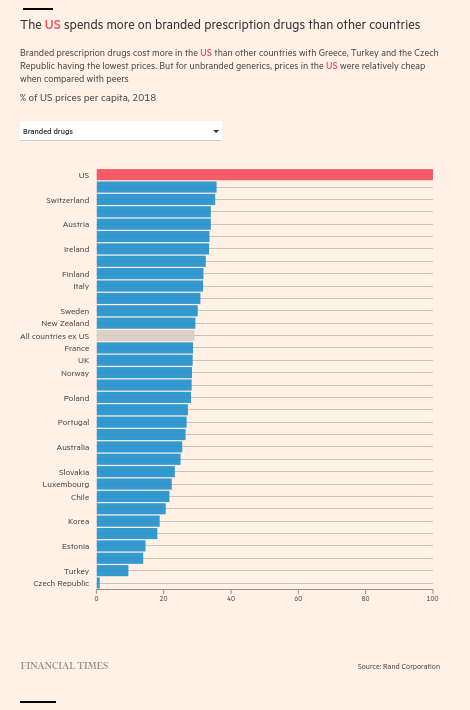

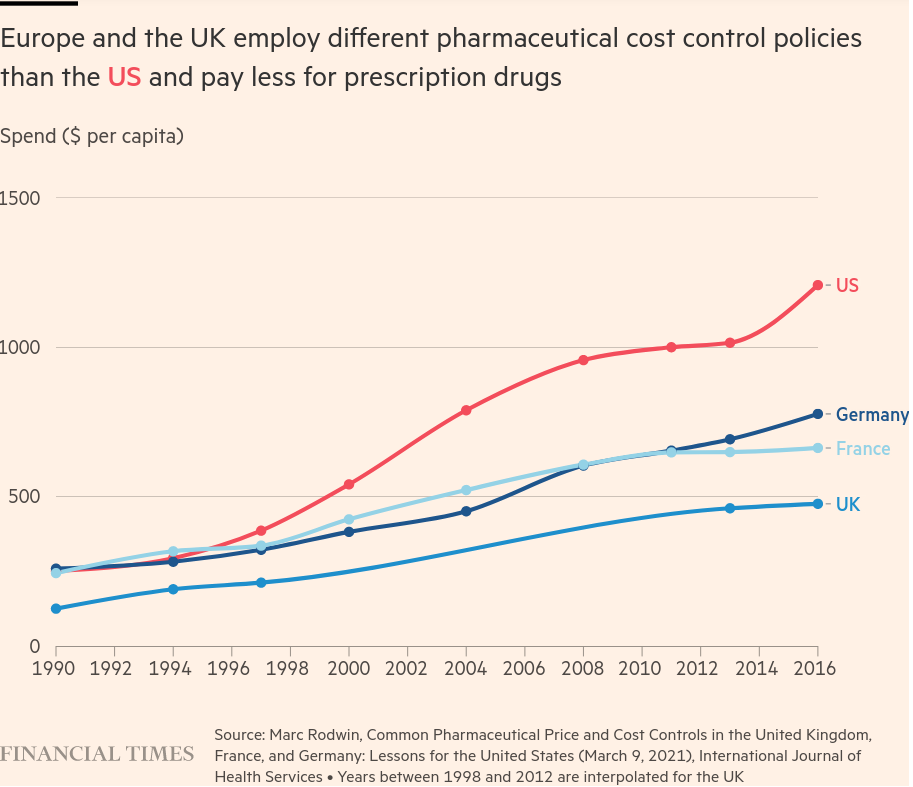

What is driving the current shift? The pandemic, inflation, and the fact that the USA is going to start regulating drug costs as it is paying 2.5 times the cost of almost everywhere else for the same drugs.

(While the difference is important to note, so is the slope of those lines. Costs on drugs are increasing at a significant pace.)

If the USA is able to reduce its prices for drugs (and thus profits for shareholders), Pharma is going to seek-out profits elsewhere.

The complaints on the pharmaceutical company side is that the revenue (read: profit) hit will reduce investment in new innovative drugs. This narrative has been spun for years in attempting to build support for high drug costs, especially in the developing world. The narrative is based on nonsense as most innovation in the pharmaceutical industry comes from public university research.

What is not nonsense is the coordination with public research institutes in those countries and where commercialization and production of those drugs happens. China has become an important alternative base for research as it is all about this kind of subsidy regime.

There is also the issue of the decisions of which drugs to develop. The most recent trend is to develop very specialized, but very expensive drugs, many around specific cancer treatment.

The pharma industry complain that costs outweigh the benefits of development:

Deloitte found that the average cost of drug development had increased to $2.3bn by 2021, while the average annual peak sales per drug had fallen to $500mn

This seems bad until you understand that most of the corporate R&D money is spent on designer vanity and copycat drugs. Spending that actually displaces research money for needed treatments.

The industry is also sitting on a tonne of spending power:

the world’s largest pharma companies currently have $1.4tn of firepower to do deals, including cash and debt, according to EY.

So, expect more marketing and lobbying.

In the end, the only solution is one that involves public production of drugs and open licenses for production.