January 23, 2023

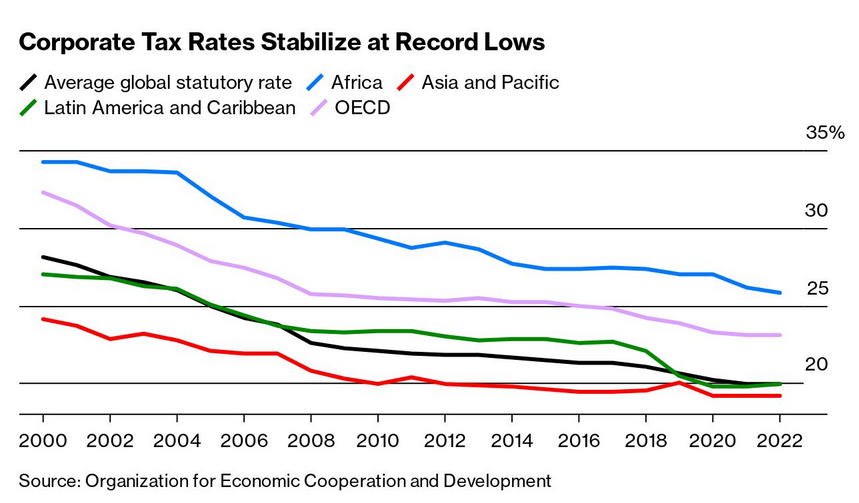

Global tax rates at record low

And you thought that the neoliberal era was over.

The era of profit subsidies through suppressed interest rates might be less important than the direct-funding of profits, but all the mechanisms of wealth transfer of the previous 50 years are still there.

IMF upgrades forecast for global economy

After driving down the forecast just three months ago, the IMF is reversing its forecast to be inline with the wants of the central banks. The banks, who think that sentiment causes changes in the market, wants people to believe that inflation is going to come down quickly and that there will be a soft land. In response to this demand of wished-for sentiment, the IMF has changed its tune on the global economy.

The upgrade comes after officials and business leaders at this week’s annual World Economic Forum in Davos also embraced a more upbeat outlook, and the IMF signalled that it would soon upgrade its forecasts for global growth.(FT)

But, there is plenty of real-world things happening that make these new found optimistic feelings by bankers suspect.

But those still around Friday morning [at Davos] will have heard a reason to temper their mood.

That’s because a string of central bankers ended the meeting warning they aren’t ready to declare victory in their inflation fight, meaning interest rates have higher to go.

As Federal Reserve officials enter a blackout before their Feb. 1 meeting, we report here that they are leaning to slowing the pace of rate hikes to 25 basis points, but likely not stopping despite market bets that rates won’t top 5%.(BN)

Europe's seeking private capital in energy

Investment in renewable energy from some of the largest capital funds is shifting to the EU. The subsidized private market in energy production—as a response to the need to get off Russian energy—along with the private nature of that shift is attracting investment.

The main push from groups like PGIM, Capital, T Rowe Price, BlackRock, Goldman, JPMorgan, KKR, and Apollo is into buying-up smaller companies which built energy assets in Europe.

The subsidy market is going to lead to massive amounts of money flowing into private capital, but it is unclear this is going to lead to increased investment in new energy generation.

Germany and Spain had been particularly profitable markets.

This money is being diverted from China which had been providing profit subsidies until the recent slowdown in the property markets.

Energy subsidies is one area where the EU is outstripping the USA in terms of profit subsidies for these large investment houses.

Diesel markets affect Oil prices

You thought energy was going to be cheaper, but new regulation in the EU which will ban Russian oil could drive up prices.

The move, which will be co-ordinated with a G7-backed global price cap on Russia’s refined fuel sales from February 5 — similar to measures already applied to crude oil since December — has the potential to spark a renewed round of turmoil for global oil markets.

Diesel supplies are already tight, contributing to prices at the pump being well above petrol in many regions.

Brent crude trade above $87 a barrel at the end of last week.

UK Labour's coming attack on the NHS

At the World Economic Forum in Davos, Keir Starmer made it very clear that he was a pro-capital politician.

British business figures and bankers said Labour leader Keir Starmer and his shadow chancellor, Rachel Reeves had impressed in their attempt to demonstrate that the opposition is “open to business.”

Another business leader who asked not to be named pointed out that the free invitation to the World Economic Forum’s annual meeting showed the party is being taken seriously by the opinion shapers who run Davos. They drew a comparison with invites for senior Tories before winning the 2010 election.

Both Starmer and Reeves attended the JPMorgan party Thursday night.

Business still does not trust Labour—something that Keir and his goofball cohort will never understand—and they will turn on Labour as soon as it is more profitable to do so.

“No disrespect to Sir Keir Starmer, but it’s not very long ago that he sat in Jeremy Corbyn’s cabinet — the extreme left-wing leader of the Labour Party,” the business secretary said. Noting that he’s “very happy for all of us to be pro-business,” Shapps added that “I would just ask who’s heart is really in it.”

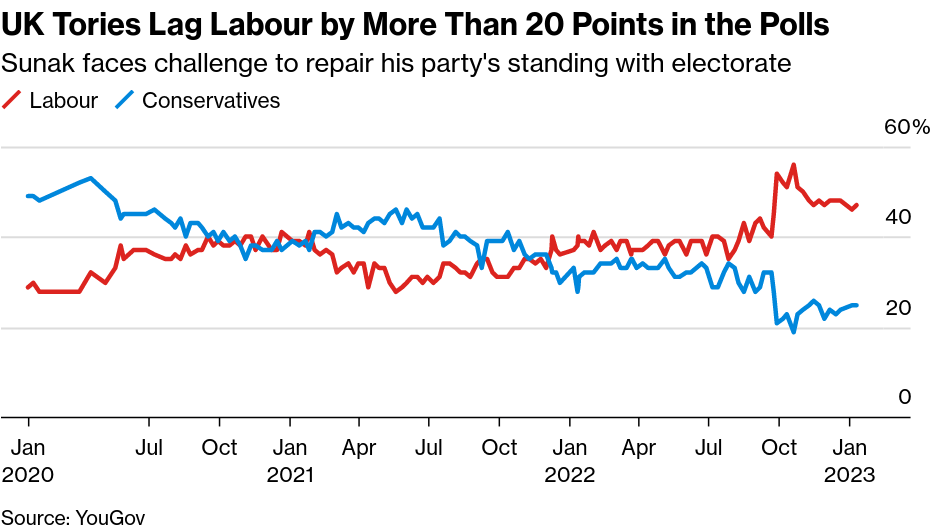

Labour is far ahead and it probably would not matter what their position on anything was right now:

The unsophisticated orientation to politics is also seen in Labour's new orientation to the NHS.

Privatization continues to be the only solution sought by governments on health care.

The lesson of the last Labour government is that investment combined with reform delivers results — such as providing patients with more choice over where they are treated.

As my front bench colleagues have warned, the state of the public finances means that Labour will not be able to open the government cheque book. Reform will need to do more of the heavy lifting this time around, and we should start with the NHS’s front door— primary care.

This is all code for privatized delivery of services:

We can draw inspiration from Denmark, where GPs collaborate closely with other local services, such as acute care teams who help prevent hospital admissions. They can also make referrals for other support. In Germany, GPs are trained to use ultrasound scanners to aid faster diagnosis — another example to consider.

salaried (private practice) GPs will be the majority by 2026

Labour wants to push GPs into private practices and take on additional services. These private practices will be funded through public and private sources of funding.

Sound familiar?