January 22, 2024

Profits and Wages

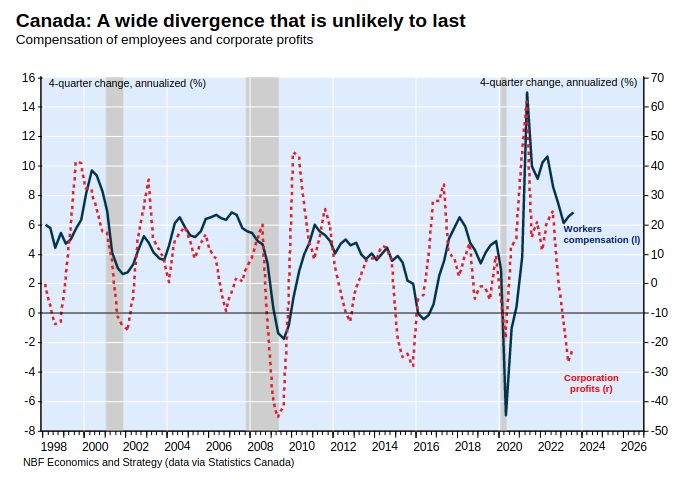

In Canada, there is a growing gap between profit rates and wages:

We note that over a one-year period, profits are down 22.4%, while workers' compensation is up 6.8%. Given these divergent trends, companies are facing difficult decisions that could result in a reduced appetite for hiring and, in some cases, job losses. (National Bank of Canada)

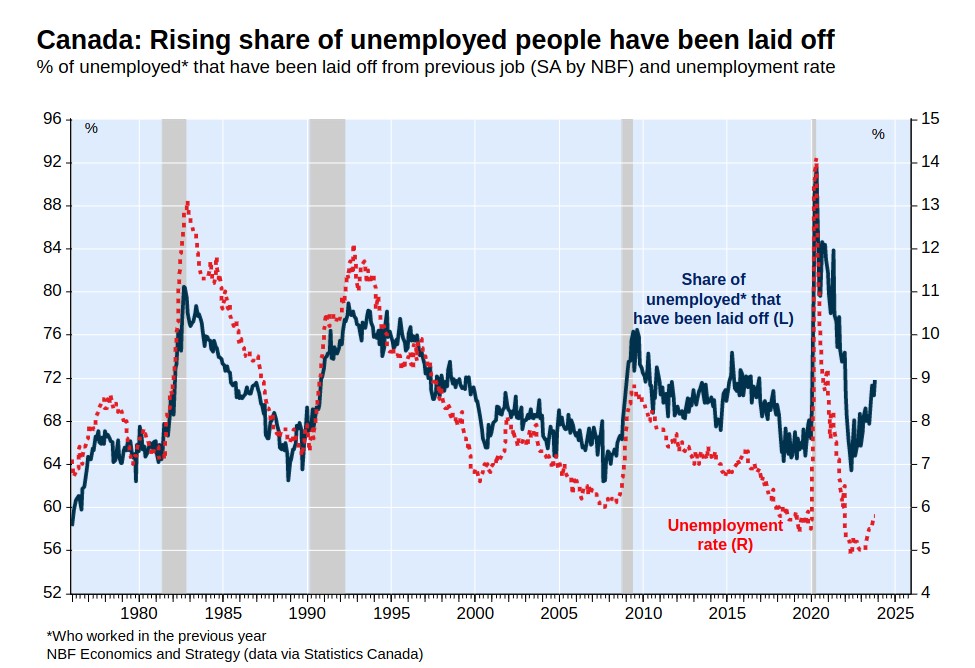

This is likely leading to increased rate of layoffs across those sectors most impacted even as the unemployment rate drops.

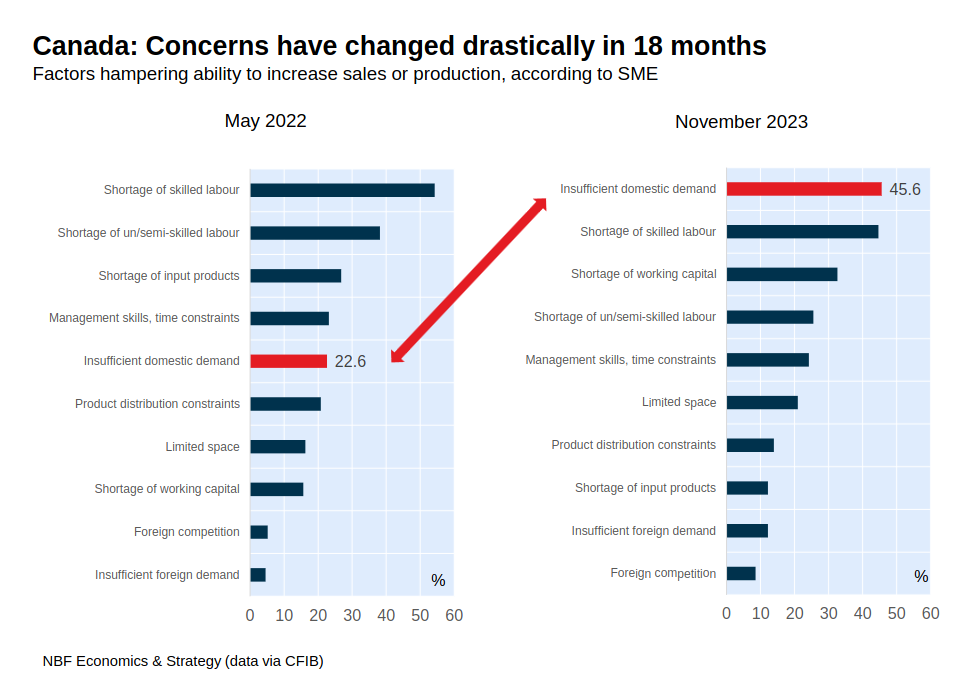

The National Bank of Canada analysis (based on CFIB data) blame this on reduced demand. But, access to "working capital" is also more of a challenge these days for Small and Medium Sized Businesses. Working capital is the liquidity available to capital for operations and is reduced as general input costs increase, debt repayment grows, and investments needed to maintain fixed capital grow (and wages).

Either way, the impact on the economy is the same with fewer inputs, less work, and ultimately fewer jobs.

This is the impact on higher rates and a slowing economy. It is not just Canada that is in this situation.

The result for workers as this happens along with reduced general labour market tightness is reduced bargaining power at the table.

Does this data mean central banks are going to start reducing rates quickly?

No. Because central bankers are beholden to the idea that if they reduce rates it will mean a return of inflation—just like what happened in the 1980s.

The worst outcome would be for policymakers to lower rates and have to raise them again later if inflation moves higher, Atlanta Fed President Raphael Bostic told business leaders on Jan. 18. “We do not want to go on these up-and-down or a back-and-forth pattern,” he said.

And, no matter what argument is put forward, the answer from the central bankers is the same. If you point to a decent (but deteriorating) labour market and falling inflation, they say that there is no need to rush because everything is fine.

If you point to a suspected rapidly declining economic situation because you look at GDP-Plus measures instead of just basic GDP measures (because rates are too high), they say that core inflation is growing too fast.

If you point to developing county debt burdens passing a sustainable level, they point to the policy of reduced spending (as if it is that easy or desirable).

If you point to massive borrowing costs impacting investment they point to high wage growth.

In their minds, the risk is just too great that they will be blamed for inflation coming back, so they are going to overcompensate the other way.