January 18, 2023

Financial markets are up

The overwhelming consensus of investors is that the worst in inflation growth and therefore central bank interest rate rises are over.

The jubilance in the markets over the first few weeks of January—especially compared to last year—is high. There is a sense that inflation will come down quite quickly and interest rates will fall which will increase the profit rates of investments.

Even cryptocurrency is up. Bitcoin is up 30% from the beginning of the year breaking the randomly assigned "value" trade of $20,000.

Party on?

Well, all signs point to this being an overly optimistic assessment of the global economy. The World Economic Forum in Davos has seen cautious optimism about the global economy this year also.

The thing is that the mood at Davos has been a strange predictors of the opposite happening in the real world. Almost without fail since its inception. Mostly because the Davos meeting of super rich are completely divorced from reality.

Gita Gopinath, deputy managing director of the IMF, signalled this week that the fund would upgrade its economic forecasts, while Germany’s chancellor, Olaf Scholz, told Bloomberg that the eurozone’s largest economy would avoid a recession.

The market jubilation is a bit like this too. Divorced from reality. The effect of increased interest rates for the global economy has not even filtered through yet.

Of the 13 S&P 500 stocks to have reported so far, 10 have beaten earnings per share estimates and three have missed, with nine stocks rising and four selling off, according to Mike Zigmont, head of trading and research and Harvest Volatility Management. The data so far “isn’t compelling for a bullish or bearish spin”, he said.

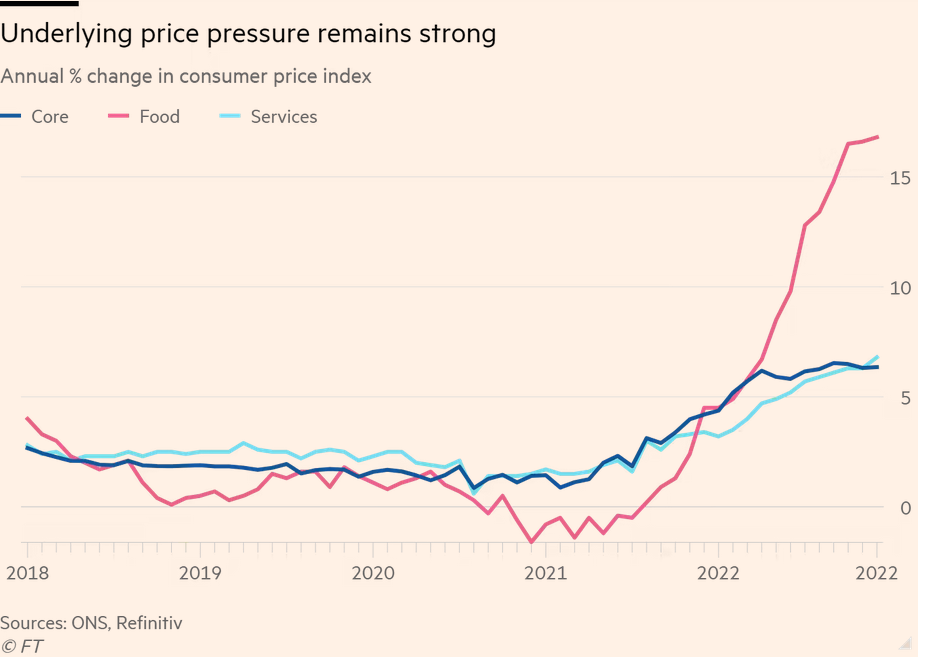

UK inflation numbers declined in line with what was expected because of the prices of fuel too, but food prices continued to increase. This is a common picture around the world.

While headline inflation may be coming down because the price of oil has come down and supply chain mess left after the pandemic, all the other aspects do not look so promising.

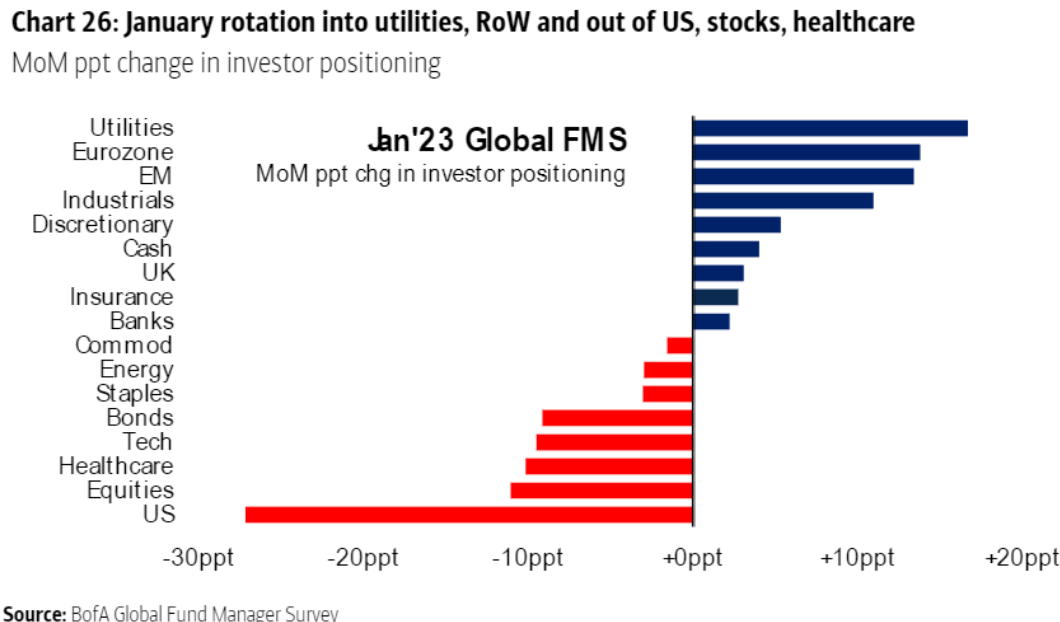

Also, there has been major shifts going on in what investors are putting their money bets on: mainly out of US equities and into emerging markets or longer-term and more stable debt owned by companies (utilities). China's "re-opening" is the likely reason.

"Soft landings" are a hope, but not usually a reality.

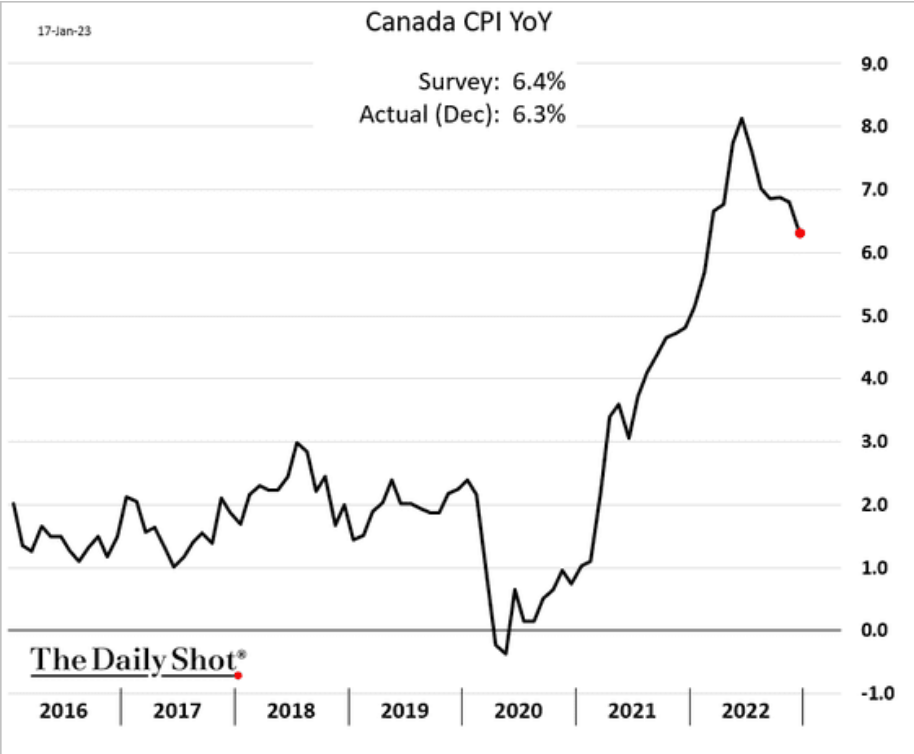

Canada stats

Headline consumer price index is down:

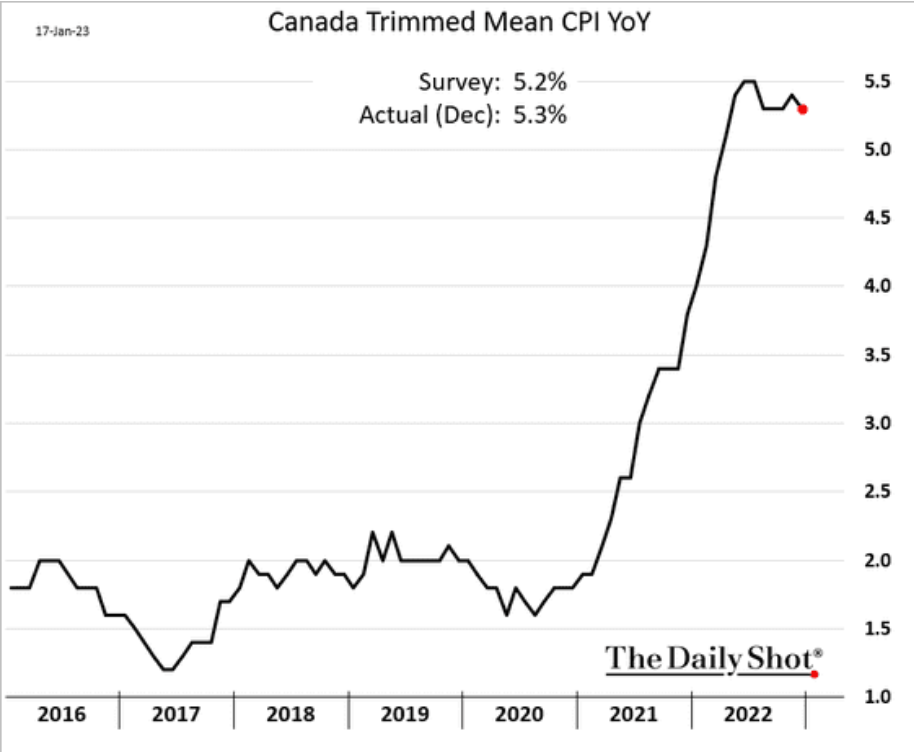

However, the core inflation numbers remain elevated:

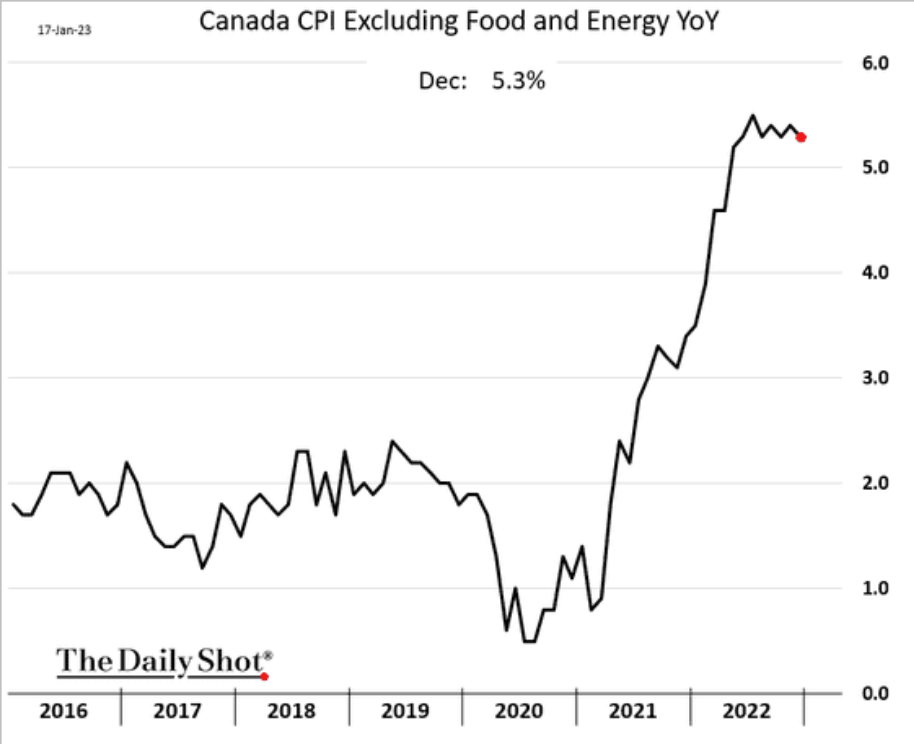

Even excluding food and energy, price growth is rather stable:

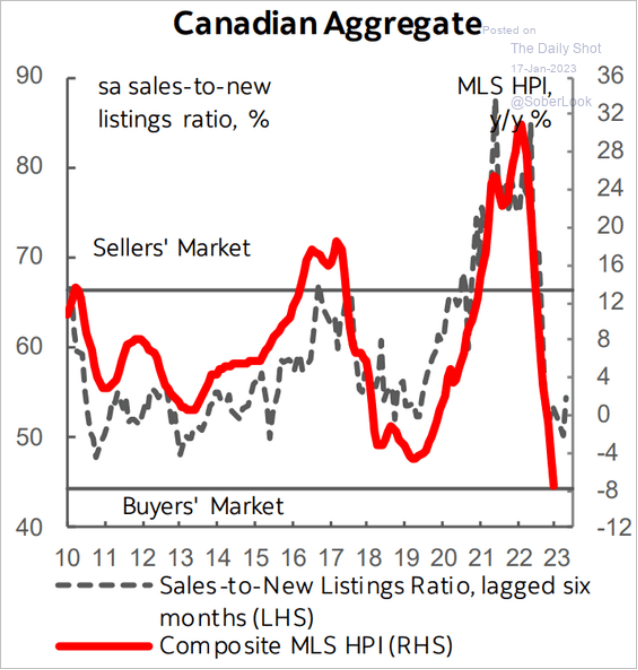

And cost of rent is sky-high as the decline in home values has not filtered through to the rental market yet (if it actually will).

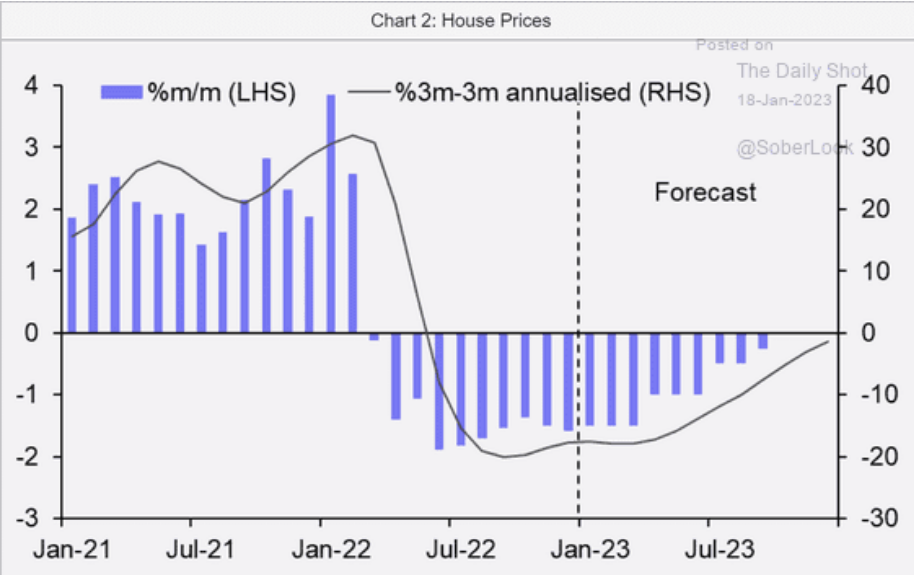

And, housing prices predictions from the housing investors show prices "should" stop falling later in the year. Not sure this helps people decide when to buy, but there you have it.