January 17, 2024

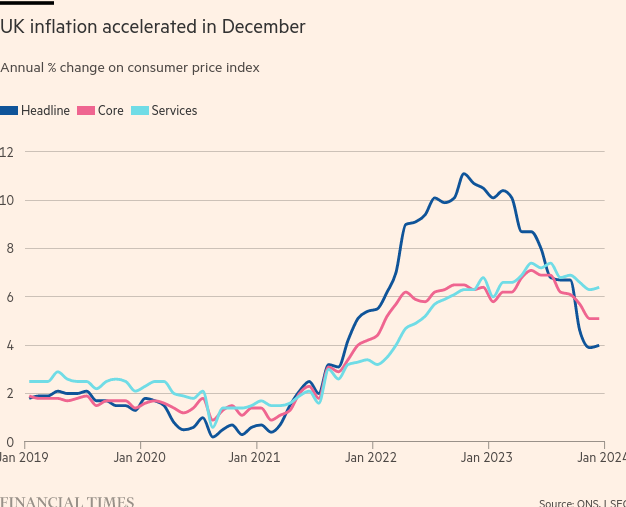

Inflation bounced back a little in December

Inflation bumped back up in the UK pushing the very optimistic attitude for rate cuts of March back to the summer.

European Central Bank's Lagarde says that the rate cut will also likely not start until summer. The reason? They are going to wait for late spring's wage numbers to decide whether to cut rates.

In the eurozone, headline price growth increased to 2.9 per cent in December from 2.4 per cent in the previous month. It increased to 3.4 per cent from 3.1 per cent in the US over the same period. (FT)

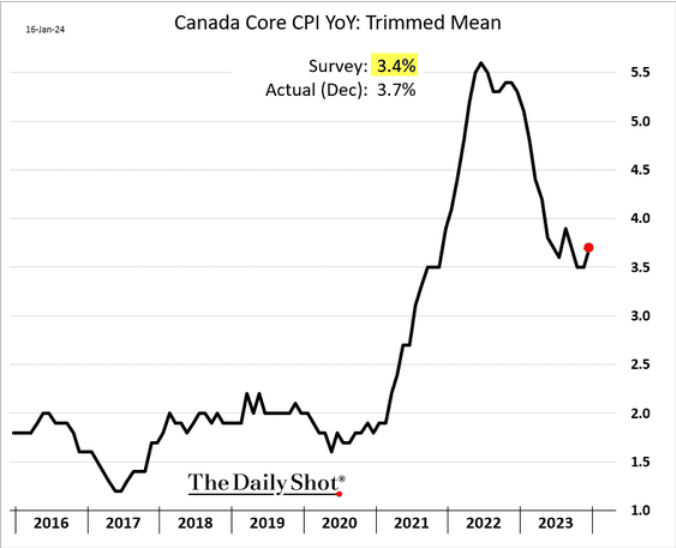

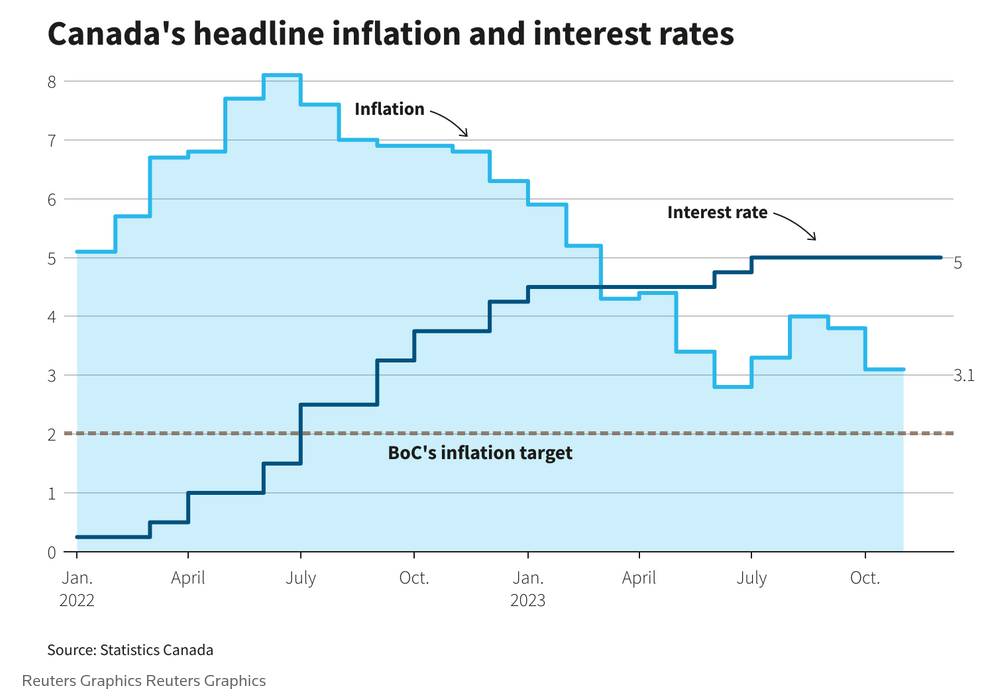

There was a similar story in Canada where the BoC seemed to indicate a longer wait before interest rates were reduced. Core trimmed and weighted measures of inflation topped expectations:

Two of the Bank of Canada's (BoC's) core measures of underlying inflation, CPI-trim and CPI-median, accelerated, with the three-month annualized rate of the two rising to 3.6% from an upwardly revised 2.9% in the prior month, according to Royce Mendes, head of macro strategy for Desjardins Group. "The stickiness in these core measures of inflation comes as a disappointment to Canadians hoping to see enough progress today to open the door to rate cuts," Mendes said. (Reuters)

All central banks are now looking at wages as their primary driver for inflation expectations.

The laser focus on wages for central bank policy creates a major blind spot for policy makers. Not only is this bout of inflation definitively not about wages, even under neoclassical hand waving it is too late to cut rates when wages are falling. The speed of impact of rate cuts on the real economy will be as slow coming as the effect of increasing interest rates. The impact is that workers in more precarious work will feel the impact most.

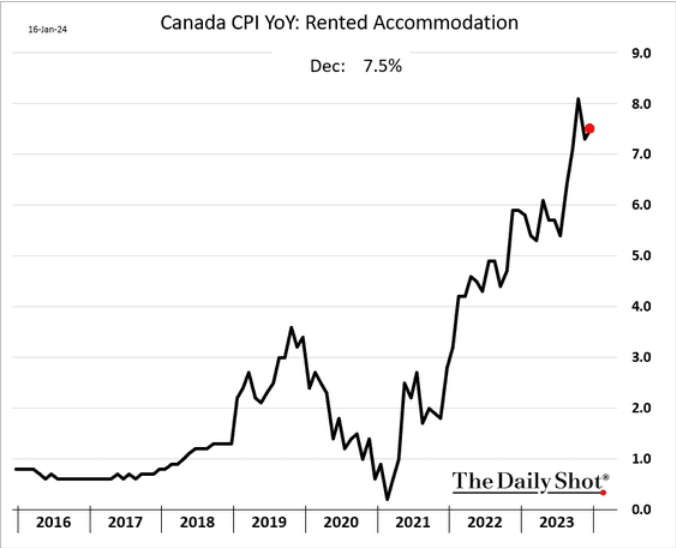

Housing costs

Housing costs (rent) remain elevated in Canada, which continues to be blamed on "immigrants". While it is true that Canada has a housing affordability problem, the immigration issue is a rather large red herring.

There are too many interconnected issues tied up in the housing market to blame a single group of people for prices. Blaming "immigrants" is basically blaming people who are "looking for affordable housing and cannot find it".

- Labour supply for building housing in Canada is dependent on immigration.

- Labour supply through immigration was reduced during the pandemic.

- The housing affordability crisis pre-dates the immigration bump.

- "Immigration" has not made things worse, it simply exposed a very clear problem with Canada's housing market.

Housing is in an affordability crisis because Canada has not built affordable rental housing. This has to do with the government abandoning its responsibilities when it comes to managing the market and directly procuring (and building) affordable rental housing.

It is not immigration that has created that problem and immigration is the answer to much of the problem.

The blame is squarely at the feet of those who promoted a private market-driven housing market investment program for Canada. Those are neoliberal politicians and their banker/developer friends.

We also have a seniors' housing affordability and access crisis. No one is talking about this, it seems, because it is hard to point the finger at "immigrants". No one is talking about this too because it is mixed-up in the access to affordable housing as many seniors cannot afford leave their homes. Many seniors have leveraged their homes with secondary mortgages/refinancing which have eaten all their savings.

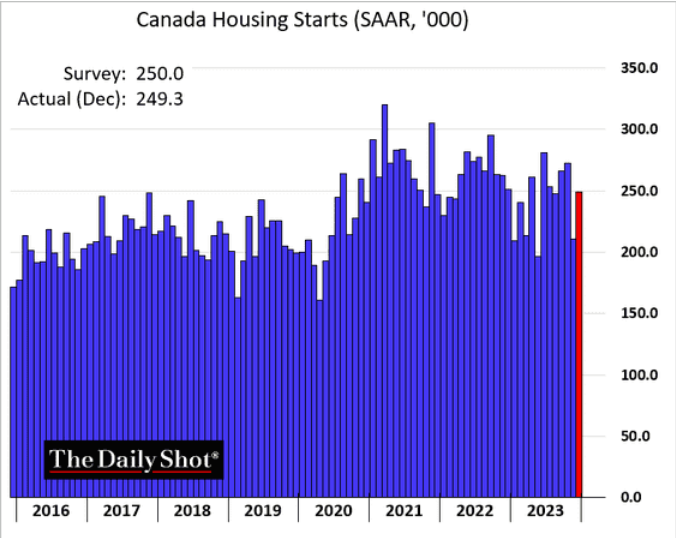

Housing starts did not collapse or even level-off, we are just not building the correct kind of housing, so housing costs for desired affordable rental housing remain high.

It is not immigrants, the working poor, or seniors who have caused the housing (affordability) crisis. It is the lack of a publicly regulated rational housing investment program.

(Note, the video above has sound, but you have to turn it all the way up to hear it.)