January 16, 2024

Canada Bank of Canada Business Outlook takeaways

There are a few contradictory signals in the BoC business outlook released:

- Price increase ("inflation") expectations are down from 2022, but not as down as they were mid-2023 in both production costs and sales prices.

- Weak business growth is predicted for 2024 as consumer expectations are low (but not declining)

- But, businesses have a positive future sales growth prediction.

- Corporate employment predictions indicate slowing labour market growth.

- While debt levels are high, businesses are gearing up for investment in new production-focused capital. This is likely because of lack of spending for the previous year and the cost of labour going up, with the expectation that interest rates will come down.

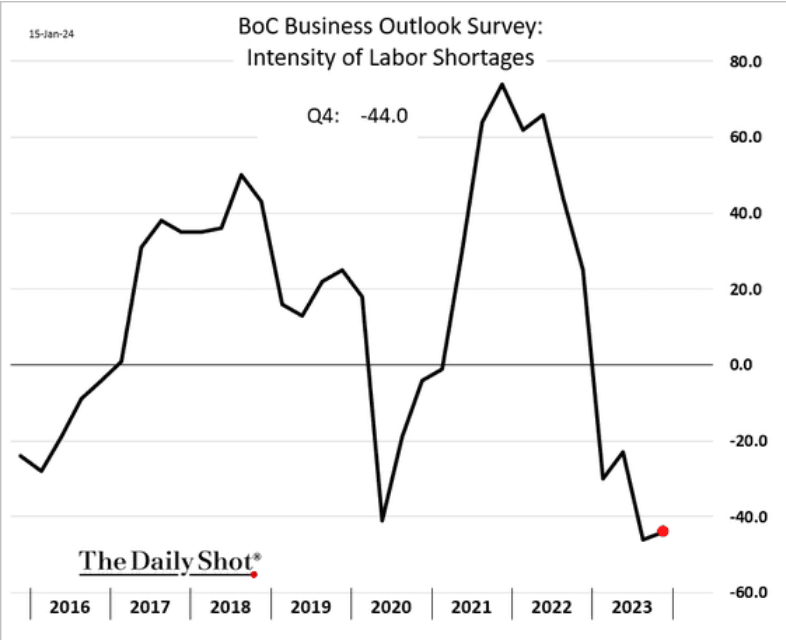

- Labour shortages are not longer a thing that businesses are worried about.

Generally, this is a bad picture for workers. Our bargaining power has declined significantly compared to just a year ago. Wage growth will also likely decline after the current "round" of bargaining is over mid-year.

I think I would recommend bringing bargaining timelines forward to attempt to make the best gains before the malaise sets in. While all bad, high interest rates expectations, memories of rapid inflation, and general sentiments around labour shortages may not stick around and that could cut some wage gains.

That is not to say that workers have made-up the losses of the previous decade in this round of bargaining or that workers facing bargaining towards the end of the year cannot make gains. They will just face some stronger headwinds in that struggle.

Profits

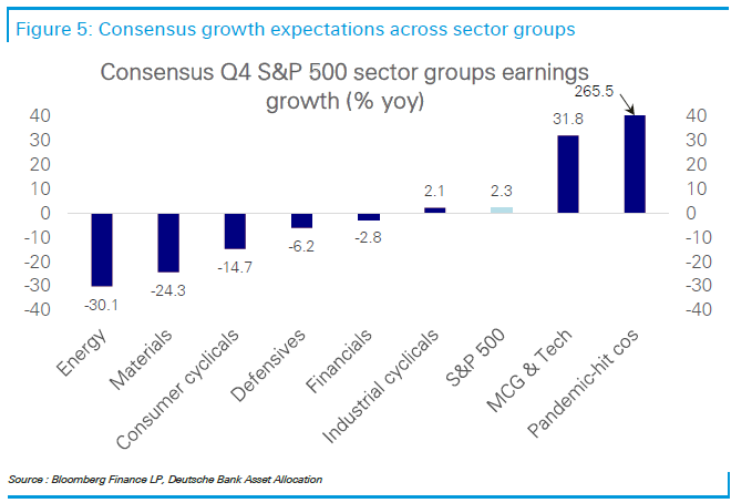

As Bankim Chadha of Deutsche Bank AG shows, companies particularly affected by Covid disruptions are expected to show a 266.5% rise in profits year-on-year, and the overall forecast of an anemic 2.3% growth for the S&P conceals some very bearish forecasts for much of Corporate America.

Quarter-on-quarter, he shows, the consensus is actually braced for a decline after last year’s very strong third quarter.

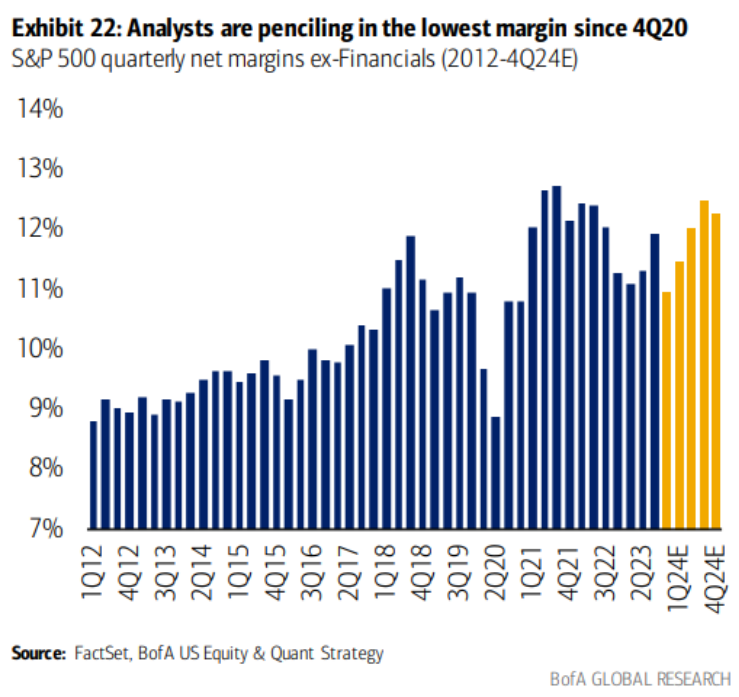

Corporate profit margins have been high over the previous six years in the USA. Much of this has to do with where the money has been put and the subsidy regime that has been operating, transferring money to capital from the rest of us.

Some say that this is because inflation has "allowed" companies to raise rate, but I think it can be explained almost entirely by the profit subsidy regime (and money printing). The lack of increased growth in value production shows that.

Supply chain changes and right-wing "economics"

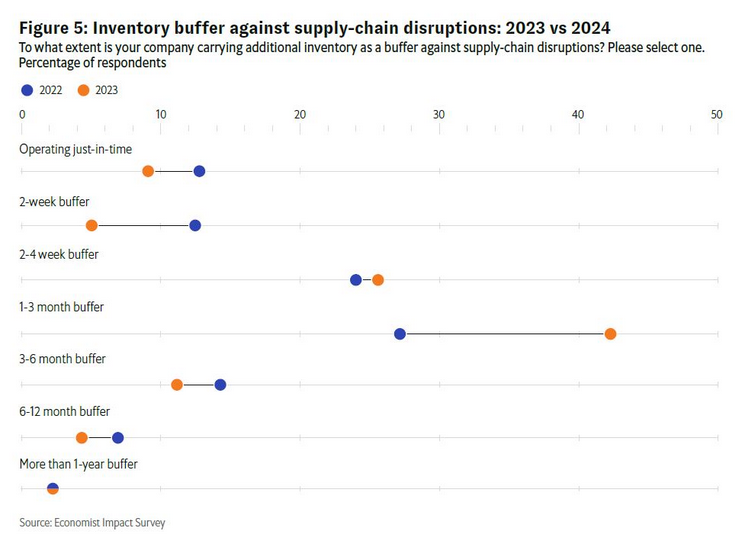

Since the pandemic disruptions, everyone is concerned about supply chains. Even as many economists do not expressly understand/believe that supply of goods caused a lot of cost pressures driving inflation, managers at the corporate level have made changes.

Just in time is down and a buffer of 1-3 months is operating:

Production capacity is slow to respond to changes as they take investment, building, tooling, and finding workers in different areas of the world. This is more costly than finding storage for midstream products. However, if there is an estimated risk that will continue, production will move.

The questions are:

- If it moves, where will it go?

- Will it actually move and not just diversify sources of inputs.

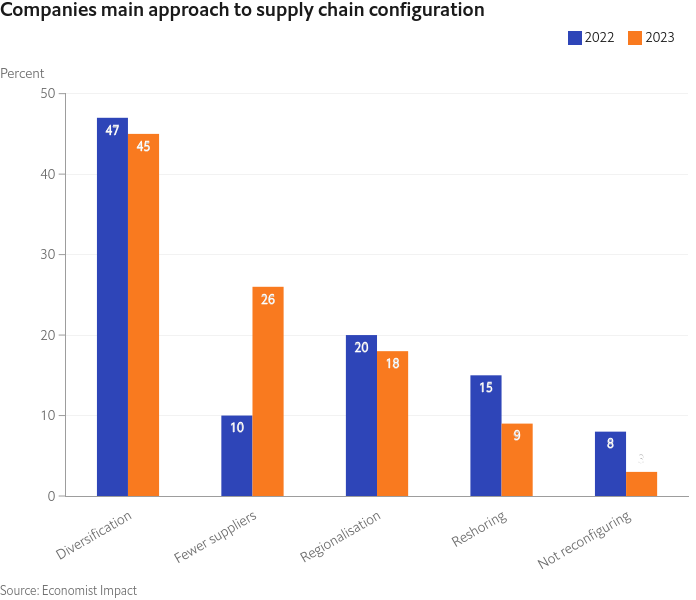

A recent Economist report shows that things are going towards fewer suppliers, keeping diversity of production areas open, but not really re-shoring.

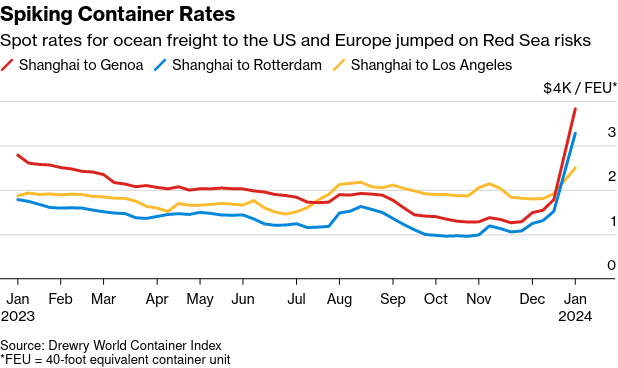

If global conflict is on the rise (and it seems to be), then there is risk in moving production just a few countries away in the same region. The Red Sea and the Panama canal are both at threat for different regions, but there are other shipping routes that are vulnerable to disruption.

Europe’s automotive industry ships about 70% of all components coming from Asia through the Red Sea

Prices of shipping containers have spiked again.

Many in the USA want the production to "return" to the USA's shores, not just "friend shoring".

The far right under Trump are thumping on about a 10% tariff on imports to try to drive home the idea that production should be ramped up in the boarders for the USA consumer.

The orthodoxy say that this will drive up costs for consumers and lower "real incomes" because of it.

The question for the left is how far down this road do we want to lean. Relying on capital to invest because things are getting a little dicey outside the USA and because the government has put political blocks on importing products is odd. This style of production economics is reliant on state-financed profit subsidies and capital controls to make-up the difference.

Why? Because capital is global. If profit rates in the USA decline from manufacturing (and no change in capital controls are added), capital will just invest elsewhere.

I am not sure that the liberal left has an answer to this kind of proto-fascist economic program that Trump/Republicans are promoting as "pro-worker".

It is also completely not believable that the land of capitalism is going to implement something like this. Which also makes the response rather difficult from the left. Those who like this kind of thing might be tempted to support it or tacitly support it by say "we don't believe they will do it".

There is another way. The left should present its own "in-house" solutions to the problems of climate change, global war, supply chains, and production rooted in the concepts of equality, work, and leisure.

Trump's cadres continue to push a future that is dystopian and Hobbesian. It is hard to believe that this is really the world that most people, in the end, want to live in.

An alternative bold economic and social vision is necessary to capture the imagination.