January 13, 2023

Recession?

- For a country like the UK, a technical recession is talked about when there are at least "two quarters" (6 months minimum) of declining/contracting Gross Domestic Product.

- It might surprise you that there is no clear definition of a recession in economics for the USA. Maybe it wouldn't surprise you that economists have fudged such a seemingly specific concept, since you read this blog.

- Recessions are about business activity and productive activity. They result from declining investment in production.

Why do we care about recessions? Because business activity growing is how capitalism stays alive. When business activity shrinks it means that capital, the stuffs that make-up owned production, is going to do what it can to save profits. None of things that capital does to do this is nice for workers, the planet, society, or your pet.

Recessions result in hardship for people who had nothing to do with causing them. That's why we care about them. The worst part is that recessions are a regular interval in capitalism.

We call them crises. They might be small by comparison to previous crises, but they are still crises and that means someone is going to get hurt. That is, unless workers decide to do something about it and mobilize along alternative policies to just waiting for capital to "solve" the crisis.

Now, capitalism is designed to solve crises. Creative destruction, or some other twisting of words describes the process. But while we are told this process produces positives, it turns out that it is really just a process of capital finding a new way to take public wealth and transfer it into the private sphere.

Crises in capitalism are usually solved via theft. This one is no different.

Will we avoid a recession? Soft landing?

A soft recession?

Massive amounts of (supposed) wealth have already been destroyed over the previous year. As capitalism entered yet another crises of its own making, we continue to be made to suffer.

Health systems in disarray. Social services underfunded. Working people making below inflation wage gains. Public money being used to prop-up banks (again). Climate chaos going unaddressed. War. Precarious computer and logistics systems constantly on the verge of collapse.

We may not technically be in a recession yet, but we are still feeling the consequences of the crisis.

Indeed, so much pain has be wrought already in the UK and Germany that they may have delayed their recessions. Of course, shifting the window on the pain seems like a slight of hand than real avoidance of a recession.

Unemployment is already up in the UK:

The idea of a "soft landing" here only applies to capital's profits, not the suffering of working people.

Work from Home and Social Care

- Ever wonder who is doing the work? I mean, we of course know who is doing the work. Ever wonder how much?

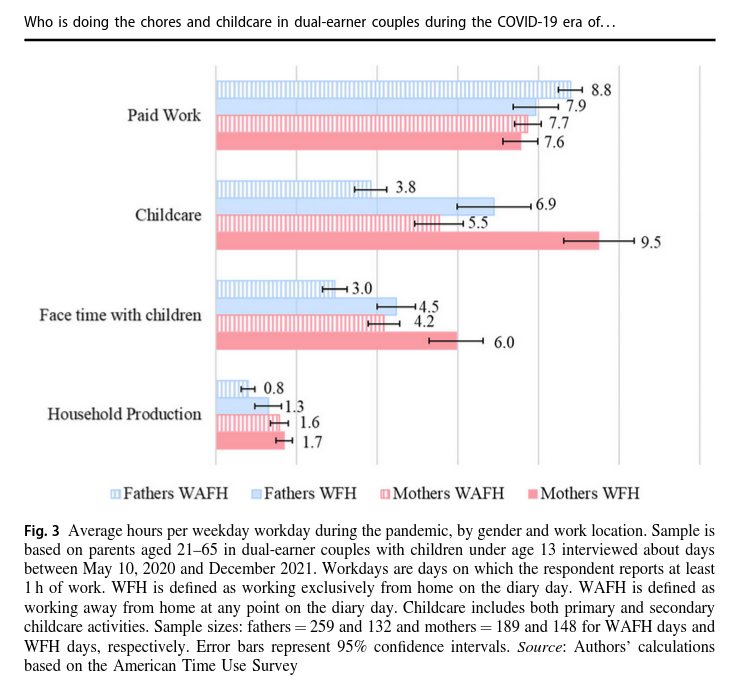

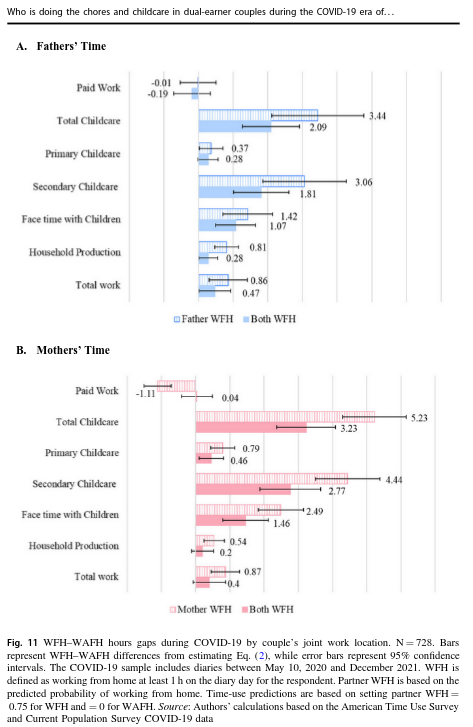

Have a look:

- https://link.springer.com/epdf/10.1007/s11150-022-09642-6?sharing_token=2SoCU43KFqWL1g9b3b2wyve4RwlQNchNByi7wbcMAY7D-kZfLpoaN1OvYxJomhfEpQlDPf-zH3l3LnCeyiTwtMNqiS2AowtUTymxUZmDiEILicOXlNGmGirwr8IfaJBYr31eptV6pzmj7JzFPXUb244O5TRC9LWwnDhZh9WId2o%3D

- The main take-away? Work from home forced parents to spend time with their children (#shudder).

- However, there was an increase in the gender gap created by this unfair societal back-peddling into unpaid labour.

Mothers were primary caregivers prior to the pandemic. Our analyses for the post-lockdown period suggest that mothers and fathers picked up equal amounts of the extra childcare burden when WFH alone. Thus, when fathers were WFH alone and thus were more available to their children, the gender care gap decreased.

- Work from home might result in an increased gender gap because women are more interested in working from home, on average, than men. Could this be because men who work from home are doing more household chores when they do? Probably.

The other part that is interesting to me is the amount people engaged in unpaid work when working from home that we so desperately want to change to paid work. The tension becomes when we ask who is going to do this paid work and who is going to pay for it? It is a question that the liberals want the "market" to solve. The Left's response must be different or all that happens is that unpaid work becomes underpaid work for the same group.

Finally, the pandemic created an opportunity to talk about the messed-up way that we structure work and in-home social care. Too bad we have squandered that opportunity by talking instead about how small businesses are suffering in downtown cores.

Even in the USA, real wage inflation is still negative

- All this complaining about wage growth. Turns out there is still no real wage growth.

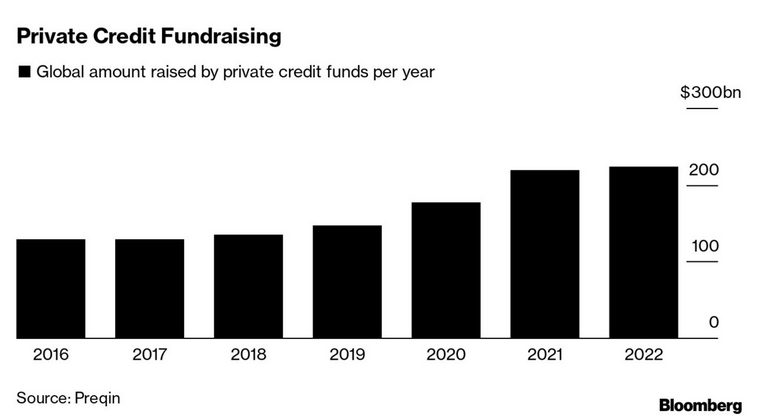

Private debt

- We are going to keep our eye on this section of the economy. It has the potential to be where the next crisis comes from.

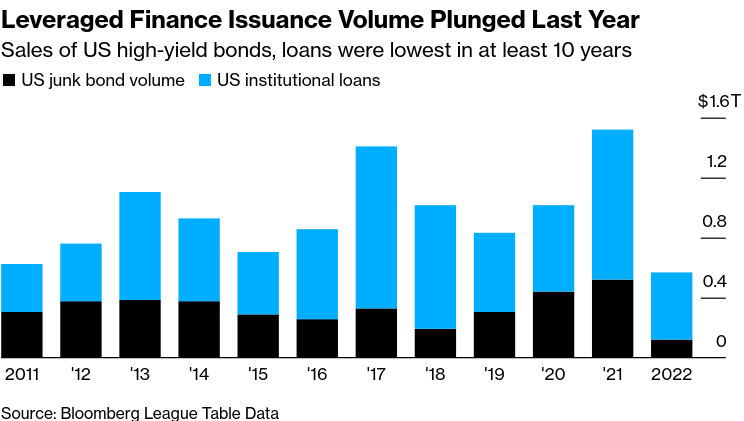

After driving a flurry of mega buyouts that contributed to a $1 trillion profit haul in the good times, some of the world’s largest banks have been forced to take big writedowns on debt-fueled mergers and acquisitions underwritten late in the cheap-money era. Elon Musk’s chaotic takeover of Twitter Inc. is proving especially painful, saddling a Morgan Stanley-led cohort with around $4 billion in estimated paper losses, according to industry experts and Bloomberg calculations.

These loans are not as large because interest rates are higher, but it still makes us question where the alternative money is going to come from.

The debt hangover at some of the world’s most systemically important lenders is tying up their limited capital to power new LBOs, leaving the pipeline for deals at its weakest in years with soft echoes of the global financial crisis.