January 12, 2023

More inflation predictions

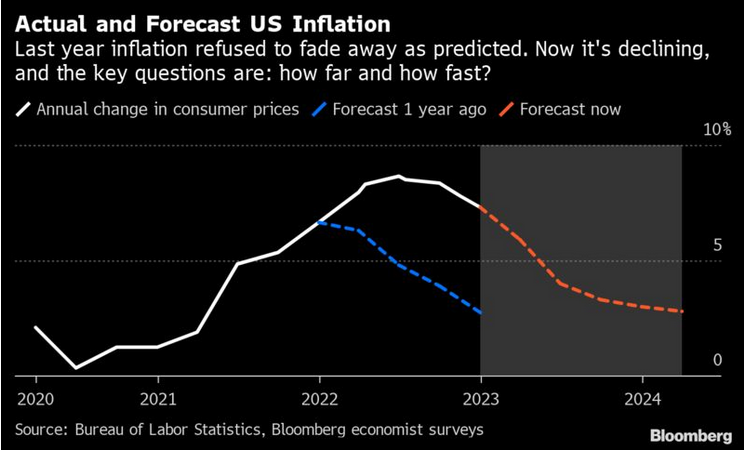

Every morning there is a different prediction from the financial markets of what inflation will do and therefore what interest rates will be set as by central banks. And, it seems every day they are disappointed by the response from reality.

Headline inflation continues to moderate, but is still quite high. Core inflation continues to moderate less quickly than the headline inflation. None of this is surprising since headline inflation is affected by the price of oil and the USA is pumping almost enough right now to make up the difference of the dislocation caused by the war in Ukraine.

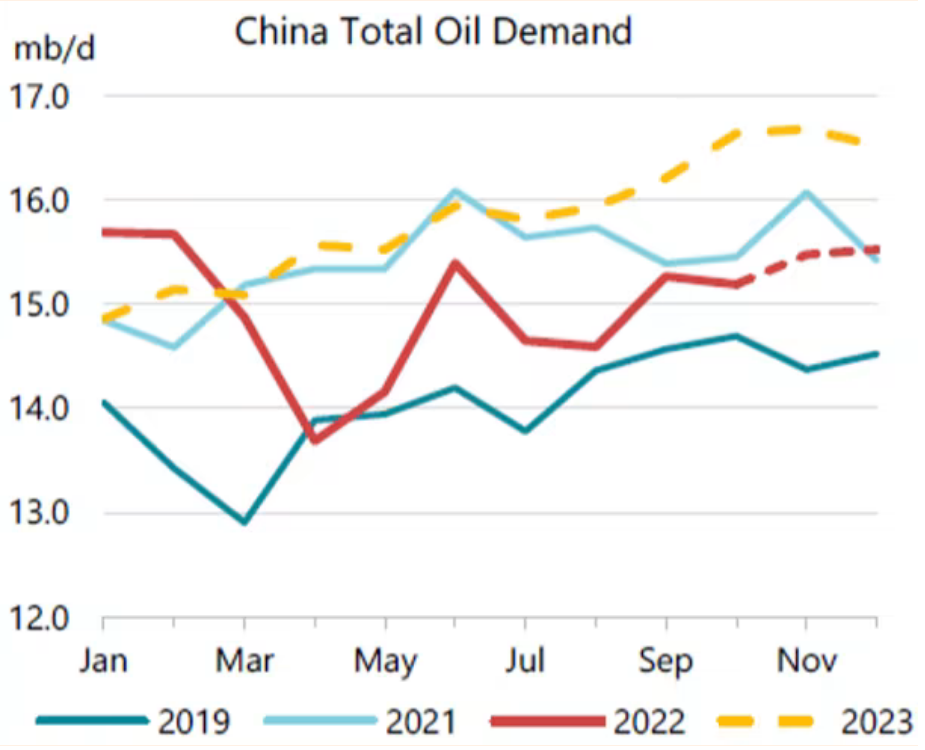

(*Of course, now that China is supposed to be open again, they will take-up more oil which may counteract oil's price drop.)

Add to this the clearing of some supply chain clogs—and China's "reopening" (read: ignoring COVID as much as USA capital does)—has revealed some pressure on prices.

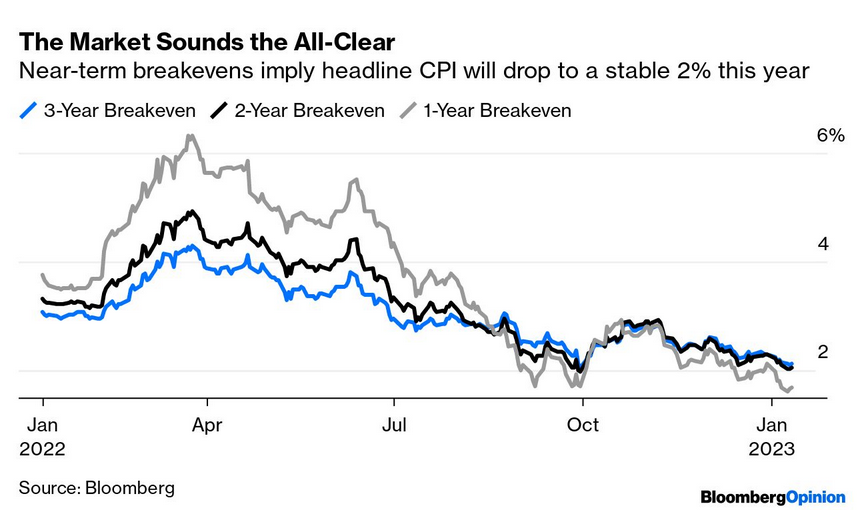

So, USA prices are not growing as much as they were. The bond markets really think inflation will collapse back to 2% very quickly. Of course, like a broken clock, they are almost always wrong—until they are correct.

But, prices are being driven by more than just one thing.

Economists have some trouble with the entire concept of multiple things happening at the same time. Which is the reason for the current confusion about where "inflation" is going. Prices will continue to increase for basics and services as the reasons for these price increases remain.

The issue for banks is that they are watching inflation because they really care about the interest rates set by the central banks. Finance capital want those rates to come down so that they can make more money.

Global Growth

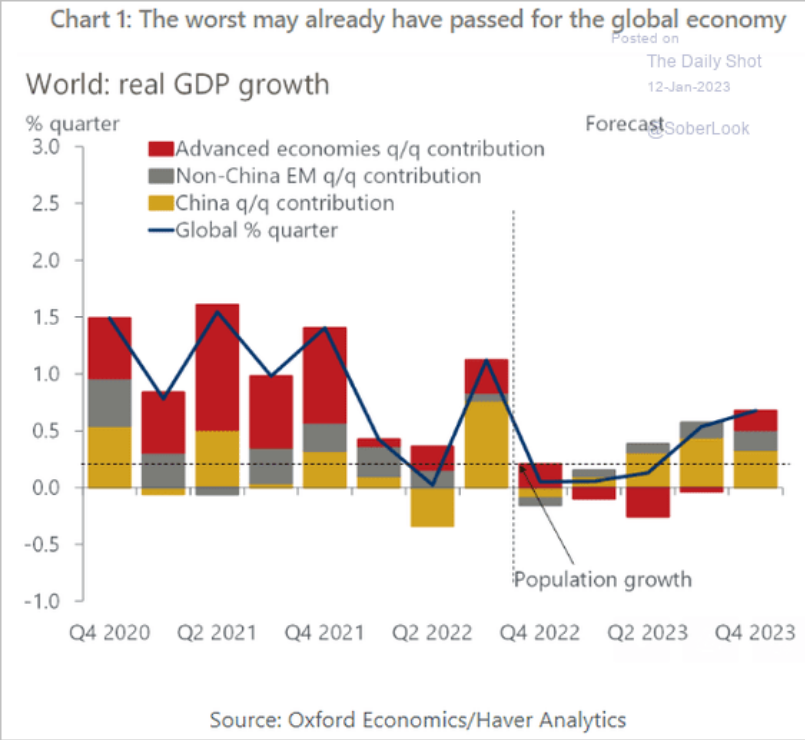

There is some optimism this morning that global growth will tick back up (even as we are pushed into recession by central banks).

I find this optimism is linked only to the idea that China will be dropping its COVID measures. This is supposed to give a boost to global growth that has been held back.

This assumes nothing bad happens from billions of Chinese citizens being sick with COVID and no negative effects of war, climate change, and other bad things.

Corporate Debt

The secondary pages of the financial press are concerned with debt. Always. Right now, they are focused on a new report that points to the unmeasured size of corporate debt and what it has been and is being used for. Namely, everything but investing in productive capacity.

Also, it is being packaged, sold, repackaged as something else, and then sold again. Great for the people reselling, less good for system stability.

This is a continuation of the concern about zombie companies, dead debt, undead risk, and all the risk associated with stuff that is not easily seen in the dark.

Mostly, people are concerned that we have had several major crises lately caused by bad practices in the financial system. Rates are going up and staying up, which means all that debt floating around is priced differently now compared to when it was created.

Someone is going to have to pay for it. Eventually.