January 11, 2024

Skimming the top, dropping the bottom

There are lots of ways that capital have the system rigged to let investors own the profitable parts of the system and pass the unprofitable parts to the government.

Take health benefits:

Those most likely to have a government-sponsored plan included seniors, people with chronic conditions, people with lower incomes, part-time workers, those not employed and the self-employed. (StatCan)

Health insurance covers mostly people who have employment and can pay into the plan, are covered by some public risk of employment injury insurance (WSIB), and those less likely to have to need constant payouts.

This is the risk profile for profitable provision of health benefits. It makes it look like the benefits program costs are spread from the fortunate to the misfortunate with a nice little profit on transfer for the insurance companies as well as returns from investments (also resulting in a significant profit on transfer).

At the social level, it is not so clear.

True costs for health provision are paid through taxes and those risks are not spread or offset by healthy individuals in the pool.

- near 50% of folks with five or more chronic conditions had a government-sponsored plan

- over 10% of individuals without a chronic condition had a government-sponsored plan

- Low income: nearly 40% had government sponsored plan

Who gets what insurance is even more skewed the closer you look at this data. No surprise, but it should be said:

- more than two-thirds (67%) of Canadians reported taking or being prescribed a medication in the last 12 months (2021)

- 20% of Canadians are uninsured for health benefits

That is a tonne of people not getting the proper financial support for medication and it clearly falls on the groups that cannot afford it.

Rate of medication use

- women: 73%

- men: 60%

- older adults: 86%

- younger adults: 47%

Lack of medication coverage matches the inverse of those statistics with

- Women having less coverage than men

- older adults having less coverage than younger adults

Recent immigrant men and women had lower rates of government- and employer-sponsored drug insurance coverage than Canadian-born men and women

Over 80% of Canadian-born men and women had at least one drug insurance plan. However, for recent immigrant men and women, who landed within 10 years, slightly less than 70% had an insurance plan. For established immigrant men and women, the proportion was 75%.

Government plans are making-up the difference and increasing the rate of coverage. And, this is a good thing, but it does make one question what the private sector is providing here other than a nice pay-cheque for itself.

The population is paying for this expanded health insurance either way, they might as well get the risk and financial pooling of a large benefits trust covering everyone managed in an efficient way under non-profit single government plan.

Of course, this is not a new call from the left.

Why don't we do it? Because jobs.

The private insurance system is so flush with cash that they have created a massive redundant employment system for themselves and throw the risk of job loss up every time the mention of a public insurance system comes up.

But, that is not the real reason. Most of that employment under the management level would shift to the government provision since you still have to deal with the same number of people; more if the provision of benefits is actually broadened.

The real reasons is profits and uncritically evaluated entrenched interests.

- Insurance companies are money printing machines for their owners.

- This money is invested in ways to maximize returns, creating a feedback of profit derived from transfer.

- Employer-sponsored plans are seen as something you either negotiated (if you have a union) or get altruistically from your employer. The argument is that it is a good deal and people believe that.

The reality is that as workplaces shrink, it is less and less a good deal. Smaller workplace, more expensive the health benefits. Which is the other gaming of the system by private health insurers. They pool all the money, but they sell you an insurance product based on your specific employer size.

This means an employer with thousands of employees' benefits are less expensive than a small business employer with 10 employees even though they are "insured" by the same insurance company, money goes into the same pot, and they are seeking the same benefits with the same risk profile.

Self-employed? Forget it, you don't get a benefits plan you can afford because there no risk sharing.

The solution? Pooling. Bigger and bigger pooling.

Unions have identified this issue and continue to attempt to pool benefits like they pool pensions. Multi-employer plans, benefits trusts, deals with non-profit insurance providers to allow smaller employers to buy into established plans. Basically anything to expand-out that coverage and reduce individual risk profiles.

But, there is a better way: broad single-payer government benefits insurance.

The pharmacare and public dental plans were supposed to be a partial solutions this, but the Liberals love to make things complicated. Instead of examining how drugs can be provided to people cheaply through bulk buying under the current programs that already exist. They wanted to build a brand new program to expand the capture at the bottom end of the coverage distribution.

Again, allowing the companies to skim the top by selling insurance to health individuals who work and then subsidize private companies to provide the coverage. Allowing the profit making through profit on transfer to continue.

The dental plan is a government paid private insurance program done through SunLife. This structure ensures that the plan will be expensive, continued to finance those who oppose national public plans, and hand a program over to the next (Tory?) government who can easily cancel the poorly run plan.

It is perfect Liberal's pretending to be social democratic all the while protecting their true interest base: bankers and finance capital.

Sure, you can argue it is better than nothing. But, lots of things are. Better is not always good.

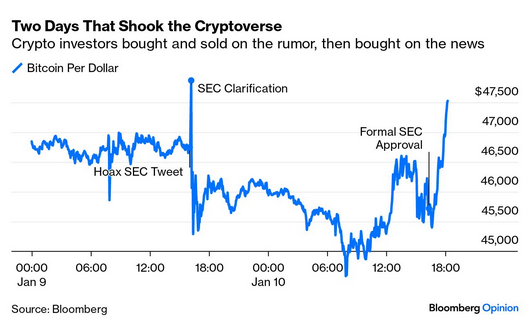

Investment funds that want to sell products based on Bitcoin investment got the SEC to agree

I will not comment on the stupidity of this because others (including the SEC themselves) have done a good job.

I will say that it, for a moment, exposes all the contradictions inherent in the financial sector. Not only does financial capital mostly exist for no value creating reason at all, it also now officially invests in an asset that has no value at all.

Fictitious capital investing in a "financial asset" based on the trading in a fully fictional asset.

Bitcoin is good for nothing except speculation and gambling.

“Bitcoin and crypto are worse than the chips you can buy at a casino because at least the casino is regulated; the spot Bitcoin market is not and that’s what the ETF is going to be pricing. There will be no SEC regulation or policing of Bitcoin.”

– Dennis Kelleher, president and CEO of Better Markets, a Wall Street watchdog group

Does this mean anything for financial investors? No. Because they do not care about true value, they only care about exchange value. And, that value is likely to go up. Then come down. Then go up again. All based on how much money is floating around that is "excess" and easily gambled with.

As soon as you financialize the trading on something (through an ETF investment program in this case), the price of that (secondary) financial commodity goes up. It is a rigged game.

Ignored is just how fraud prone this commodity is. The Bitcoin crowd of thieves could not even wait for their payday, hacking the SEC's Twitter account before the announcement to scam even the announcement. This is a regular trick of this unregulated game of fraud.

Green jobs

Much is touted about green employment. The numbers tell a slightly different story:

- 3.0%: size of national GDP attributable to environmental and clean technology products

- 327,506 jobs: Employment, environmental and clean technology products sector

- 21%: the amount of employment in green electricity, which makes up the majority of the electricity already generated in Canada before they talked about "Green"

It isn't nothing, but it isn't enough.

- The volume of environmental and clean technology product exports decreased by 2.3% in 2022

- The volume of environmental and clean technology product imports increased by 7.9% in 2022, with manufactured goods accounting for almost two-thirds (62.5%) of all imports.

So, our manufacturers want green products, but we are not growing the production market here. This is a problem since this is where production is generally heading.

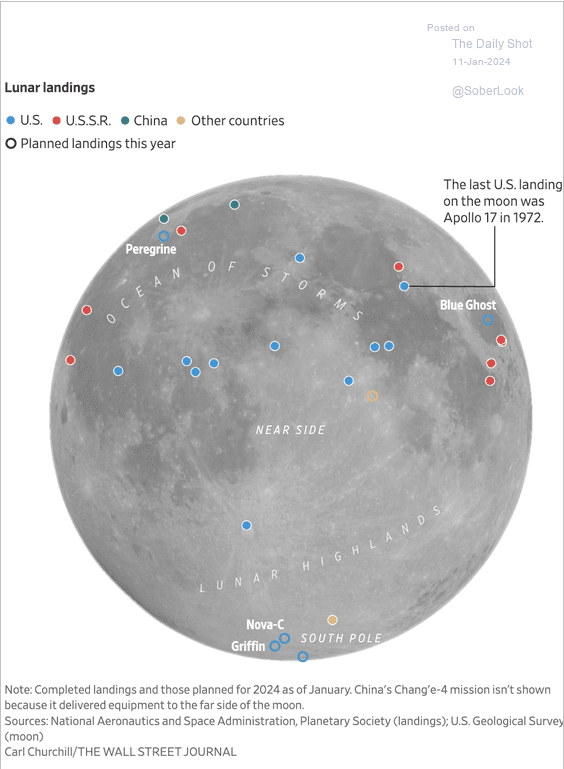

Lunar landings