January 11, 2023

Greenhouse gas emissions

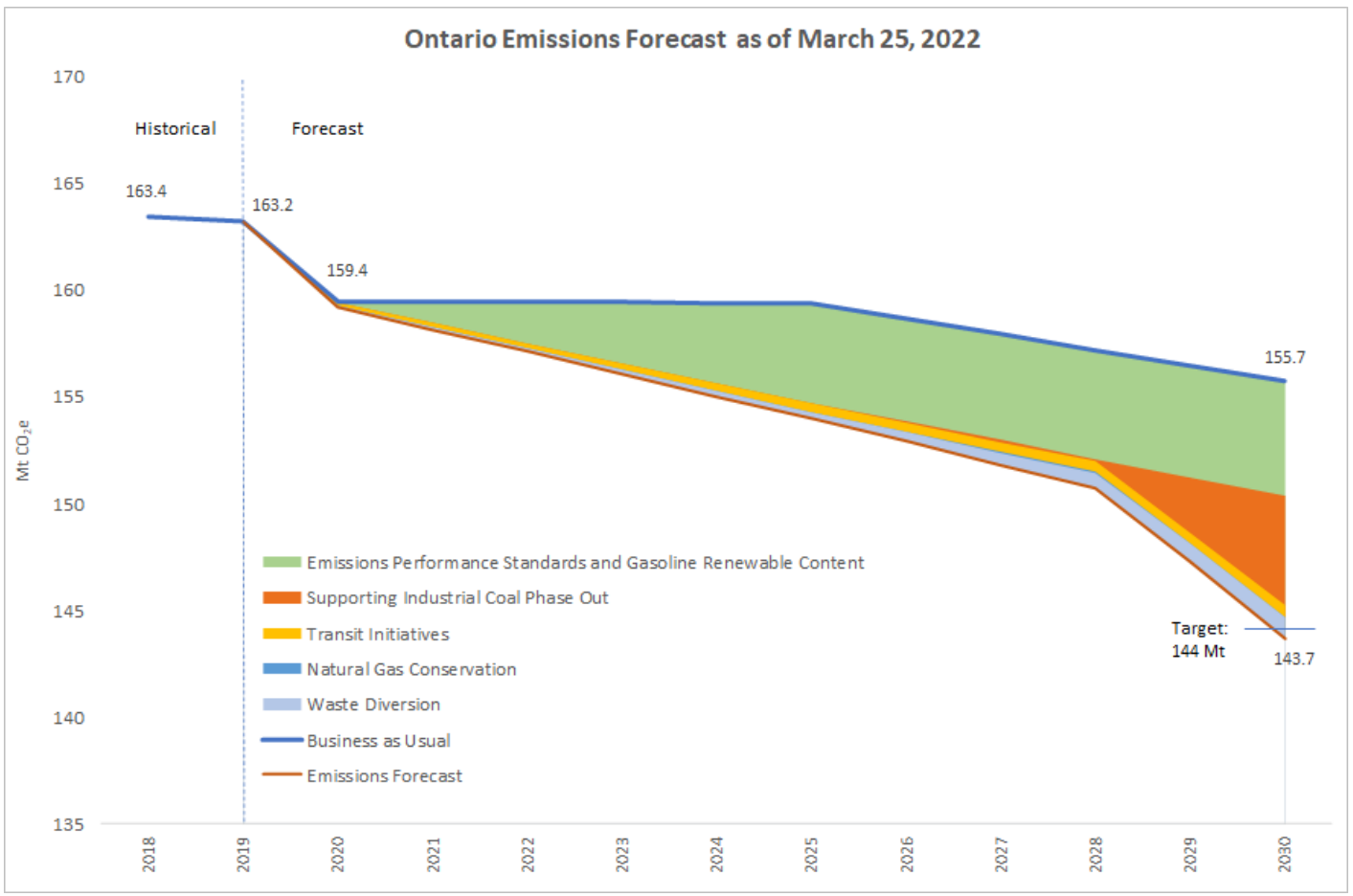

- Ontario has completely fudged its 2030 greenhouse gas emissions plan.

- An emissions plan that was not only not serious, but also not living up to the needs of people.

- Massive injections of profit subsidies were supposed to create a windfall for companies to invest. Capital didn't invest and the money has not been spent, which is only shocking to people who do not understand how capitalism works.

Sure. That's a real plan. Wait until 2028 and then magically reduce emissions at 10 times the rate of the previous decade.

Meanwhile, Canadian emissions are the same as they were in 2008.

The emissions reduction programs are not worth the paper they are written on. And, none of that is surprising. Using the "magic" of markets and Carbon sin taxes was never going to reduce emissions.

We continue to rely on magic to save us from climate change in the form of electric cars, carbon capture and storage, and free markets. It is not working.

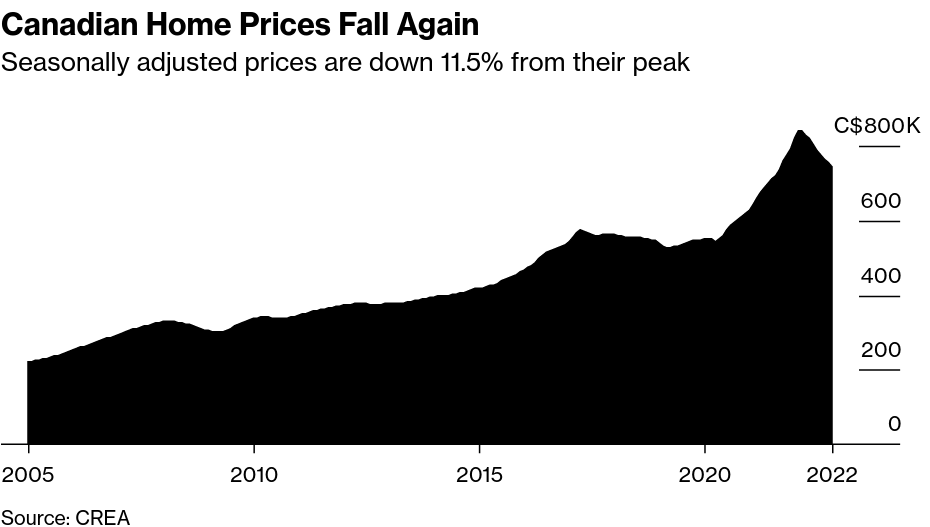

Canadian House Prices

Look at all that "value" evaporating.

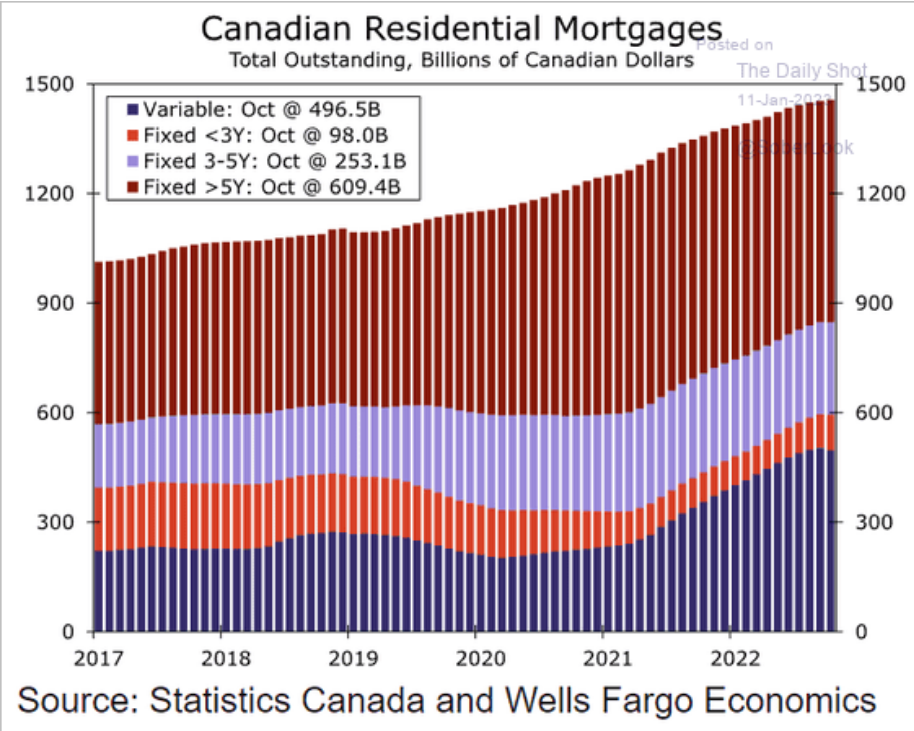

This might be a bit of an issue along with increased interest rates. There seems to have been a large spike in variable rates last year.

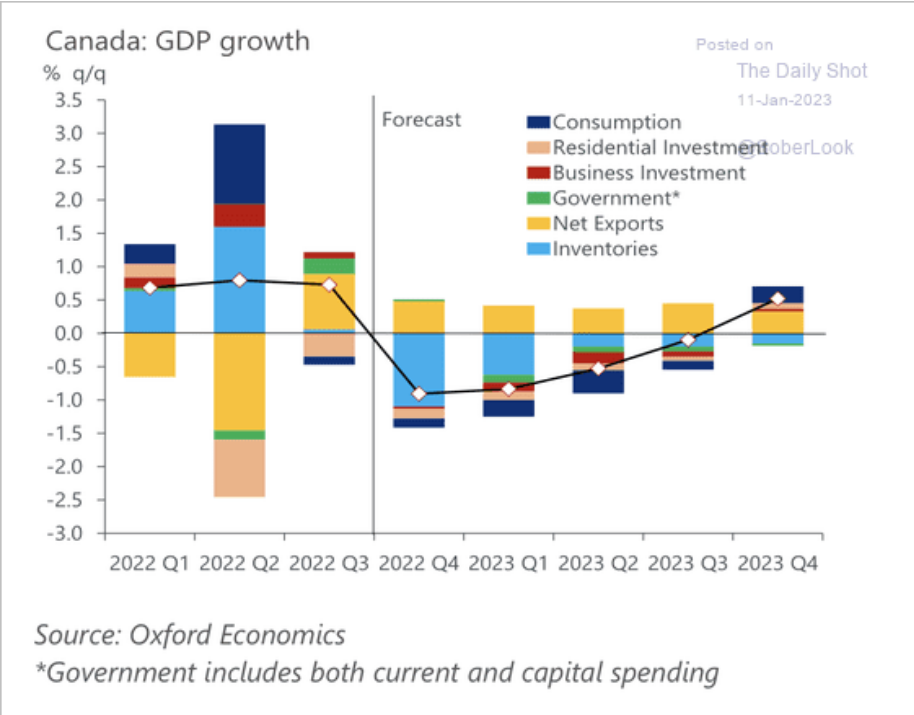

Especially as we head into an all but guaranteed recession

Policy Alternatives?

The question really is what kind of recession is this going to be when it comes to getting out of the recession. The government has plenty of options to shift the weight of carrying the economic slowdown.

Working people did not create this recession, the central banks did. And, as Galbraith has stated, the central bank's only aim is to save USA capitalism (at the expense of workers).

Does the Federal Reserve, at its highest levels, know these things? One can’t be sure about the economists. But the bankers at the Fed certainly do; it’s their business to know how the world really works. So what are they up to? A power struggle between oligarchs, is the obvious answer. Real estate, construction, tech and energy at the moment are losers; banks as always are among the winners. No surprise in this: the Federal Reserve works for the banks. The interest rate it sets is not natural in any sense: it is a weapon in the struggle. “Fighting inflation” is just a smokescreen for the real fight.

All the calls by the Left must be grounded in this reality. We cannot shrug at inflation caused by the mess created by an economic system that is neither an accident or inevitable. Prices have gone up for different things for different reasons, but they are all based in one system:

- Food prices are caused by climate change (and supply chains)

- Money inflation is caused by a failed profit subsidy regime of the previous decade

- Oil prices increases are caused by war

- Consumer goods prices are caused by the failure of "just in time"/minimal cost supply chains

- Service prices are caused by labour supply and general price pressures

- (much of the) labour supply issue is caused by a failed response to COVID.

And what is the response to all of these causes of price increases?

Increased unemployment.

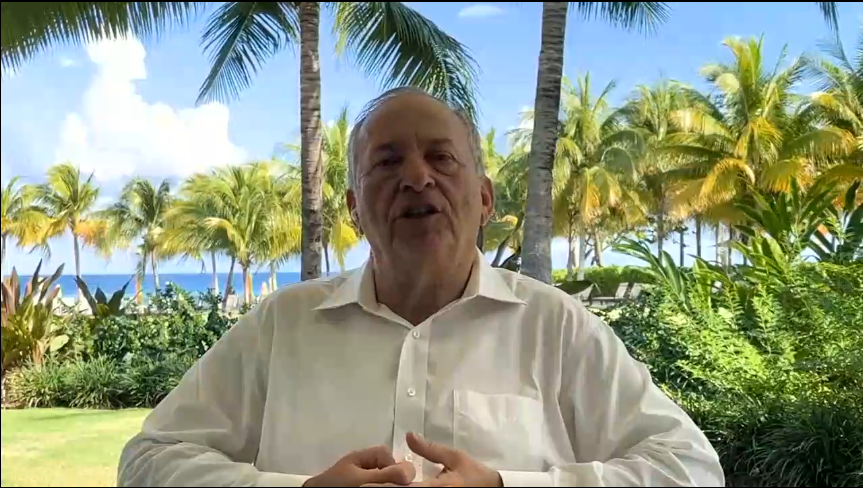

That is what people like Summers demands central banks bring in a talk to the ASSA as he sits in the tropics on vacation.

Can you get more insulting and clueless than this dude?

These are the people making decisions about the world based in extremely flawed understandings of the economy. The flaws in the economics profession are held tightly because they are about sustaining the unequal system we have, not about understanding the world and fixing problems. Their answers do not change no matter what the problem is we face. Workers must pay for Capital's excesses.

We must build understanding that there is an alternative way forward. A way to understand the real world of economics. There are alternative solutions to be found different from the Same Old Response.